Barley the top performer but could do better.

The Snapshot

- Australian barley has had the strongest price performance since the start of the year and since the invasion of Ukraine.

- Barley was starting at a low base, with strong discounts against wheat and overseas values.

- Australian barley has risen between 10-15%, dependent upon port (based on a monthly average). French values are up 38%.

- Typically French values trend in a similar pattern to Australia.

- Australian feed barley is at the largest discount to French since at least 2010.

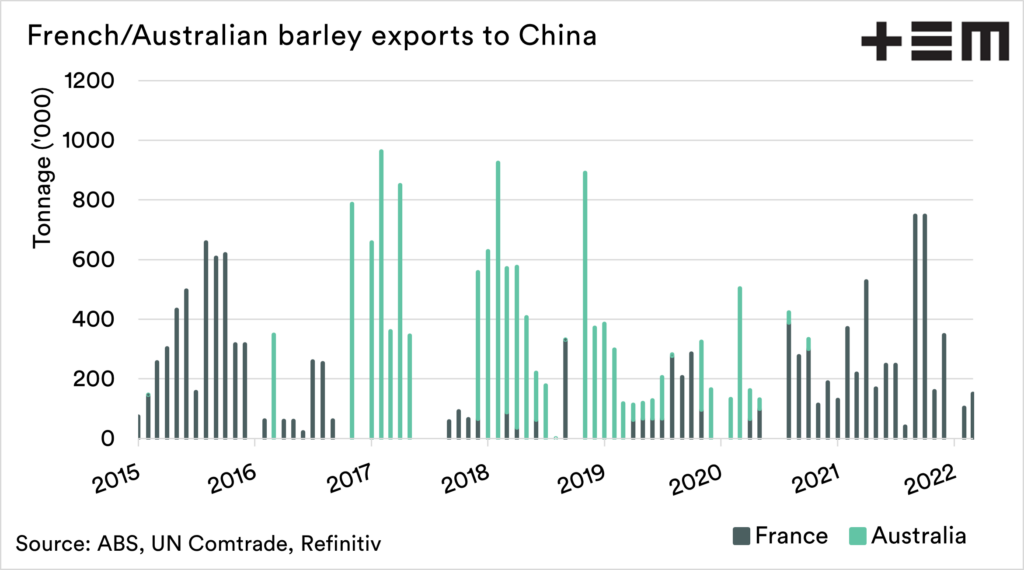

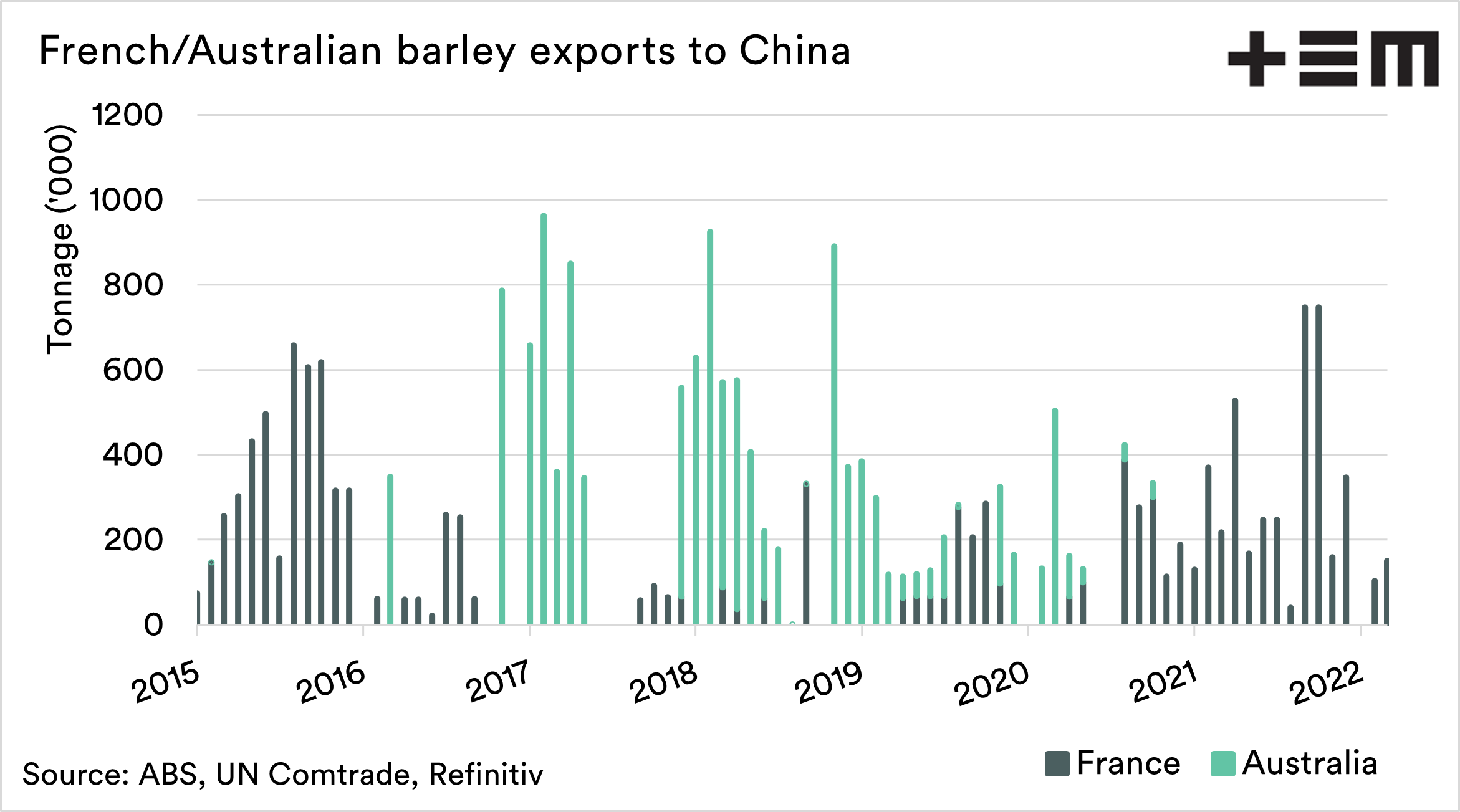

- France has capitalised on our loss of China in recent years.

