Chinese GM could cause concern for Australian growers

The Snapshot

- China approved a series of GM corn and soybean varieties in December 2023.

- It is expected that China will increase GM hectares to 7% of corn area.

- China last year imported 13mmt, but in recent years has imported more nearly 30mmt in both 2021 and 2023.

- The US has increased the use of GM corn to over 90%

- GM corn varieties yield between 5.6% and 24.5% higher than conventional varieties.

- This analysis looks at the hypothetical scenario of China moving to GM corn more fully.

- The widespread adoption of GM corn in China could exceed the volume that China needs to import.

- This would impact the pricing of corn globally, which could flow through to wheat pricing.

The Detail

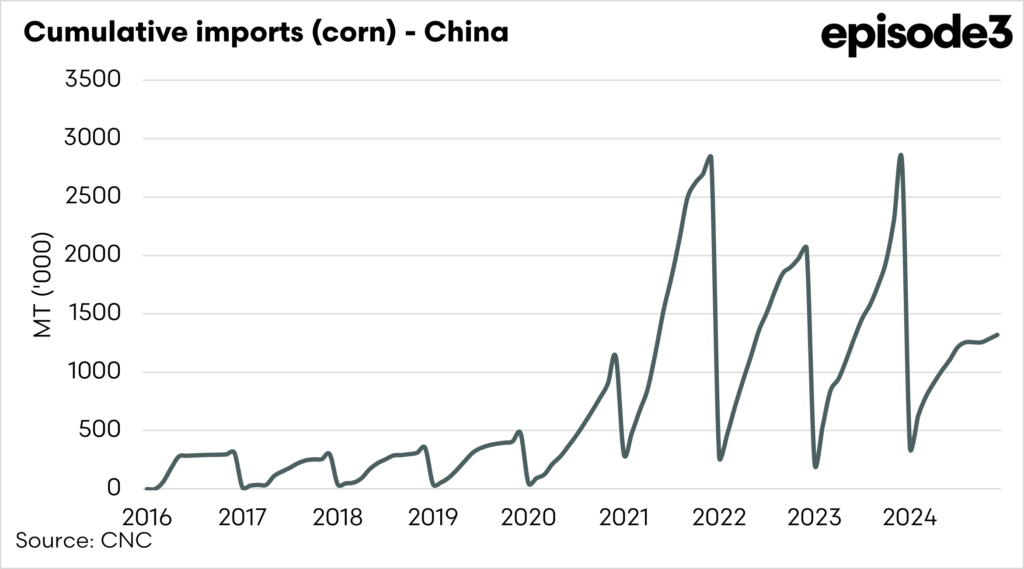

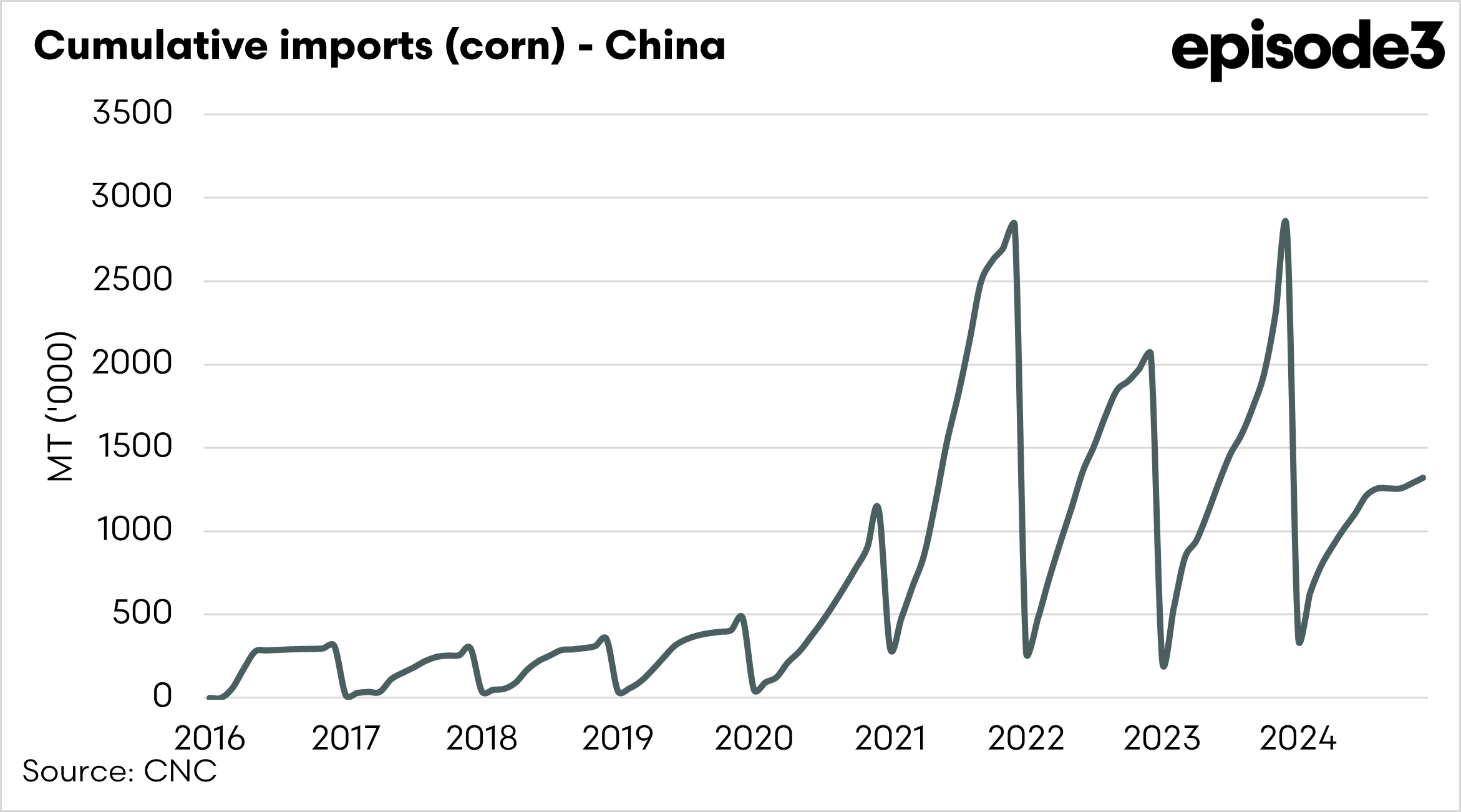

China is making some changes which might have long-term consequences for the grain trade. China is a huge importer of corn. In recent years, they have imported nearly 30mmt of corn (2021 & 2023), although last year they only imported 13mmt, of which about 15% came from the United States.

