Movement, but not progress

Wool Market Update 27th October

“Don’t confuse motion with progress. A rocking horse keeps moving but doesn’t make any progress.” – Alfred A. Montapret

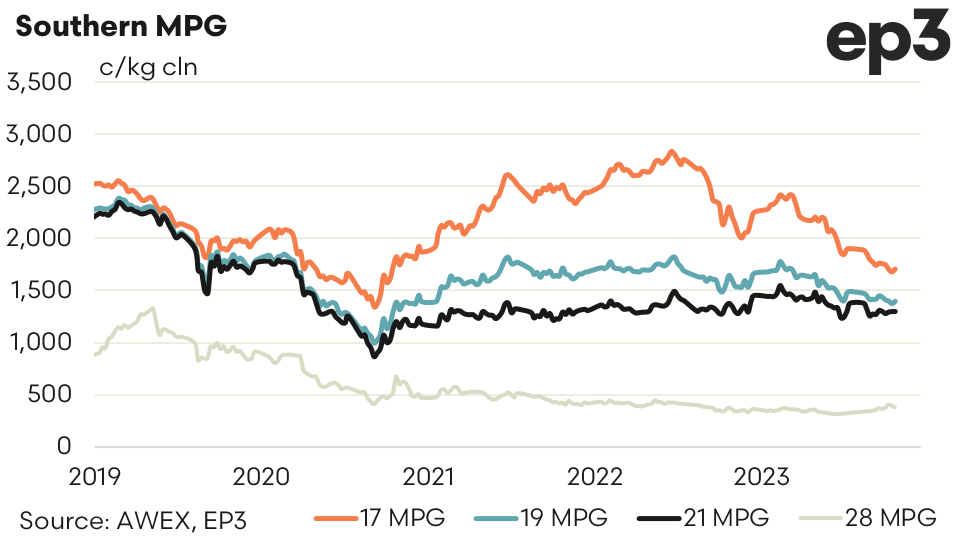

The auction market, in general, went up and down on the one spot. Individual micron categories varied. The super fine were a little dearer, medium merinos and crossbreds cheaper leaving the Eastern Market Indicator unchanged.

The forward market paints a similar picture. Buyers and sellers are spread either side of the Current cash price meeting in the middle irregularly to mitigate each other’s risk. This week’s trades were executed either side of the closing levels. 18.0 micron at 1520 (cash1527), 19.0-micron 1415 (cash 1413) and 21.0 at 1300 (cash 1294). All were for end November maturity. This highlights not only the lack of direction in the market but the concern on both sides of the potential break either way in these uncertain economic and political times.

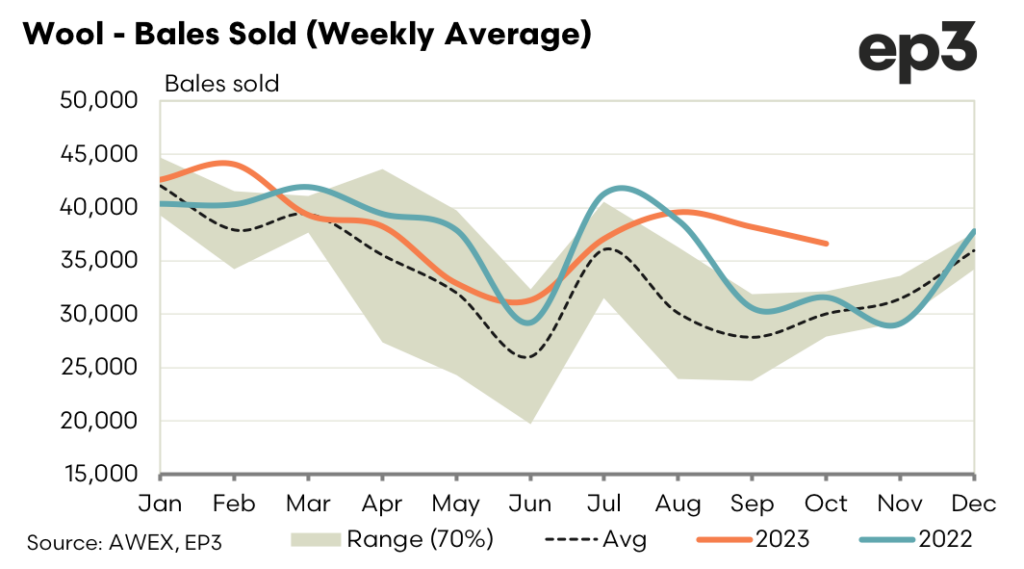

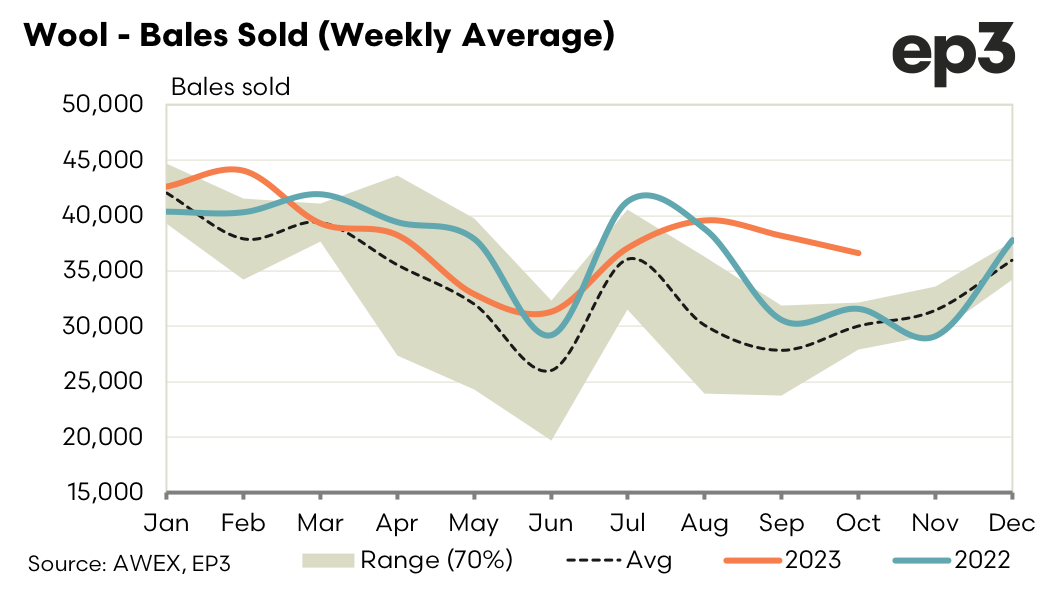

Volumes on both segments of the market are subdued. Buyers are getting very muted demand signals leading to interest being focused in the prompt window (2 to 6 weeks). Medium term interest (first half 2024) that was apparent flat to cash prior to the elevated hostilities in the Middle East has been temporarily put on hold. Longer dated interest (first half 2025) remains in little volume around 60 cents over cash. Sellers maintain their passive approach but showing some indication to alleviate a little risk at or around particularly as we head into the new year.

This week’s auction was dominated by traders. Hopefully they will execute more business over the coming days and look to cover at auction and forward. Bidding on the forwards currently 20 under cash indicating no urgency on the buyer side.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.