Market Morsel: Wools ain’t wools

Market Morsel

The greasy wool market is actually a combination of inter-related markets (think of carpet wool versus superfine merino wool for example) and this variation is in full display at present in terms of both supply and demand.

As an example of strong demand, good merino fleece wool accredited to RWS is selling for sizeable premiums (although some 90% on offer this week came from New Zealand). At the other end of the demand scale crossbred wool prices continue to struggle. Italian focussed exporters were active this week in both Sydney and Melbourne, helping to set a higher price level for the better fine merino wool.

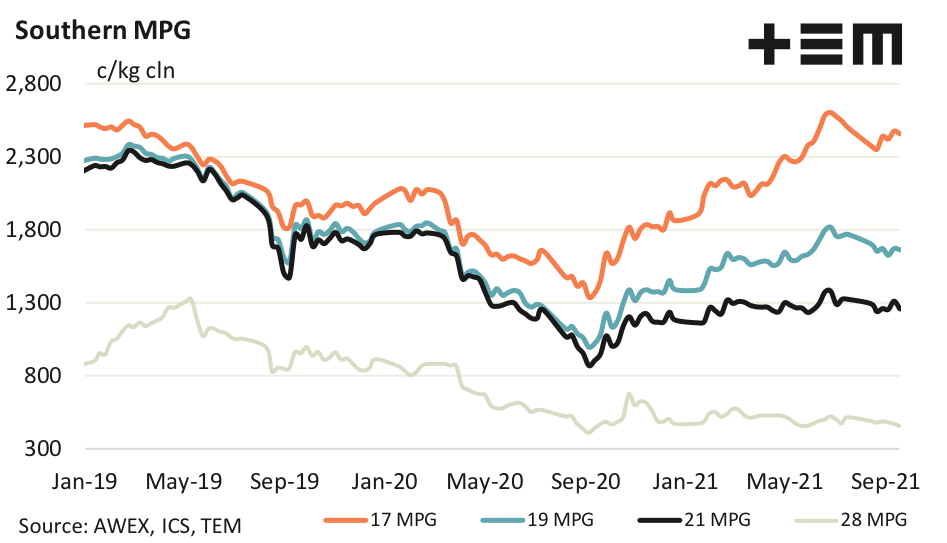

The minimal price differentiation seen in the market in 2017 and 2018 has been transformed into a more traditional price structure with premiums for better specifications and discounts for faulty types, with an overlay of non-mulesed accreditation and quality systems increasing the pricing structure complexity.

17 Micron

It was a solid week for fine merino prices, with some handy premiums for higher staple strength wool (the average staple strength is running around a high of 38 N/ktx as it is) especially if combined with being non-mulesed and even better if accredited to RWS. Pressure also seemed to ease on discounts for higher vegetable fault this week which is a good sign.

