The gravity of it

Wool Market Update 24th May 2024

We’re always in the middle of two energies. Gravity is sinking you down; inspiration is pulling you up. – Mandy Inger

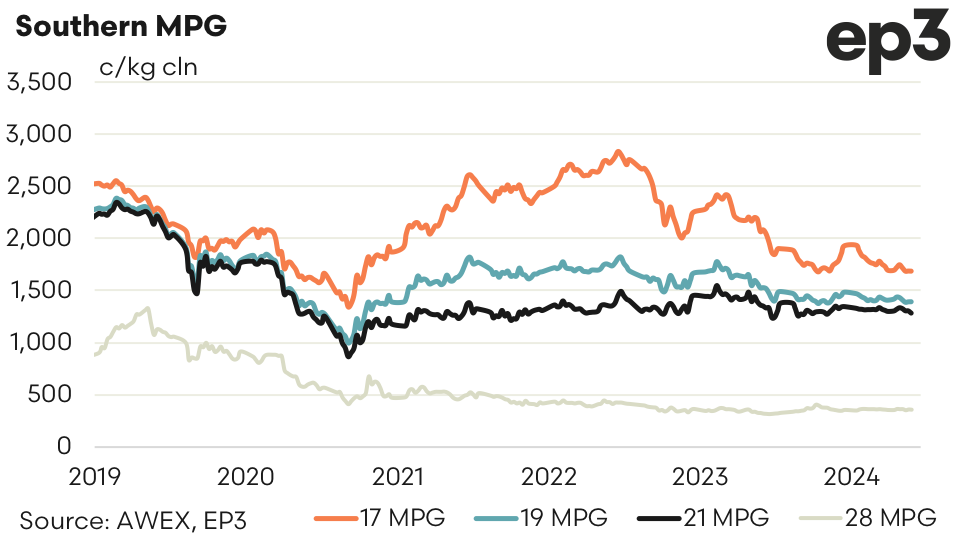

The spot auction again failed to deliver much if any inspiration. Super fine and fine wools tended to hold their ground while the medium qualities succumbed to the tepid demand and unhelpful Australian Dollar.

The forward market had modest action this week. Buyers have been endeavouring to cover some risk as prices looked to bounce off midpoint of their more recent trading range. Some trading occurred with 18.5 executed for June at 1455 and 21.0 in July at 1300. Bid levels have generally held firm to cash mirroring price action in the spot, 17 to 19.0 and Crossbreds unchanged for the week and 19.5, 20.0 and 21.0 reduced 20 cents. Sellers have generally been cautious, undervaluing certainty.

Selling levels are beginning to appear in the spring and early summer. They are currently set at 60 to 70 cents above cash. It will be interesting to see how the buy side react. Presently buyers see that level of premium to the spot market only justifiable twelve months out. This is reflected in the current bidding of 19.0 micron for the second half of 2025 and beyond. At 1500 this is 100 cents over cash and stretch out to July 2027. Volumes are thin but emphasise to one of the important roles of forward markets – giving, particularly growers, an indicative forecast of return. Growers will likely be targeting levels closer to the mid-point of post Covid recovery period 2022/23 of 1500 to 1800. The robustness and value of these signals can only come about with better participation by both buyer and seller.

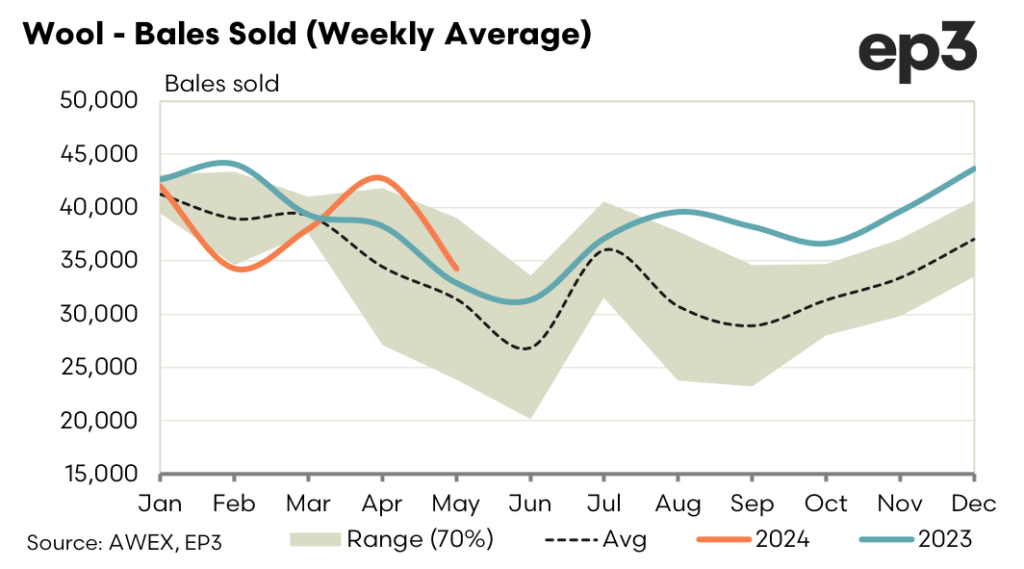

Spot volumes remain tight with just 33,000 bales on offer next week. The placid demand persists with consumer confidence still low, economic recovery disappointingly slow and resolution to global conflicts still in the future. Hopefully we will see inspiration in the form of better bidding into the spring and new year to match the confidence of 2025/27.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.