ABARES the bears

The Snapshot

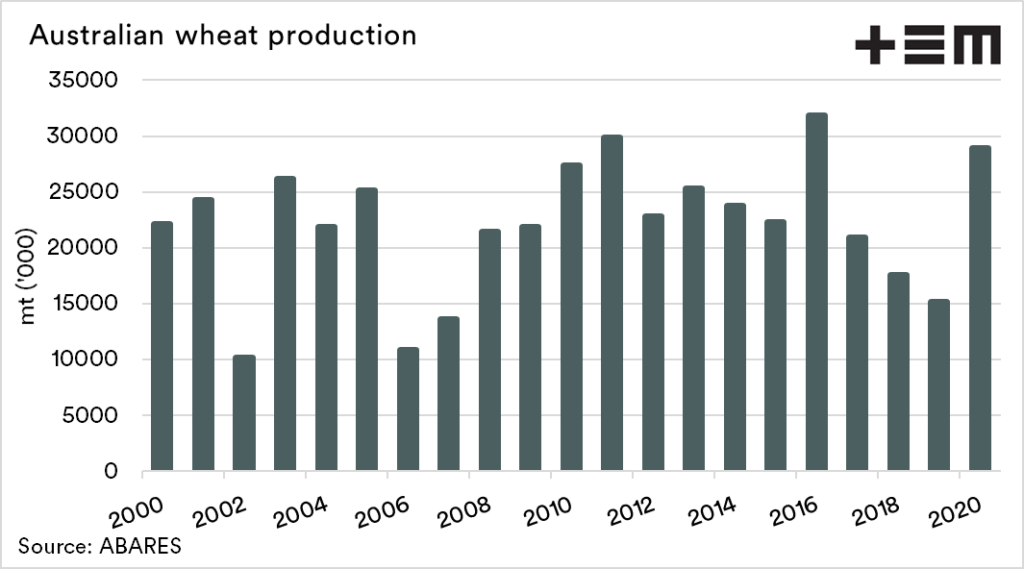

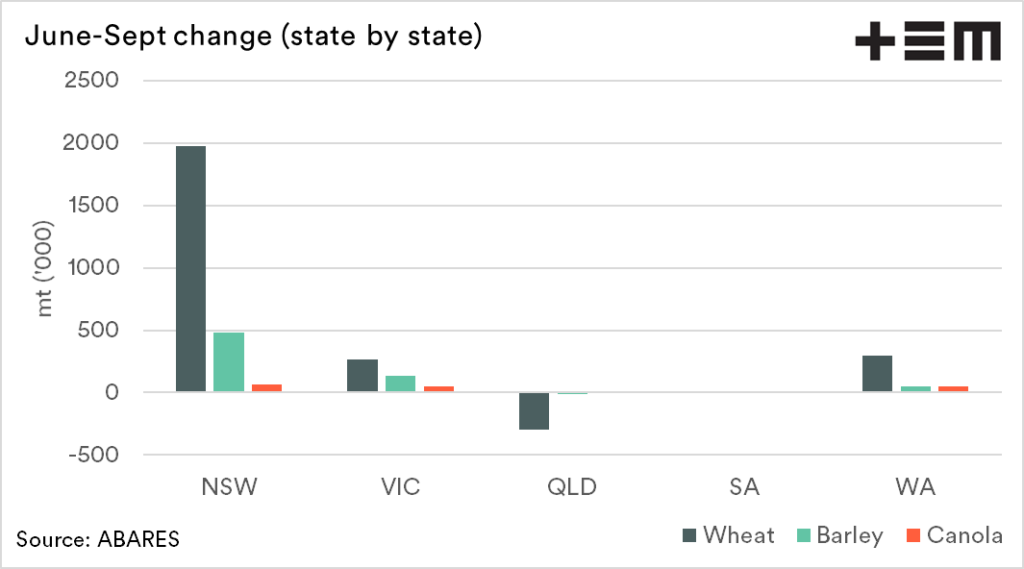

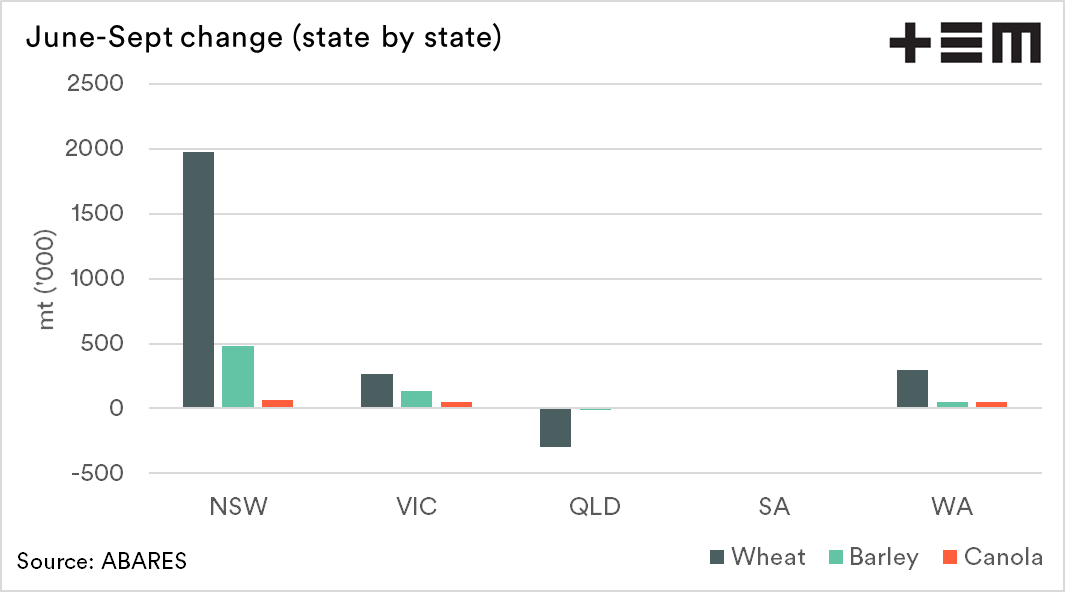

- Wheat production is increased by 2.2mmt to 28.9mmt, with the majority of the increase in NSW. The third-largest crop.

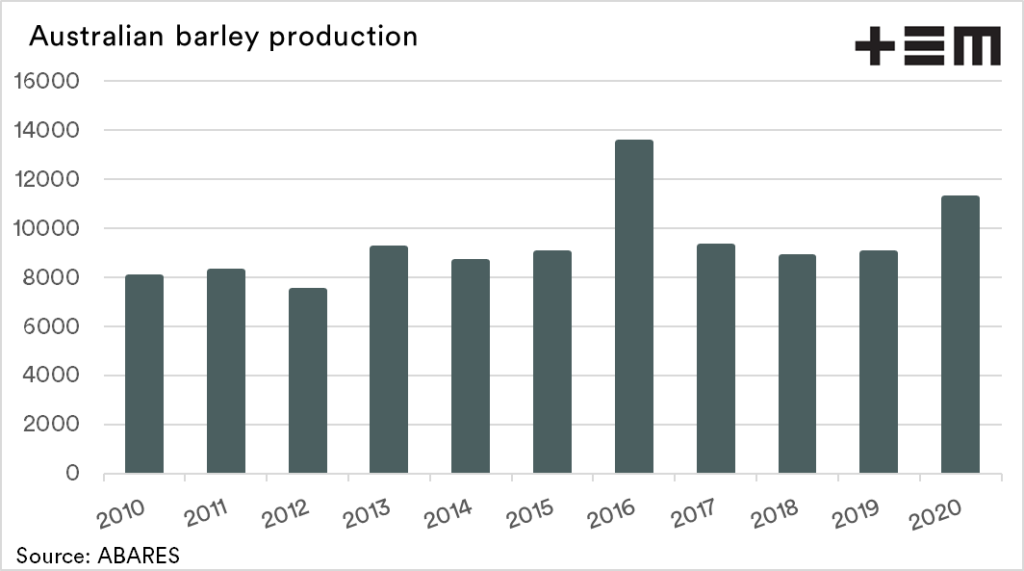

- Barley production is increased by 658kmt to 11.2mmt. This is the second-largest crop behind 2016.

- The 2016 barley crop lead to anti-dumping allegations by China. In that year the majority of the barley surplus went to China. They are not an option this year, which will likely lead to larger stockpiles.

