Are farmers getting stuck with A$200/mt?

The Snapshot

• When used appropriately, swaps are a valuable tool and with a full understanding of the risks.

• The current rise in prices has meant that many swaps taken out last year are out of the money.

• Providers are starting to call upon these contracts and close them.

• This means that farmers are stuck with the position they are currently in.

• Estimates are that the bill for the closure of these contracts could be as high as A$140m. That is if all were called in, but in this tranche potentially A$40-60m

• The current market has caused lots of risks on existing swaps.

• In reality, this current market has allowed the opportunity to ‘kick the can’ down the road with high prices into 2023 (+A$500 +/- basis).

The Detail

Yesterday afternoon my phone was off the hook with folk from Western Australia. There seems to be an emerging issue.

There is a significant volume of wheat that farmers have covered off with swaps taken out over the past year. There are now requests from some providers to cash out the contracts. There is an expectation of 5-800k mt.

I won’t go into the mechanics of swaps (and basis), but I will try and cover that fully in the next week or so.

So let’s keep it simple, with a basic explanation of the current situation unfolding.

When taking out a wheat swap, the general idea (as a farmer) is that you sell wheat futures, and then hold them until you are ready to sell physical wheat. When you sell physical wheat, you buy back your swap, which you had initially sold.

The problem for some farmers is that the provider is now concerned about their credit risk. As we are all aware, the market has increased massively during the past couple of months.

They have now asked farmers to pay the contracts out. So let’s see how that plays out in a couple of steps.

Step 1.

