Crude words about diesel

The Snapshot

- The diesel price in A$ terms is the highest since at least 2004

- Crude oil has driven up the price of diesel.

- The ‘premium’ for Australian diesel over crude has reached record levels in recent months.

- The risk of an economic downturn and new Chinese covid outbreaks has created a fear of demand destruction.

- If crude falls, we should see diesel pricing fall.

The Detail

Why do they call it crude oil? Because of the crude words you say when you see the fuel price.

When we look at the top costs for farmers, diesel is near the top of the list. It’s getting exxy, so let’s have a look at it.

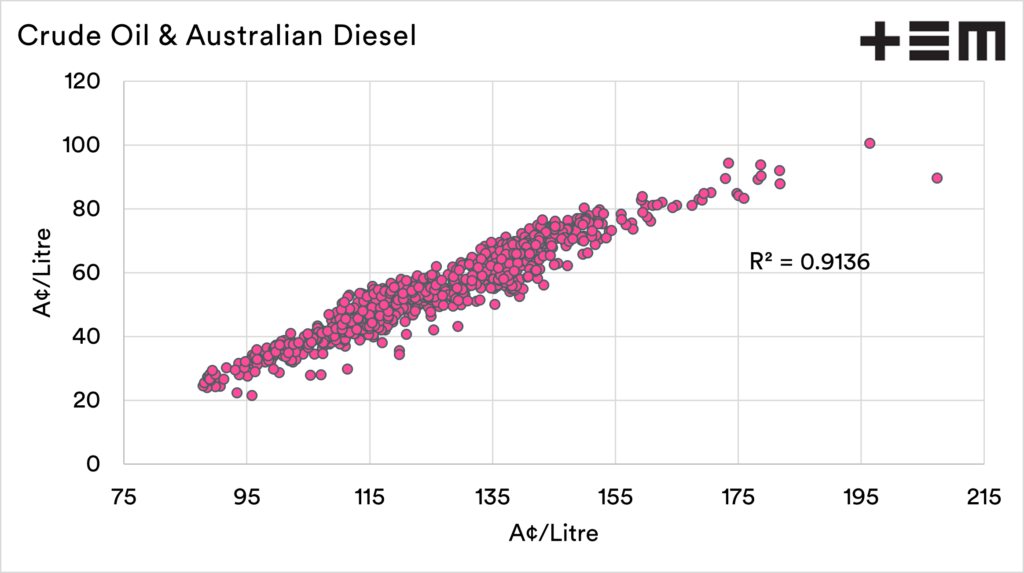

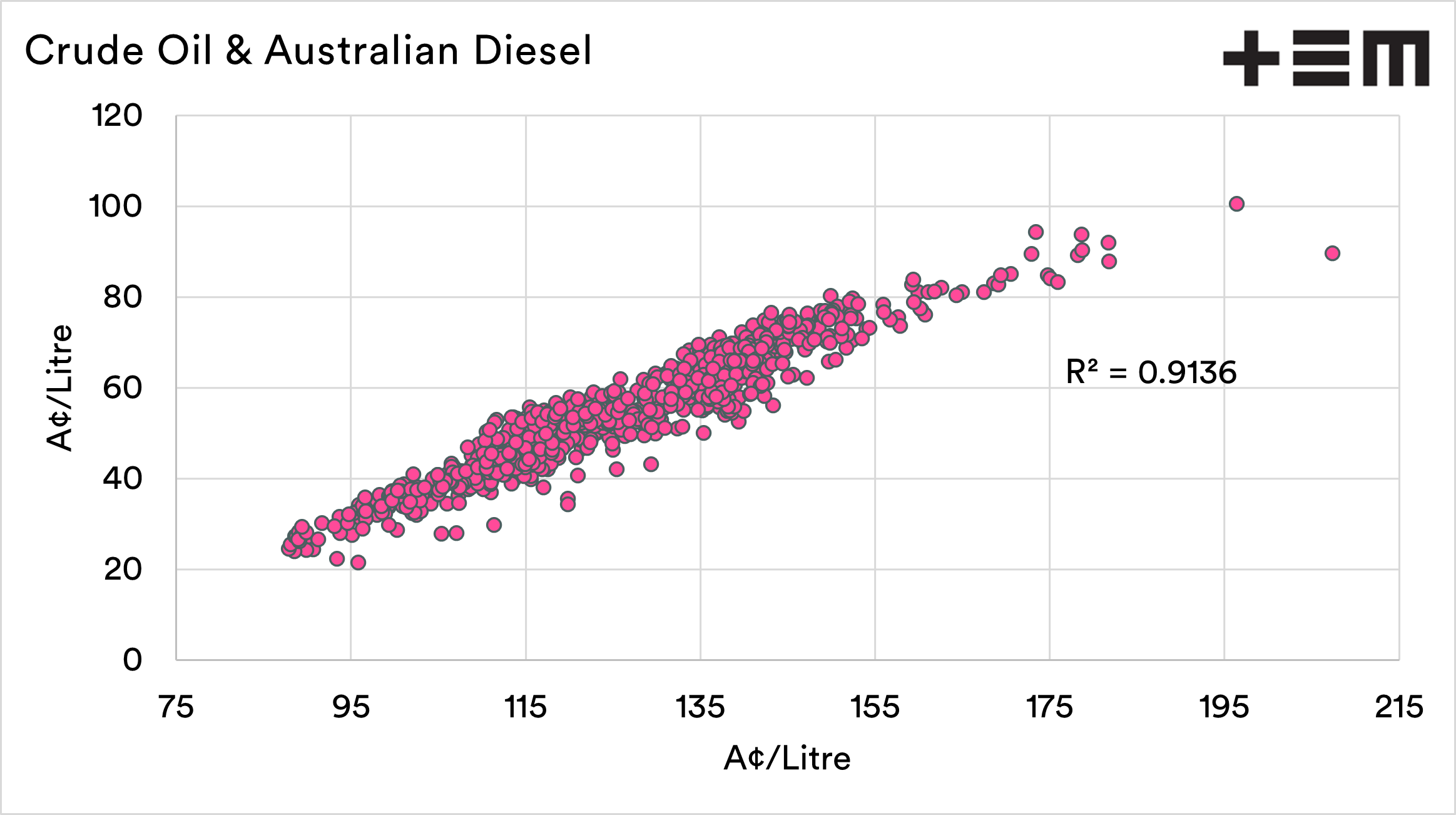

Crude oil is the main driver of diesel prices. The correlation is strong, when the market for crude oil increases, the cost of diesel increases. The chart below shows the relationship between crude oil and diesel, when both are converted to A¢/litre.

This makes sense; after all, diesel is made from crude.

