Softly meandering

Wool Market Update 1st November 2024

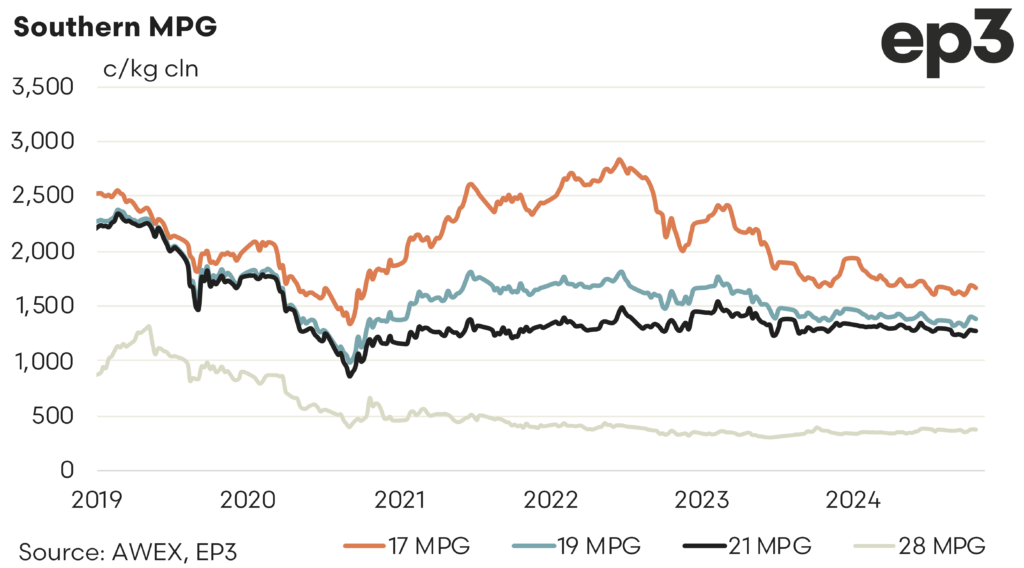

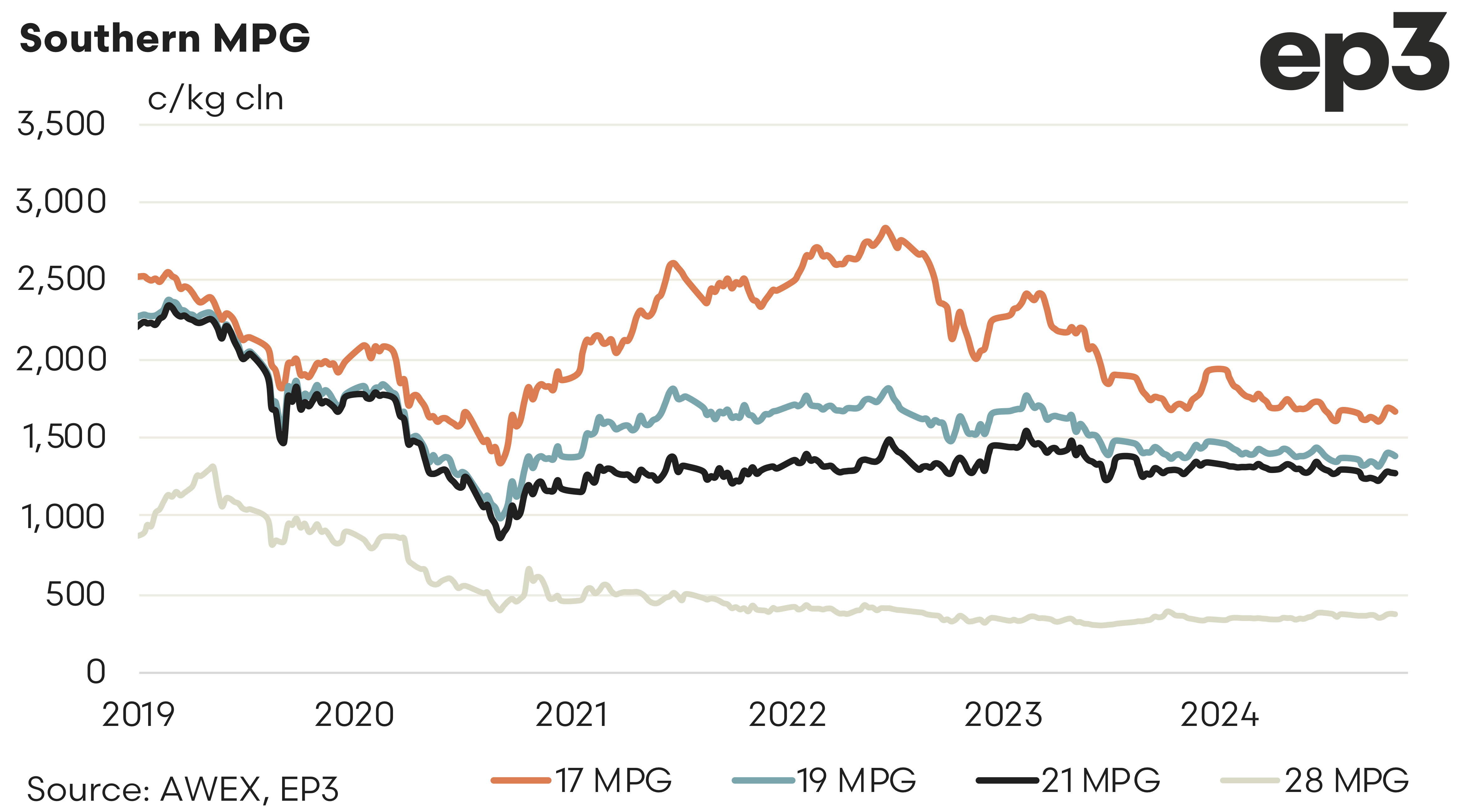

Another week where the spot market meandered with the tone that has haunted the market in the latter part of the month generally softer. The early October rally put almost 7 per cent on prices in the first two weeks. The next three weeks has given back almost half of those hard-fought gains.