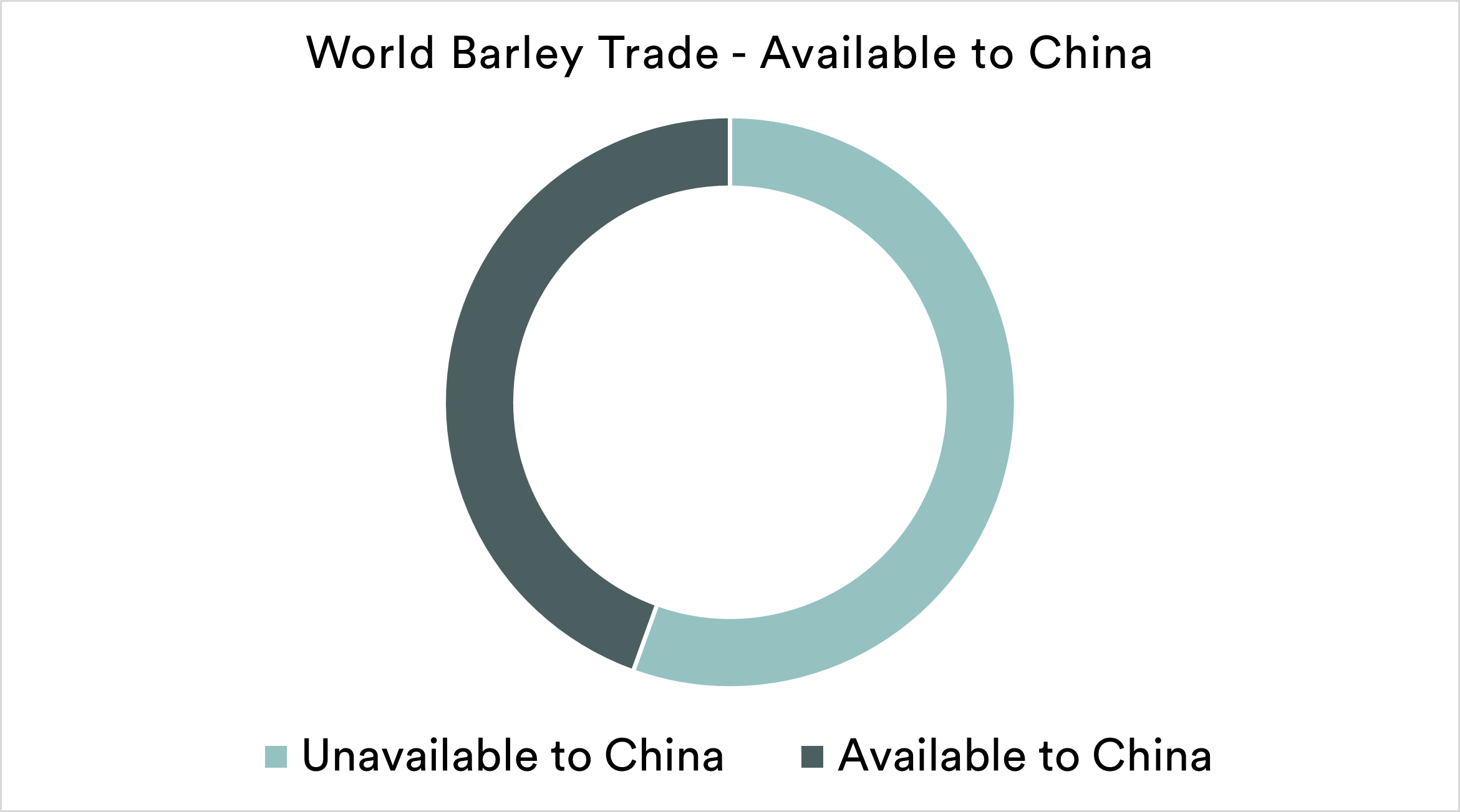

- China has lost access to approx 56% of the world’s exportable volume of barley.

- The discount for grains in Australia vs the rest of the world means that margins will be strong for anyone that can get grain out of the country.

The Detail

It’s time to take a look at what has happened to barley. We have focused a lot on the impact of the invasion of Ukraine in relation to canola and wheat. Let’s see what has happened with barley.