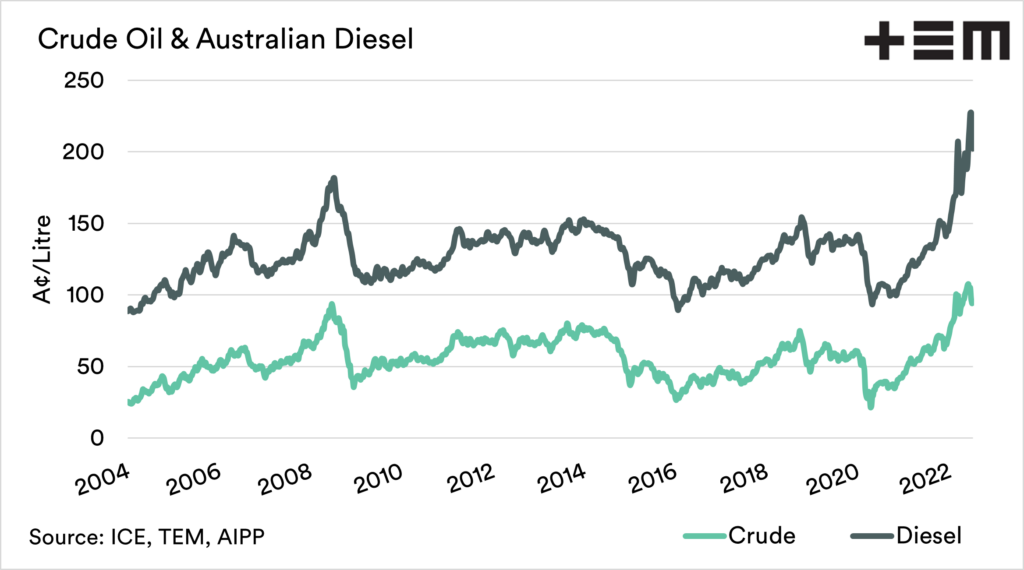

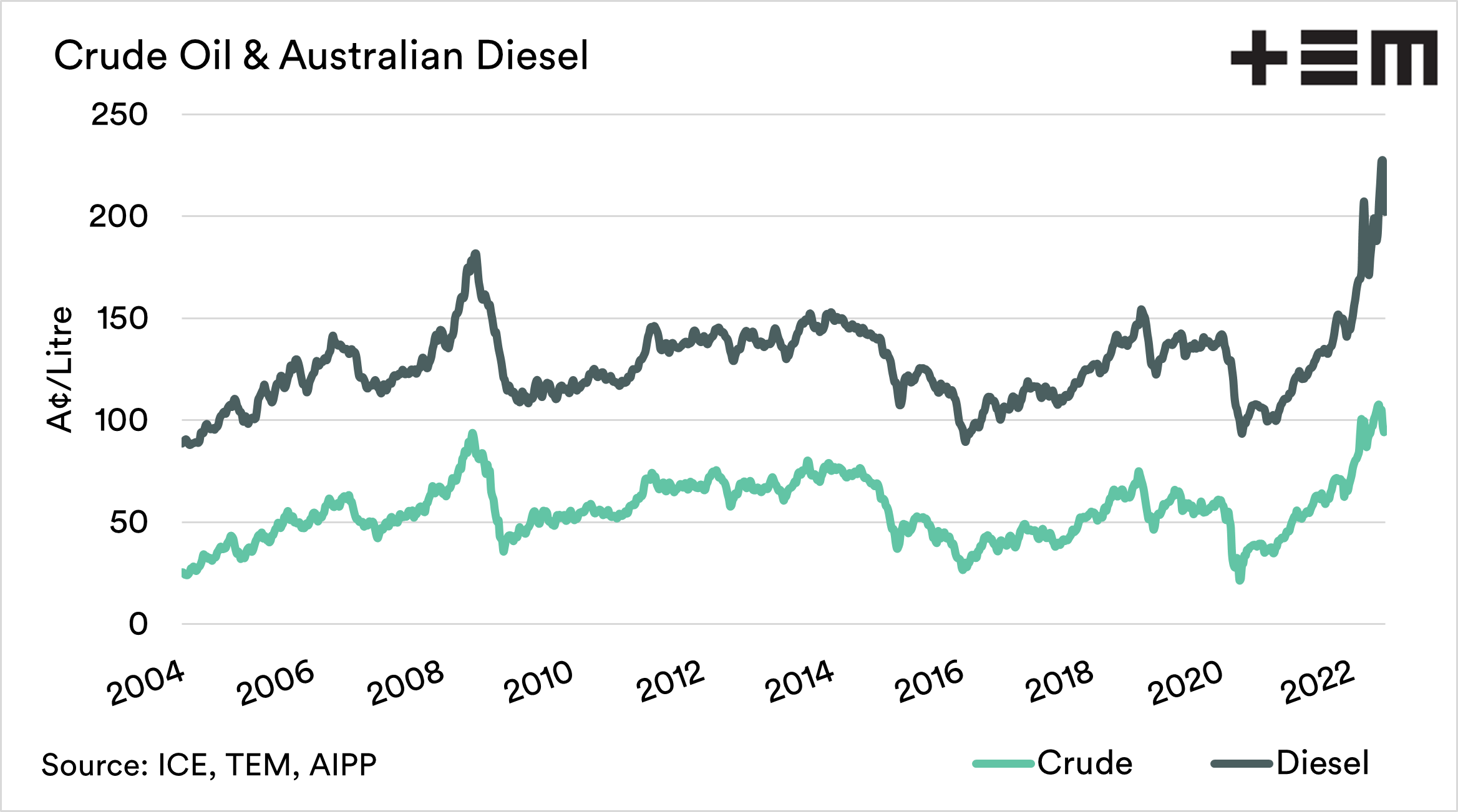

The cost of crude oil has risen dramatically during the past year, off the back of increased demand but also the impact caused by the war in Ukraine.

