A move from site to ex-farm storage?

Market Morsel

- Graincorp are the largest storage provider on East coast of Australia.

- This year harvest is so far off to a good start in terms of incoming grain into their sites.

- Graincorp has seen a declining trend in the volume as a percentage of the crop, albeit it has recovered from recent droughts.

- During droughts, farmers are less likely to deliver to site, as they will maximise domestic options.

- The 2020 and 2021 crop will provide good solid volume (and earnings) for Graincorp.

- There is a slight relationship between harvest receivals and share price performance.

The Detail

All eyes are seemingly on the Australian crop at present. In the past few weeks, our overseas contacts have been interested in what is happening over here. As quality grain around the world is in shorter supply this season, I guess we are in the front seat!

Harvest has started, albeit in the very early stages. Last week, Graincorp, the largest bulk handler on the east coast released their first harvest update of the year. So I thought that based on the requests from subscribers that we take a look into it.

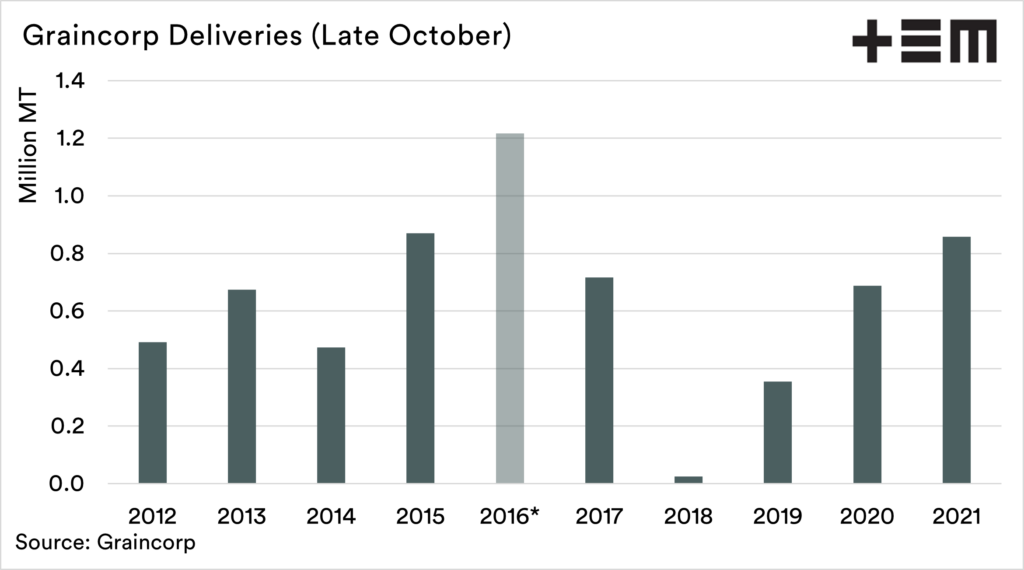

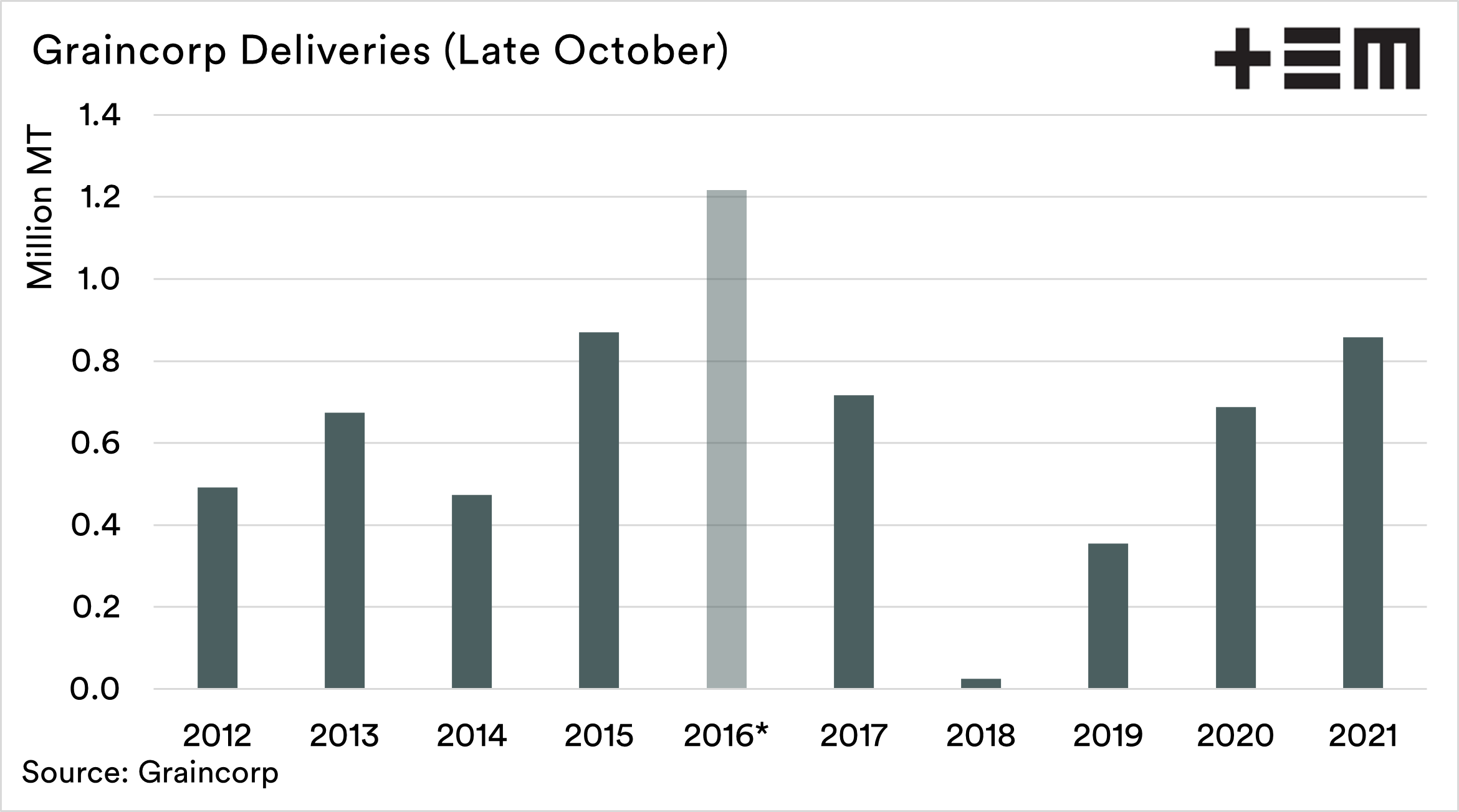

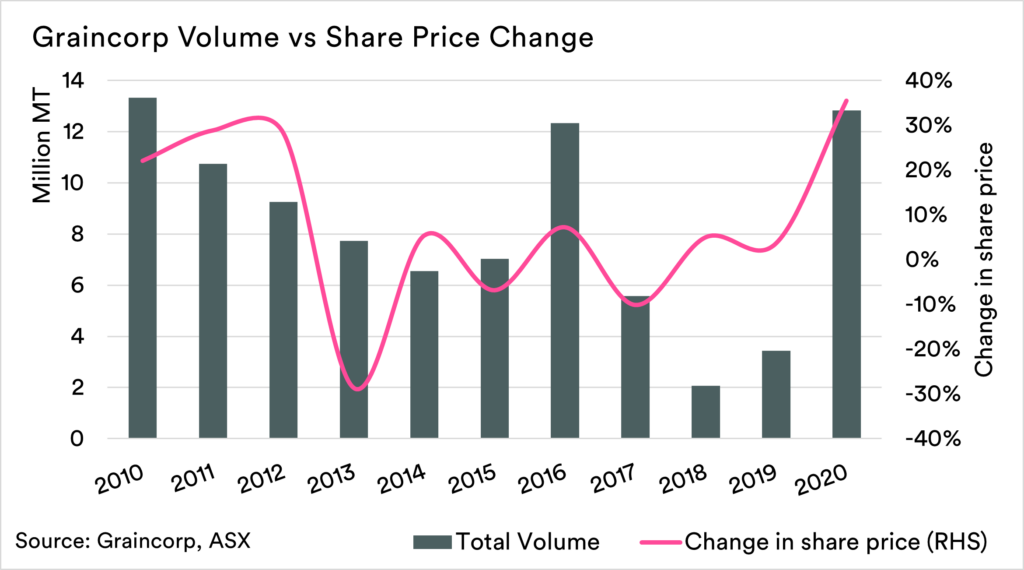

The chart below shows the deliveries each season from 2012 for late October, the exception being 2016, when the harvest was delayed, and Graincorp didn’t release an update until the second week of November.

Whilst it is clearly very early in the season, with most receivals being in Queensland, we are off to a flying start, with the second-highest volume since 2012 (ignoring 2016) for the end of October. Let’s hope the trend continues, but whilst we are looking into the data, we might as well delve a little further.

A move to more on-farm storage?

There has been a move to more on-farm storage in recent years, especially since the instant asset right off. Do we see an impact of this on Graincorp receivals?

