Optimistic opening

Wool Market Update 12th January 2024

“What is the difference between an obstacle and an opportunity? Our attitude towards it. Every opportunity has a difficulty, and every difficulty has an opportunity” – J Sidlow Baxter.

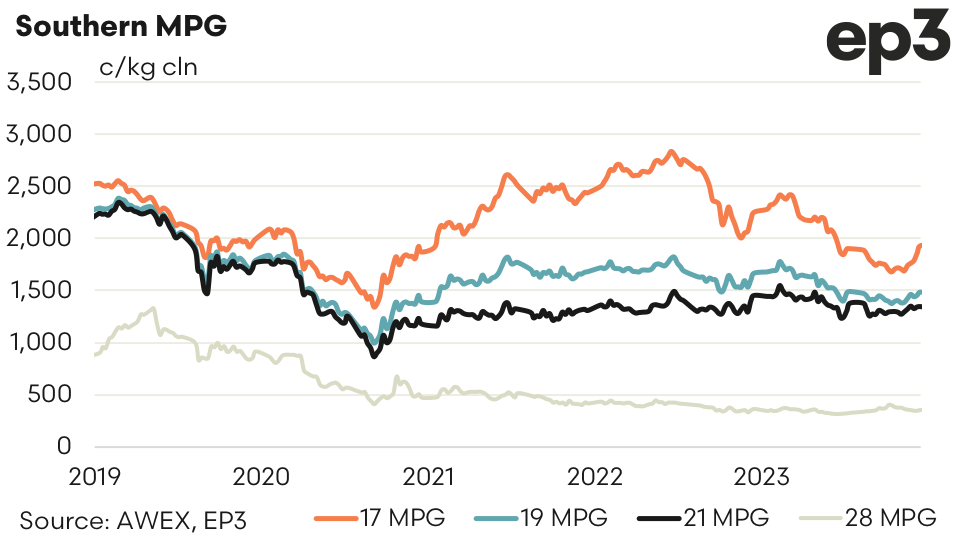

The return from the Christmas recess began with optimism. Over the break both super fine and crossbreds traded at cash in limited volume. Forward bidding indicated a steady if not solid start with all indices (17.0 through to 30.0) bid flat to close out to June. This unfortunately couldn’t draw selling levels out with growers wanting to see the open.

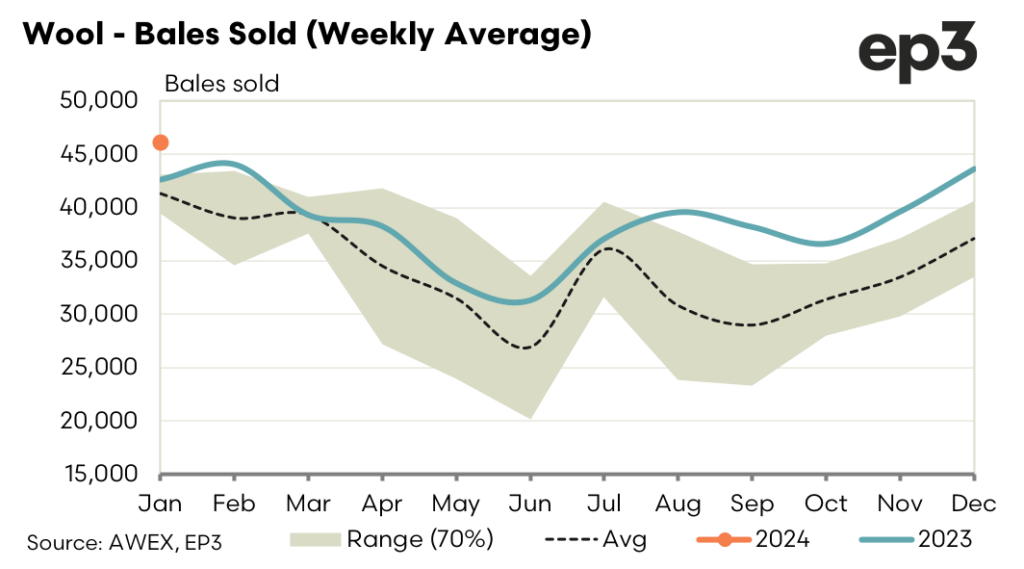

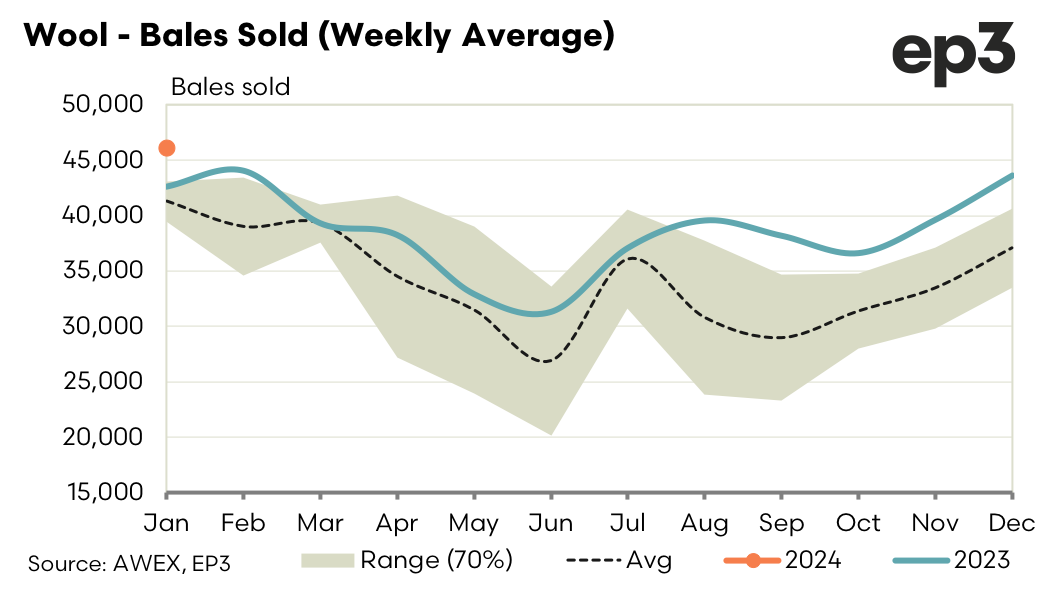

The reality didn’t quite match the optimism but with the Melbourne market regaining the loses of final day pre-Christmas slip it was enough for the bidders to lift levels in an endeavour to attract the attention of sellers. Sellers were again not prepared to enter the market even with the subsequent easing of prices Wednesday. With Thursday’s auction market drifting lower again the resolve of buyers was finally tested and bid levels retreated. Buyers have set the new support levels. Demand signals remain challenging ahead of next week’s 55,000 plus bales.

A combination of timing and weather shocks across a vast area the production area saw growers miss the first hedging opportunity of the new year. With Chinese New Year approaching the prospect for hedging will likely appear again over the next few weeks and we work through the larger auction volumes.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.