Canadian tariffs are already hitting Aussie farmer’s pockets.

The Snapshot

- Canola prices in Australia have been smashed in recent weeks.

- Fundamentally, very little has changed in these markets in recent weeks.

- The driver was initially tariffs from Trump, but now tariffs are from China.

- Canada is reliant on the US and China for the majority of its trade in seed, oils and meal.

- The GM spread will likely remain large due to the decline in Canadian canola values.

The Detail

Tariffs are going to be a major challenge for global trade for the foreseeable future. Canada is the first to get hit by them, and it gives us a good insight into the problems. Tariffs on a major export nation have impacts that reverberate to other nations.

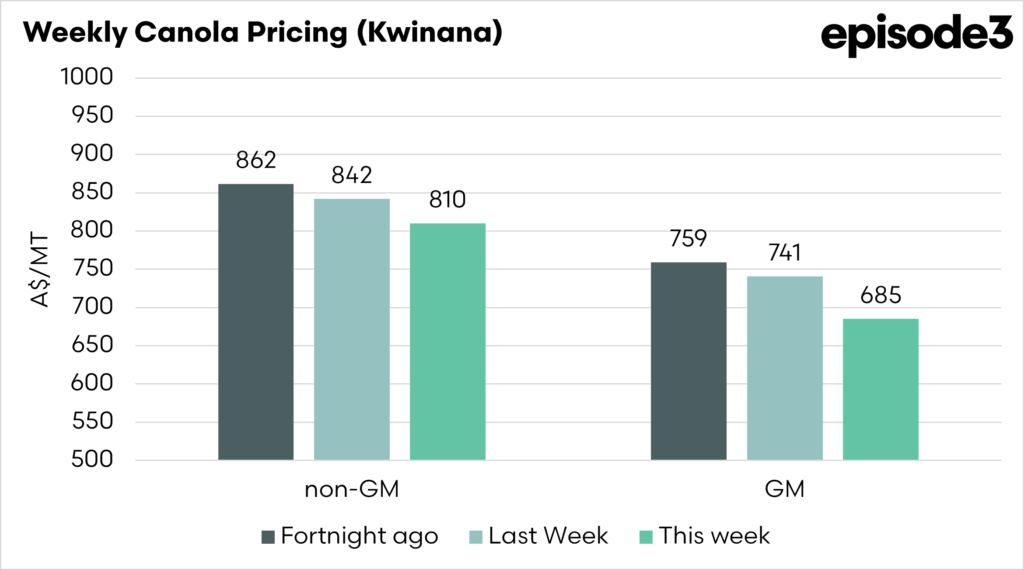

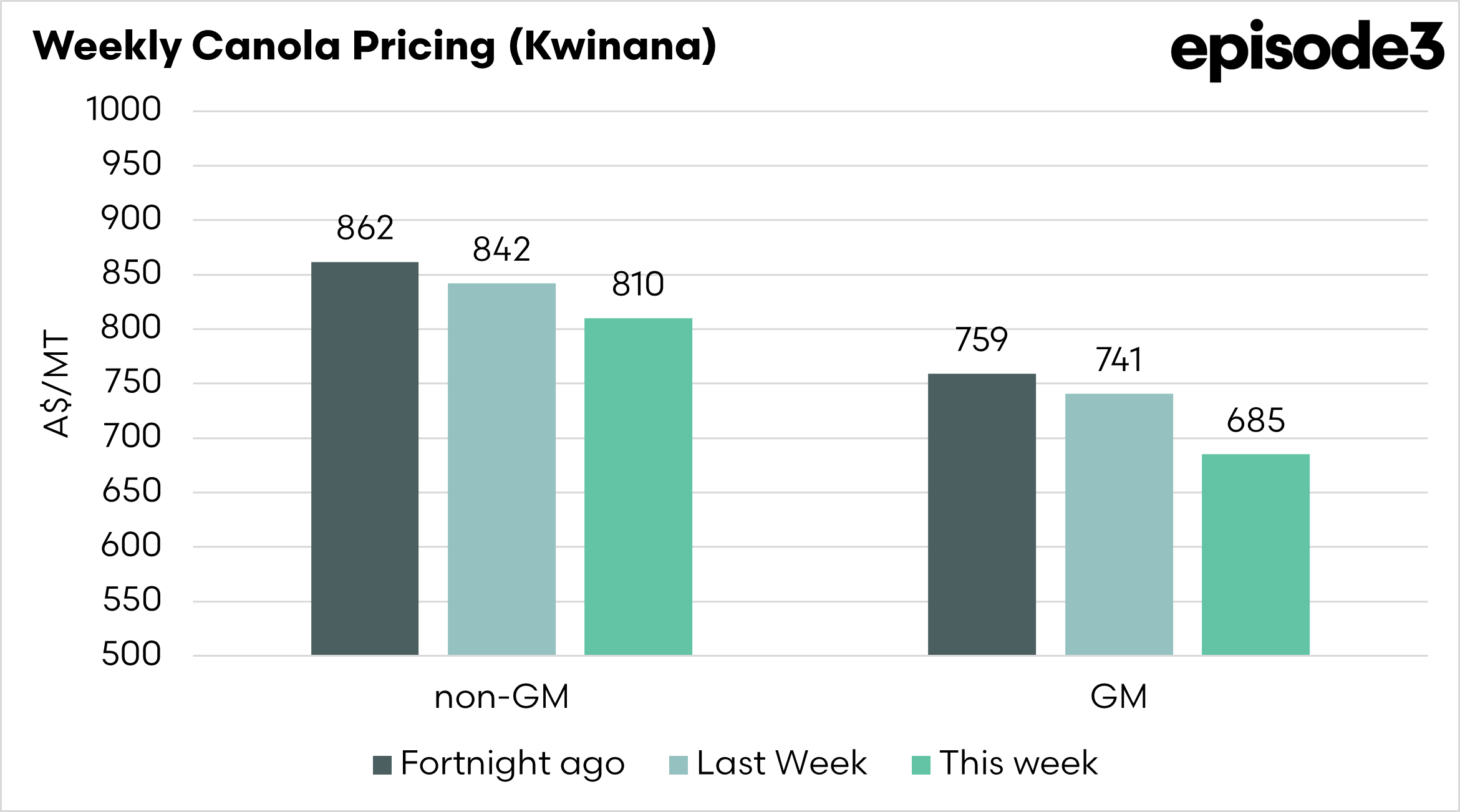

We are already seeing this in the movement in our canola pricing. The chart below shows the weekly average price for Canola in Kwinana. In a fortnight, non-GM canola has moved from A$862 to A$810, and gm from A$759 to A$685

It is important to note that this is a very fluid environment; things change very quickly, and things could get worse or better in a couple of days. However, even this changing environment just causes uncertainty.

So what’s happening to the Canadian Canola complex?

USA: The Trump administration has flip-flopped back and forward with tariffs on Canada, but as we write, Canada will be faced with a 25% tariff on exports to the United States, which includes canola (and its derivatives).

China: As a rebuke to EV tariffs by Canada, China has introduced a 100% tariff on Canola oil and meal exports to China. The important distinction is that this tariff does not apply to seed.

