Taking a breath

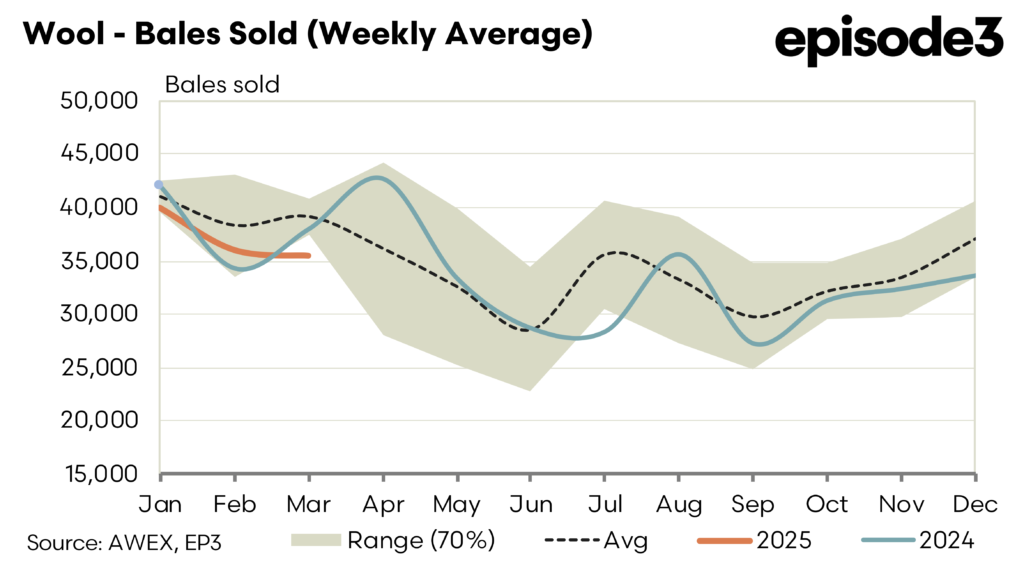

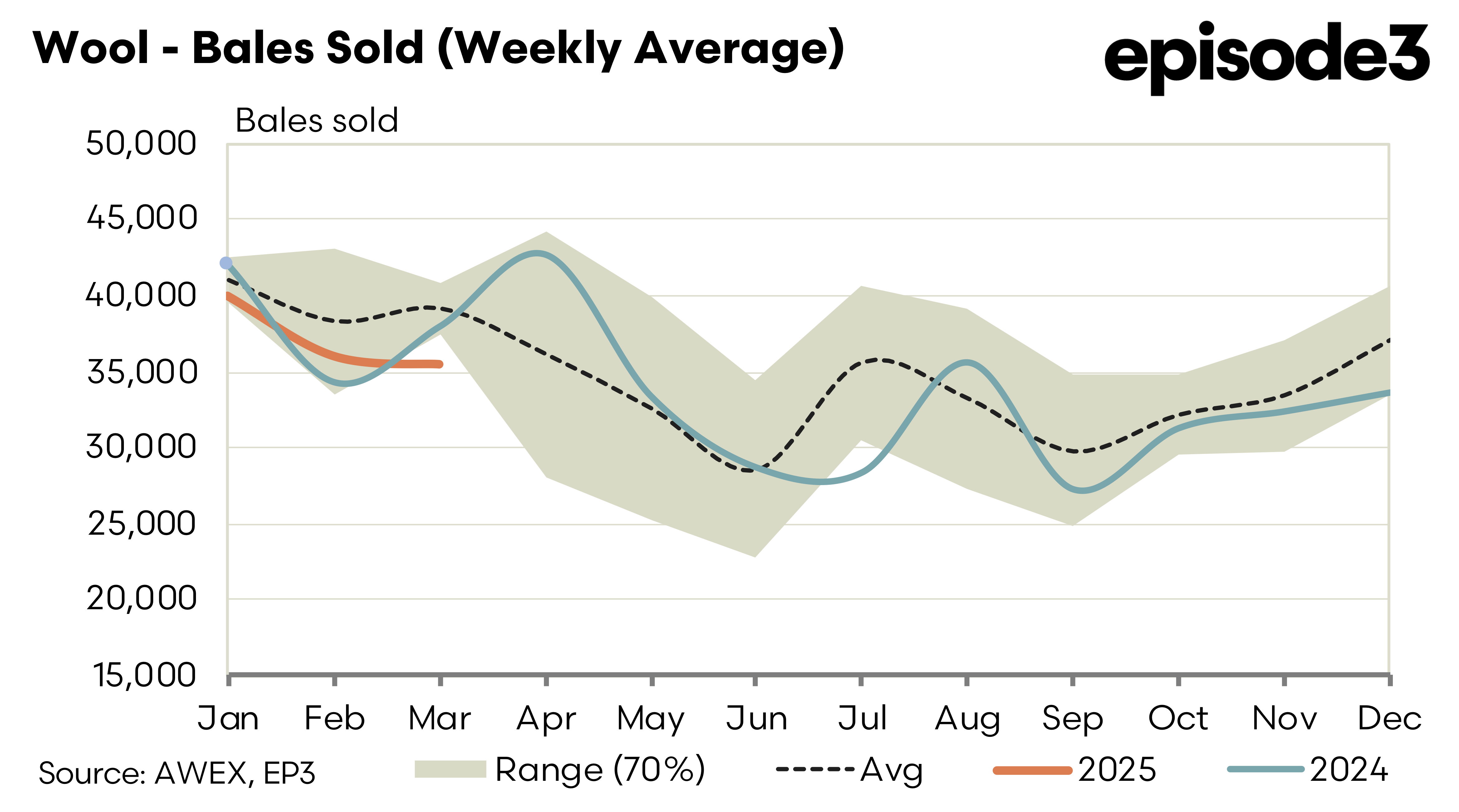

The spot wool market took a breath after 11 straight auction sessions which saw the Eastern Market Indicator (EMI) move from 1180 to 1251. Demand remains tepid and a slight shift in supply saw most of the merino sector of the market lose a little ground.