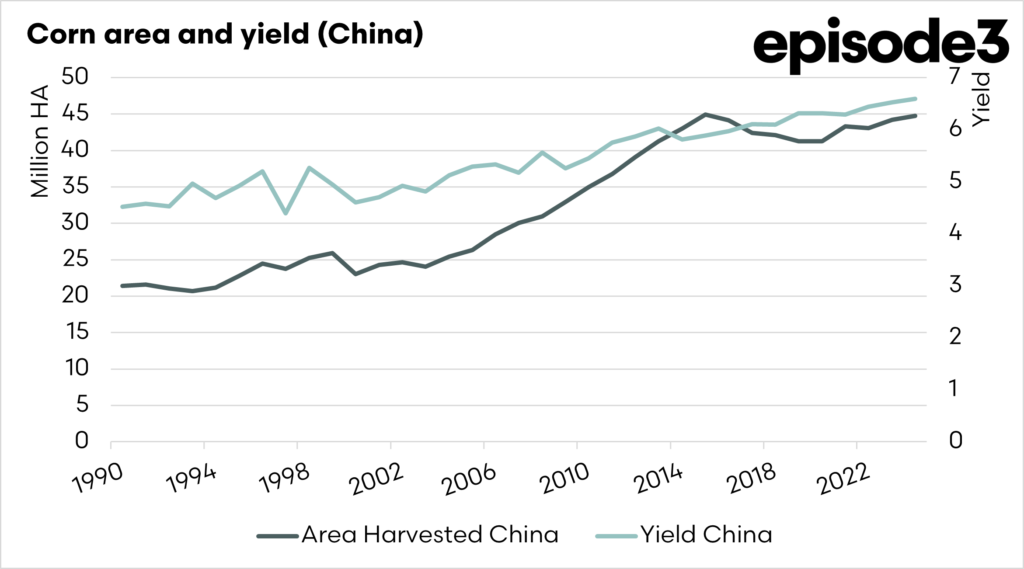

GM seeds are only a new addition to China, and the GM area is expected to increase this year from 666k ha to approximately 3m ha. Some view this as part of a move to become more self-sufficient when it comes to corn. So, what does that mean?