19 Micron

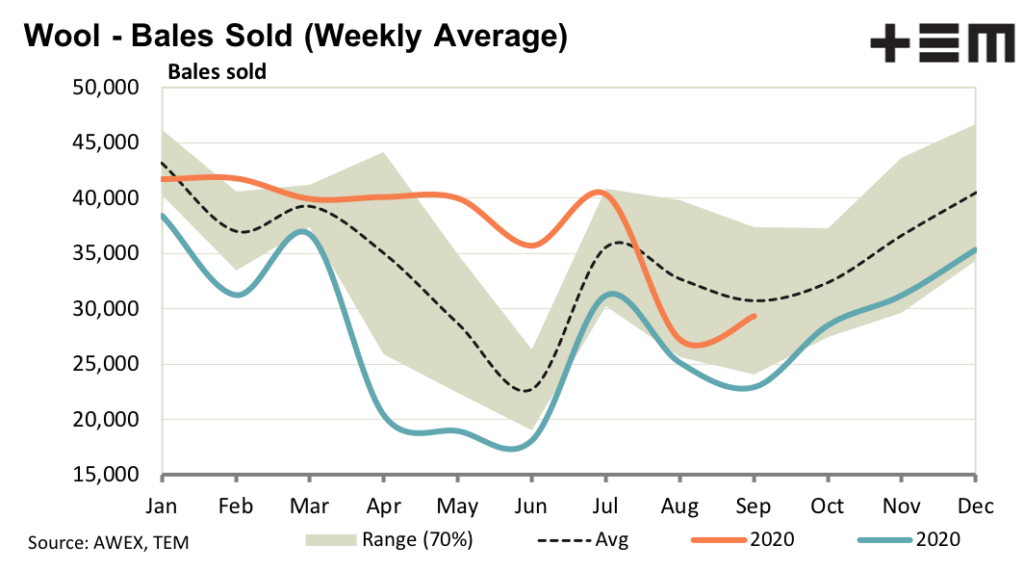

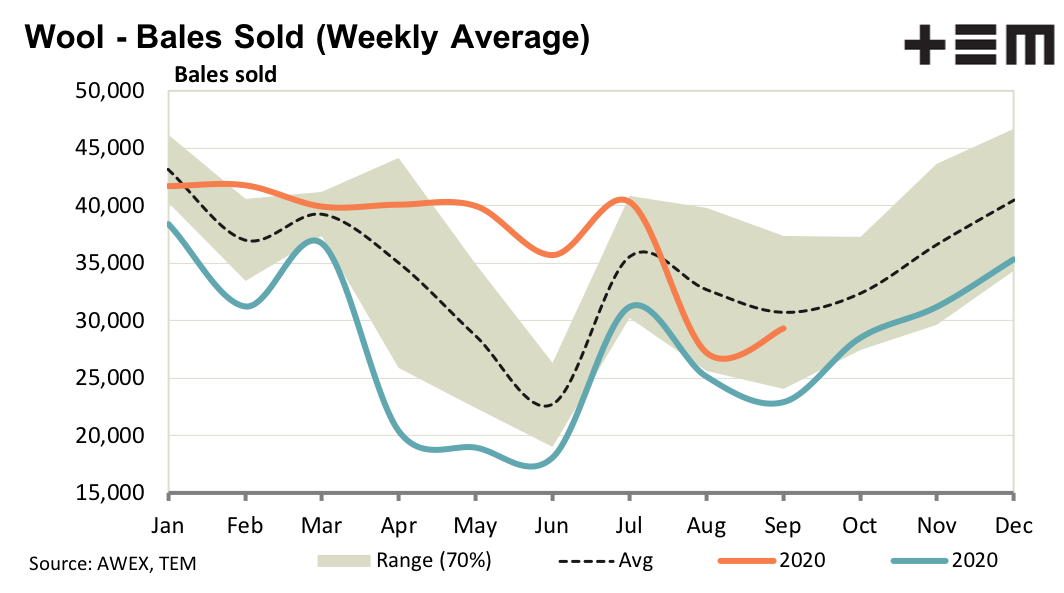

In US dollar terms the greasy wool market fell in the two weeks after the mid-year recess and since then has stabilised. As a general rule if prices are going to be weak then they will be weak early in the spring, which is now. So, the fact that prices are holding in mid-September (albeit with reduced clearances and a consequent build up of grower stocks) is a good sign.

21 Micron

In eastern Australia the average merino fibre diameter has fallen year on year in September, a little earlier than anticipated. This should help take the pressure off broad merino micron discounts, allowing them to shrink. The micron discounts had blown out to maximal levels (around 490 cents for 23 micron fleece versus 21 micron) in July.

28 Micron

The increased supply of broad merino wool in the past year has been the largest in proportional terms in three decades (off a very low base). As a rule increased broad merino volumes are associated with a widening of the 28 to 21 micron discount, so at a time of weak crossbred demand the increase in merino volumes has added to the downward pressure on crossbred wool prices. This cycle looks to be changing which will help reduce some of this pressure as the season progresses.