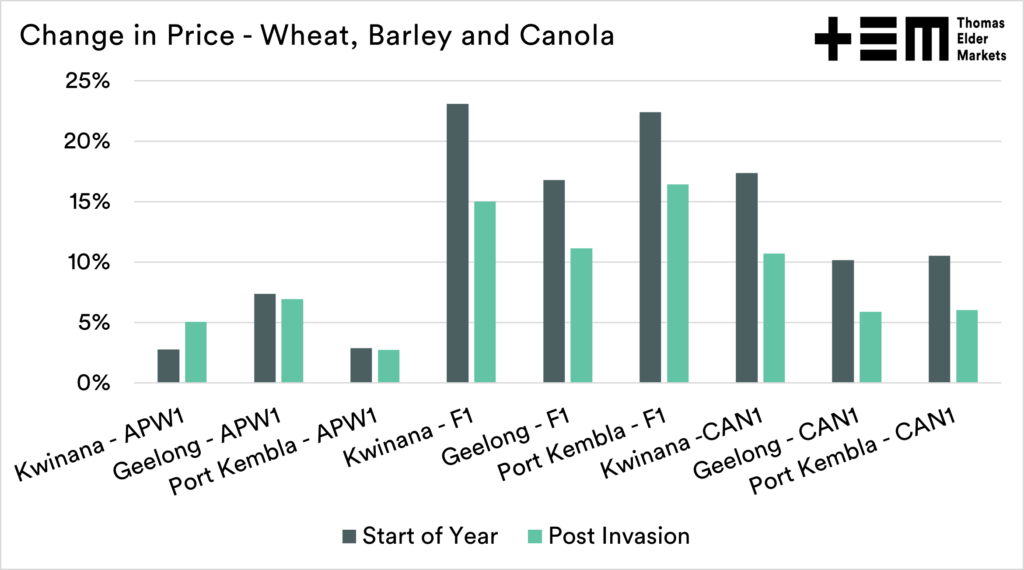

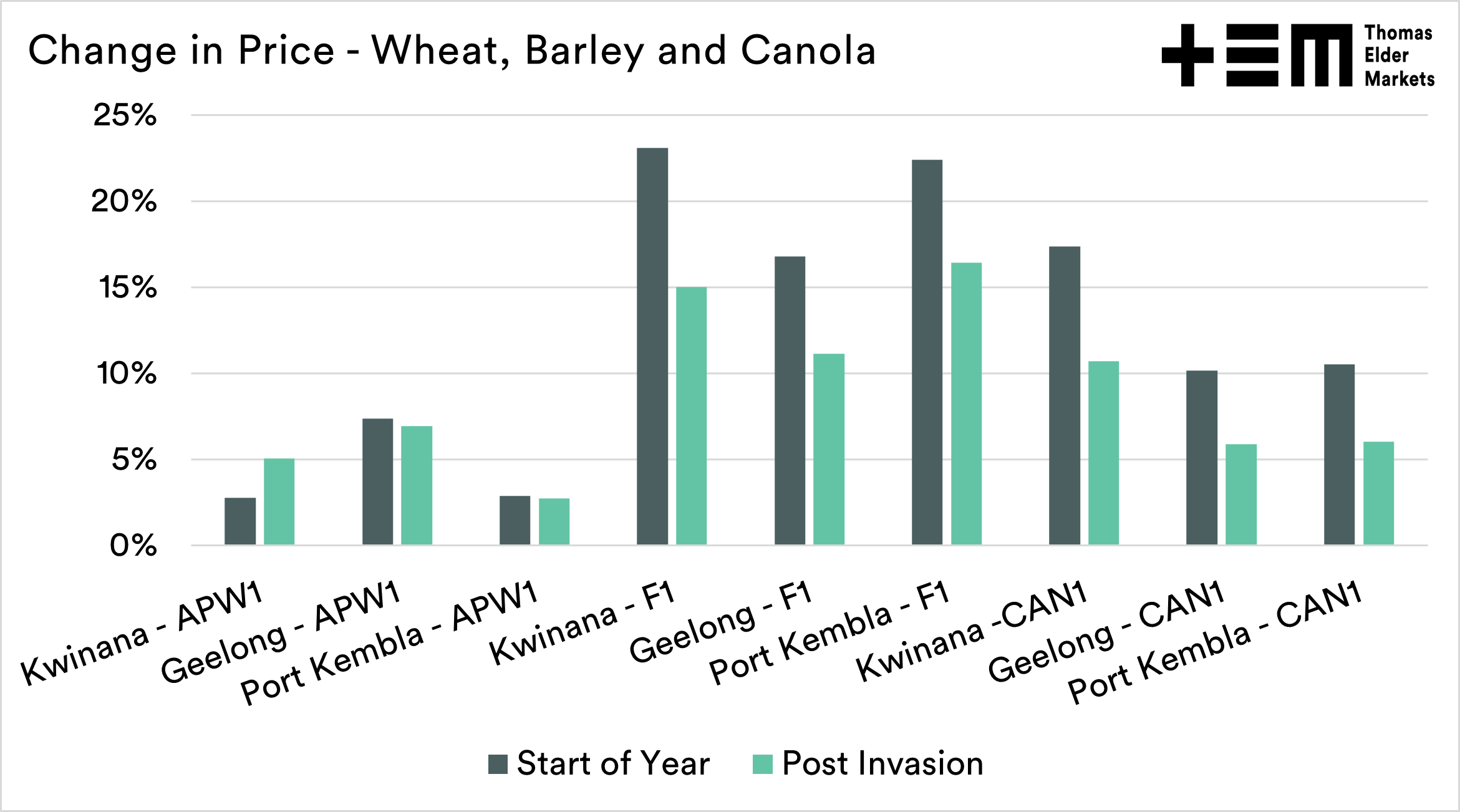

First, how have prices compared between grains in Australia? The chart below shows the change in price between two points and present. It’s important to define these two pricing points, one was before a Russian invasion was considered likely, and one since the invasion commenced.

