Can grain exporters do more to help price?

The Snapshot

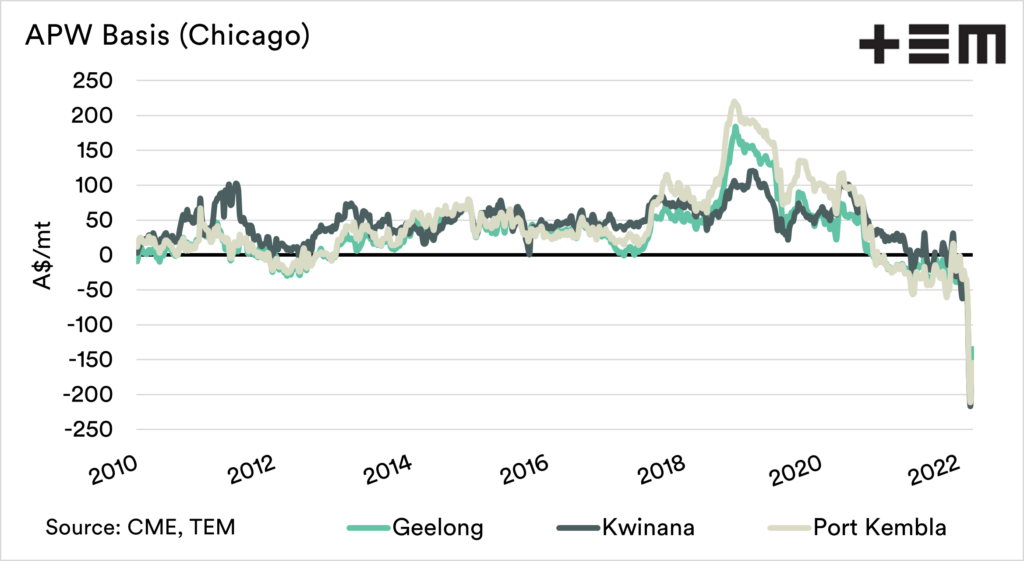

- Australian basis to Chicago has improved but is still at a substantial discount.

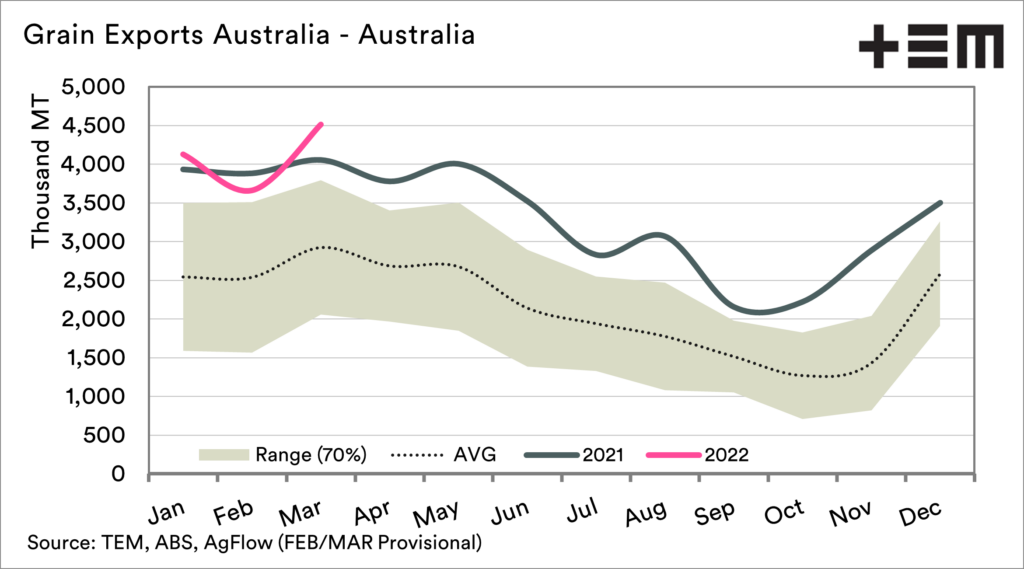

- One of the reasons for the huge discount is the inability to increase the volume being exported.

- Australian exports of grains are running very hot, running close to capacity.

- In theory, Australia could export 50mmt of grain (Barley, Sorghum, Canola and Wheat).

