China still all-powerful in grains?

The Snapshot

- Demand in China is dropping for a number of commodities, especially iron ore and coal, which are used in manufacturing.

- This demand destruction is due to a new extended lockdown.

- The demand in recent years for imports of grain in China has been nothing short of astronomical.

- Demand for the first quarter is overall very slightly down, but well up on pre-2020 years.

- To put recent demand into perspective, during the first three months, China has imported more than the whole of 2016.

- In 2021, more was imported than the total imports of 2016 to 2020.

- Chinese demand is still strong and seems to be staying there. A major demand reduction could have an impact on pricing.

The Detail

For better or worse, in recent years, we have seen China as a significant driver of the price of grains. While they haven’t been partaking in Australian barley, their rampant demand has meant caused a flow-on effect as they vacuum up grains from all over.

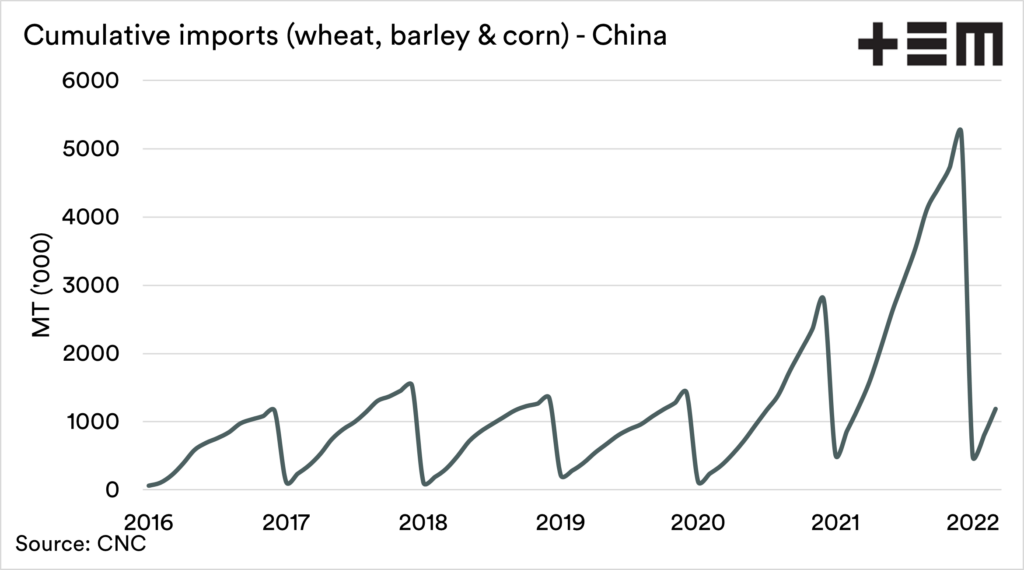

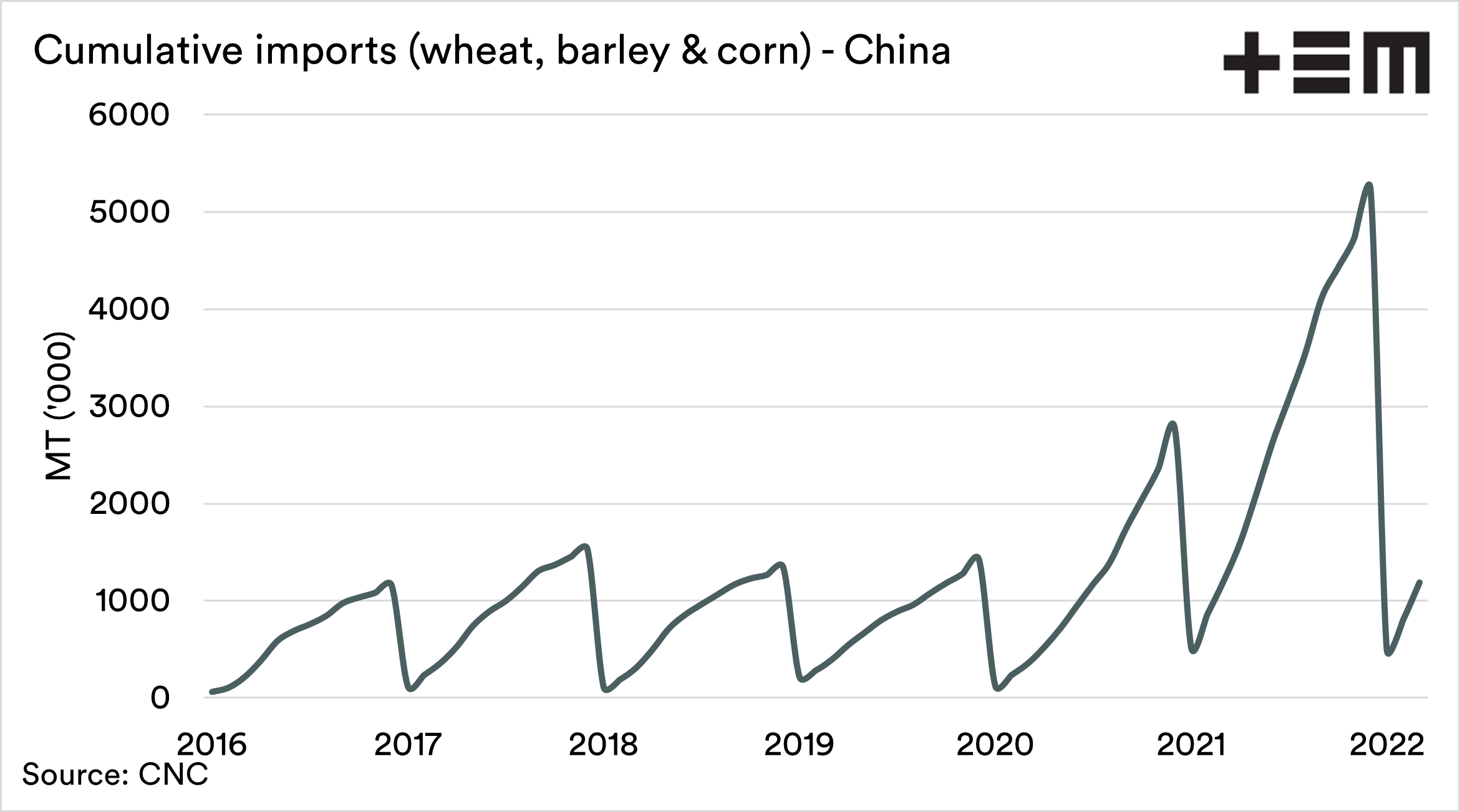

Imports of grains have been humungous. In the four years to 2020, China imported a total of 54mmt of combined wheat, barley and corn. In 2021, they imported 52mmt. Four years in one, that shows how huge the jump has been. The chart below shows the extent of the increase in grain imports in the past two years.

A significant number of Chinese cities are back under COVID lockdown. This has reduced demand for a number of commodities, especially iron ore and coal, as manufacturing drops. This has had an impact on the Australian dollar, dropping it to low levels (0.709).

Will we see a shrinking in Chinese grain demand? If Chinese demand fell back to more normal levels, then it would have a considerable impact on the global demand picture. This has been one of my concerns for the past year.

So is that happening?