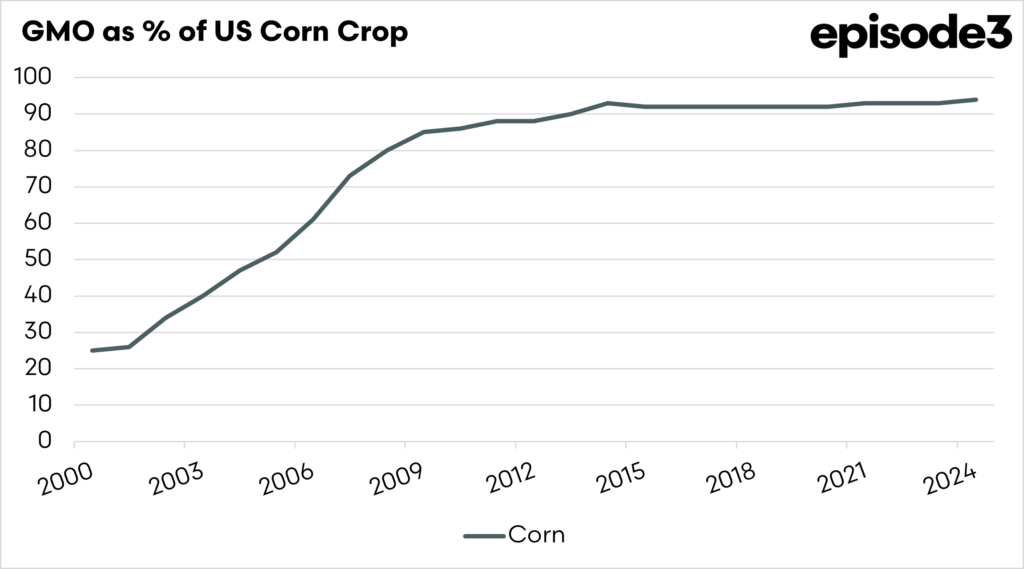

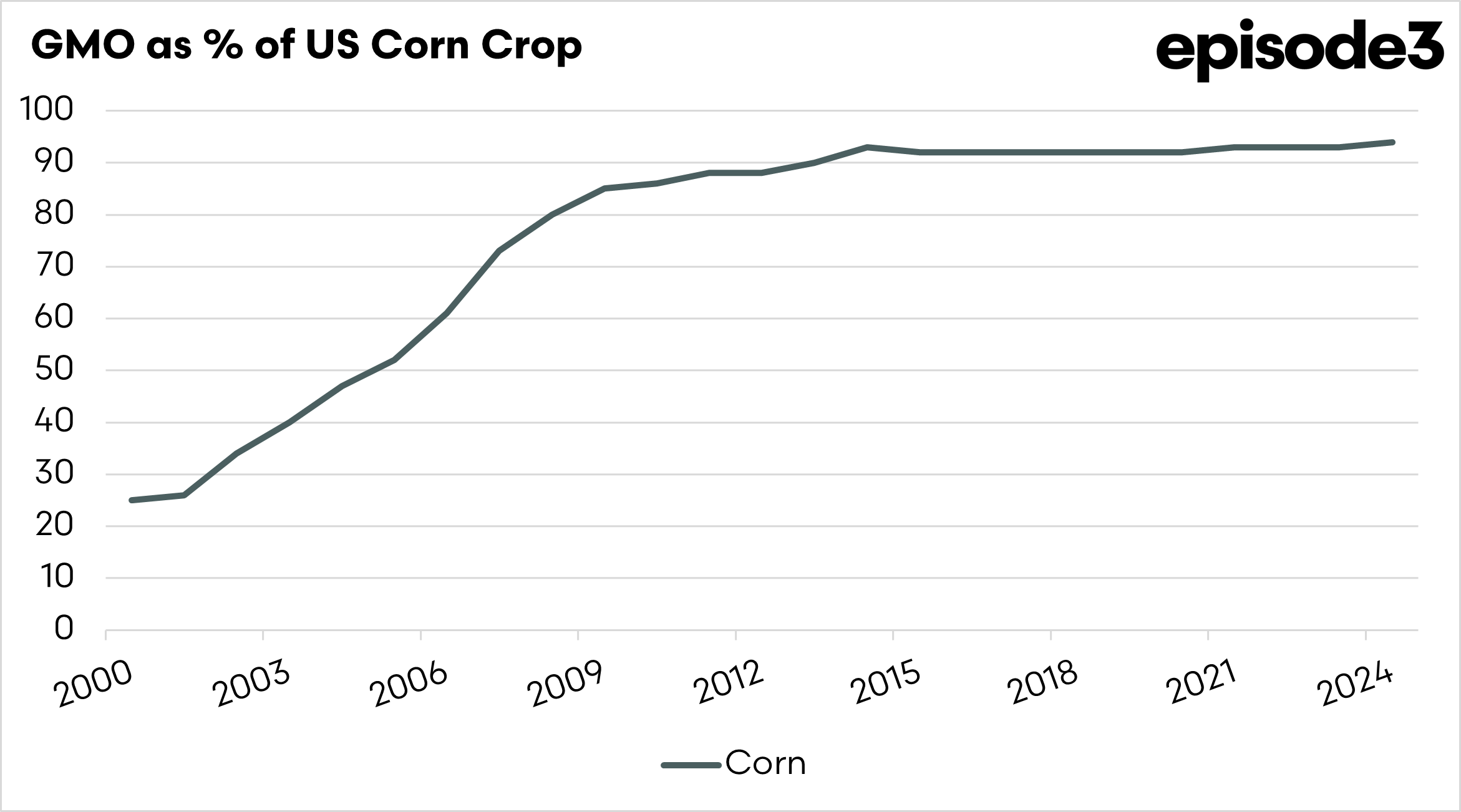

This year, China is expected to plant 7% of its corn area in GM varieties. This is a very small percentage of the crop in comparison to the United States, which has seen more than 90% of its corn crop planted in GMO varieties for the past decade.

However, we should watch this move with interest. The chart below shows that the adoption of US GM corn was very, very fast.

Will we see the same in China, and what impact will that have?