In the chart below, we can see that in A$ terms, crude and diesel are both at the highest levels since at least 2004.

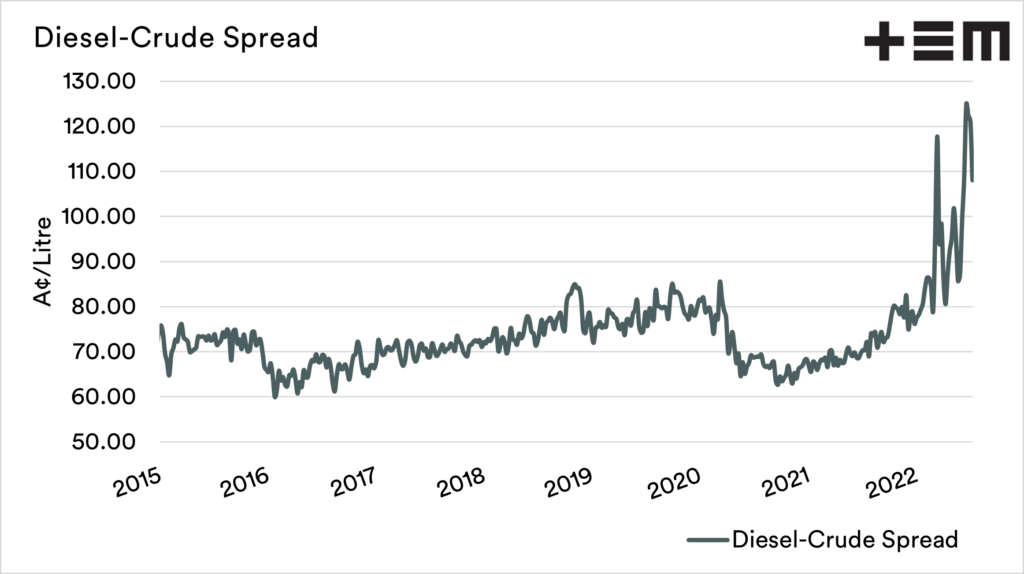

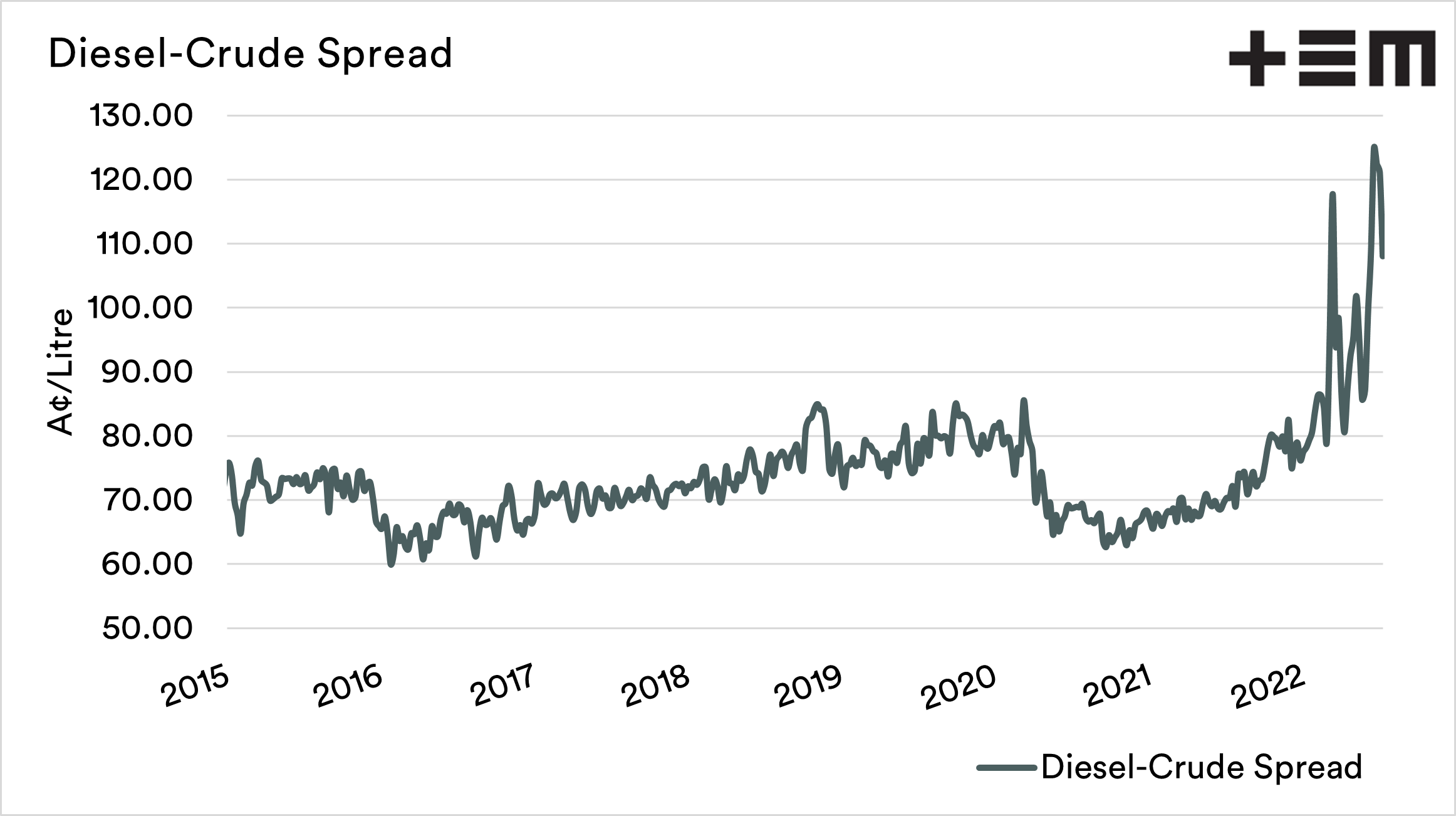

The diesel spread is shown in the chart below. This shows the difference in price between crude oil and diesel.

The glaring point of this is that the cost of diesel in Australia is trading around record premiums over crude oil during the past year.

