Take it or leave it

“As a child my family’s menu consisted of two choices: take it or leave it.” ― Buddy Hackett

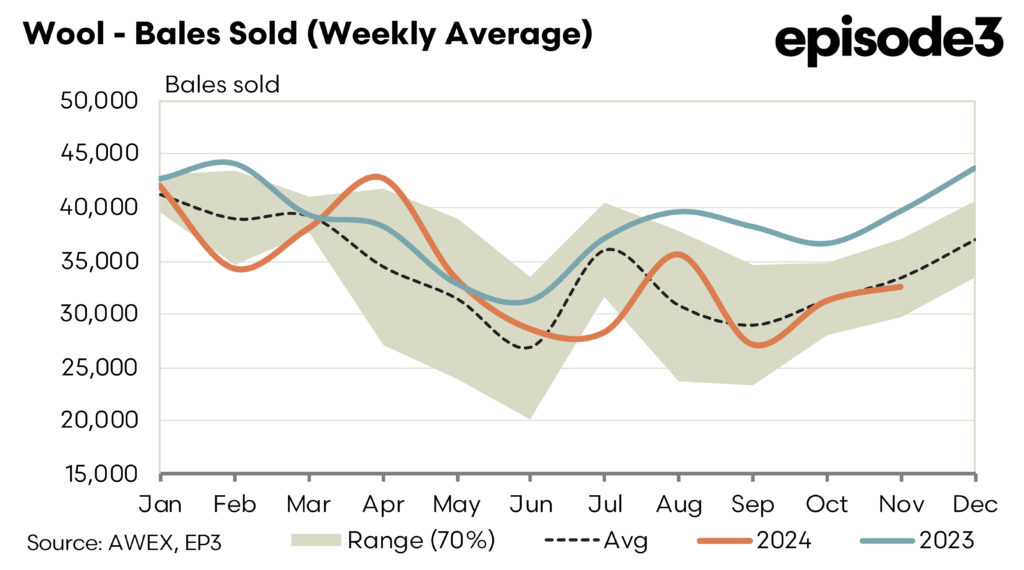

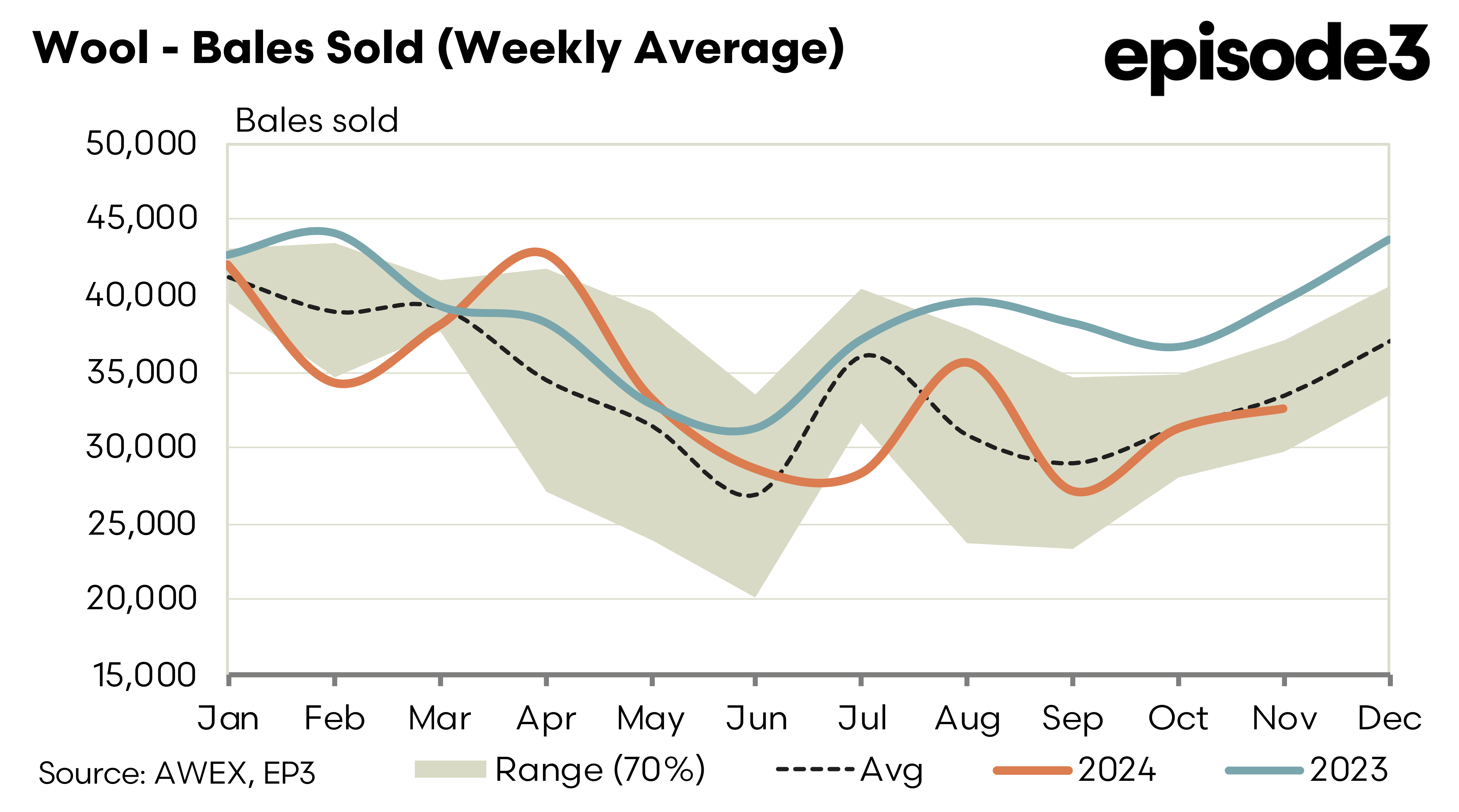

Meander, wind, wander how many synonyms can we use to describe the current path that the auction market has taken in the first half of the season. The last six weeks has seen the Eastern Market Indicator (EMI) move in single digits each day with a nett result of just 2 cents over those 14 selling days. This against a backdrop of 20 per cent less volume coming through the auction. The other constant has been the low (less than 10%) passed in rate. Growers are “price takers” even at these low historical levels.