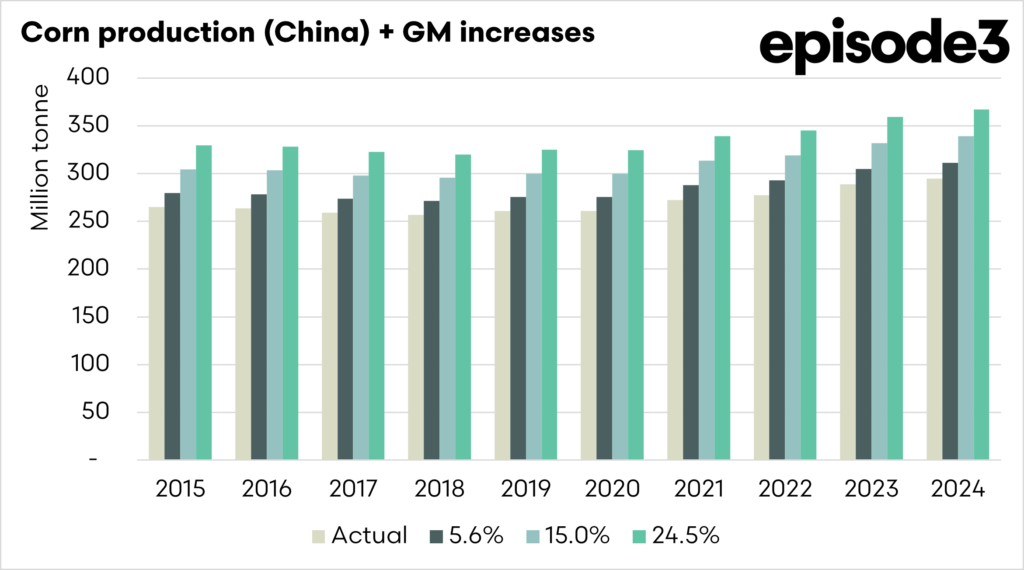

A meta-analysis of 6000 peer-reviewed studies shows that the yield increase between conventional and GM varieties of corn was between 5.6% and 24.5% higher. This is a significant increase in yields, and increasing the area planted to GM varieties will impact Chinese production.

So let’s run some hypotheticals.

It is important to note that this analysis is very rudimentary and is just here to show an example of the impact of GM on the supply of corn in China.

Let’s assume that Chinese yields increased by 5.6%, 15% and 24.5% in corn due to GM varieties.

The chart below shows how much corn was actually produced, and how much would have been produced if the Chinese crop had shown the yield improvements mentioned above.

To highlight one year, 2024, the volume of corn production in China would be increased by 16.5mmt at the low end of 5.6% and 72.2mmt at the high end of 24.5%. At a middle ground of 44.2mmt, this would represent more than the record import volume of corn into China.

This is a significant volume of additional corn. You might ask, Why does that concern us? Australia doesn’t produce all that much corn.