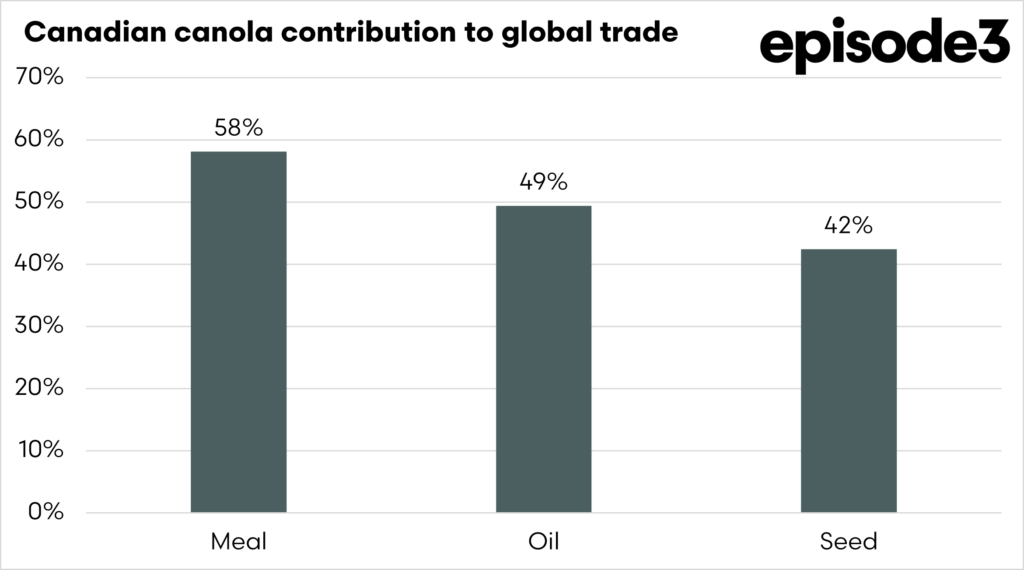

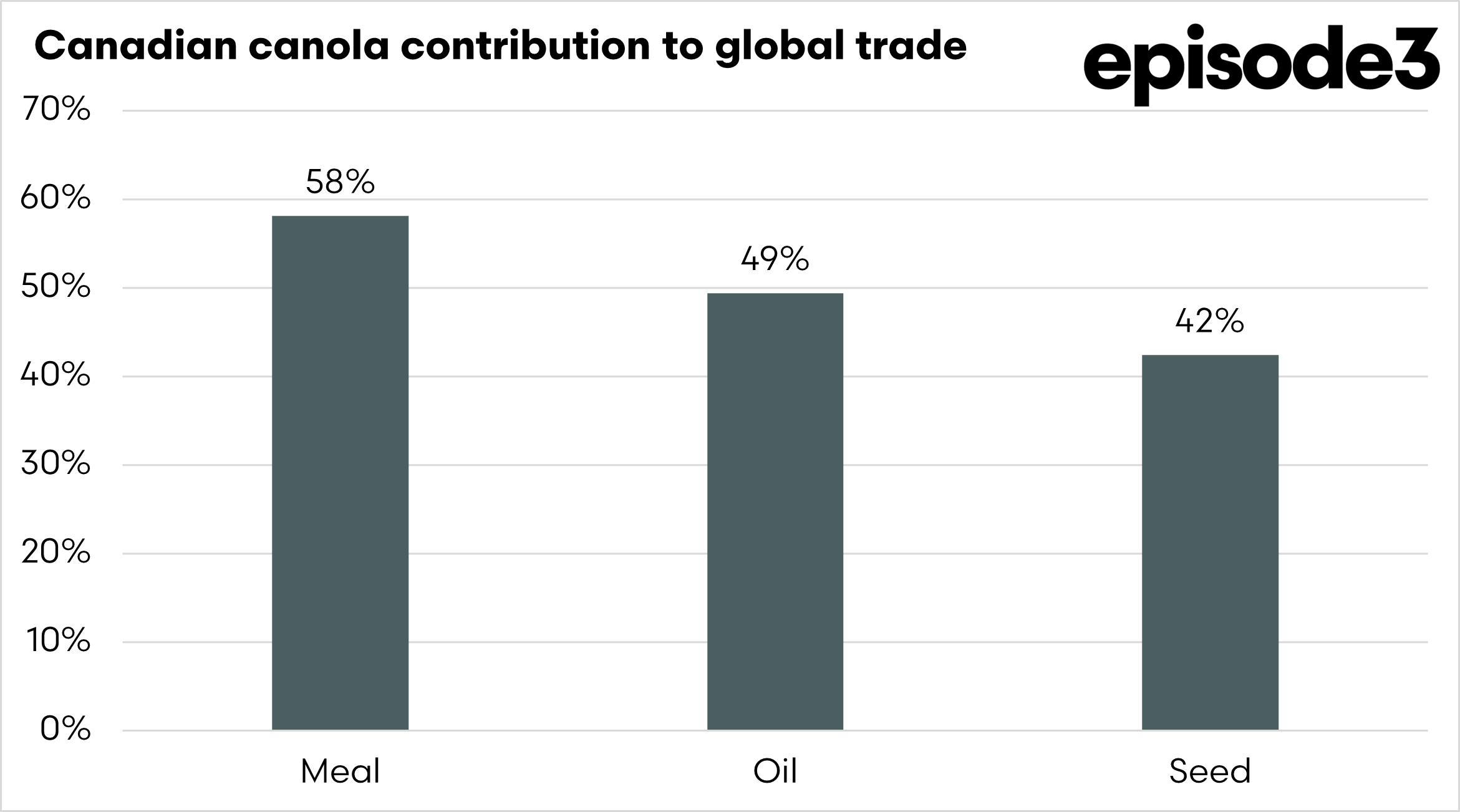

Canada is a huge contributor to the global trade in meal, oil and seed, as can be seen in the chart displaying the five-year average.

It’s important to understand how focused Canada is on the two markets introducing or threatening canola tariffs. Let’s delve into it.

