China is back for Australian canola.

Market Morsel

China is tentatively back in the market for Australian canola. Australian grain traders are set to export around 150 to 250kmt of canola to China as part of a trial.

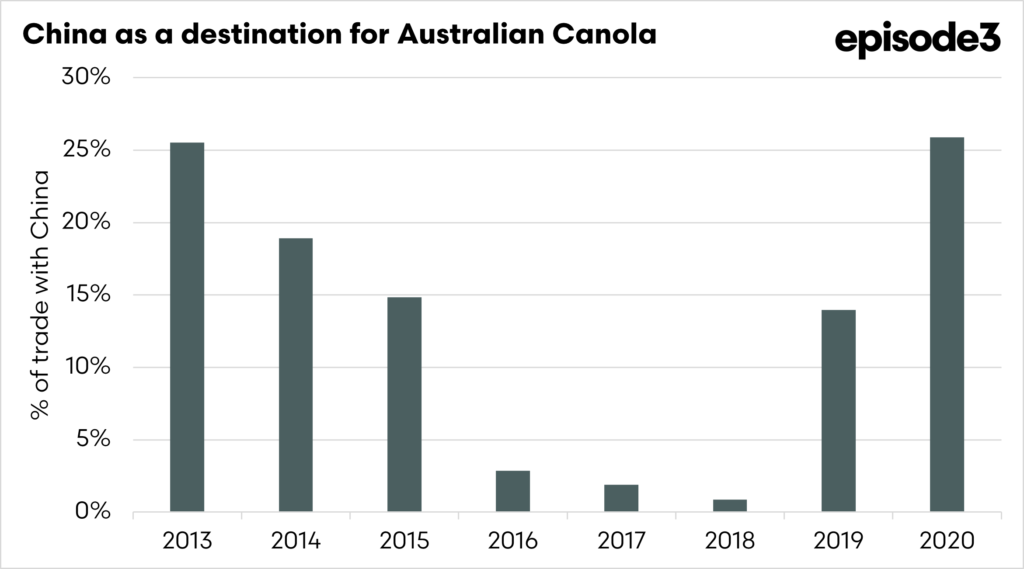

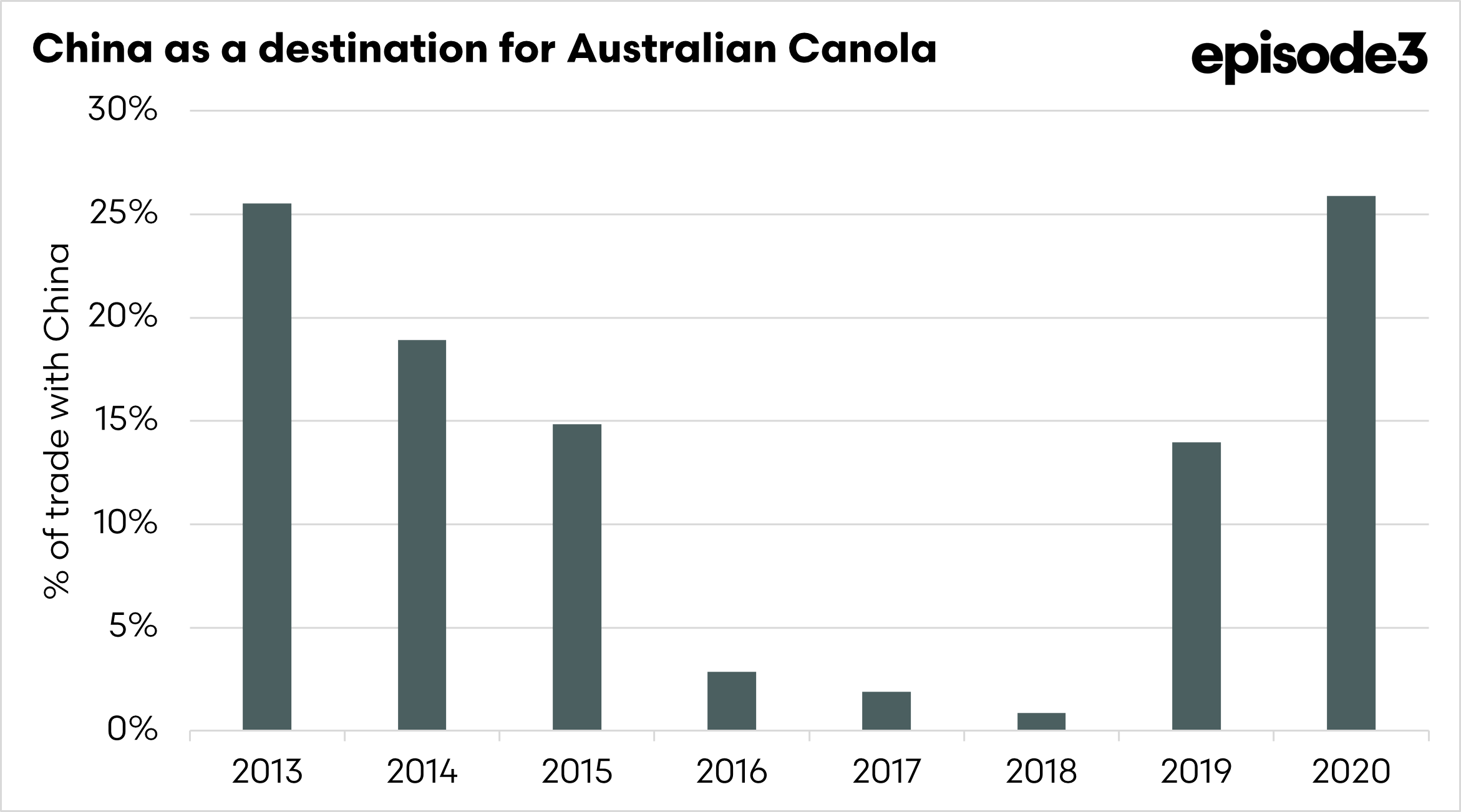

China effectively banned Australian canola in 2020, citing biosecurity concerns related to the presence of blackleg fungus, a disease that poses a serious risk to China’s domestic canola crops. There was 1000 tonnes sent there in 2024 as a trial, but for all intents and purposes we didn’t have access.

However, the move also occurred during a period of escalating diplomatic tensions between the two countries, following Australia’s call for an independent inquiry into the origins of COVID-19. In response, China imposed a series of trade restrictions on Australian exports, including barley, wine, beef, and coal; canola was caught in this broader wave of economic retaliation. While officially framed as a phytosanitary issue, the canola ban reflected China’s use of trade as a tool of political leverage, sending a clear signal amid worsening bilateral relations.

In 2024, China launched an anti-dumping investigation against Canada, in retaliation for huge tariffs on Chinese-built electric vehicles. At the time, I suggested that China would look towards Australia as a potential source, albeit they would need to get around their blackleg restrictions. A country like China, once it decides on a direction, will find a way.