- This is in theory and isn’t likely as it is hard to run a supply chain at 100% for an entire year.

- Over time supply chains run less efficiently, and we face truck and train driver shortages.

- The reality is that there are big margins available for exporters who can get grain to market.

- This will mean that if there is a way to increase the export flow, it will be found.

- If traders can access higher margins overseas, hopefully, some of that value is passed down the chain.

The Detail

Australian grain prices remain at massive discounts to futures levels. In recent weeks the premium/discount between most of Australia has technically improved. For example, the basis in Kwinana averaged -A$217 for the week commencing the 7th of March. Last week it averaged -A$164.

So while it has improved, it has gone from a really really huge discount to what could be considered a really huge discount. Australian prices have typically traded at a strong premium over Chicago wheat futures like most port zones in Australia. So whilst improved for growers, it is hardly a great spread.

One of the reasons for the lack of response in the local marketplace has been the lack of availability for adding additional volume to the shipping stem. To an extent, this is true in that logistics were already at close to capacity before this current rally. However, where there are huge margins to be made if the grain can be exported. At these margins, there is the incentive to find a way.

I thought it was worth having a look at exports and what is the theoretical maximum export potential.

Australia is notoriously difficult to get easy and quick access to export data compared to other developed nations. In other parts of the world, the data is released regularly and timely (and free of charge). In Australia, ABS release the data a couple of months after the event, and there is a charge to get access.

To get the most up to date data on exports, we use data from our partners at AgFlow, who have access to export volumes through their network of contacts. This allows us to update until the middle of March, instead of the ABS data which has January as the most up to date data point.