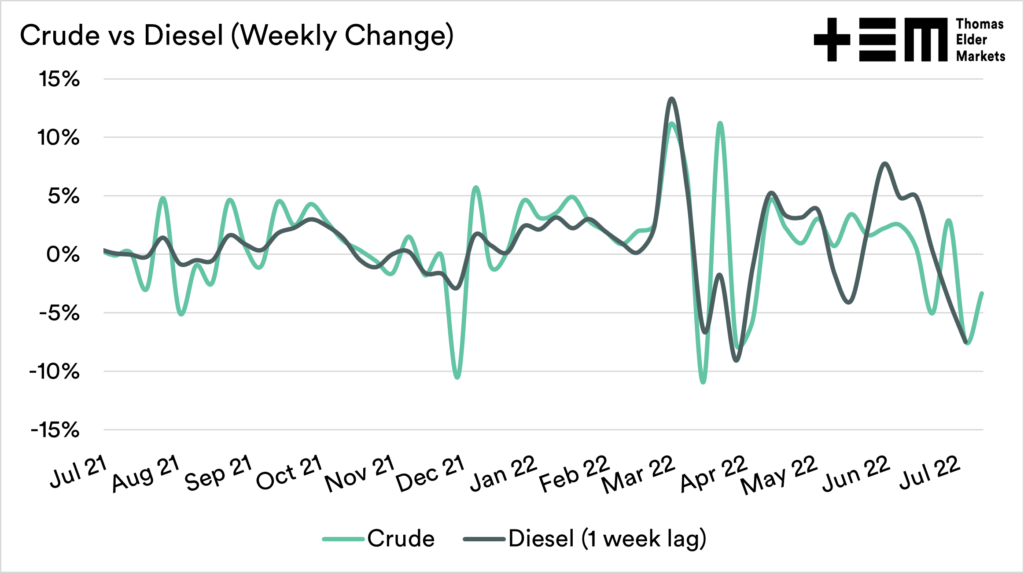

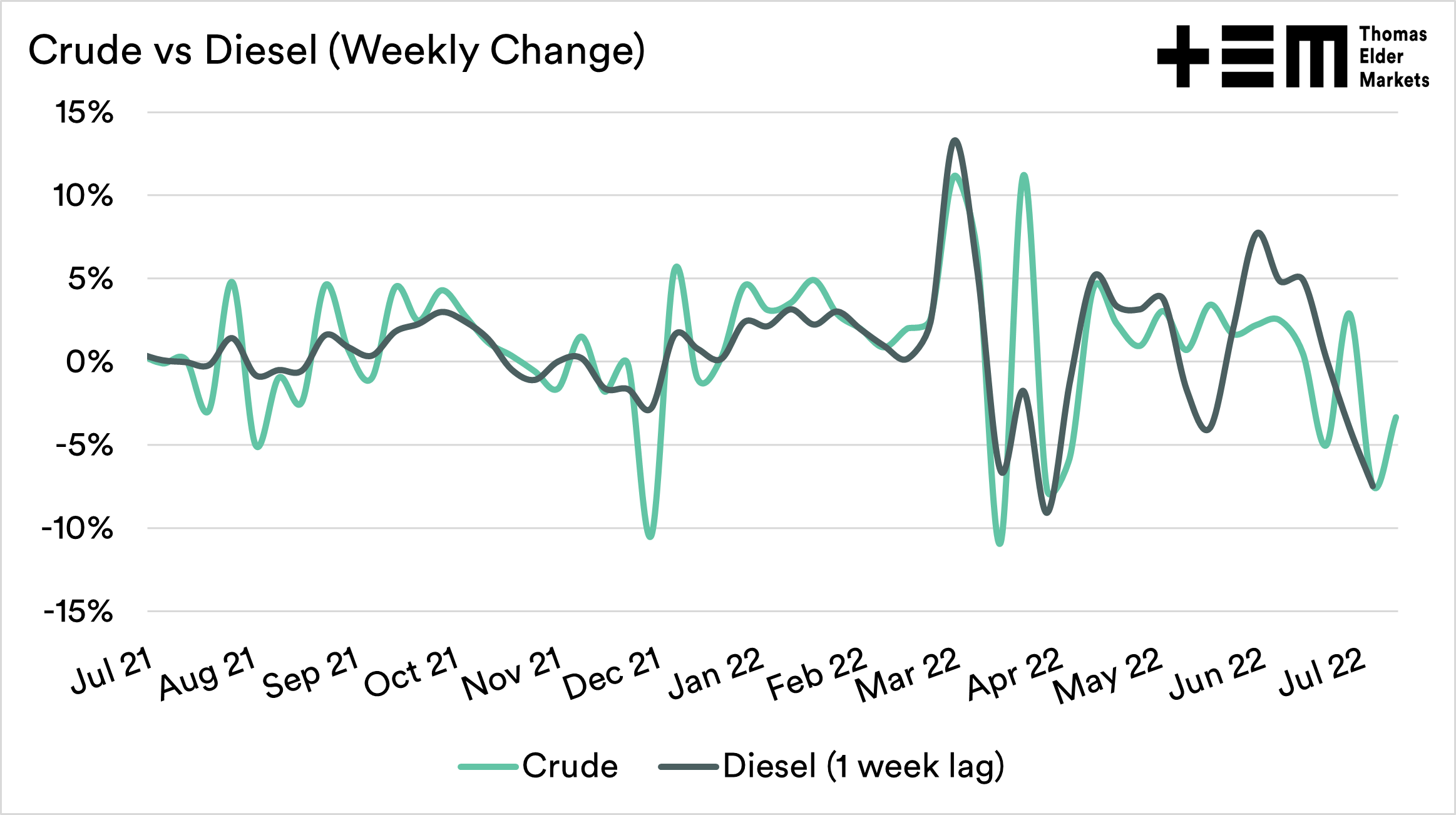

Generally, crude oil is a lot more volatile than diesel. Over time, there is about a week lag between the change in price in crude and diesel.

The crude oil price has come under pressure in recent times as there are concerns about an economic slowdown and the potential for demand destruction. If we see this eventuate, then we will likely (hopefully) see falls in diesel pricing.