Wool market learnings

Wool Market Update 26th July 2024

“Learning is not compulsory… Neither is survival.” — W. Edwards Demin

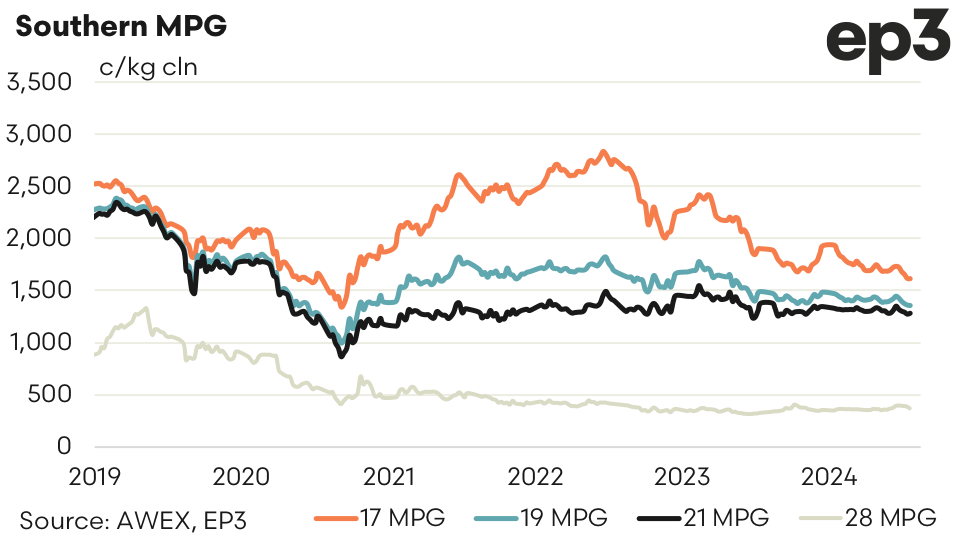

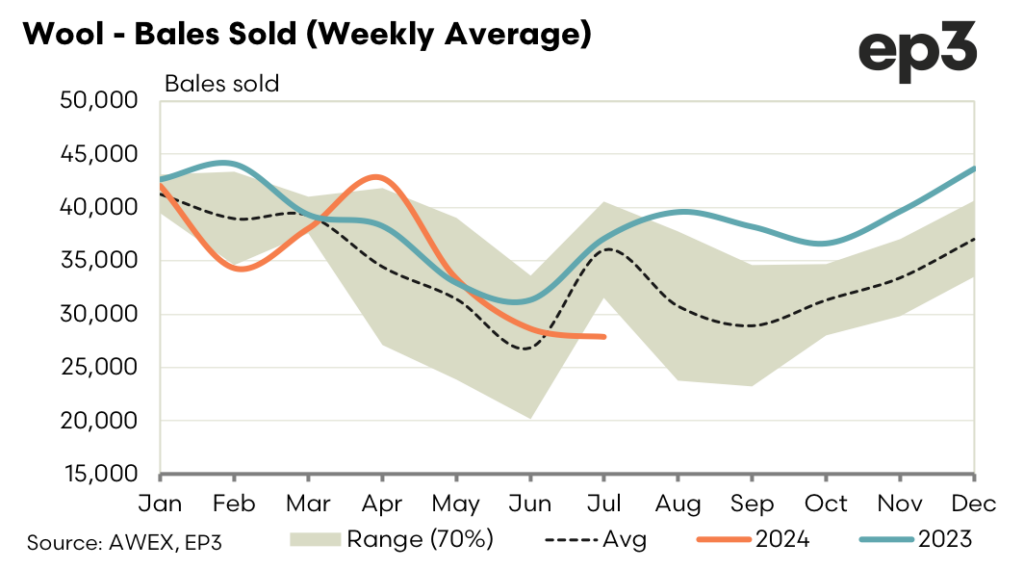

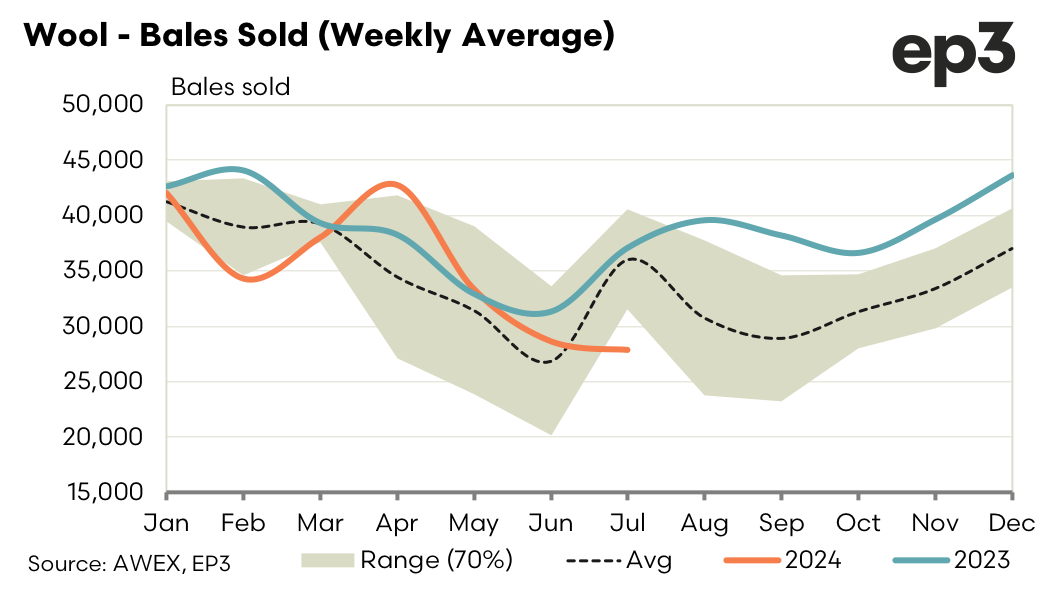

The last round of auction sales before the mid-year recess delivered a positive result with all microns groups showing gains for the weeks. Finer the better seemed to be the call for the week. 18.0 and finer gained two to three per cent, 18.5 to 22.0 one to one and a half per cent. Crossbreds regained most of their losses since the start of the month lifting three to five percent for the week.

This price action although welcomed does little to allay the concern that the industry faces at this junction. Commentary from local sectors and peak bodies are in agreement that the industry is at a defining point in time. Current prices are not sufficient to maintain the interest of growers who without better signals will look to production alternatives.

That necessary message is being related to wool customers across the world. We need to ensure wool will be available when the economic conditions improve. The indications that conditions will improve are there in the forward markets which have been active in modest volumes for 2025. Trades in 19.0 micron contract from the third quarter of 2024 and throughout 2025 range from 1470 to 1500. This is 100 to 130 cents above the current spot price and is still bid 1500 for January 2025. Unfortunately, volumes are not sufficient to deliver confidence in the market signals. The pipeline requires certainty. Certainty not only in availability of supply but certainty of price. Lifting awareness of the role of forward markets and how to participate is key to providing the mechanism for processors and downstream customers to respond to the message of concern of unsustainable prices.

With our objectives in sync, we need to we must continue to support the efforts to have wool in front of mind when consumer demand pendulum swings back in our favour. We must provide our end user customers with the tools to send genuine positive price signals to the farm gate.

We need this recess to begin the reset that will spin this turning point into a tipping point.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.