Unfortunate surprise

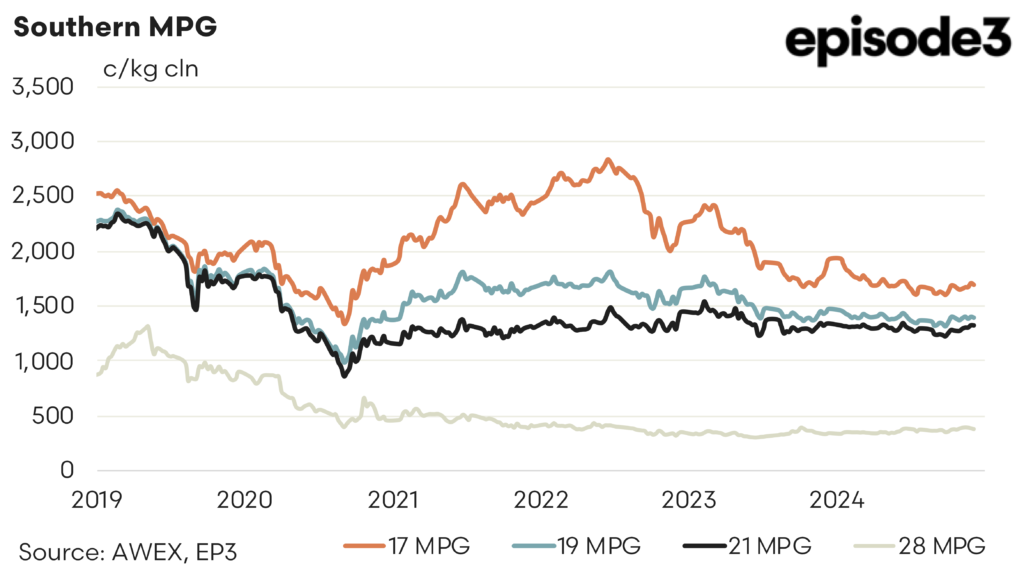

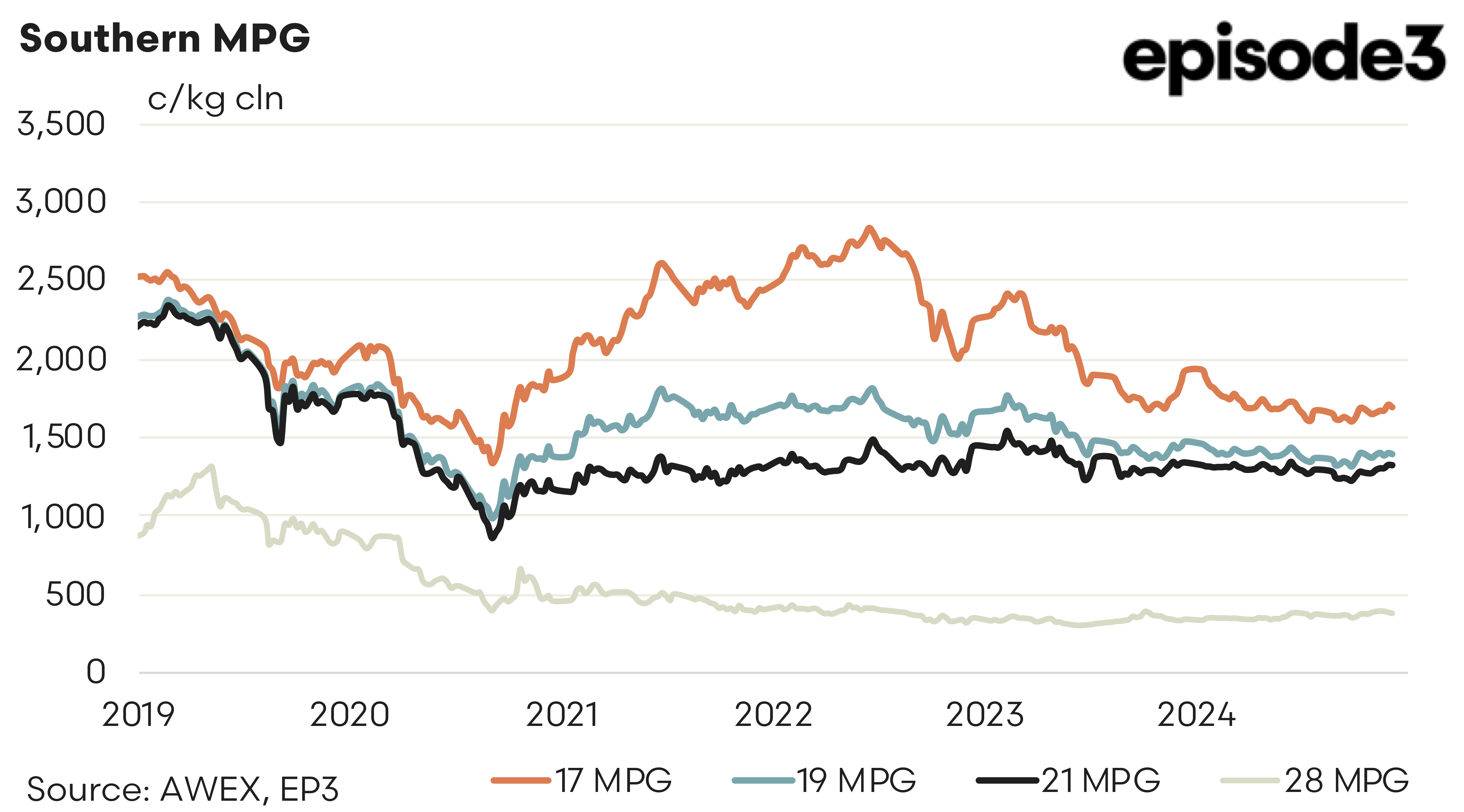

The spot market again surprised but not in a good way. A solid opening on Tuesday buoyed by a strong USD indicated a continued positive run to the Christmas recess. Wednesday delivered nothing but disappointment as the majority of merino qualities finished the week lower.

The forwards linger unchanged. Bids remain at flat to a modest premium for January and February. They rise slightly as we move through the year with December bid 3 to 4 percent over cash. Premiums in 2026 lift to around 7%. Depth on the bid and offer continues to be thin.

With growers reluctantly accepting the current historically low levels in the spot, for sound economic reasons, it is important that the forward market accurately indicates the levels required to assure supply will continue to be delivered.

