Basis: Back to black.

The Snapshot

- Basis after being at a discount for the past couple of years, is now back to a premium.

- Basis is driven by supply; a lower expected supply increases basis levels.

- I expect that with declining conditions in Australia, especially around areas of strong domestic demand, we will see a continuation of the premium.

- Higher basis is not always a good thing. It means we have less to sell, and sometimes the extra price doesn’t cover the yield loss.

The Detail

For the last couple of years, I have been asked a question regularly. When will basis return to a premium? The answer has always been the same – when our production drops.

That is now starting to occur. The basis level in Australia has moved to a more normal premium against Chicago wheat.

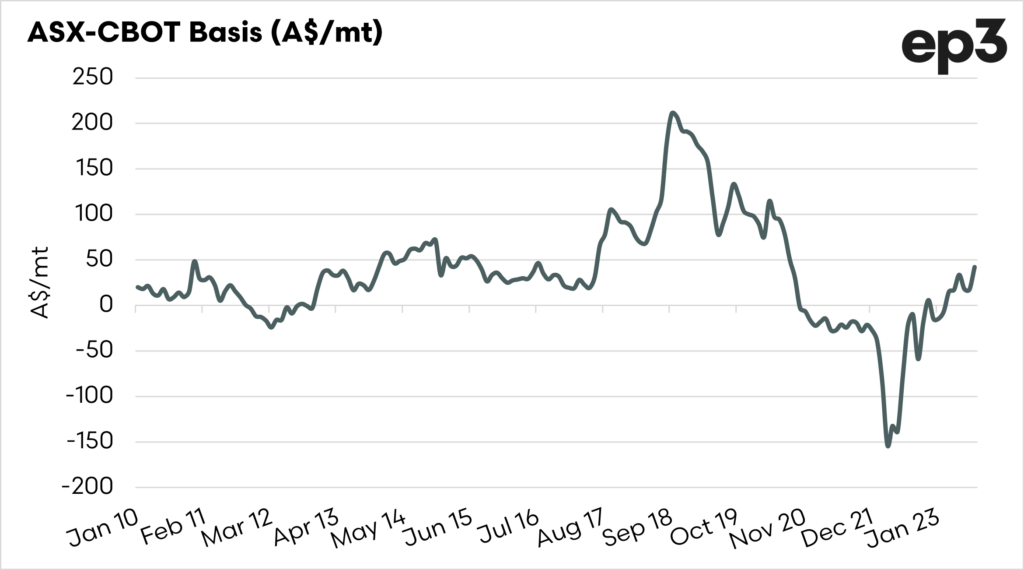

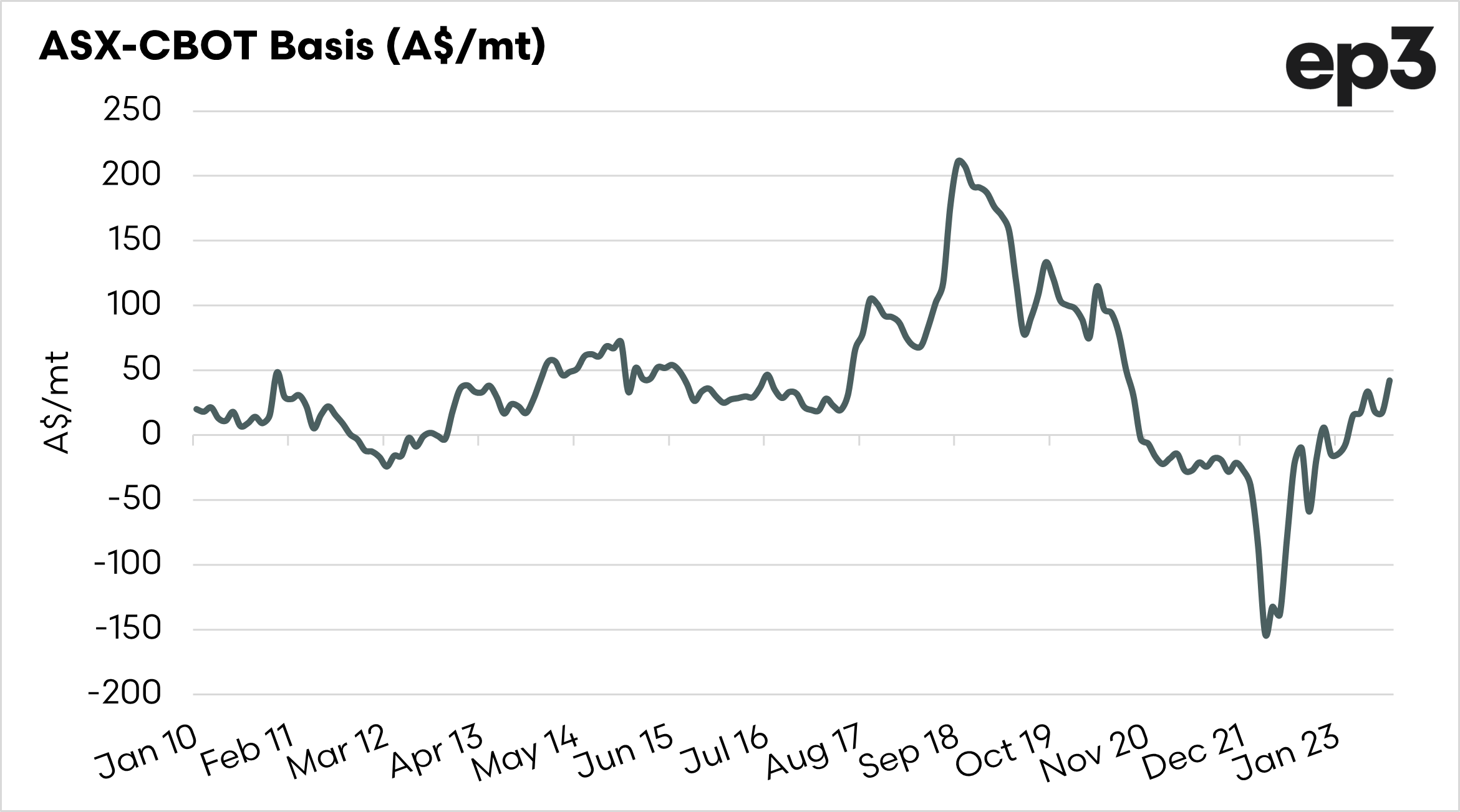

The chart below shows the monthly average basis level between ASX wheat futures and CBOT wheat futures (spot) since 2010.

We can see that the basis level was at its peak during 2018 and 2019, the drought years.