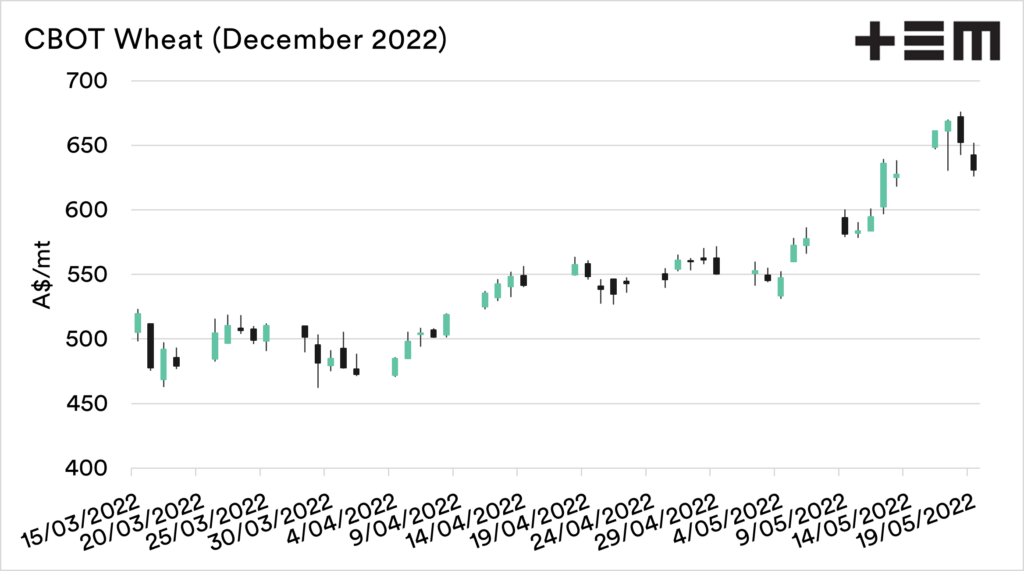

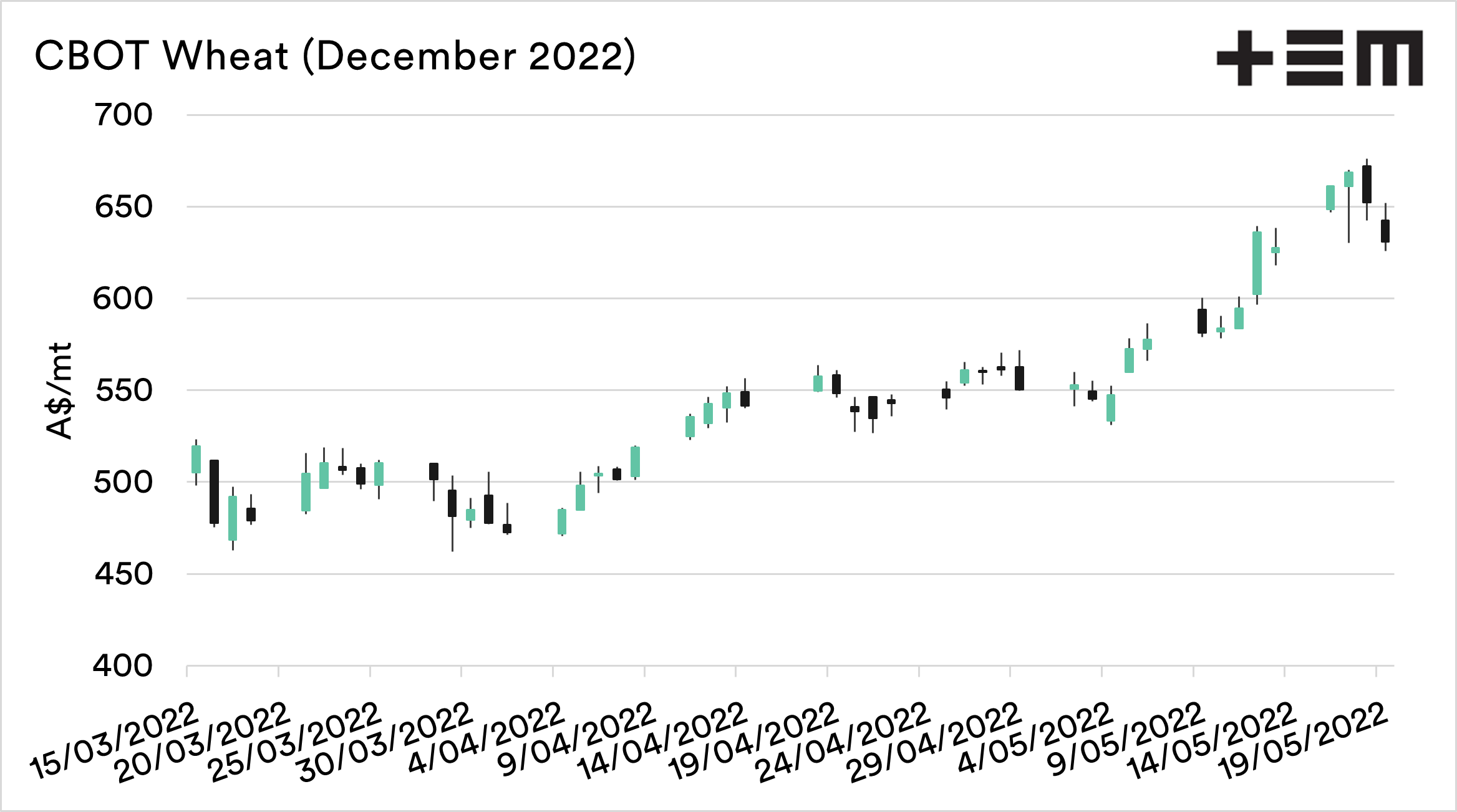

Farmer opens SWAP at +A$350

Farmer closes SWAP at -A$630

The farmer now has a bill for A$280/mt. This is because they have sold at A$350 and have to close out the contract by buying back at A$630. They will generally get invoiced for this straight after closure.

Step 2.

Buyer converts to physical at the current rate of A$480.

Traditionally, the grower would convert to physical as they closed their derivative position around the same time. This is to ensure that they minimise time risk.

