Tragedy or farce?

“History repeats itself, first as tragedy, second as farce” – Karl Marx

The spot wool market wailed against the trend of other commodity and financial markets and the farce that is the geopolitical circus, to post gains across all microns this week. The Eastern Market Indicator (EMI) has steadily risen for the eight consecutive sessions reaching 1242 its highest point since May 2023.

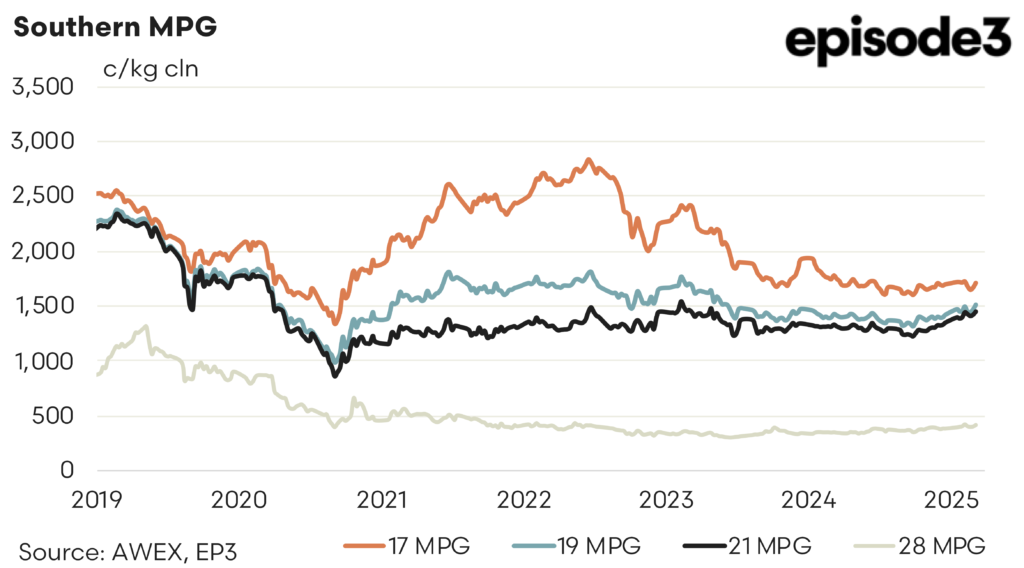

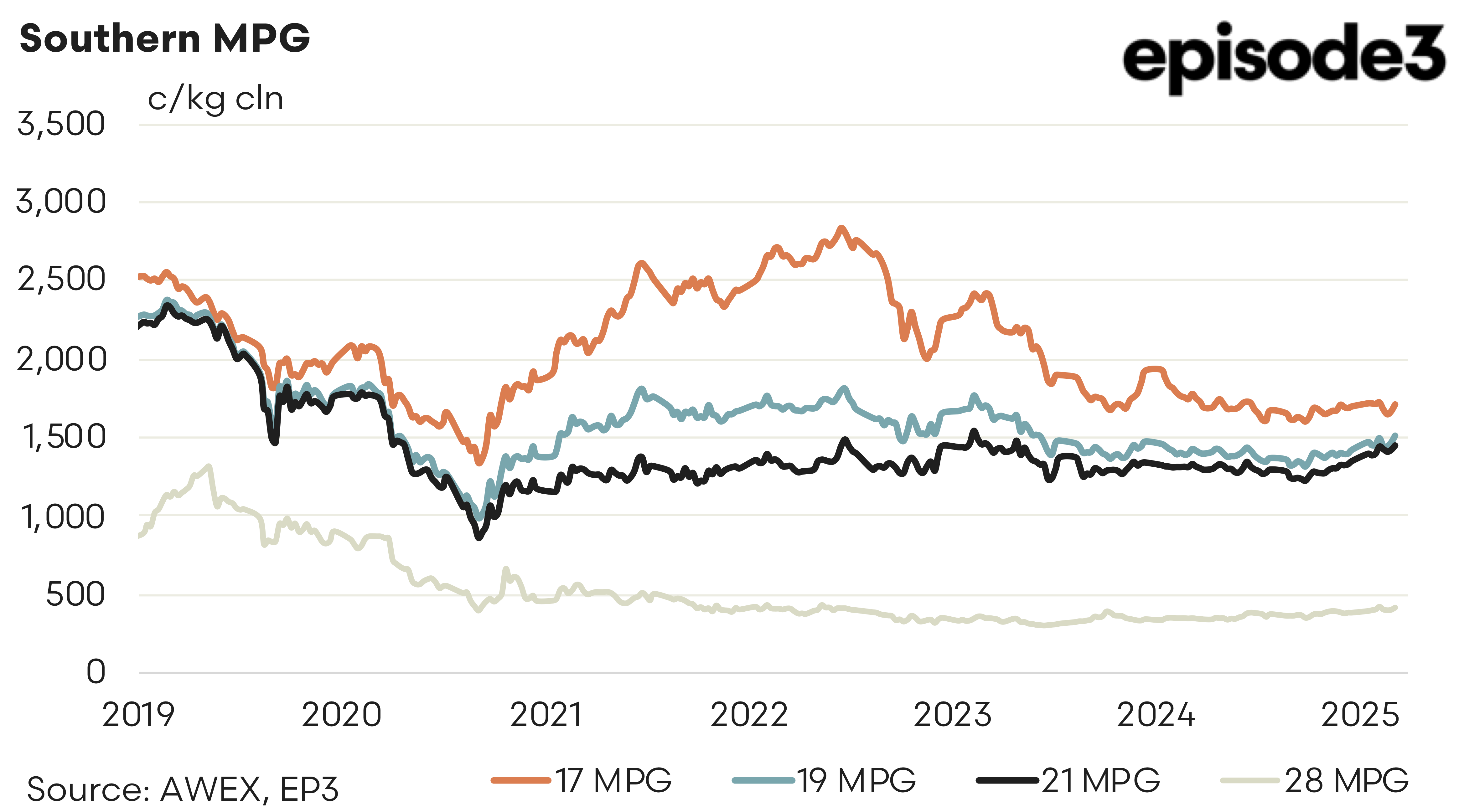

Medium microns are touching levels rarely seen since Covid. The 21.0 micron index peaked at 1489 on Wednesday as it nudged its way towards the top of the range (1500 cents) that has held for all but two weeks in the last 5 years.

The forwards were a little more active as both buyers and sellers tried to wrangle with the competing influences of tight supply versus the impact of a potential global tariff war. The focus was on the spring with trades being executed at a premium in the finer wools and flat to a slight discount for the medium wools. 19.5 traded November and December at 1570 (spot 1532). 21 microns traded at 1475 (spot 1483).