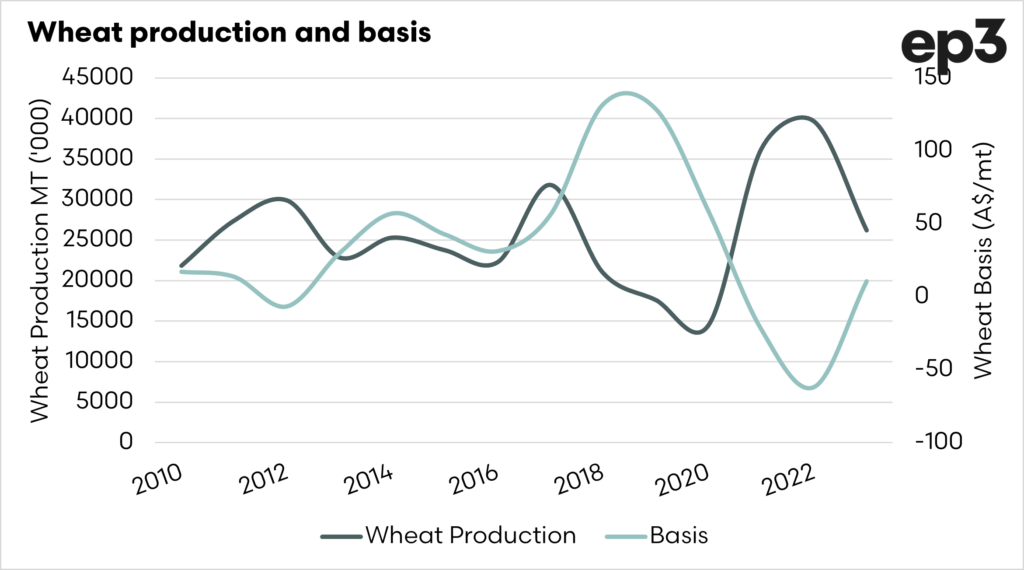

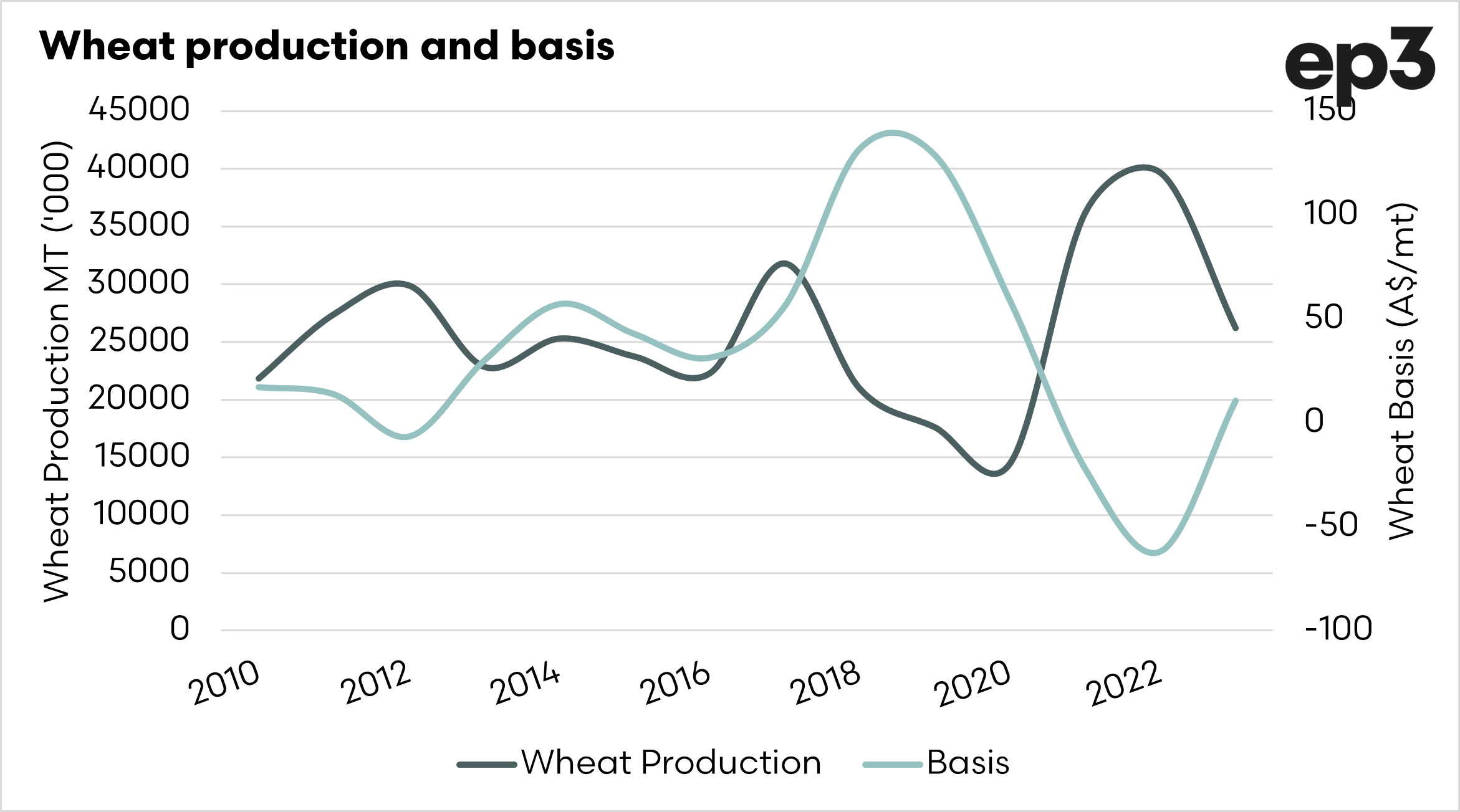

The relationship between production and basis can be seen in the chart below. When production goes to extremes, the basis goes to extremes.

In a year of low production, the basis will rise to extremely high levels as the domestic market ‘pays up’ to keep the wheat in the country. In times of excess supply, then the ‘FOMO’ is no longer there, and the market doesn’t need to pay a premium.

That’s the real basics of basis; it’s simply supply and demand.

The current outlook is not looking too flashy for grain production in Australia. The current ABARES forecast is for production of 26.2mmt, but things are drying out around the country. The real test will be what the weather is like in September.

If the production declines considerably from the current estimates provided by ABARES, then it would not be unexpected to see the basis rise to higher premiums over Chicago wheat.

One thing to remember about basis, that I mention in all our market presentations. High basis generally means you have very little to sell, and a low basis at least means you have something to sell. In the past couple of years, we have had a low basis, but we have had plenty to sell, and the overall price has been high due to a rise in global values.