If they converted this at present at the time they are forced to close, they would be left with an overall price of A$200. This is when they account for the price for physical at A$480 against the A$280 owed on the swap.

This is a poor situation for the grower to be in, as they have plenty to do at the moment with seeding etc. I am doubtful that many farmers will convert to physical at the moment, as they will be hoping for a better basis level.

Closure?

There are requests for these facilities to be closed, as the provider has counterparty risk. In the example above, the farmer has an exposure of A$280/mt. If the market continues to rise, this will become further in the red.

Based on our estimates, the exposure is approximately A$120 to A$150m.

The issues.

I am going to have to come back to this and do a 101 swaps over the next week, but the issues at play at the moment are:

- Farmers will have to ‘cash’ out of their swaps early.

- If they elect to lock in at the time of derivative closure, they will be locking in a heavily negative basis.

- Farmers who have locked in swaps last year will be locking in very low prices.

The grower has also not had the time to examine their situation due to seeding, and at a time of pretty strong volatilty. This has meant those who closed out on Monday were in a A$30/mt worse position than today.

The silver lining

These tools are still very useful products. They do, however, require a good solid level of understanding, and they should only make up a small proportion of overall marketing.

The silver lining for the farmers who locked these in is that they should only impact a very small percentage of their crop. That doesn’t help much with high input costs, but it is something.

The point of a swap is to lock in a futures level at a price that the farmer is happy with and then take into account basis. Typically, the basis in Australia is positive, but history has shown us that this is not the case.