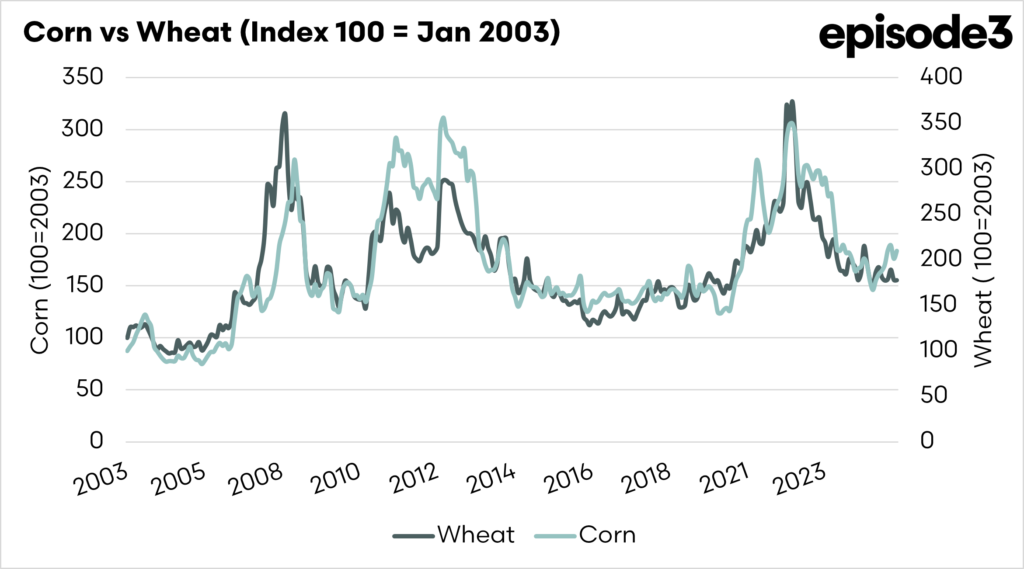

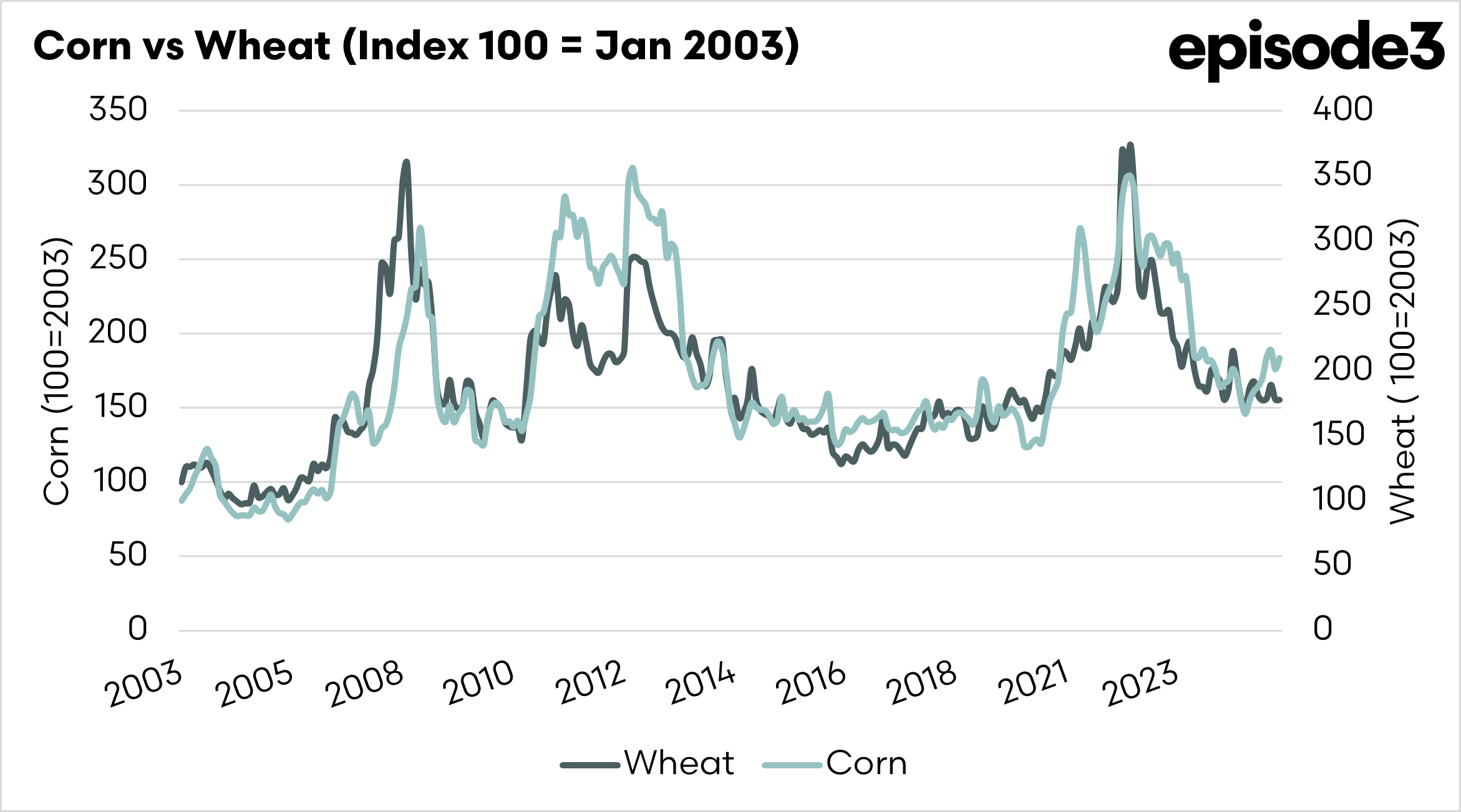

We have mentioned it many times, but corn and wheat follow each other, and supply is the primary driver of pricing. If there is a huge increase in the volume of corn grown in China due to a switch to GM varieties, that will impact corn pricing globally and have a flow-on effect on wheat.

It will take some time for China to fully introduce GM varieties, but this is more of a piece explaining the potential impact of a huge change in supply dynamics caused by GM corn in China. If we saw the widescale adoption of GM wheat around the world, we could also see increased supply and, therefore, a fall in overall pricing.