This chart shows that wheat has been the poorest performer, but barley has actually been the star.

It is important to note that barley started at a relatively low base. Our barley pricing has been low compared to other commodities in Australia (wheat) and with our competitors overseas.

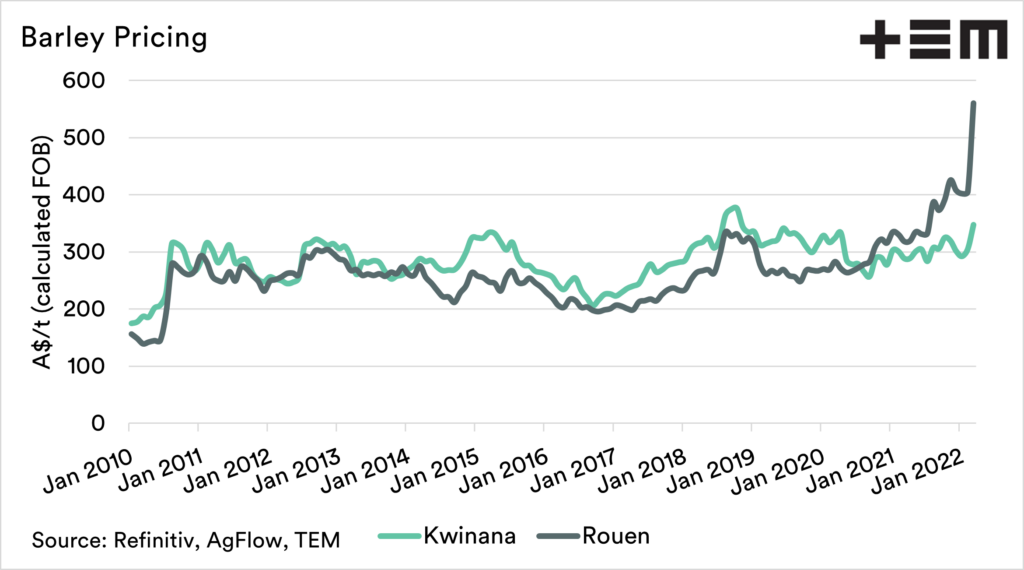

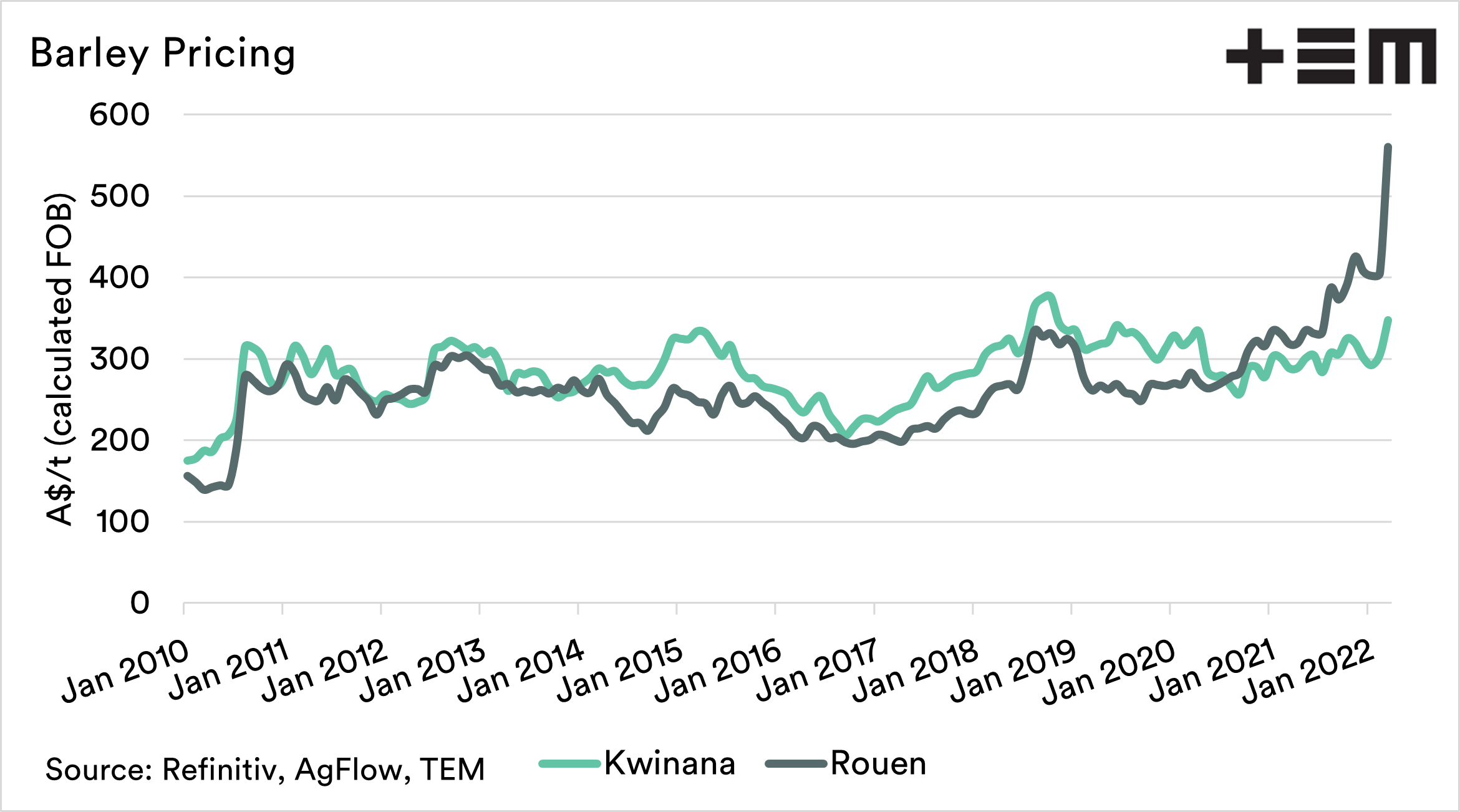

The market in Australia has improved dramatically, but how does it compare to overseas? It is always essential to ensure that we are comparing against relative values. We know that markets tend to follow one another worldwide, as commodities are interchangeable (or fungible).

What we can see is that French feed barley values have increased by a significant level, compared to the strong but more muted response seen in Australia.