Looking forward

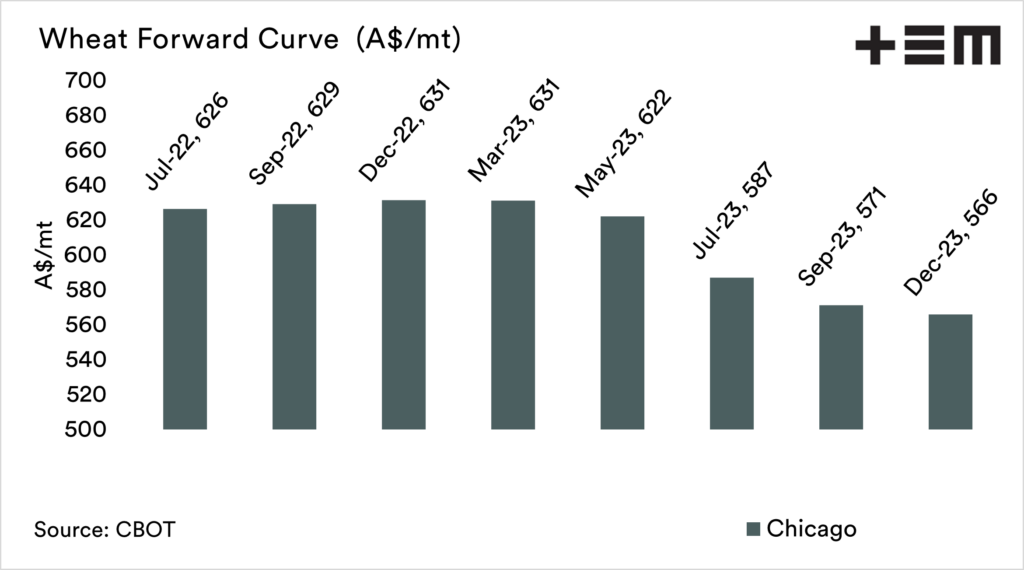

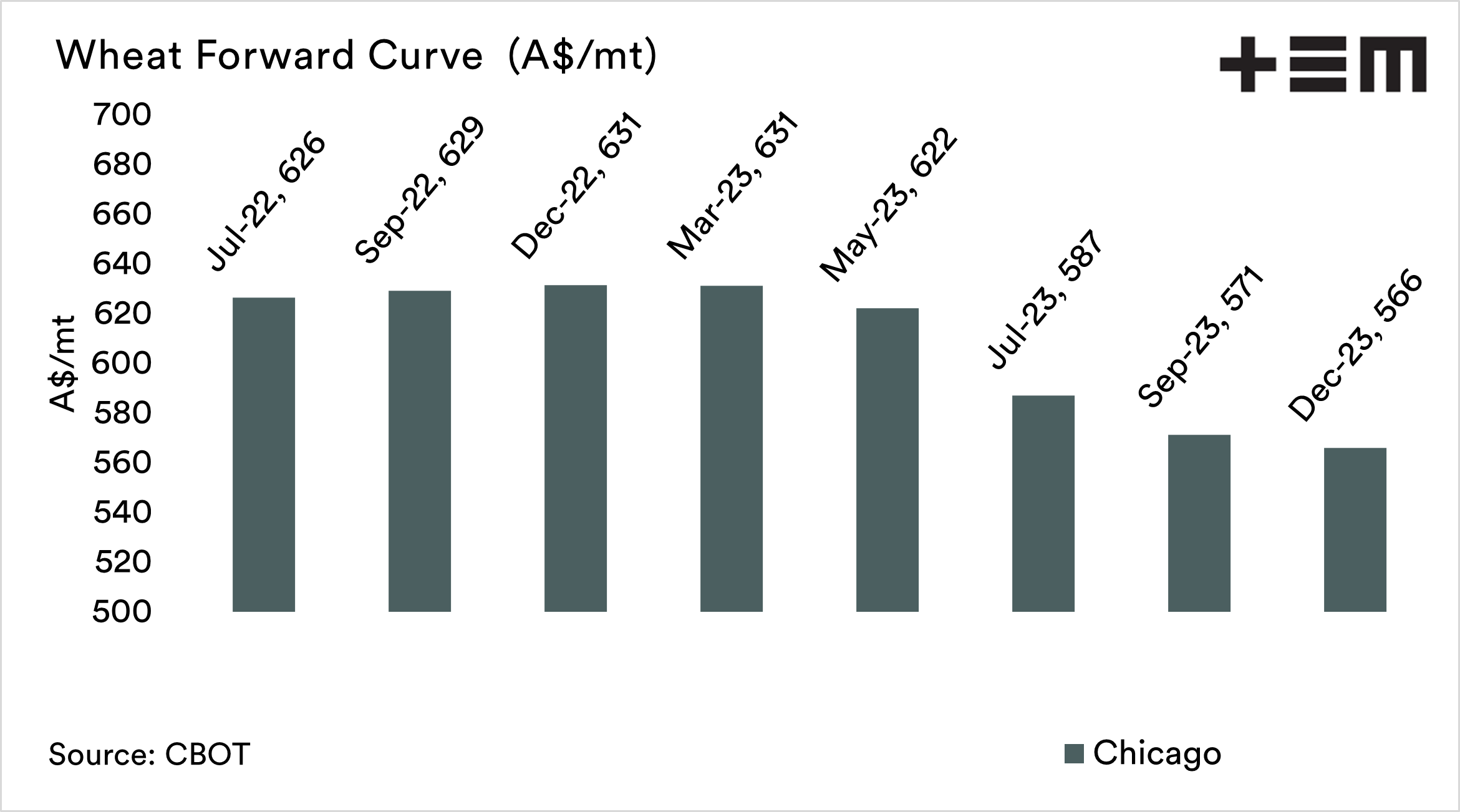

If we look forward to next year, the futures price for December 2023 is A$566, with the basis to be locked in at a later date. Is this a good price?

If you locked in a swap at A$566, the same factors have to be considered as when taking one out at A$350.

- What basis will you lock-in? Will basis be positive or negative by harvest 2023? That will depends on our conditions locally.

- Will the futures market be higher or lower. If the market rises to A$800, you’ll be paying out. If the market falls to A$400 you’ll receive the difference.

A few have asked for some basic articles on swaps, so I will look to get my head into gear and put some basics out there in the coming updates.