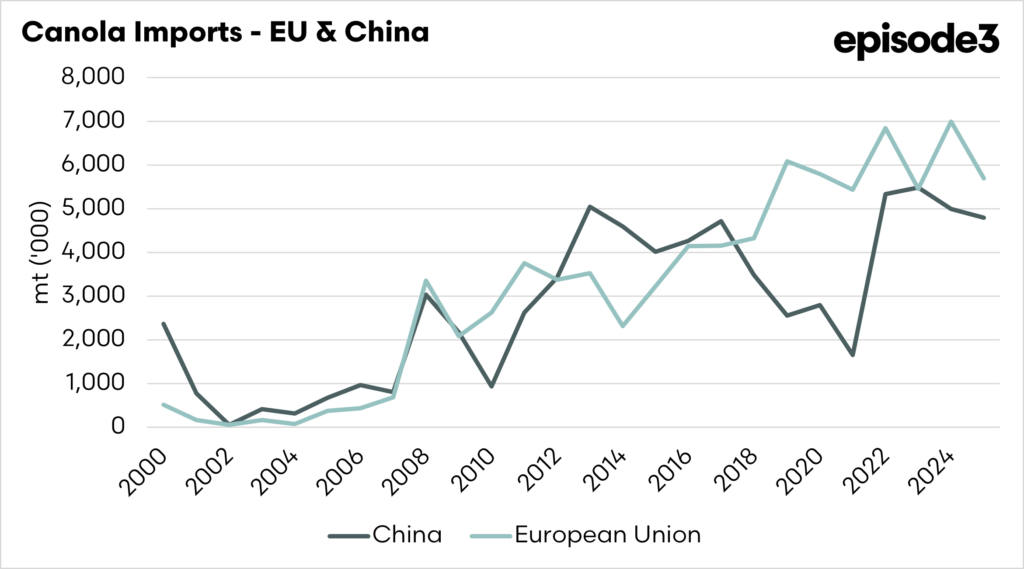

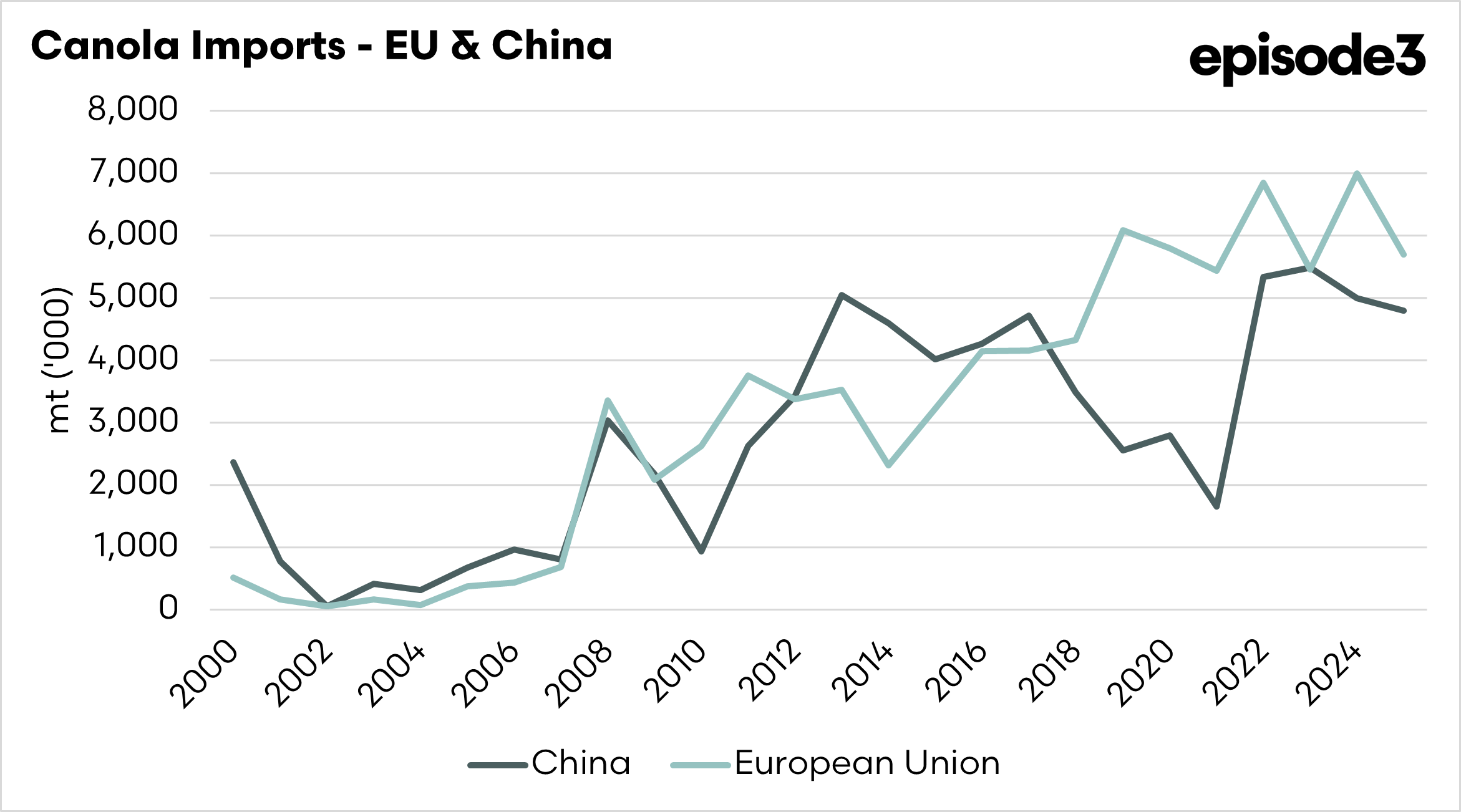

China is a significant buyer of canola, ranking second only to the European Union as the largest importer of canola globally. Gaining access to this market will be beneficial for Australian producers, as it reduces our reliance on Europe as a destination market.

