Wool roller coaster

Wool Market Update 28th June 2024

“Life is like a roller coaster. It has its up and downs. It’s your choice whether to scream or enjoy the ride”.

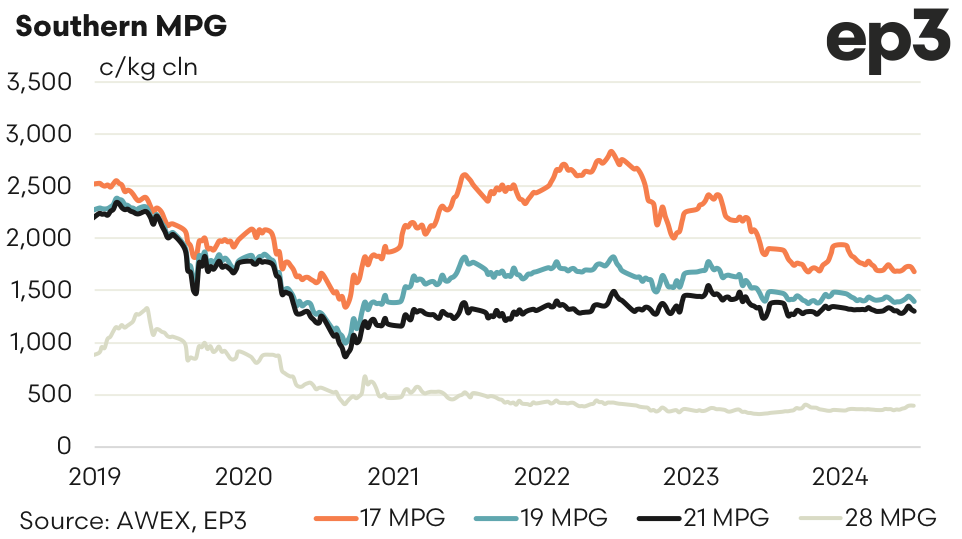

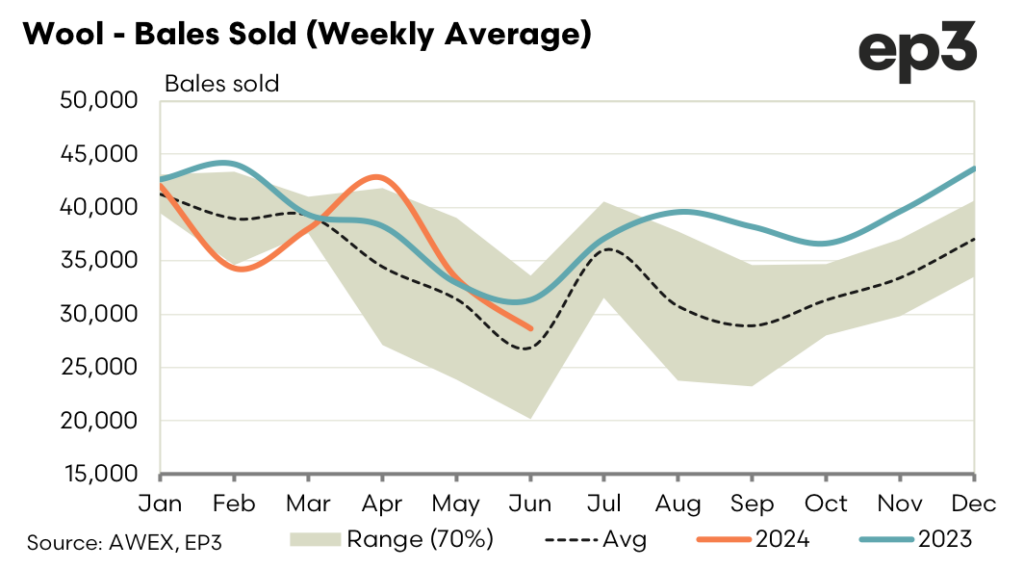

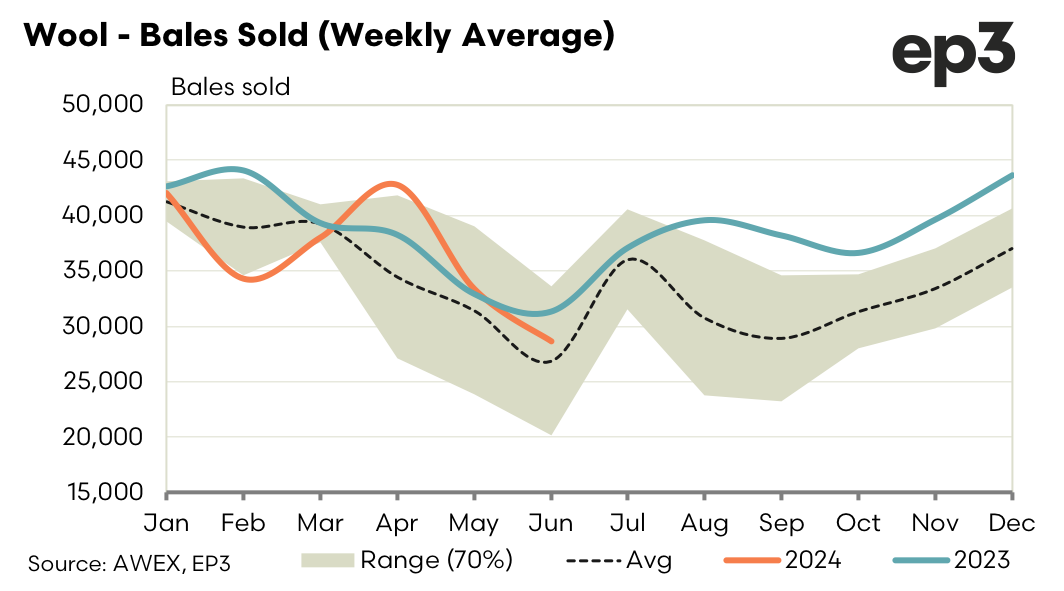

The wool season 2023/24 finished on a downward trend as the spot market continues to be governed by the “just in time” strategy of the offshore buyers. Medium term demand remains elusive leading to the spot market being driven by the domination of the indent customers and vagaries of the currencies. Most microns suffered a decline of between 1 and 2 percent for the week with coarse crossbreds the only exception.

The forward market again suffered from lack of liquidity. The finer microns traded early in the week as the limited number spring buyers hedged their positions finally. Buyers have been restricted by the scarcity of offers into the spring and early summer preventing them to build meaningful and tradeable forward book. September 2024 traded at premiums to the spot close. 18 micron 26 cents, 18.5 17 cents and 19.5 34 cents over close. Setting hedge targets and putting a value on certainty has been beneficial to both buyer and seller but slanted heavily to the seller on the derivative side of trade in the last half of the season. 75 per cent of trades were a positive result for sellers with maturities from January to June.

Next week will likely be light trading in the forwards again. Current selling levels for prompt and out to the spring and summer are now 50 to 60 over cash. Buyers are unable to find interest at these levels. Spring 2025 through to Spring and Summer 2026 remain bid 100 cents over spot cash.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.