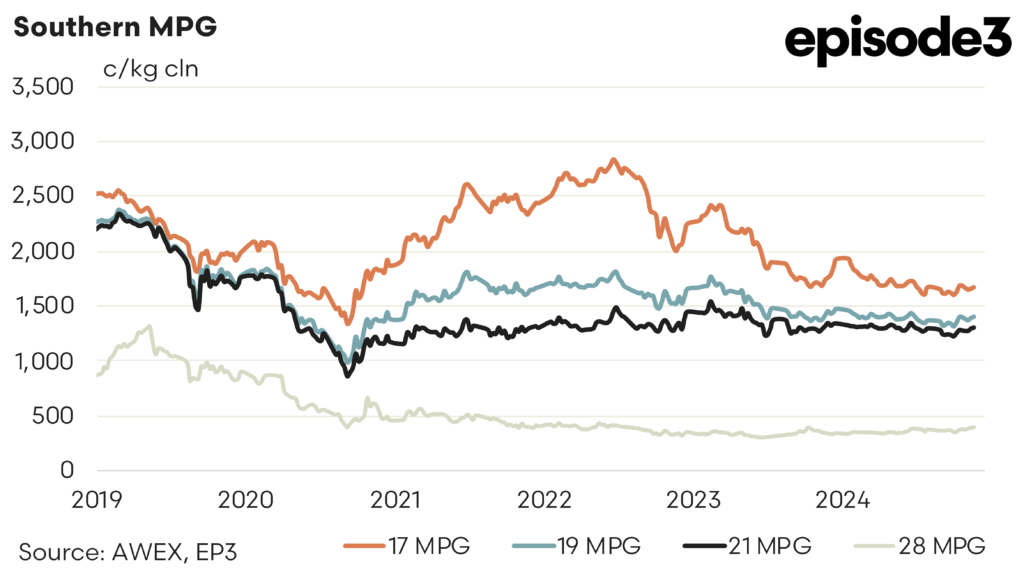

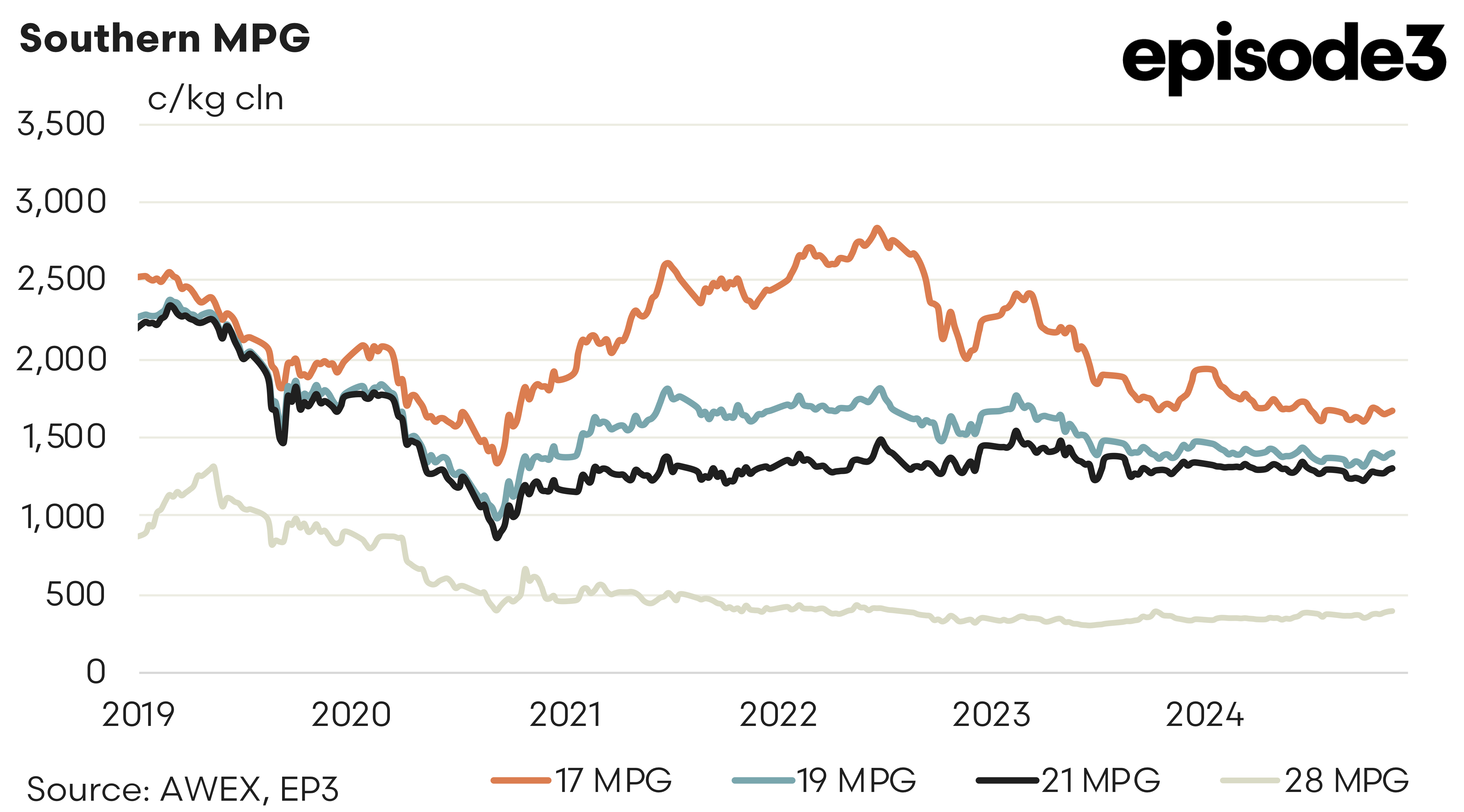

The forward markets are suffering from the absence of liquidity triggered by low volatility and nearby demand. Volumes for the season to date are running at less than 0.5% of the underlying clip. The viability of the market is at risk. The only trade for the week was in the 19.0 contract which was executed at 1430 for January 2025 (30 cent premium to cash). The 19.0 remains consistently bid across the maturities. With cash at 1400 – Nov/Dec bid 1390 (-10), Jan/Feb bid 1410 (+10), March 1415 (+15), May 1410 (+10) Dec 1450 (+50). Out in 2026 19.0 micron bid January and March at 1500 (+100 to cash)

Growers are gradually showing where they consider fair value by offering prompt (Dec24) at 1415 (+15). Later into 2025 July is offered at 1485 and August at 1505. With current prices in the lower half of historical percentiles sellers need to populate the forward markets at levels that they believe represent fair value.

Next week is likely to deliver a similar tepid spot market with light volumes again the only potential trigger.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.