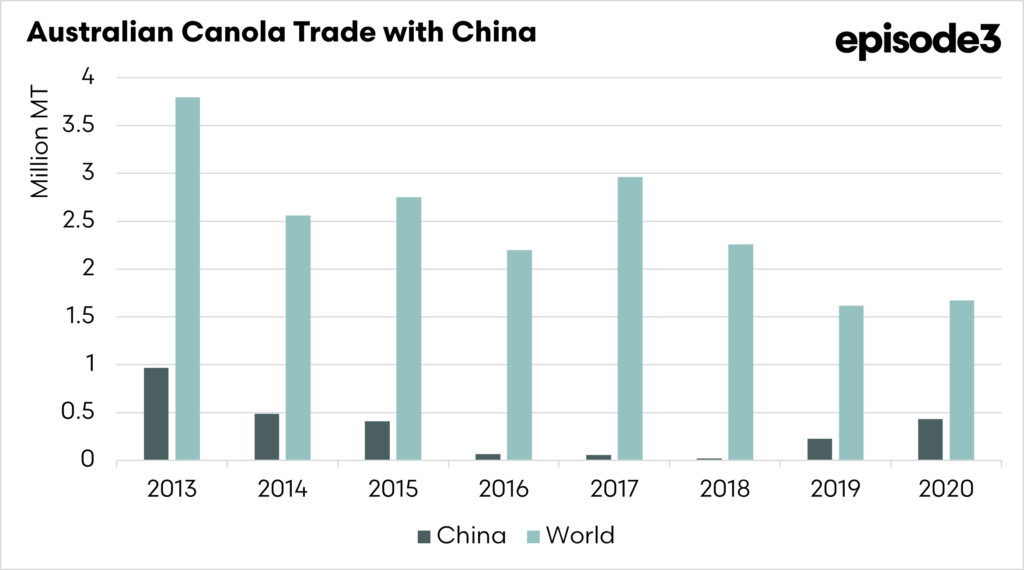

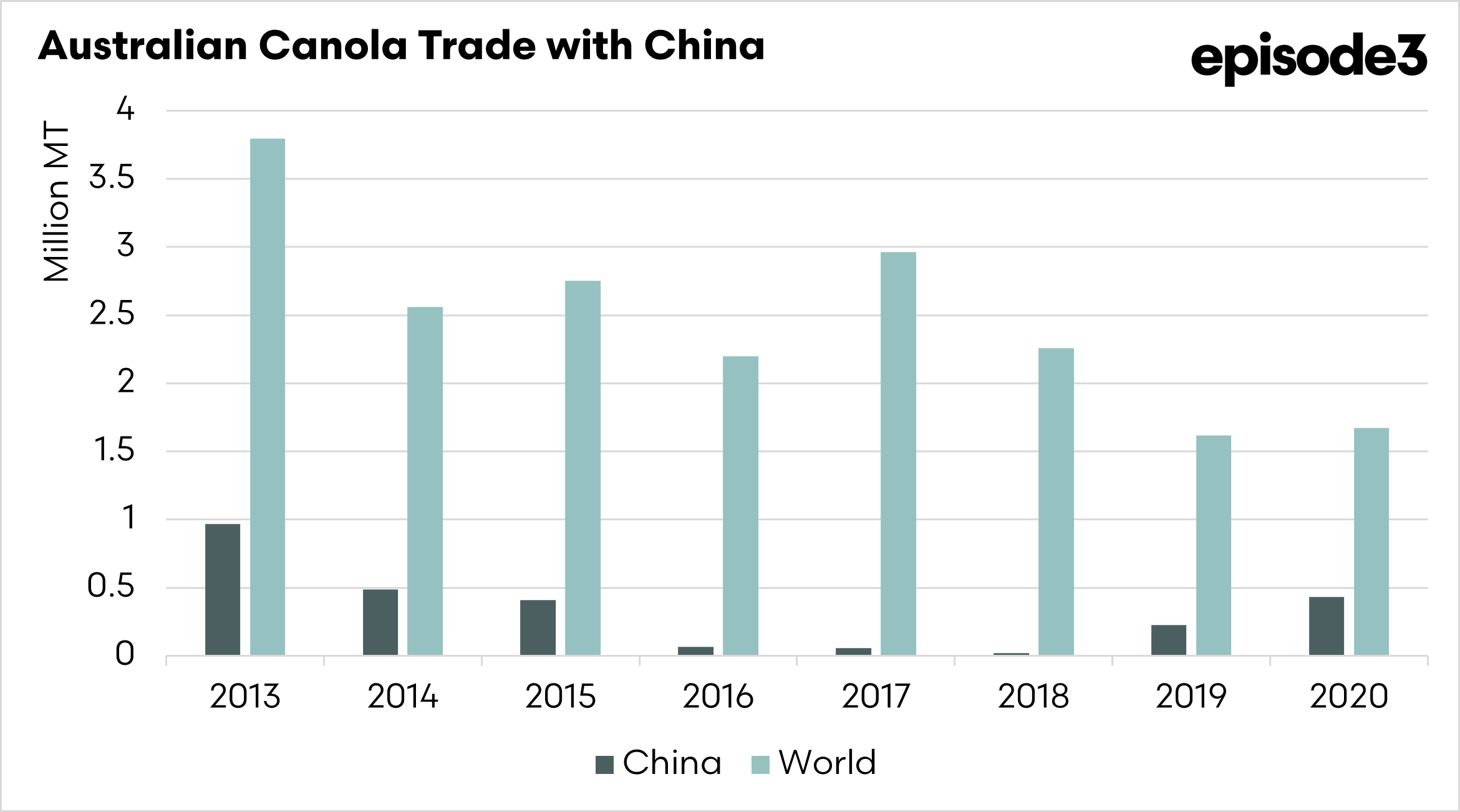

Australia was a significant origin for China during much of the 2010s, as shown in the chart below, which displays the percentage of our exports going to China. It is important to note that they are a price-sensitive market, and we did see a reduction in volume going to China during the period of drought.

Currently, there are no tariffs on Canadian seed imports into China, but this could change if the Chinese government deems it to be in its interest. As the world’s second-largest exporter of Canola, they have no choice but to prefer Australian canola, or face the prospect of Chinese consumers paying higher tariff values.

Securing renewed access to the Chinese market for Australian canola is strategically important, as it would diversify export options and reduce Australia’s growing reliance on the European Union. In recent years, Europe has become a key destination for Australian canola, primarily driven by demand for feedstock in the production of biofuels. However, this dependence carries significant long-term risks.

The EU is rapidly tightening its environmental regulations under the Green Deal and associated sustainability frameworks, which include stricter criteria around land use, deforestation, and the carbon footprint of imported agricultural products. These evolving policies could limit the volume of Australian canola that qualifies for European markets or introduce compliance costs that affect competitiveness.

By regaining access to China, Australia would be better positioned to balance its export portfolio. China’s need for alternative suppliers has increased due to its trade tensions with Canada and domestic shortfalls in oilseed production. This creates a valuable opportunity for Australian growers to expand market share, command better prices, and reduce vulnerability to Europe’s increasingly restrictive green trade policies. Diversifying into China also strengthens Australia’s position in global oilseed markets, offering more resilience against shifting regulatory and political dynamics.

We live in a time of changing trade flows, and some will be beneficial and some will be negative. In this case, we could see some positive changes.