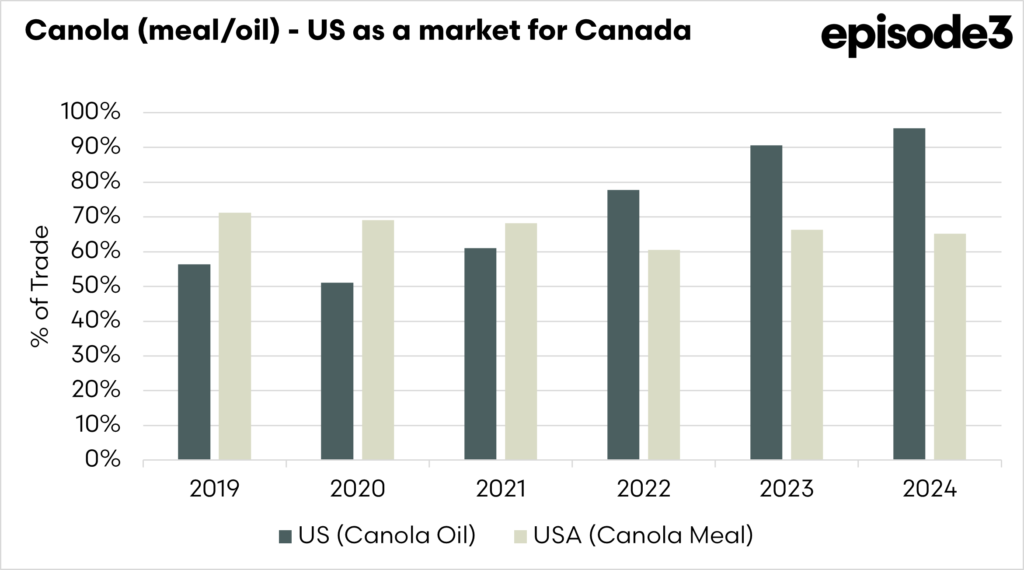

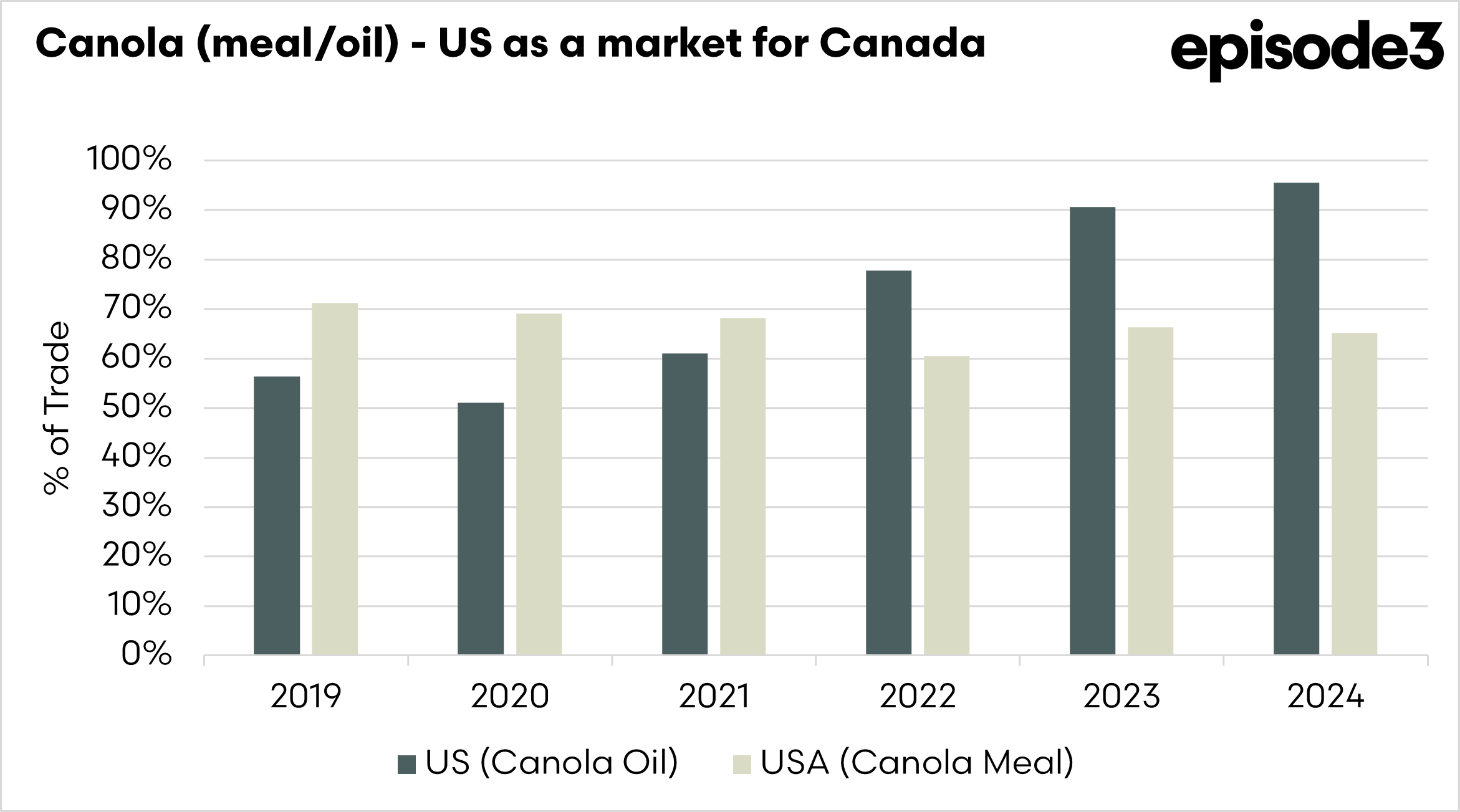

The chart below shows the percentage of Canadian canola oil and meal that heads across the border into the United States. There is very little seed headed across the border.

In recent years, more than 90% of all oil exports from Canada have been exported to the United States. Simultaneously, more than 60% of canola meal has made the same journey.

