Stronger supply, sluggish demand

Wool Forward Market Report 10 March 2023

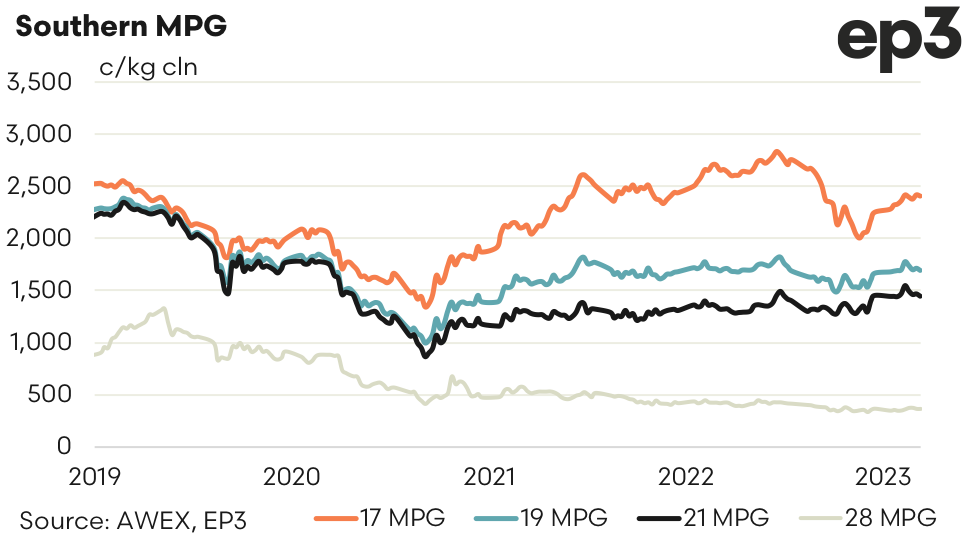

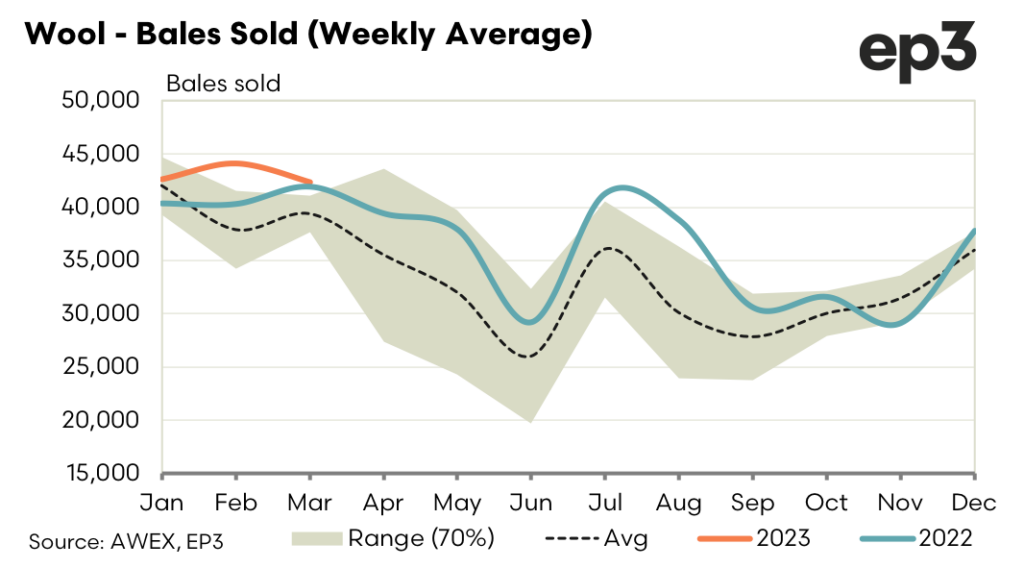

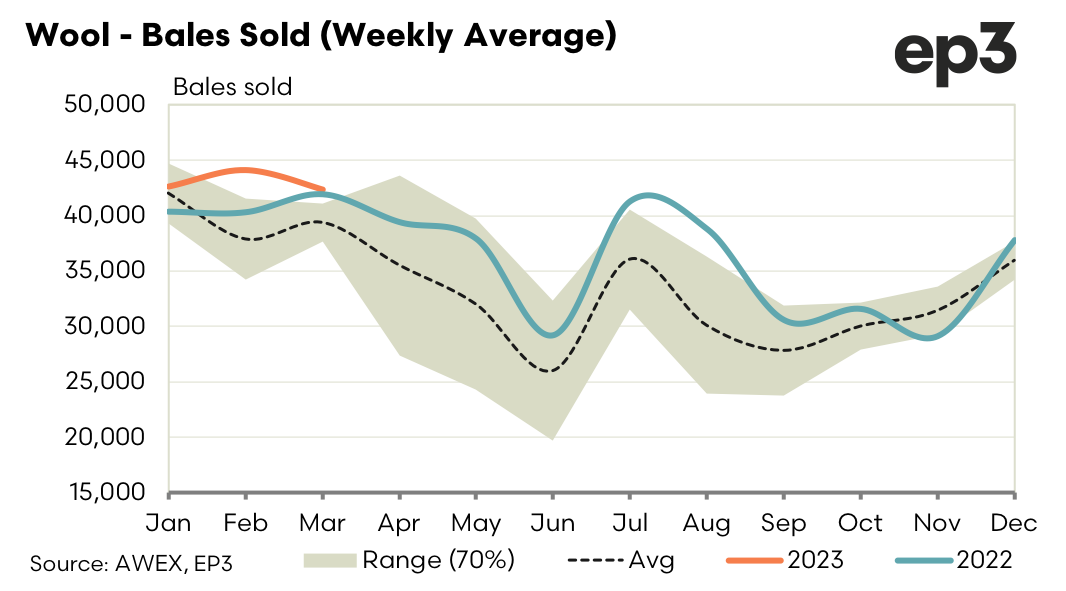

The spot market continues its downward trend with all merino qualities losing ground. The decline has been a combination stronger supply especially in the last month and sluggish demand. The market as worked through what is anticipated as the peak supply period. Result has been a fall from the early February highs of about 5% with the broader qualities most affected. 19.0 micron has decreased 80 cents to 1696 cents (2-year average 1664). 21.0 has dripped 100 cents to 1448 but still well above the 2-year average of 1334.

The forward market again suffered with lack of depth. Buyers started the week with expectation of a steady spot. Bids were about 1% under spot for the nearby shipping window. Those bids attract the attention of growers in any meaningful volume and soon disappeared once the prospect of a solid market were dashed. The only nearby trades were March 21.0 micron executed at 1460, 12 cents above the closing cash.

The “where to from here” will likely be dominated by the macro-economic factors. The currency influence will be secondary as we saw again this week with a 2.5% strengthening of the USD unable to stop the spot market decline. Activity post the China lockdown remains sporadic. The general positive rhetoric has not yet translated to encouraging market action with most commodities under performing in the main. Cotton has fallen around 6% in USD terms since early new year highs but thankfully Aussie growers have been somewhat sheltered in AUD. The wool to cotton ratio remains in its recent range around 5 to 1.

It is expected bidding will remain conservative to start the week unless the weekend bring out better demand signals. We envisage bidding to be once again just slightly under cash at 1680 for 19.0 and 1440 for 21.0 into the March/April export window. Spring interest is very haphazard but full year 2024 pricing remains resolutely at 1670 for 19.0 micron slightly above the 2-year average.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.