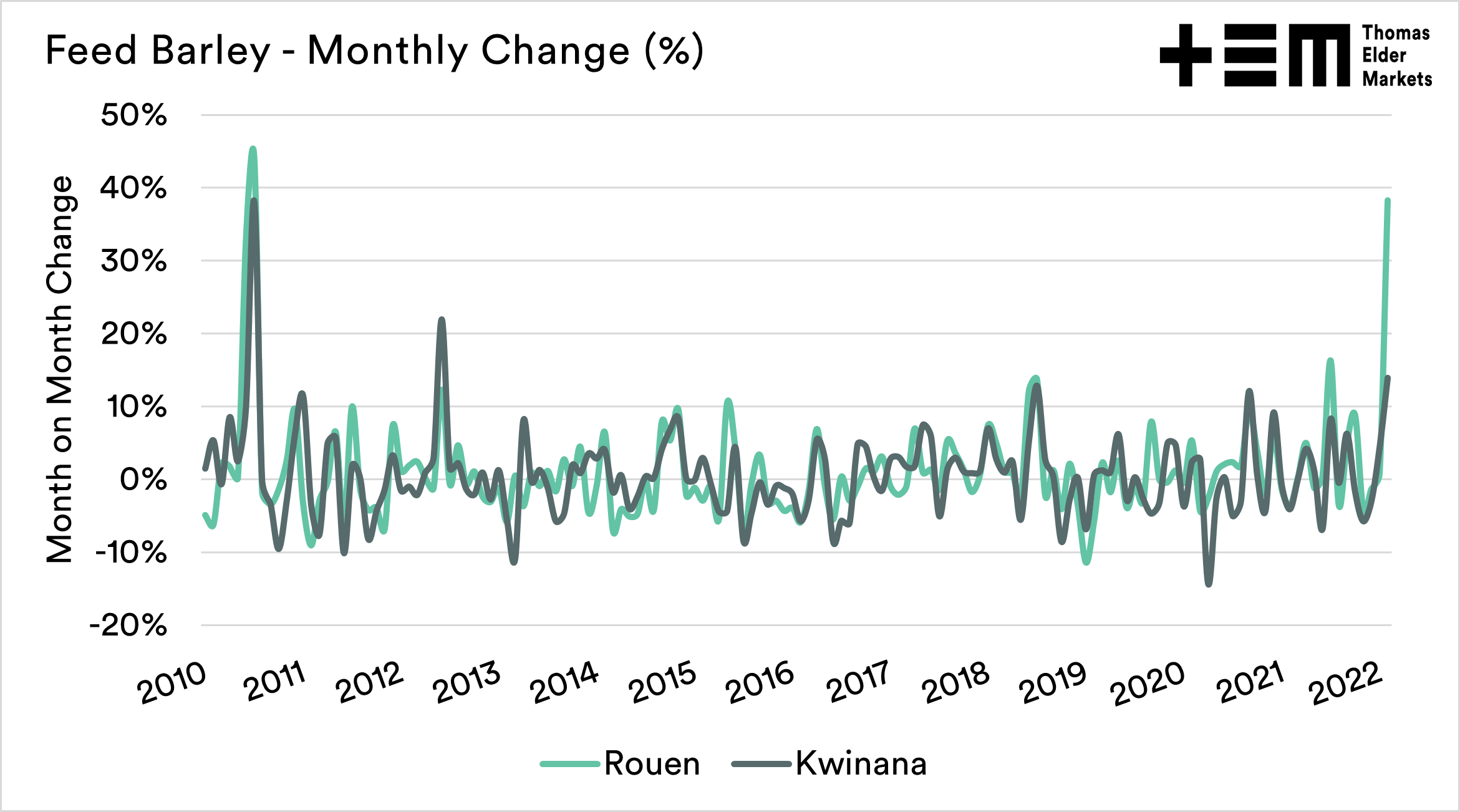

The chart below shows the monthly change in price. Generally, in percentage terms, we can see that pricing tends to follow a very similar trend. We can even see this back in August 2008, when both Australian and French prices rose dramatically due to the Russian drought-induced export ban. Coincidentally also the month that I moved to Australia.

The difference we can see in the current month is that whilst prices have risen, the prices in France has dramatically outpaced our rise at +38% versus +14%.