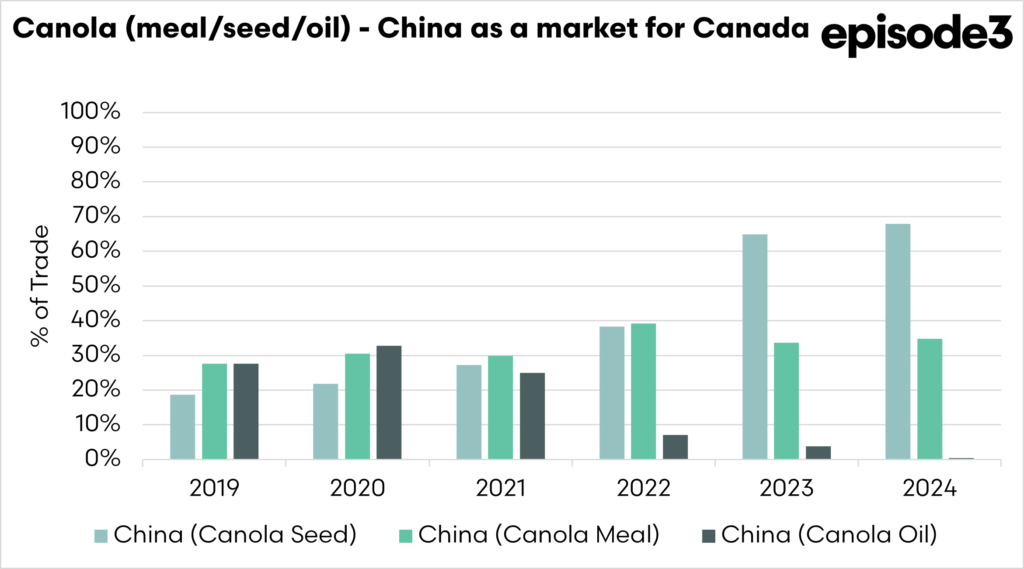

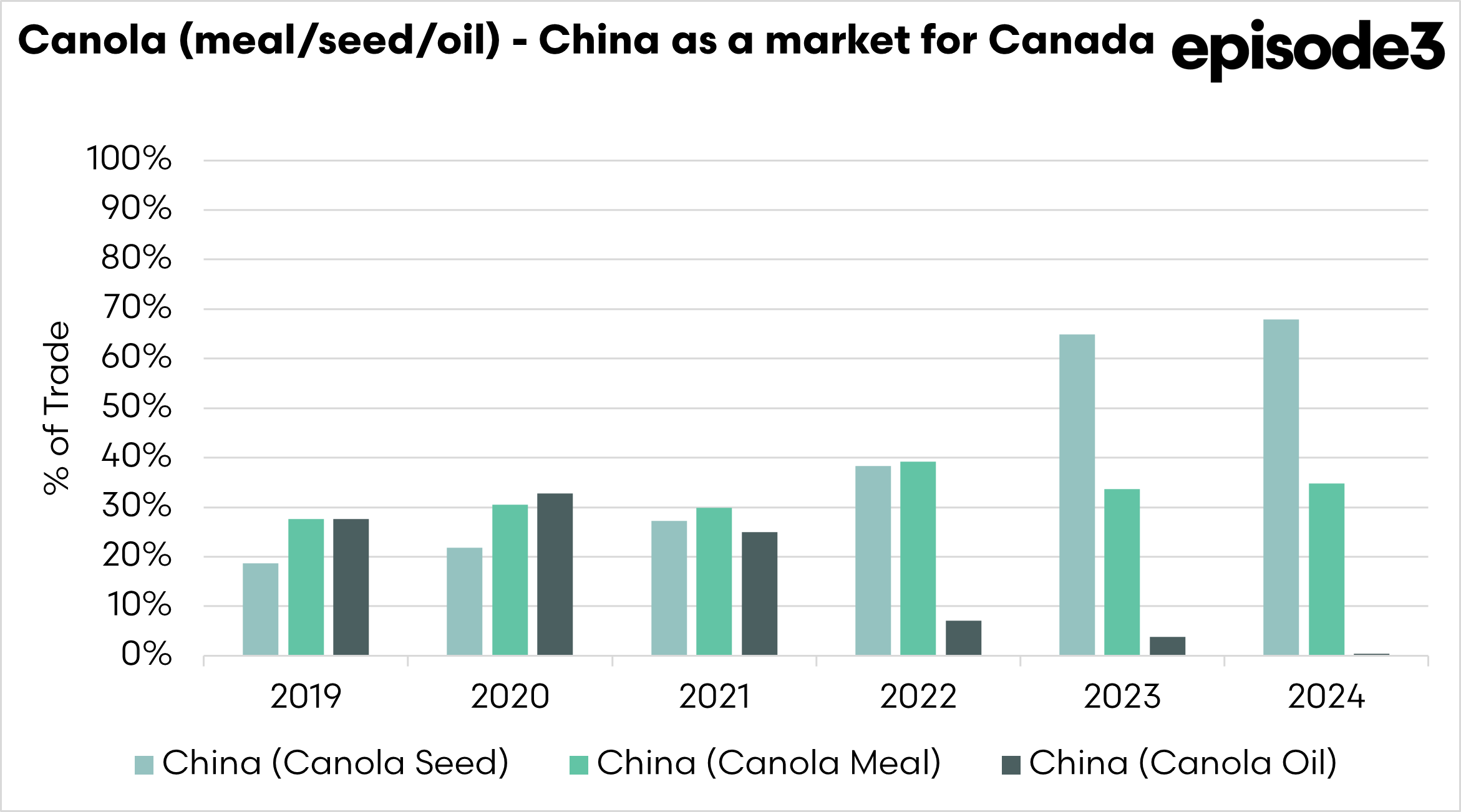

The chart below displays the exports of canola seed, oil and meal from Canada to China as a percentage of their trade. In recent years, the trade in seed has been above 60%, and meal has been around 30%.

The trade in oil has fallen to almost nothing in 2024.

Canada heavily relies on China and the US for a huge chunk of its trade in canola derivatives, oil and meal; almost all of it has gone to these two countries.

Tariffs will make these markets unattractive, which will mean that they will be looking to move canola to different markets, which may be directly competing with Australian trade.

Our non-GM trade into Europe is important, with the majority of our non-GM canola going there.

We will likely see a continuation of that large spread between Non-GM and GM for at least a little while.