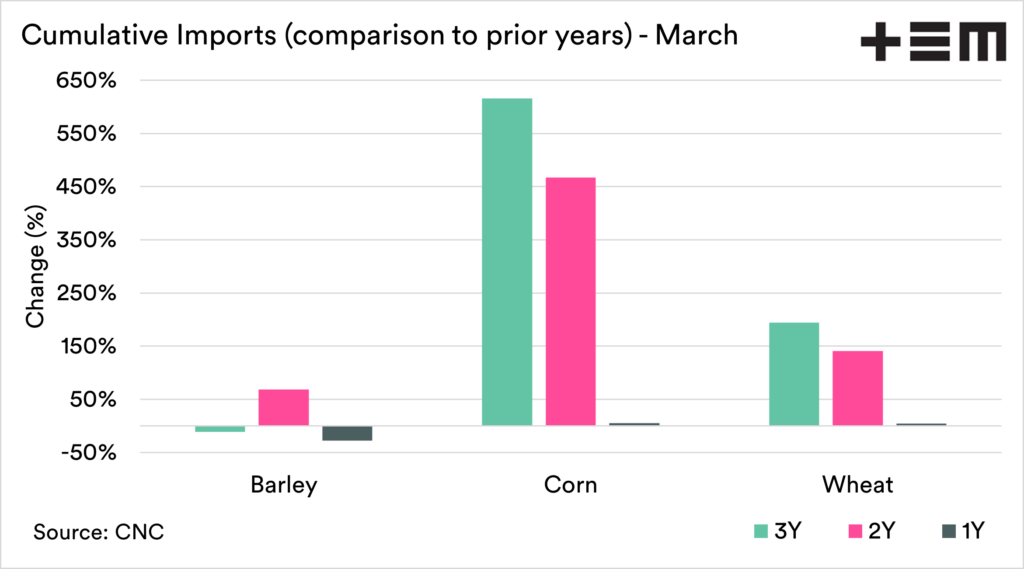

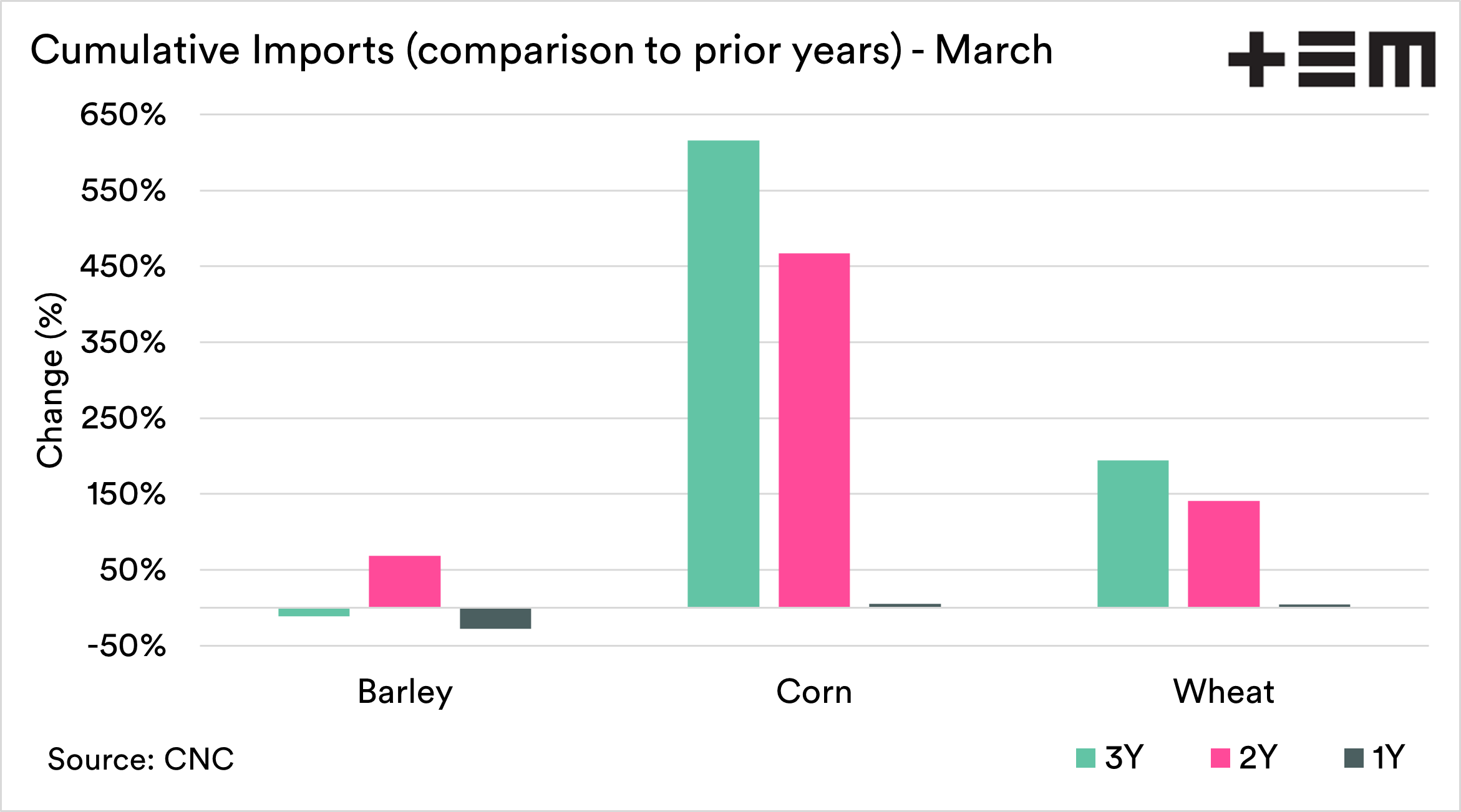

The chart below shows a comparison of Jan-Mar imports over recent years. We can see a slight dip in barley, down 28%, but corn and wheat are slightly up by 6% and 4%.

Overall grain imports into China are still very high, with only a slight dip year on year, mainly from reduced barley imports. There is a well-documented blockage at the ports, which has been getting worse in recent weeks; we may see that imports naturally drop off in April when the data is available.

At present, the ravenous appetite from China seems to be continuing. The benefit to Australia is that they are a keen buyer of wheat, and their corn/barley demand keeps the general feed market higher.

Their demand is still strong, with the first quarter achieving close to the annual imports in the years prior to 2020. Is this a structural break? Let’s hope that it is, as it supports grain pricing.

It’s one to keep a very close on.

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here and to follow us on Twitter. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise.

If you want to support this service, share with your network and encourage them to sign up.