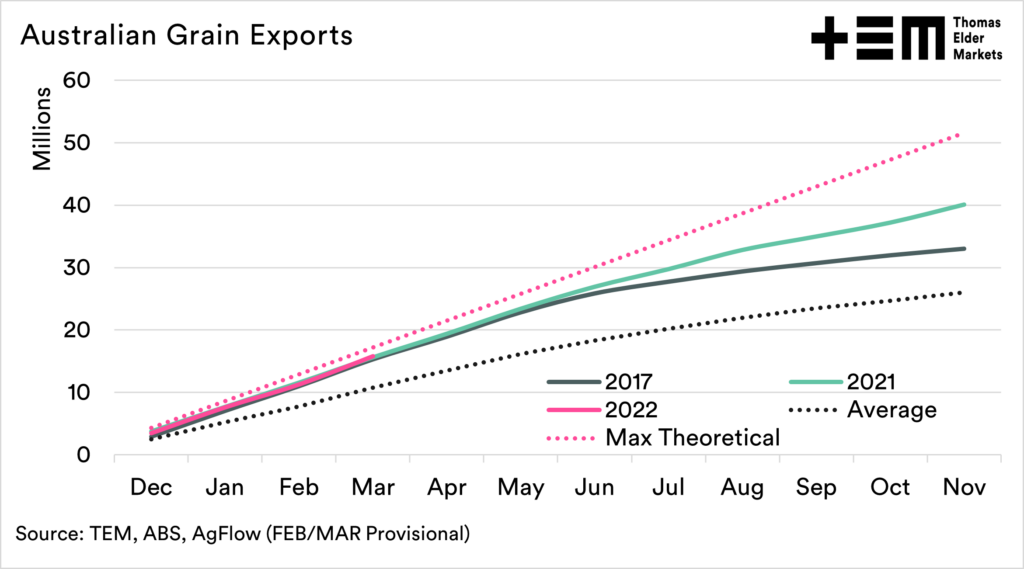

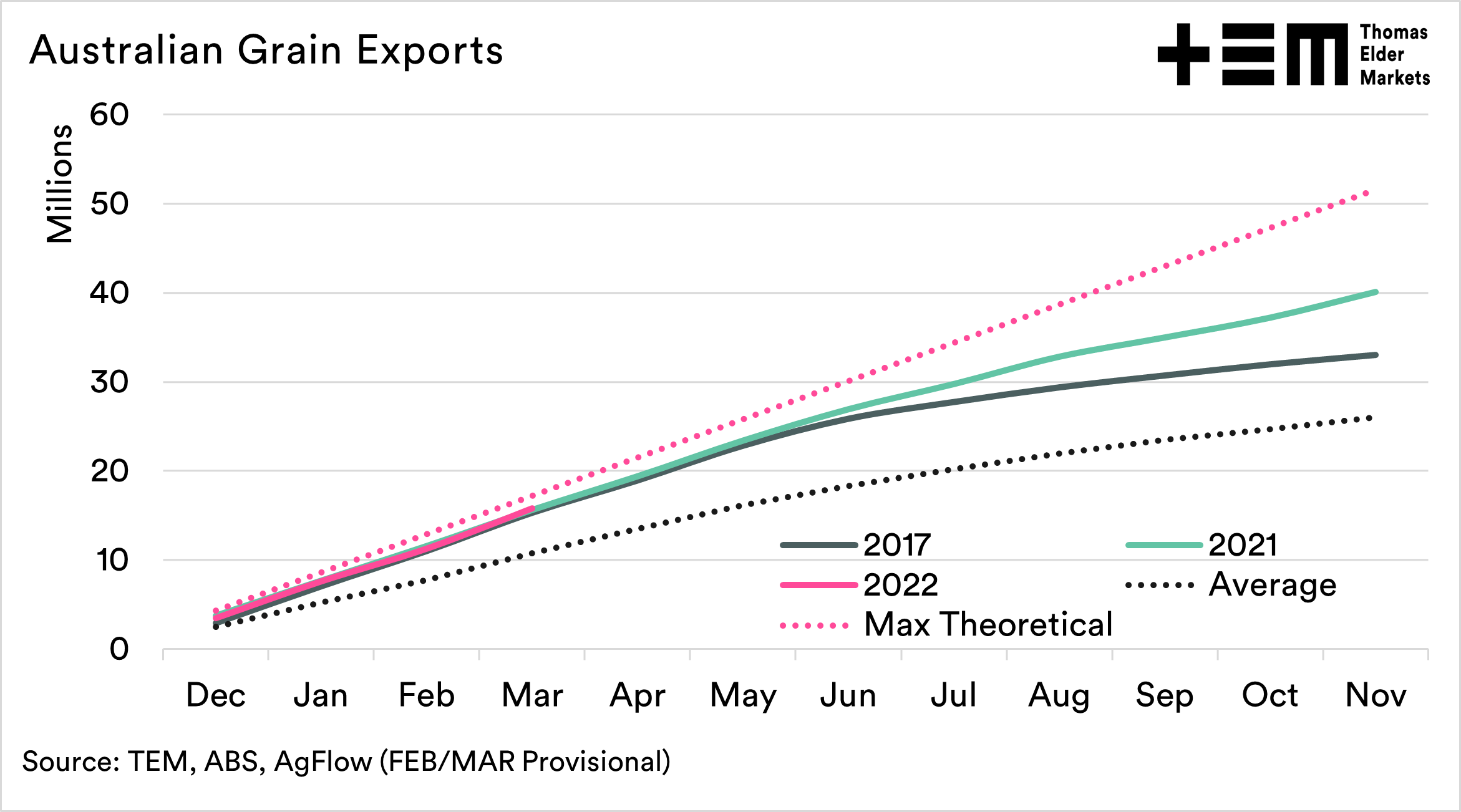

The chart below shows our exports of grain (Barley, Canola, Sorghum and Wheat). So far, we are meeting the same export pace as last year, a huge export year. This is well above the average we have exported over the past decade. Can we do more?

In theory, we could do more. The theoretical line in the chart below is if we loaded and exported our record volume, then repeated it every month. So, in theory, we could increase our export program to >50mmt.

It is important to note the term ‘in theory’. It is theoretically possible that I could get a position as a ruckman in the AFL, but that doesn’t mean it will happen.

It won’t be possible to run the Australian supply chain at 100% for 12 months. There are already challenges with truck and train drivers, and also that the low hanging fruit gets picked off early in the year, and as time goes on supply chains get ‘longer’.

We can, however, run the system as hard as possible to ensure there is a realistic maximisation of the supply chain. If there is a year to get grain exported in as large of a volume as possible, it is 2022. Let’s hope that export volumes are increased in order to help increase the flow of overseas values into local growers’ pockets.

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here and to follow us on Twitter. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.