Babushka doll of taxes to help Australian wheat price

The Snapshot

- Russian introduced an export tax in mid-December on wheat.

- As we commented at the time, this tax didn’t work.

- The solution from the Russian government is to increase the tax.

- This export tax will benefit the Australian wheat trade in the short term.

- The additional export tax will be unlikely to do the desired effect of

The Detail

The box of government intervention once opened leads to more intervention.

A month ago, we spoke about the introduction of the Russian wheat export tax. The introduction of an export tax was intended to stifle domestic food inflation within Russia. We explained in our articles how this:

A) Wouldn’t help with reducing food inflation

B) How this tax would assist Australian producers.

The original articles are ‘From Australia with love‘ & ‘Putin putting barriers up‘. A month after the introduction of the tax, plans are in place to increase the tax further.

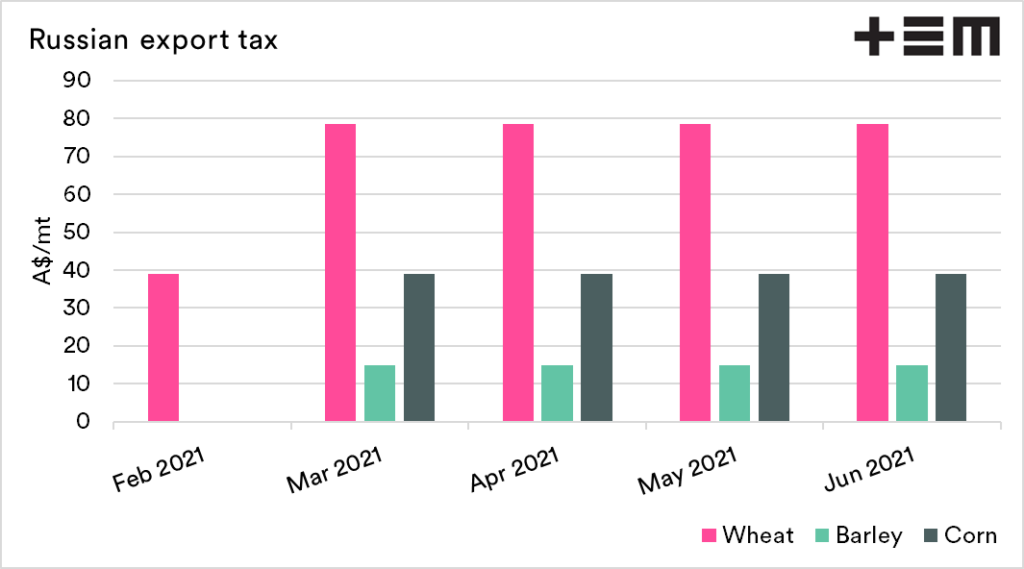

The tax was initially set at approx. A$40/mt starting in mid-February. The newly increased tax will commence in mid-March and is just under A$80/mt. At the same time, export taxes on corn and barley will start.

Why doesn’t it work?

Russia is the worlds largest exporter of wheat. When they enact what are effectively price controls, it impacts the global market. Therefore the price of wheat around the world will move up to meet the tax.

This then flows back through to Russian prices. Although the tax discourages exports, consumers end up paying more due to the overall price being higher. If Russia wasn’t a significant exporter, then it may have worked.

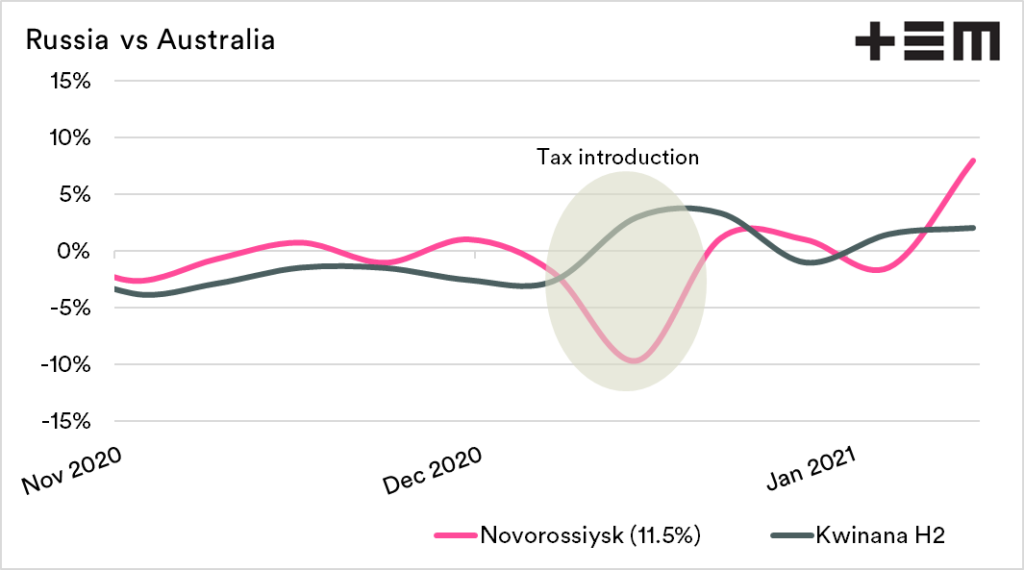

In the chart below, we can see the impact of tax on pricing. Initially, the price in Russia fell at the same time as Australian prices rose. The market in Russian subsequently gave back all the losses, and then some.

Whilst the rise in recent weeks is also due to fundamental factors, consumers’ net effect is nil.

It’s another of the many examples where governments should not interfere in the marketplace.

Is this bullish or bearish?

There are a number of thoughts on whether this is positive or negative for the marketplace. In my view, it is dependent upon the timeframe.

Short term bullish

The additional costs of exporting from Russia make it far more attractive to export from Australia. This is a bullish indicator for Australia and other exporters, from mid-February until the tax is lessened.

Mid-term bearish

When faced with an export tax, many growers have the logical thought of holding onto their grain into the post-June period. This has its issues, as it means that a large stock of old crop will potentially come onto the market at the same time as the new crop is harvested.

The Russian government have thought about growers/traders holding off on exporting. Russia has an export tariff formula which is currently set at nil but was used in the middle part of the last decade.

There have been overtures that this formula will be put back in place for the new season. Whether this talk is just to discourage growers from holding, or whether it actually happens will be something to watch out for.