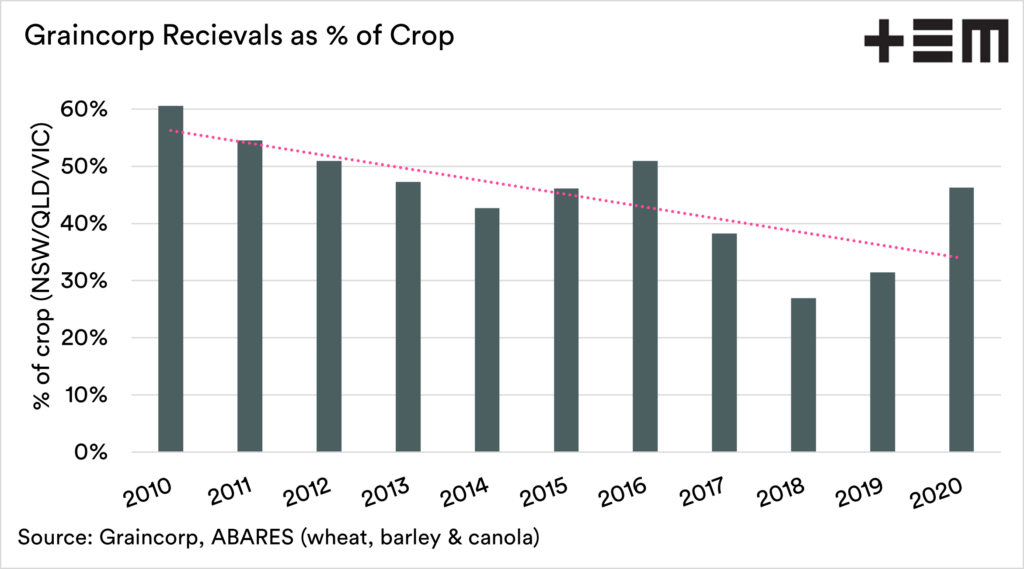

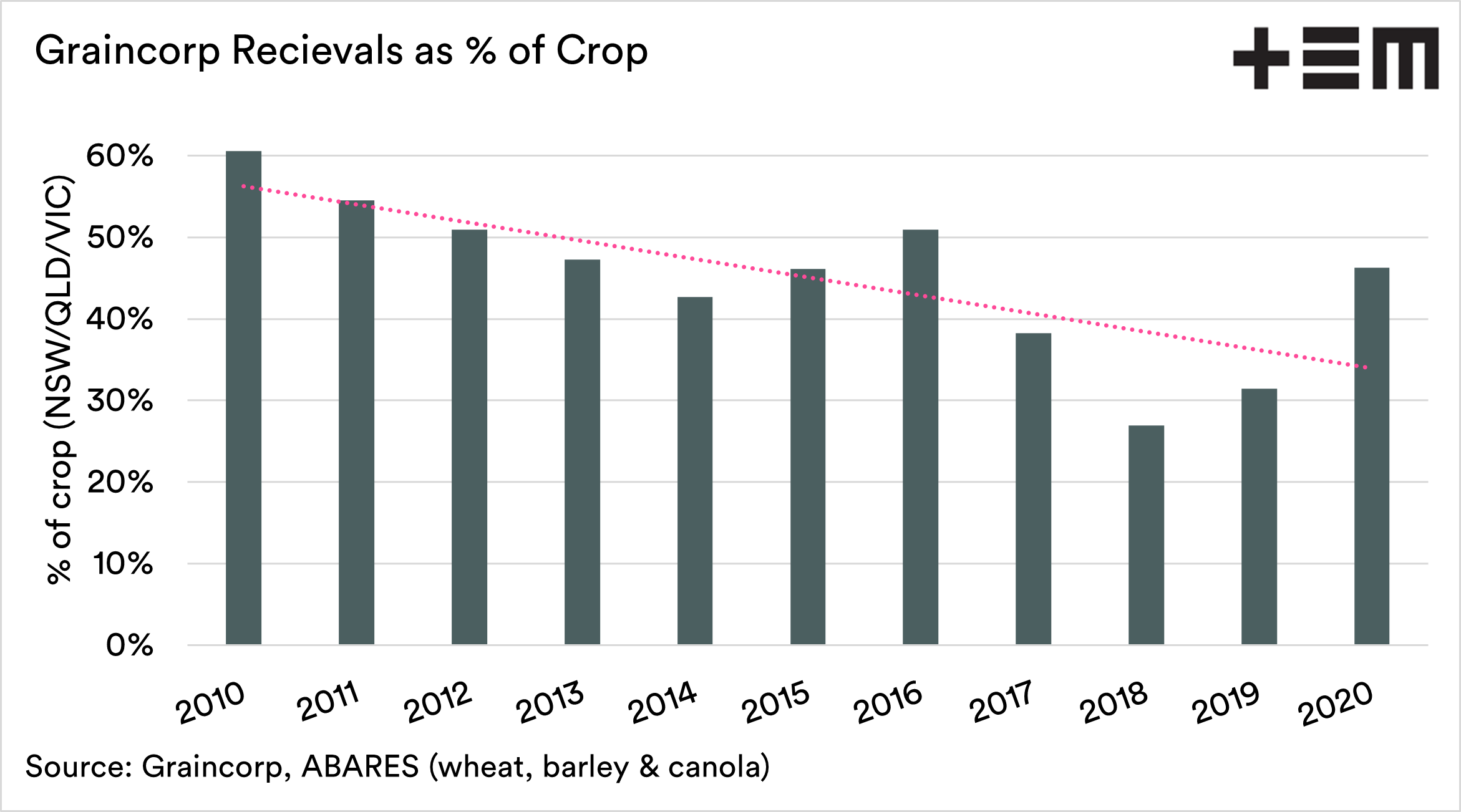

I thought it would be interesting to have a look at the total receivals at the end of the year versus the ABARES total crop production for Victoria, Queensland and New South Wales.

Whilst this is a very simplistic exercise, it does show a general trend lower in terms of the % of the overall crop received at Graincorp sites.

In times of drought, it is generally expected that storage sites will see less volume as a percentage of the crop as farmers store or farm or sell directly to consumers. We can see this clearly in 2018 & 2019, with a strong resurgence in 2020.

What about the Graincorp Shares?