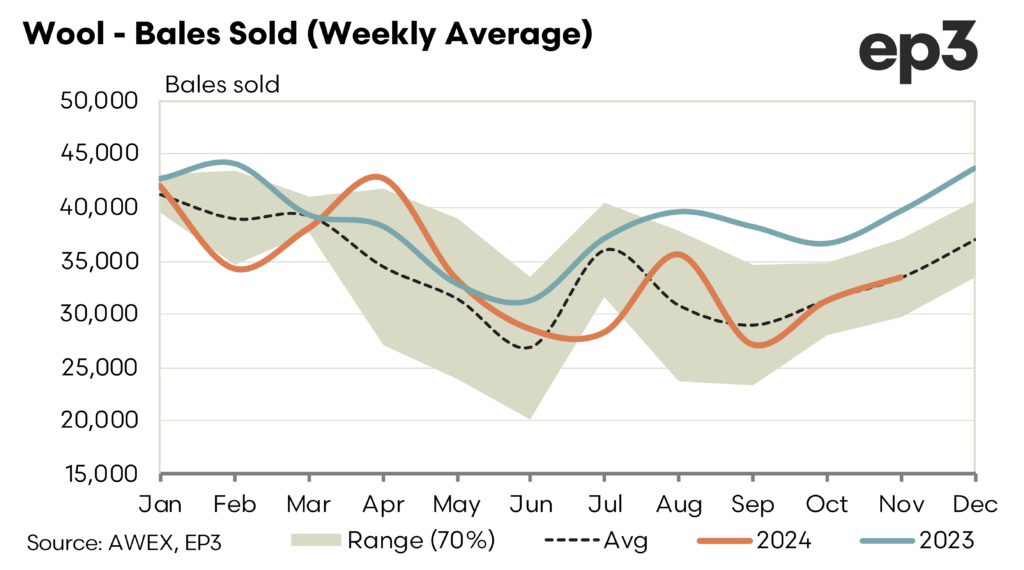

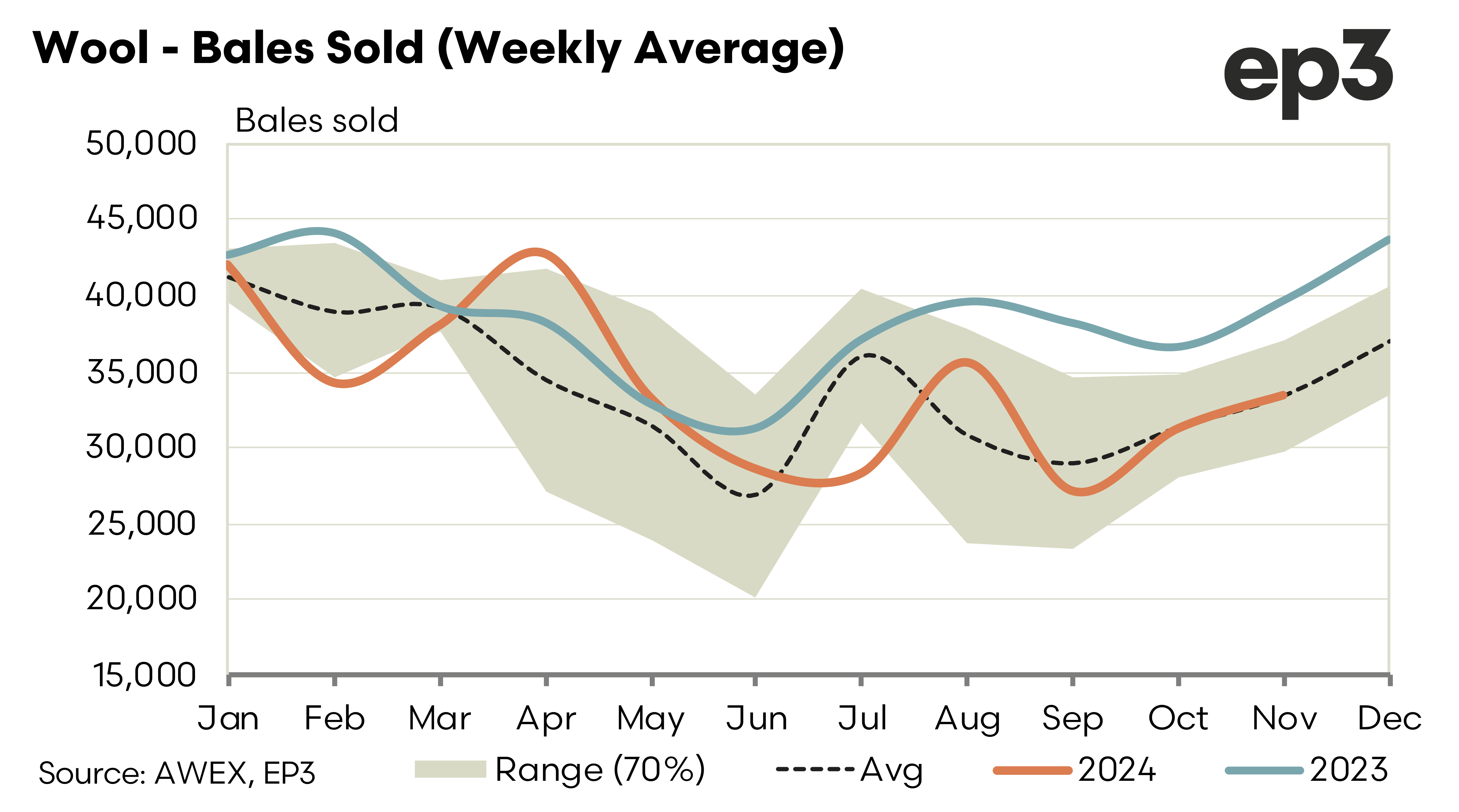

Both the spot and the forward markets are suffering from a lack of confidence. This malaise is affecting most soft commodities with consumer confidence low due to cost-of-living pressures and the current economic and political uncertainty. Passed in rates remain low with more than 90% of wool being sold. Growers are accepting of the levels, albeit historically low. Frustratingly they are not engaging in the forward to manage their risk.

Forwards remain lightly bid and offered. The outliners remain the strong bidding in late 2025 and into 2026. 19.0 bid Dec 2025 at 1450, Jan 2026 at 1450, March 2026 at 1500 (cash 1382). 19.5 bid Jan 2026 at 1450 (cash 1345).

Next weeks 38,000 bales on offer will likely see prices remain range bound.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.