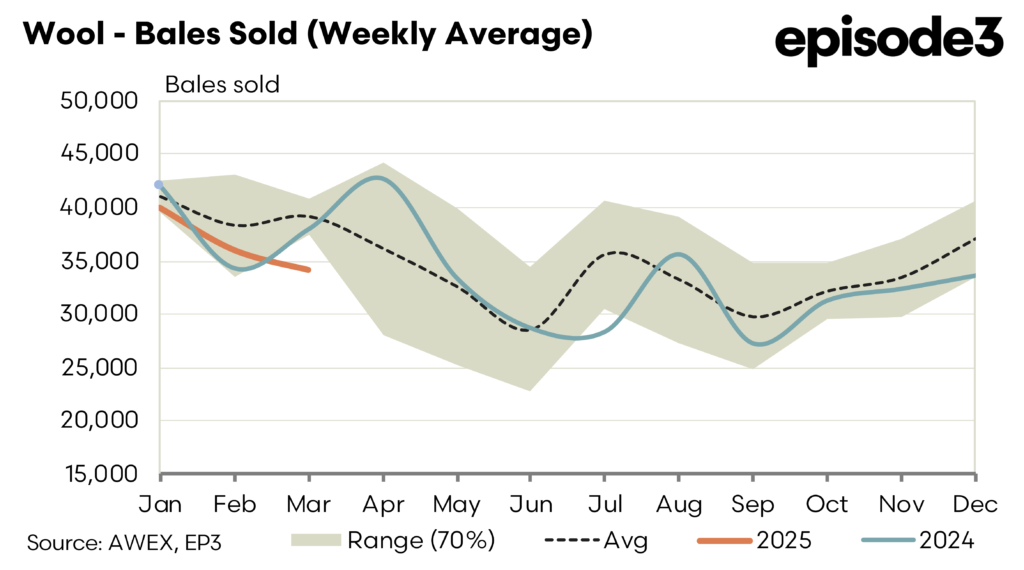

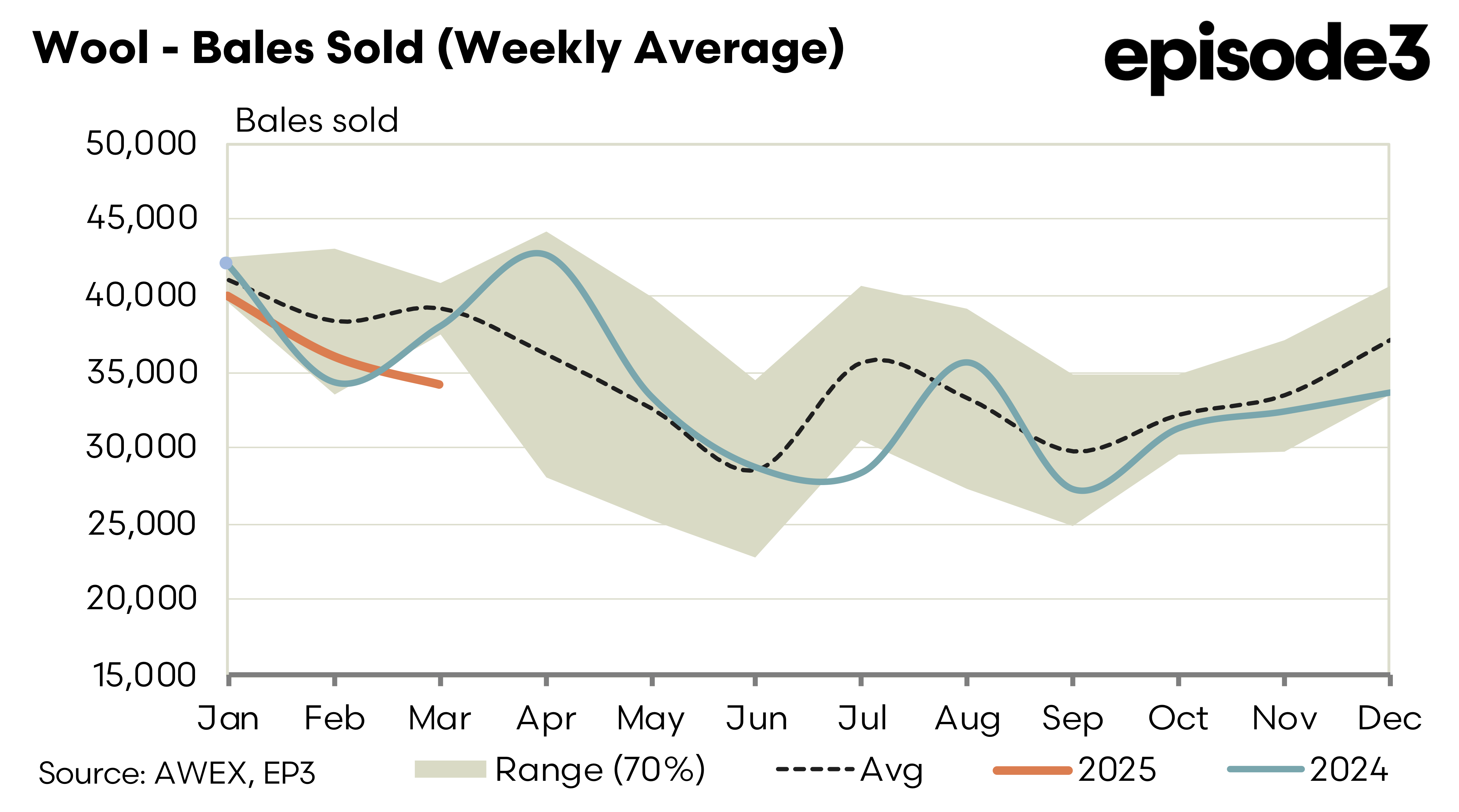

While tight supply is a lock the uncertainty around demand is escalating with tit for tat reactions from the key manufacturing and consumer countries rarely out of the headlines. Buyers continue to look for forward cover to balance the books. This will result in opportunities for growers to hedge.

Forward levels for next will likely start a little under spot for the nearby window (April to June) as processors digest the rise of the last few weeks. Spring bidding is at a premium for fine wools (19.0 1575) reflecting the tight basis to the medium wools. A more cautious approach is likely on the 21.0 contract. Buyers likely to re-engage at similar levels to this weeks trades.

Trades this week

19.5 September 1465/75 9t

21.0 November 1570 5t

21.0 December 1570 5t

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.