Sliding doors

Wool Market Update 21st June 2024

“When one door closes, another door opens; but we so often look so long and so regretfully upon the closed door, that we do not see the ones which open for us. – Alexander Graham Bell

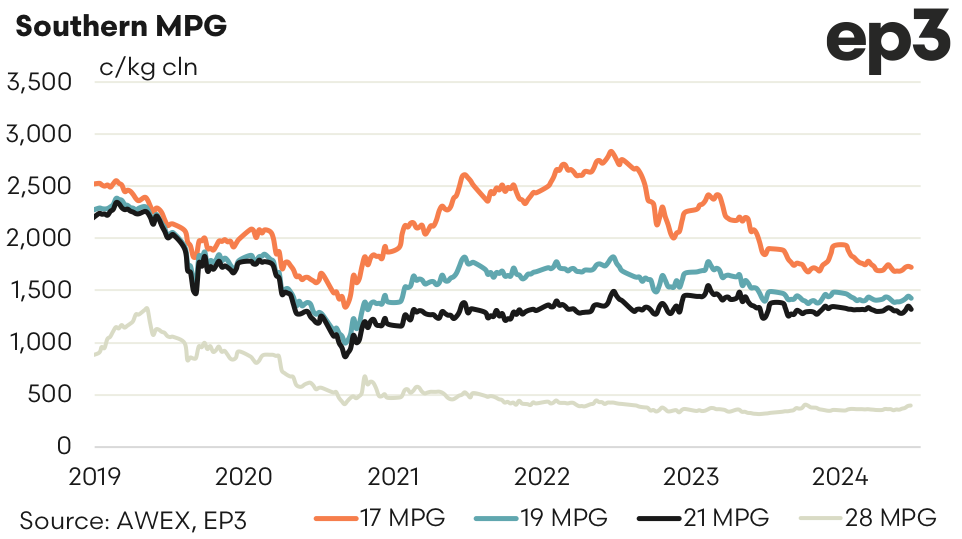

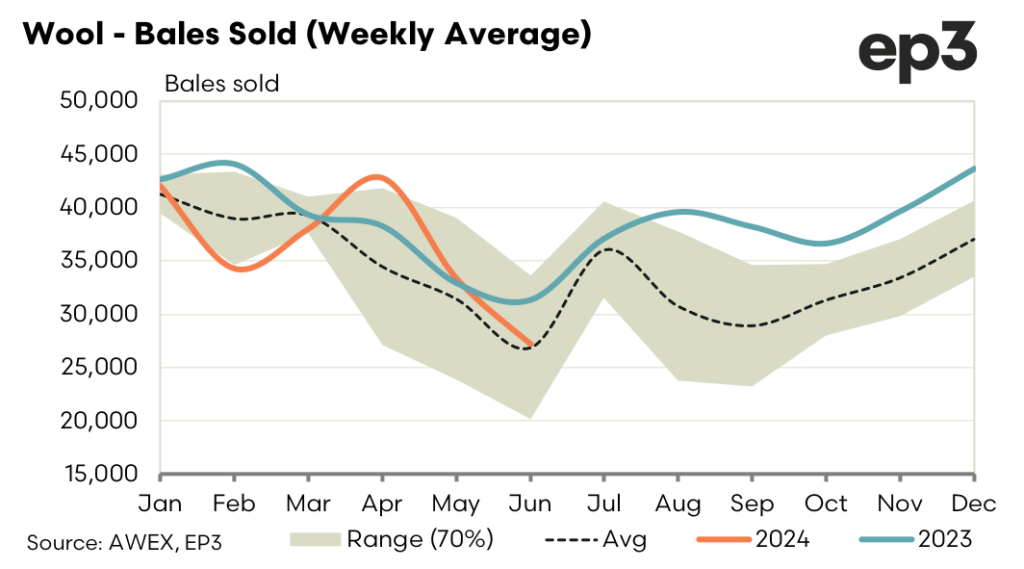

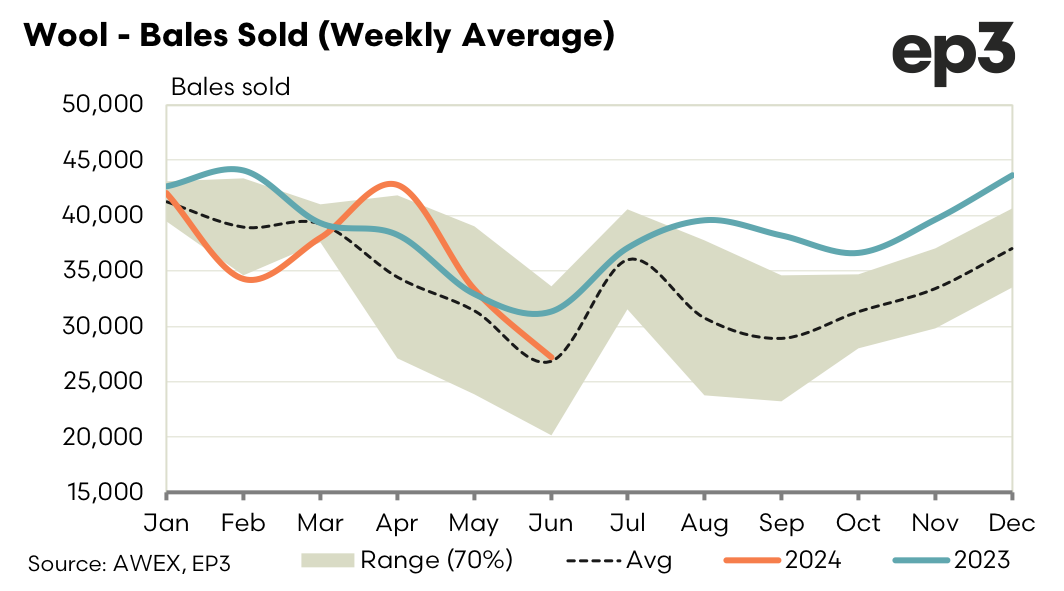

A combination of a strong AUD and a continuation of soft demand saw the spot market give back some of the hard-fought gains of the last three weeks. The negative price action caught most by surprise as limited supply this week, with only the East Coast selling centres operating, was expected to see the market steady. Prices fell across all merino types by 1 to 2%. Crossbreds and cardings remained steady.

The forward market started the week solidly bid by traders expecting a continuation of the positive market and looking to cover their risk. Spring traded at a 1% premium to cash with 19.0 executed at 1460 and 19.5 at 1420. The weak start to the auction series saw 17.0 trade for late June at 1735 before traders withdrew bids to see how the rest of the week would pan out.

Next week has 40,000 bales rostered. Forward buyers are cautious waiting to see the reaction offshore to the pull back in prices. We are likely to see a continued ebb and flow of price levels as we navigate the last five weeks of the current season. Forward price opportunities are likely to arise for the spring and early summer as traders look to hedge their risk. Levels for late 2025 and 2026 remain at a 6% premium to cash at 1500 for 19.0 microns.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.