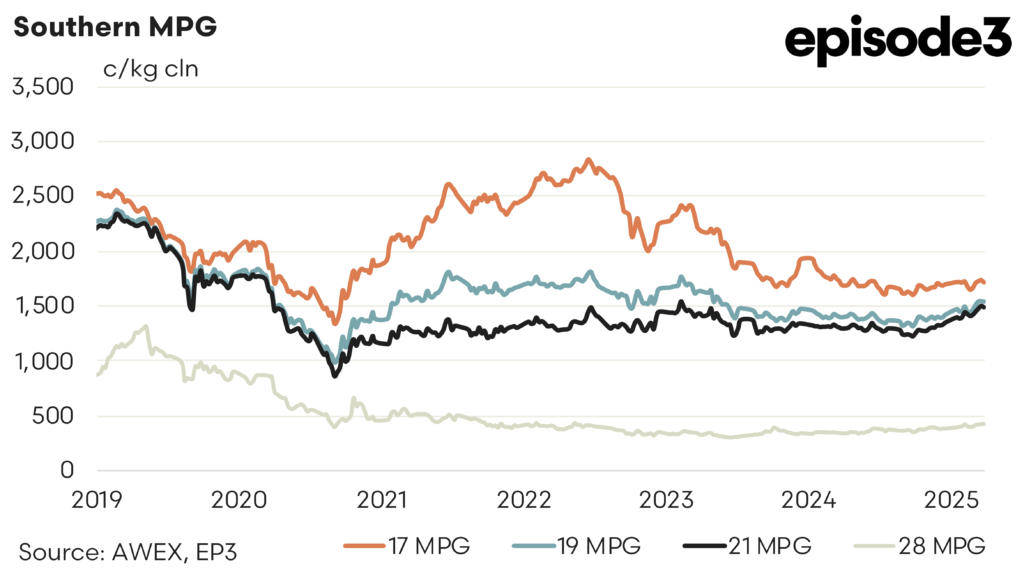

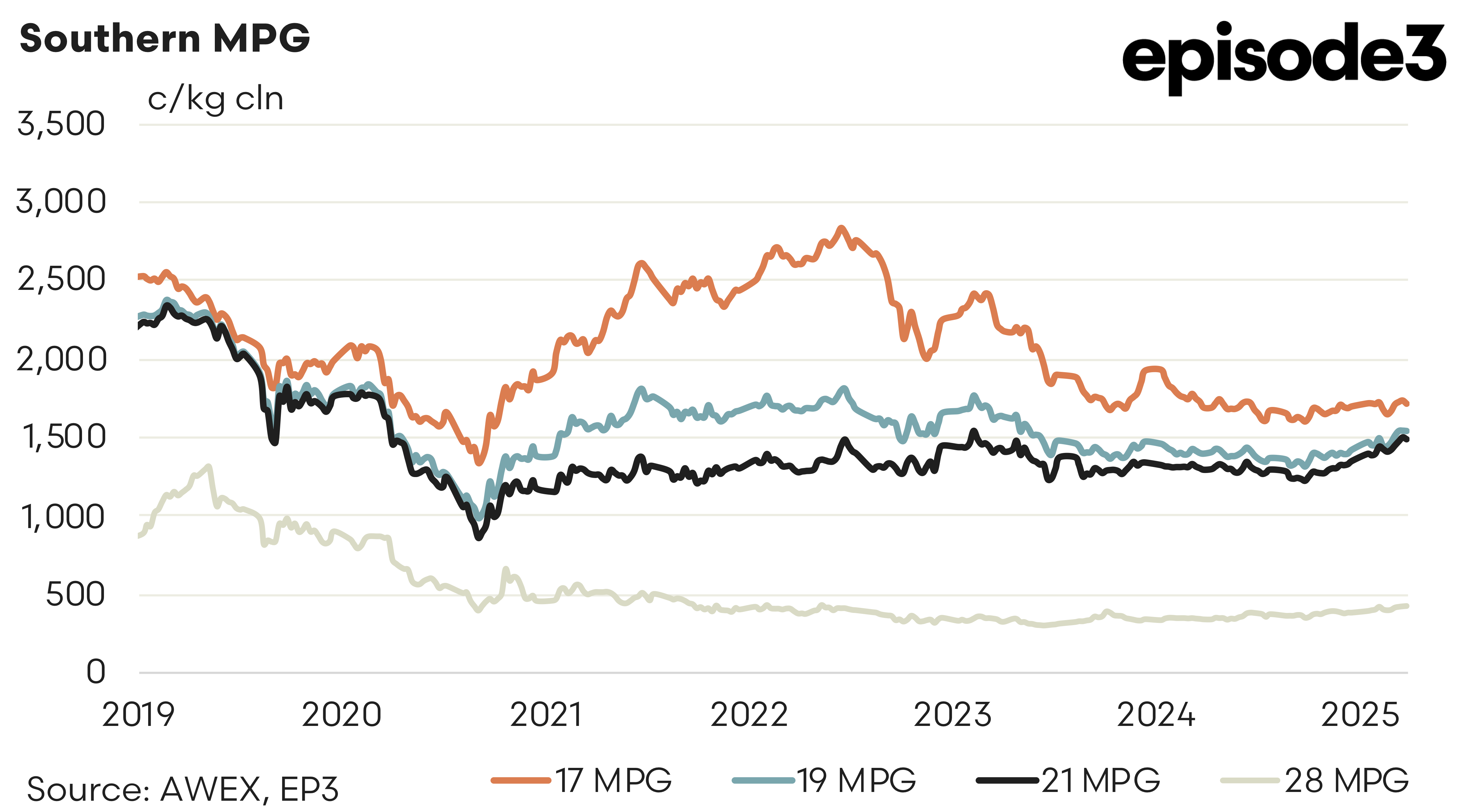

The forward market reacted as you would expect. Buyers became a little less keen with the spring premiums on the fine wools disappearing after the auction start on Tuesday. Sellers came of the fence especially on the medium wools with offers in the medium-term window discounted slightly to the peak of last week. Spring sellers of 21.0 micron are now targeting the 1500 level. This looks a sound strategy. Since the impact of covid-19 the 1500 barrier has only been breached twice. First time was for 4 selling days in February 2023. The second being the peak of 1508 last week at auction and this week’s slip back to 1502. Hopefully the retraction will be minimal, and a base will be formed off which the market can regain momentum. That said some insurance at an historically positive level is a sensible policy.

Trades this week were restricted to the finer microns with 19.0 executed for May and June at 10 and 20 cent premiums to cash.

Next week will see the steady, albeit below average, supply hit the market with 41,000 bales on offer. Tight supply at the medium end of the market has seen the continued contraction of the basis to the finer wools. The 20- and 21-micron price guides have converged and the difference between 19.5 and 21.0 ( the key China micron types) has contracted to under 50 cents. Strange buy not unprecedented days.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.