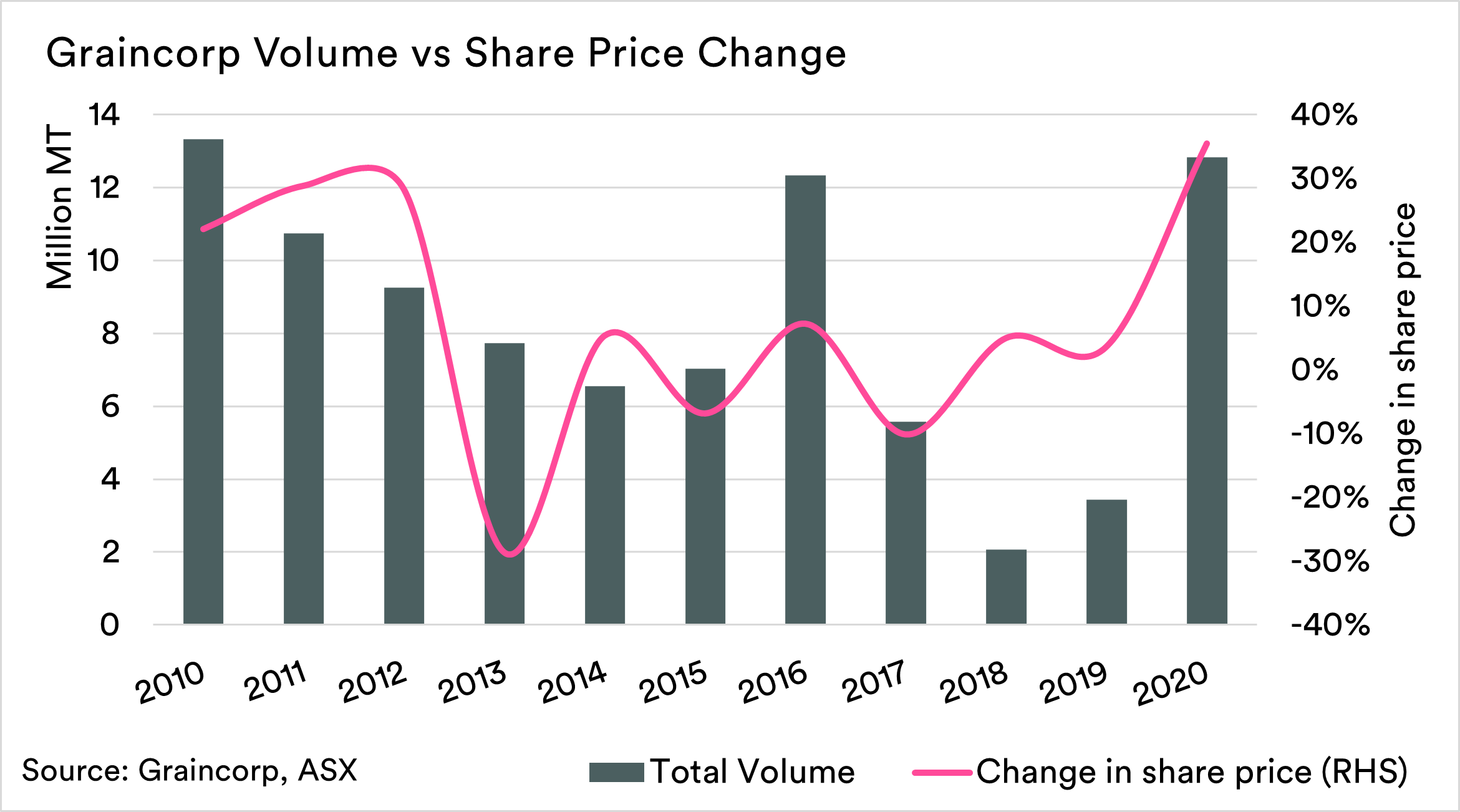

The chart below shows the annual volume into Graincorp sites vs the change in share price (GNC) for the year following harvest i.e. 2011 receivals vs 2012 average share price. There is a slight relationship, but only slight.

More volume into Graincorp does result in higher earnings, but Graincorp is diversified with assets overseas which reduces reliance on the Australian crop.

There are also other factors that drive the share price, such as corporate takeovers. If we recall the 2012 through 2013 period, ADM made a play to purchase Graincorp, resulting in a very strong increase in the share price. Ultimately this approach was blocked by the government, and the share price fell.

The reality is that a strong east coast crop is beneficial to Graincorps bottom line and is a bullish factor for the Graincorp share price.

NB Whilst this is East coast centric, I have reached out to CBH in the West to see whether they can provide similar information.