Market Morsel: Weaker A$ supports wool

Market Morsel

Apparel fibres were generally firm again, although cotton eased last week before steadying this week, so the apparel fibre backdrop to the greasy wool market remains supportive. In local terms the firmer prices were in large part a function of the lower Australian dollar (down 1.6% against the US dollar). Demand for merino wool is reasonable but nowhere as good as the Australian dollar prices portray.

In South Africa greasy wool prices are suffering due to the embargo on imports by China due to foot and mouth outbreaks. RWS premiums are struggling in South Africa, which is the largest supplier of RWS accredited wool, due to the Chinese embargo. In the economic background conditions continue to deteriorate, with prospects of demand weakening in the new season. At this stage, however, there is little sign of concern in the apparel fibre markets.

17 Micron

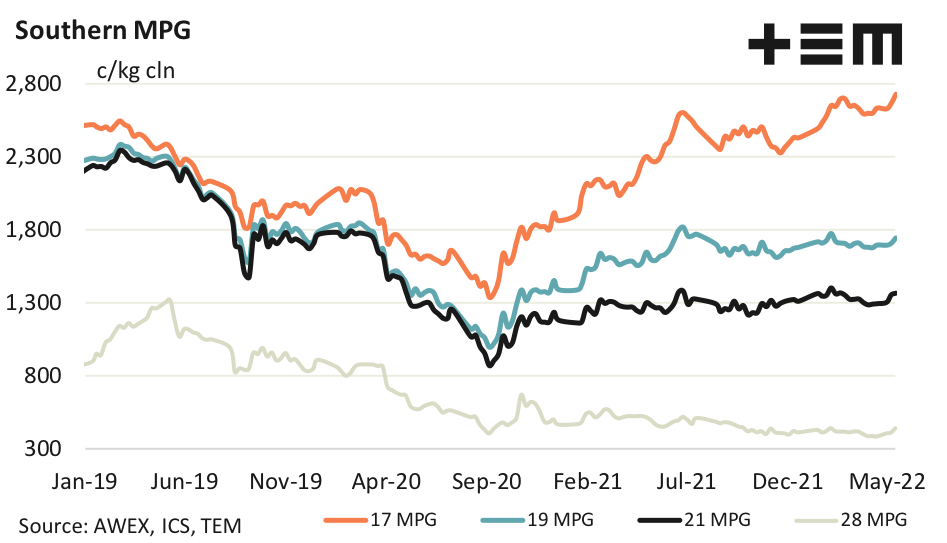

The Australian dollar continues to give a different view for fine wool prices to that seen by buyers in US dollars and Euros. For the Europeans prices are back to late 20221 levels, some AUD300 cents lower than the current AWEX 17 MPG, whereas the 17 MPG is tracking at late 2018 price levels.

19 Micron

The average fibre diameter of the merino clip continues to vary slightly from month to month around 19.0 micron. Staple strength remains high and mid-point break low. Yields are generally good with high vegetable matter levels. Apart from the level of wool with water stain and unscourable colour (like vegetable matter a legacy of wet summers/seasons) the basic specifications of the Australian merino clip are quite good. Vegetable matter has been a big restriction on the ability of exporters to put consignments together but even this has eased slightly (for this time of the year) in the past month or so for the major micron categories.

21 Micron

Due to the rise in cotton prices during the past year the 21 MPG price ratio to cotton is down to levels not seen since late 2010, which makes broader merino wool extremely cheap in relation to cotton (which is very expensive). This should help support broad merino prices, at least limiting the downside risk.

28 Micron

A look at crossbred micron categories shows that 33 micron and broader prices have picked up since mid-2020. It is the 27 to 31 micron categories which have continued to lag in price since the pandemic initially pushed apparel fibre prices down in 2020.