Meandering along

Wool Market Update 23rd February 2024

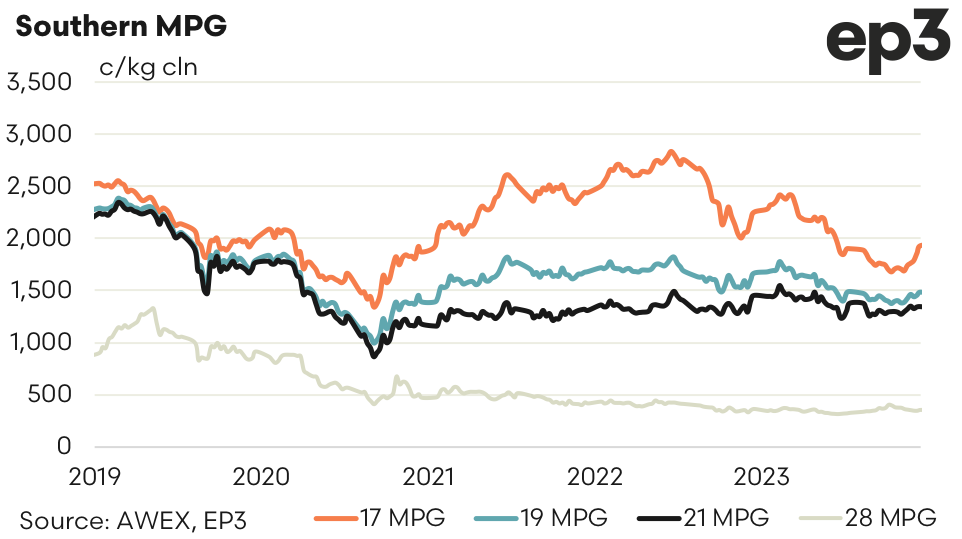

The market meandered along with the Eastern Market indicator ending unchanged for the week. Buyers again tried to motivate sellers by offering flat or slight premiums out to June with little result. May traded at 1380 early in the week, a 10 cents premium, for 19.5 but with no follow-on business fell back to par on the close.

Bidding in the distance months remains stable. June to December 2025 bid 1470 and January 2026 at 1500. Premiums of 60 and 90 respectfully above the spot cash of 1408 for 19.0 micron.

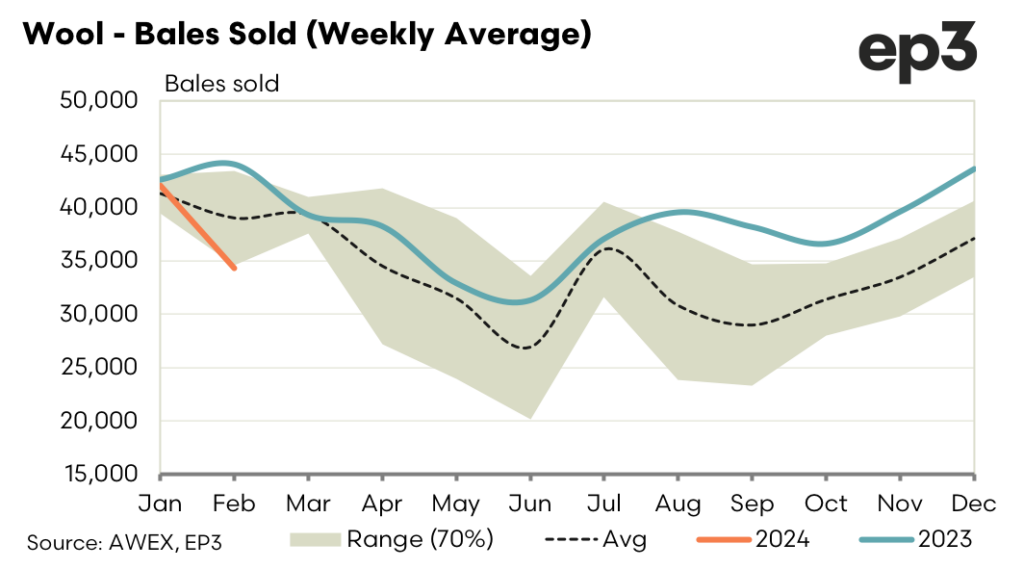

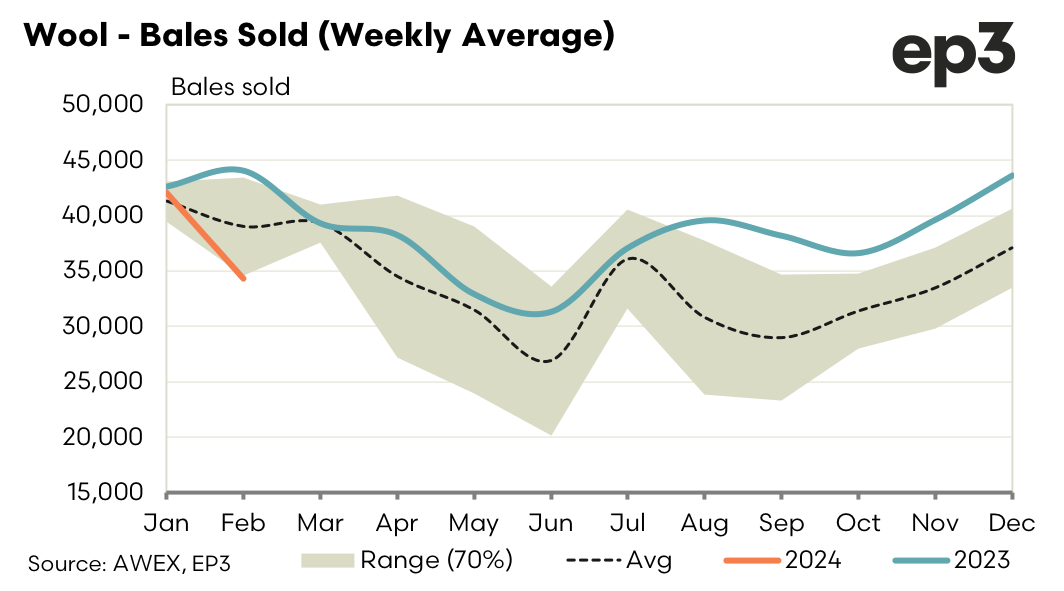

Average weekly volumes of bales sold during February are running 12% below the seasonal trend based on the last five-years of trade. Average weekly bales sold sits at 34,315 compared to the five-year average of nearly 39,000 for February. In February 2023 bales sold averaged 44,000 per week so the current volumes traded are running 22% lower than this time last year. Despite the lower supply wool prices are struggling to lift suggesting that demand remains weak so far in 2024.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.