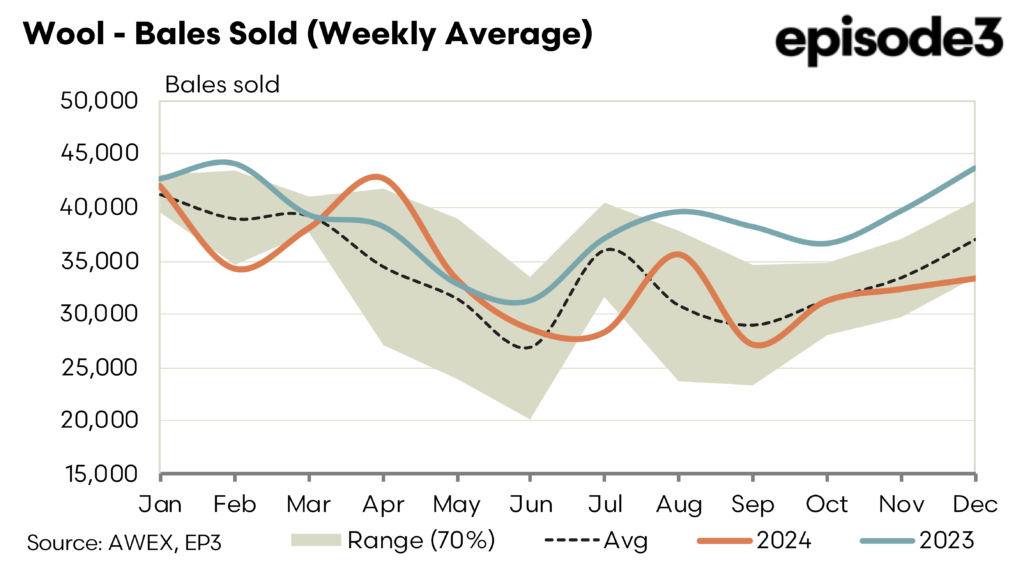

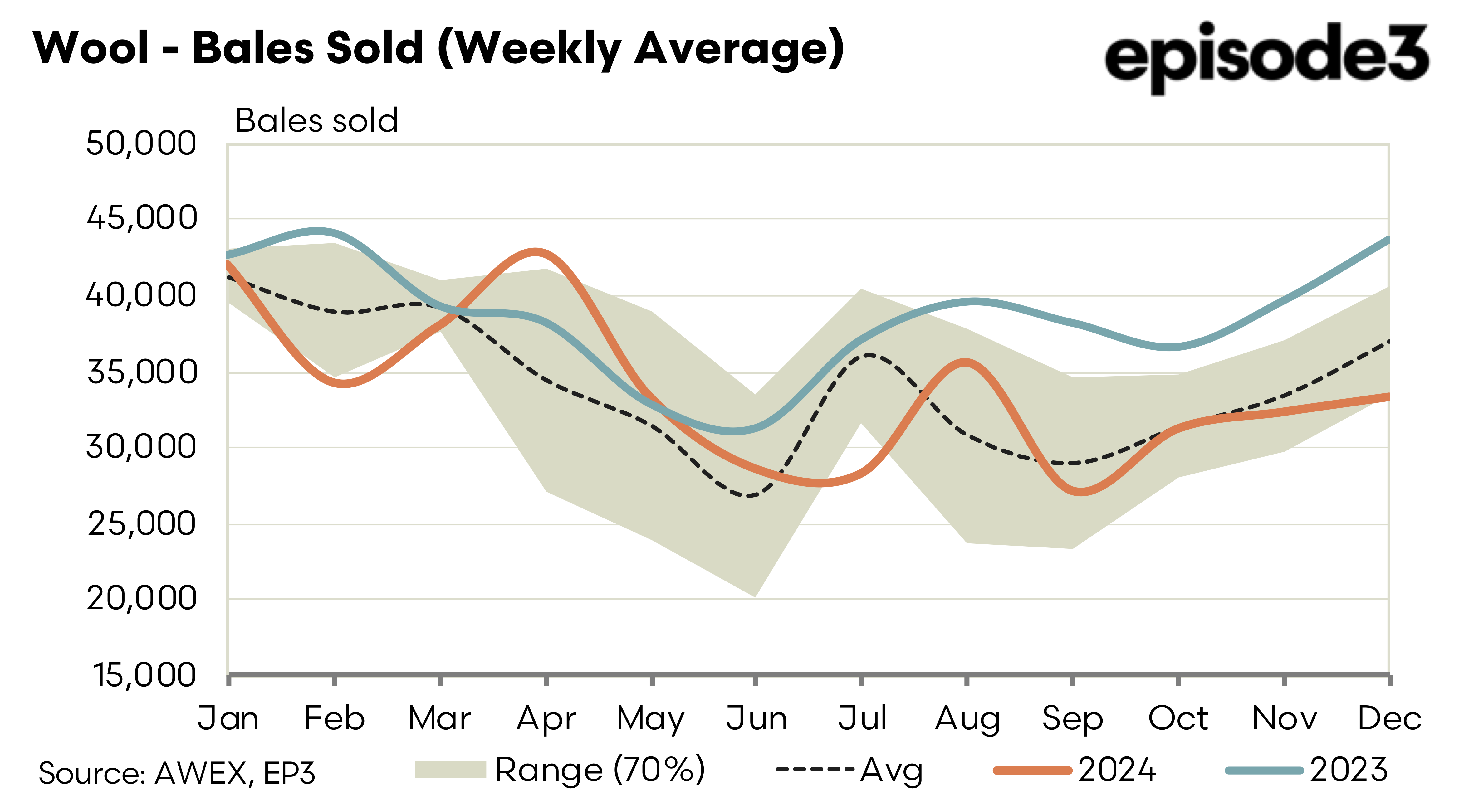

Supply remains tight with around 40,000 bales each of the next two weeks. Testing is down around 10% year on year. Market direction from now and into the first quarter will be dominated by fluctuations in demand and potentially modified by the USD/AUD cross with both difficult to predict. Recent demand signals give little encouragement. The macro landscapes in Europe and USA continue to challenge. Closer to home feedback from the recent domestic conference in China provides little short term confidence.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.