We’re on a road to nowhere

The market continues to go nowhere fast. The Eastern Market Indicator (EMI) remained unchanged with the weakness in the merino section balanced by the strength of crossbred and carding wools.

The forward market remains apathetic. Light bidding flat to cash into the spring, early in the week, bought out a few sellers looking for insurance. Levels traded finished 2 to 3% over the closing of their relative micron price guides. Bidding withdrew as the merino market’s “get up and go” had gone off and went.

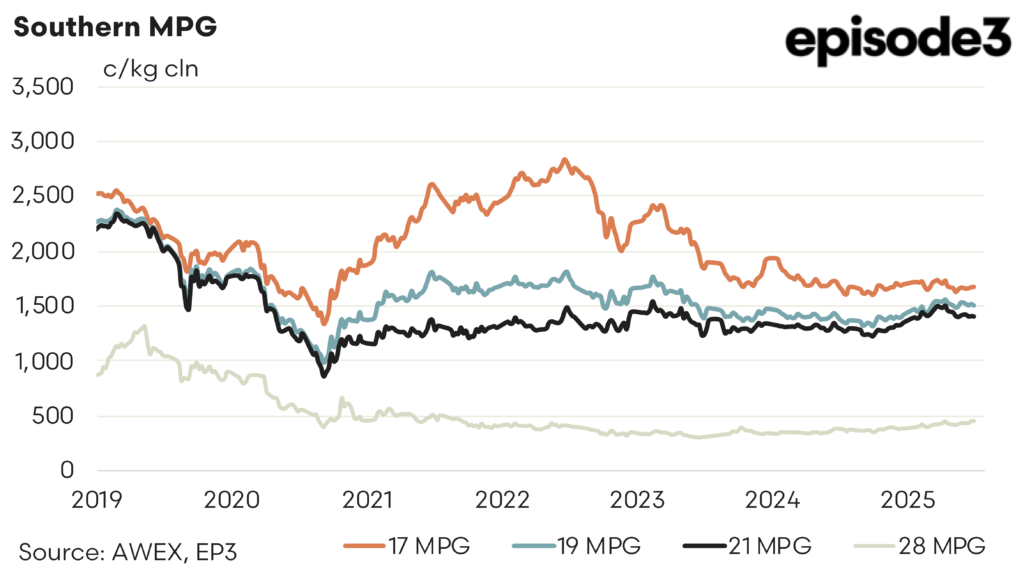

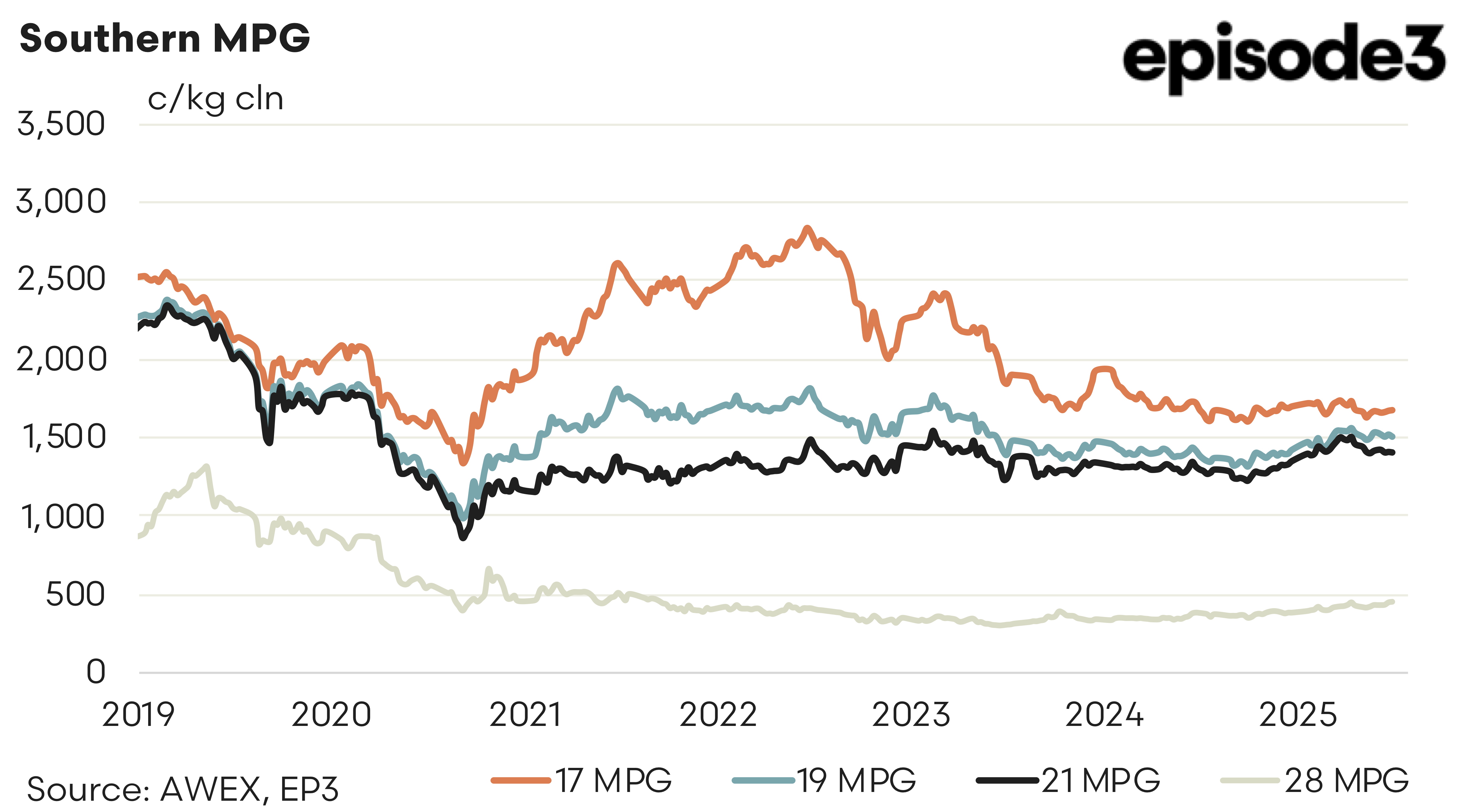

The year that started with such promise failed to deliver. Most merino types rose steadily gaining up to 150 in the first quarter. Unfortunately, this failed to spark any significant interest in the forward market and opportunities were left on the table for both sellers and buyers. The second quarter has seen much of the merino market slip upwards of 100 cents, around two thirds, from those peaks.