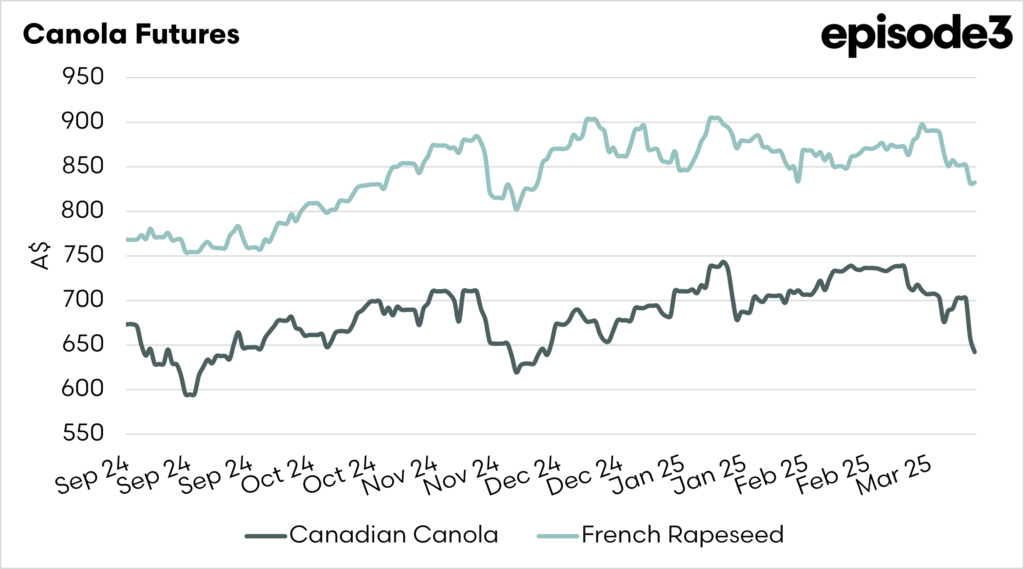

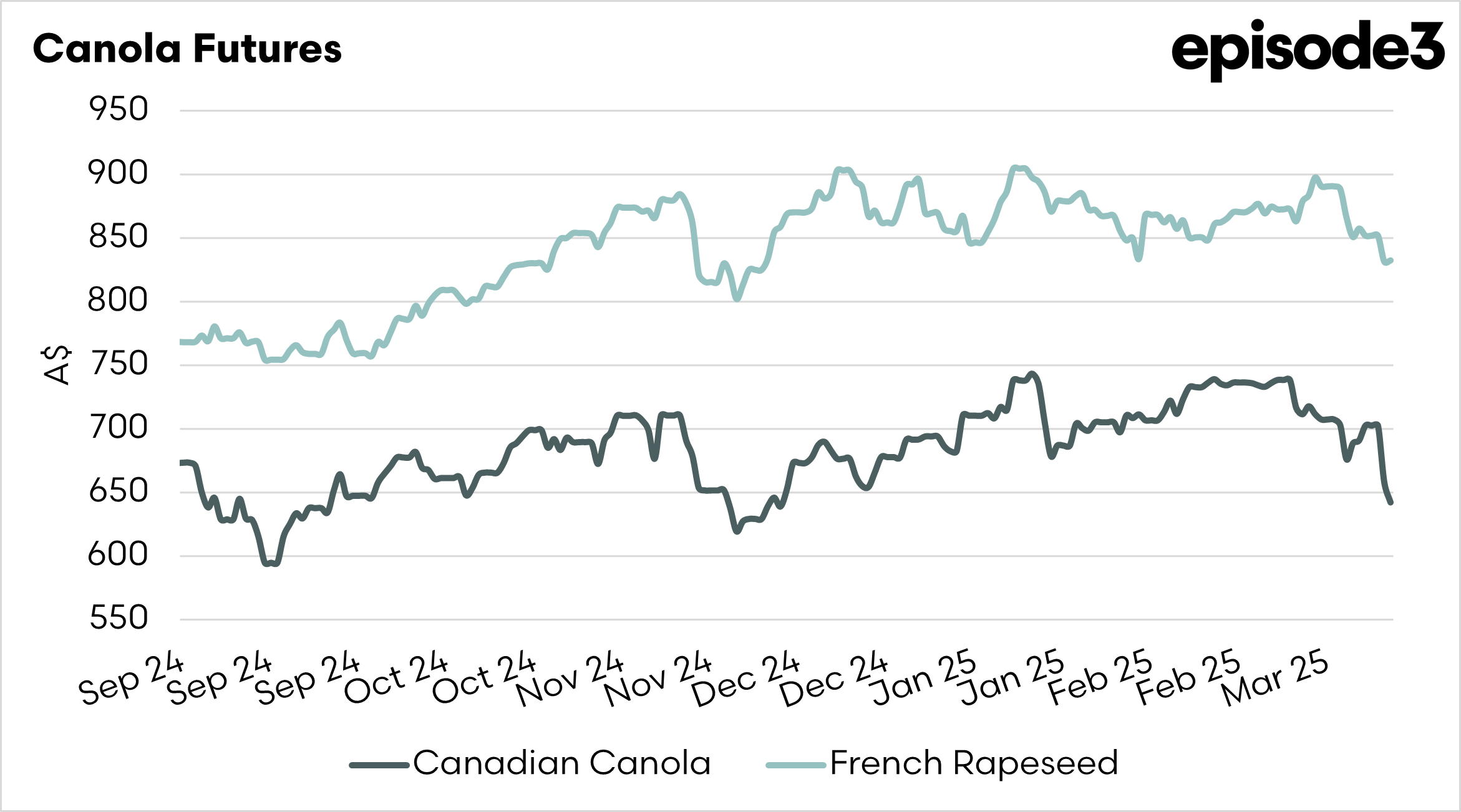

The trade has reacted to the concerns related to the tariffs from both Trump and China, and the market has reacted swiftly.

Uncertainty has pulled the market down, and this is being felt in our prices here.