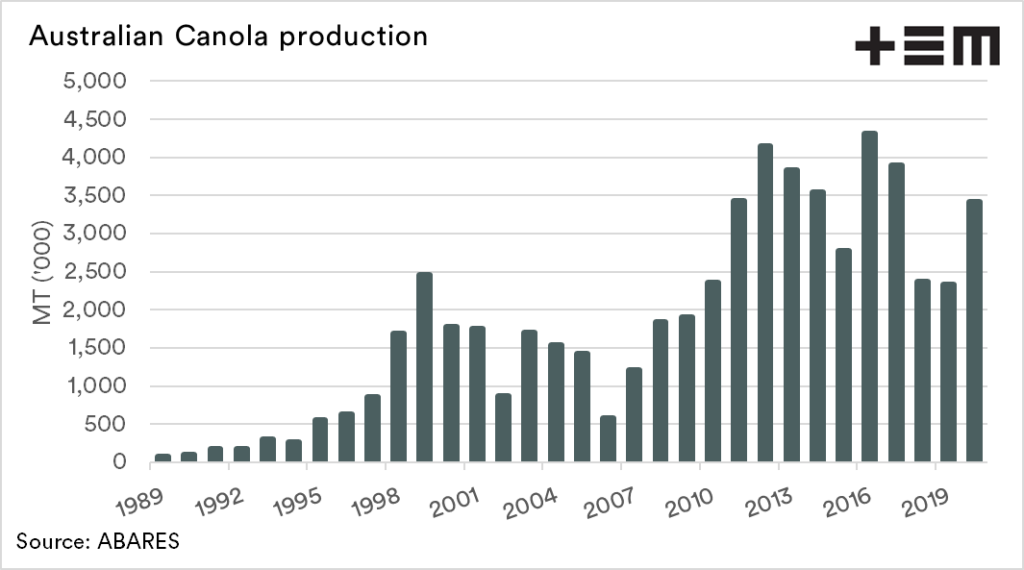

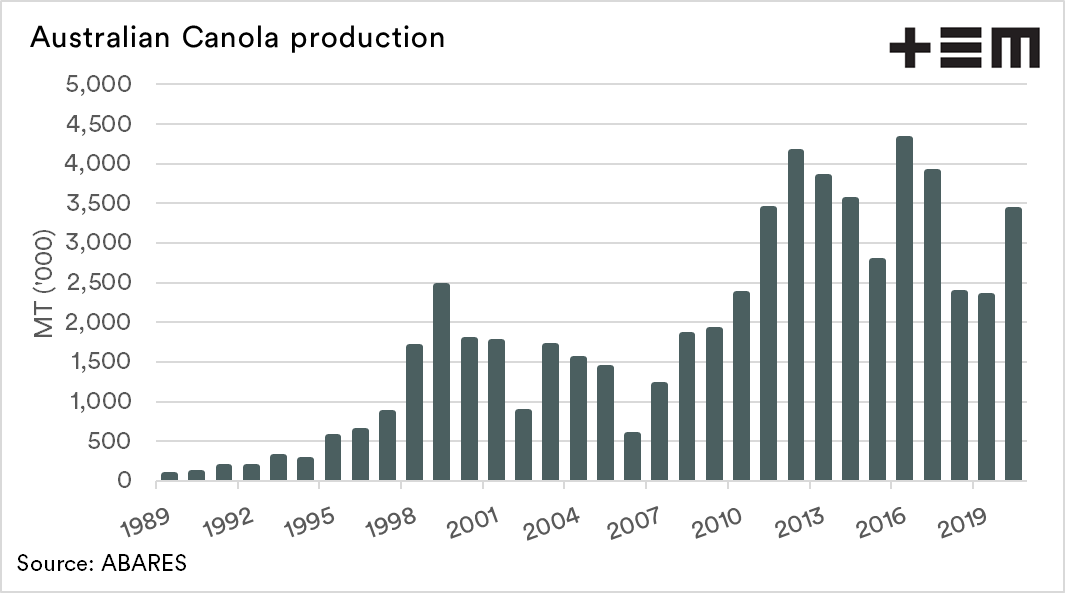

- Canola production is forecast at 3.4mmt. The acreage is below the ten-year average, but yields are strong.

- The overall ABARES have made a big call on the wheat numbers, and they are based on a wet spring.

- At present everything will have to go well, if not perfectly from here on in to meet these expectations.

The Detail

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) released their crop report this morning. We were up early to have a look at the numbers.

Remember to follow our twitter to see further charts and discussion of the numbers: EP3arkets

ABARES provide a report detailing the major broadacre commodities, with the crop acreage and production estimates. This report is produced every quarter and provides some insights into the coming crop.

Let’s look at the headline numbers.

Wheat

The most important crop, wheat, has been increased by 2.2mmt to 28.9mmt. This would make the crop the third largest, behind 2011 and 2016. This is a substantial increase, beyond the expectations of many trade participants who we have been chatting with. It is still possible that production will meet these forecasts. However, it will be dependent upon a favourable finish.

Barley

The barley crop has increased 658kmt, to 11.2mmt, the second largest behind 2016 at 13.5mmt. If we remember back to 2016, it was a challenge to export the volume. The surplus lead to lower prices which in the end were primarily hoovered up by China.

Leading to the current anti-competitive dumping allegation, and now China no longer being a destination. Although we are producing less than 2016, our possible export destinations are constrained.

There is a strong possibility of expanded end-stocks going into the 2021 harvest.

Canola:

The canola crop is forecast at 3.4mmt, this is a rise of 5% or 169kmt. The production of canola has been constrained by lower than average acreage. Meanwhile, yields on a national level are predicted to be the second-highest level.

The overall production narrowly missed out on 6th position, to fall into 7th. Overall production of canola should meet domestic demand. Internationally, however, strong demand for oilseeds is helping maintain healthy pricing levels.

Canola always makes me nervous at this time of the year, whilst it is a picture-perfect crop, it does have the capacity to lose yield quickly.

When you delve into the data on a state by state basis, it is clear that the bulk of the rise has come from New South Wales. This is hardly surprising given the mild weather. Thee wet spring predicted by the BOM seems to be evaporating, which may take some of the honey from this forecast.

The most perplexing part is that the forecast for the major commodities (wheat, barley & canola) in South Australia was left entirely unchanged.