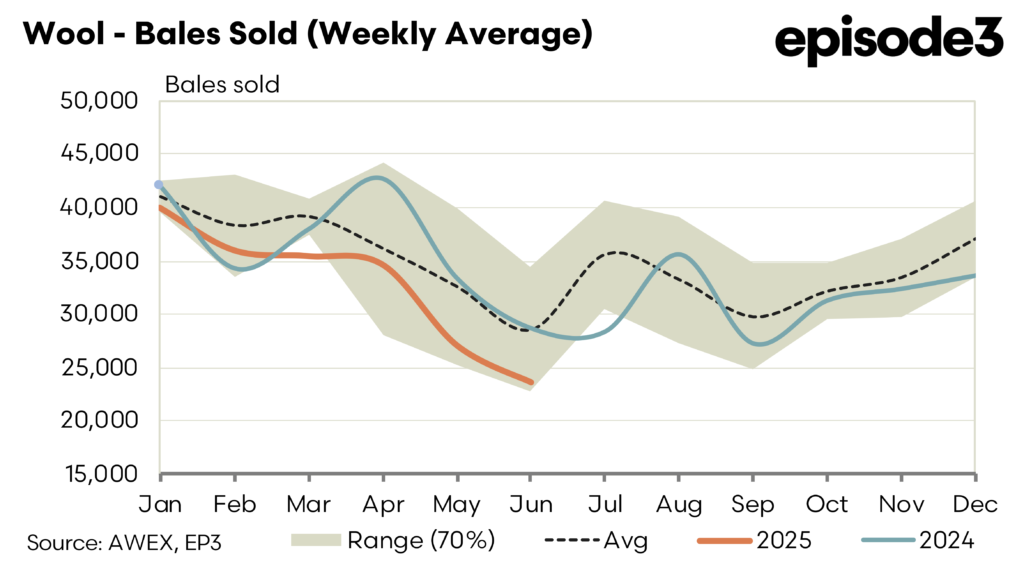

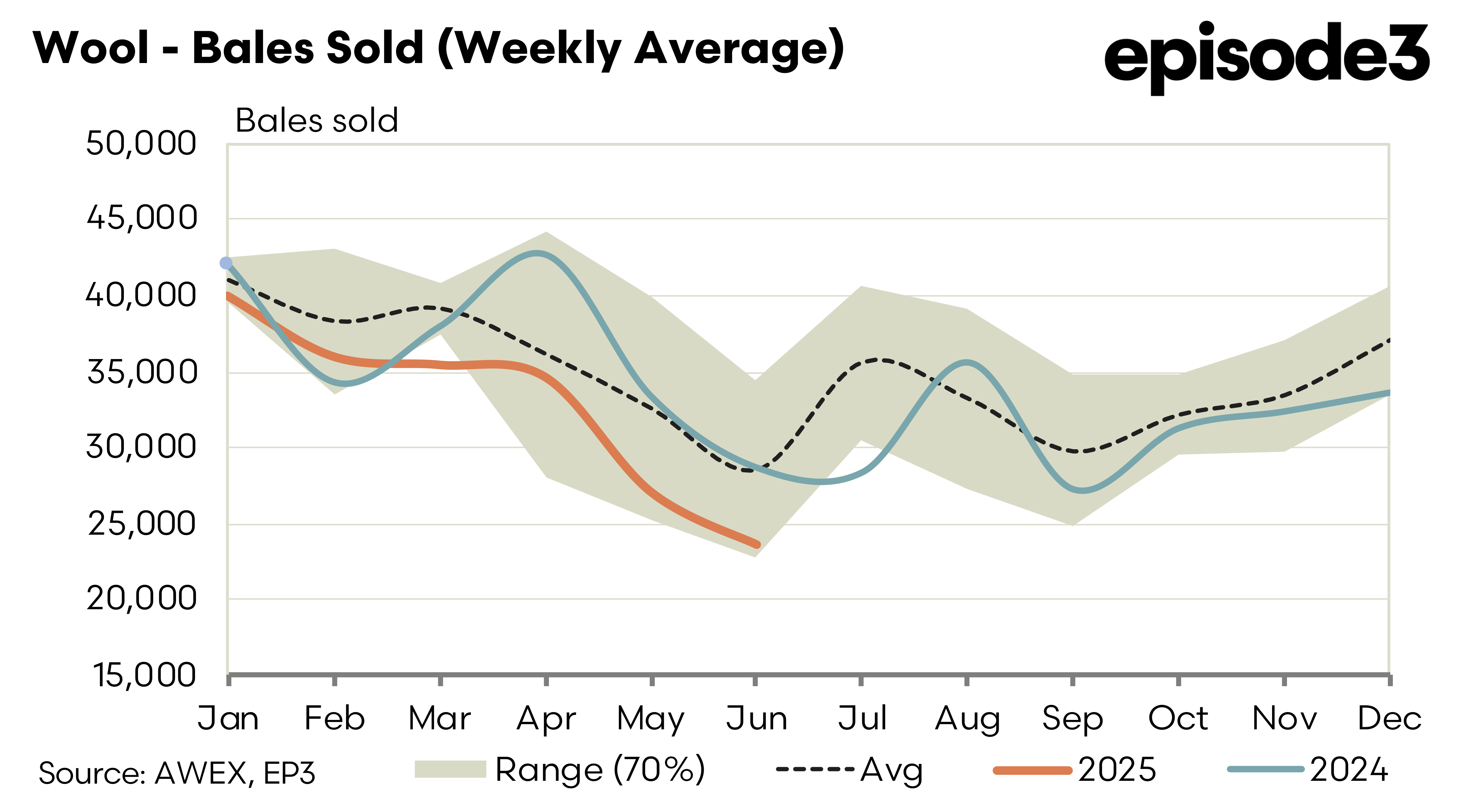

Consumer confidence and demand are the drivers of the wool market. The malaise that continues to overshadow all markets has been moderated in the wool market by the tight supply. As we move towards the July/August recess hopefully the tight supply will be enough to hold levels and provide time for new demand to kick in to balance the spring lift in supply.

Trades this week.

19.0 Oct 1520 10t

19.5 Oct 1510 7.5t

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.