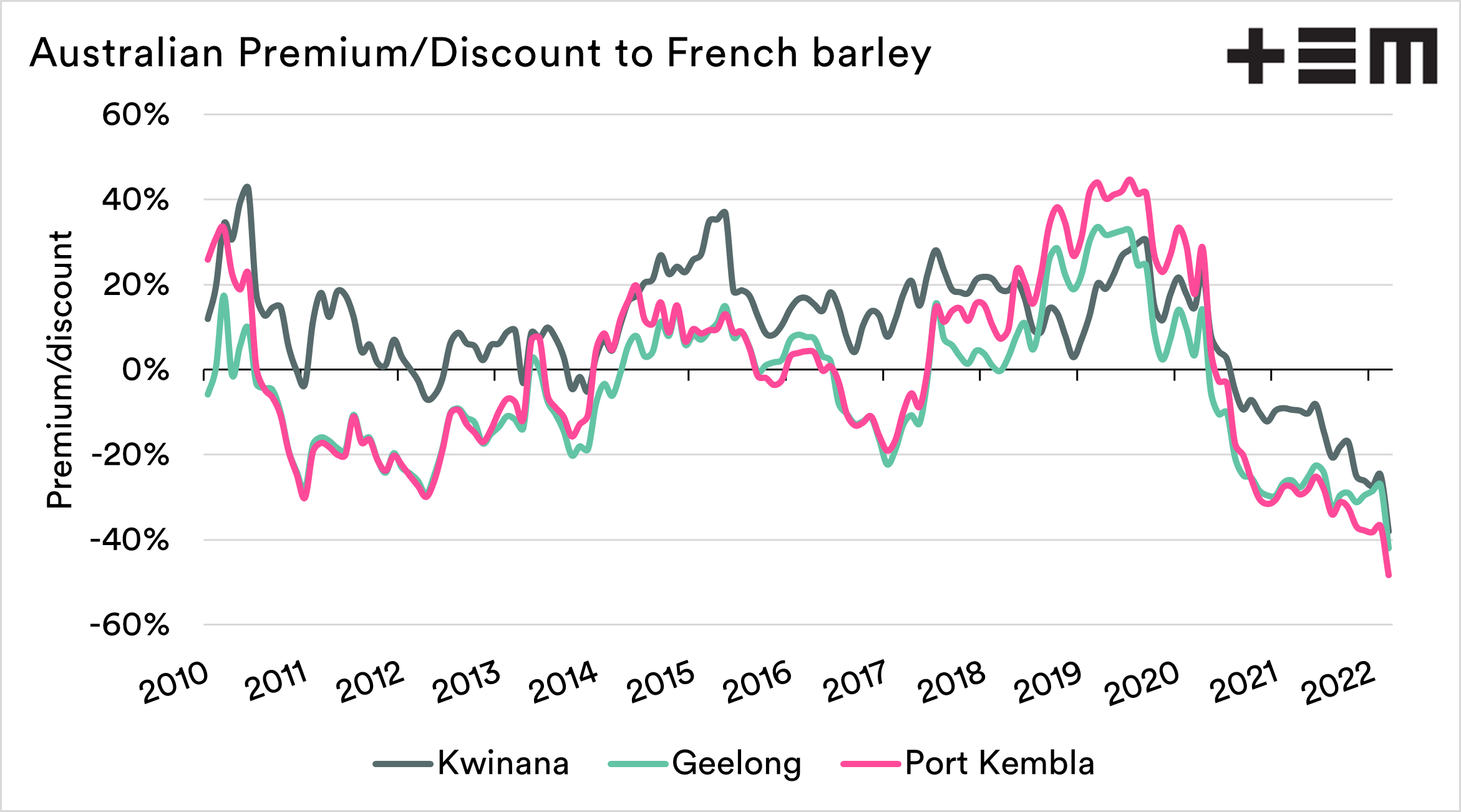

14% is clearly a fantastic return month on month, but as we have seen with many of our grains, our pace is not keeping up with the rest of the world. This has meant that our pricing levels have fallen to the largest discount to French barley that Australia has experienced since at least 2010.

Australia is heavily discounted, and this has been the case since immediately after losing China.

As the conflict continues, the flow of grain from the black sea ports will be constrained. This is a major concern for Chinese consumers, as they have increased their reliance on a few export nations. At present, 56% of the world’s exportable surplus of barley is not available to China.

If I was a Chinese consumer, be that feed or malt users, I would be lobbying hard to get access to Australian supplies.

The removal of Australia from China has hugely benefitted France. They have been able to capitalise on our loss by increasing their flows into China. At present, France is now likely the majority into China.

Whilst logistics is a major constraint in Australia; there are opportunities to find a solution. At present, the margins are strong enough to encourage exporters to find a way to get boats loaded and en route to destinations.

The longer the disruptions, the more likely solutions are found and the potential for some more trickle down to the grower bids.

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here and to follow us on Twitter. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.