Drop it like it’s hot – Canola falls further.

The Snapshot

- Canola prices have fallen in recent months, both locally and globally.

- Canada has improved their fortunes, returning to an average crop.

- Europe is on track to produce its largest rapeseed crop since 2017.

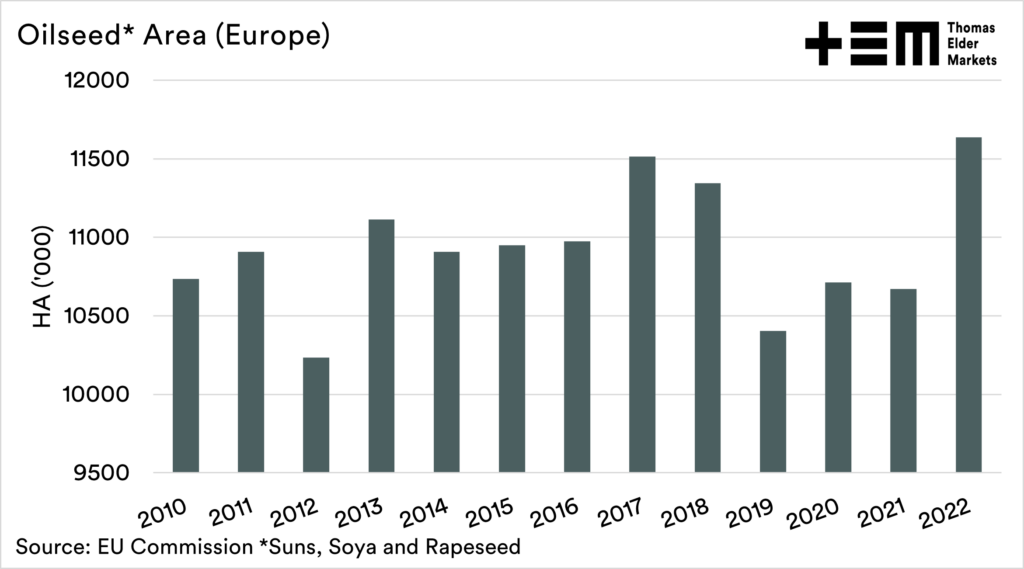

- High prices are the cure for high prices. Oilseed acres have increased due in part to high prices on offer.

- Australian prices have fallen at a faster rate than overseas (Esp WA), causing basis to fall back to large discounts.

- Many were calling for a new norm for canola pricing. This term always scares me. There is no new norm

- At a flat price level, canola is historically remaining strong.

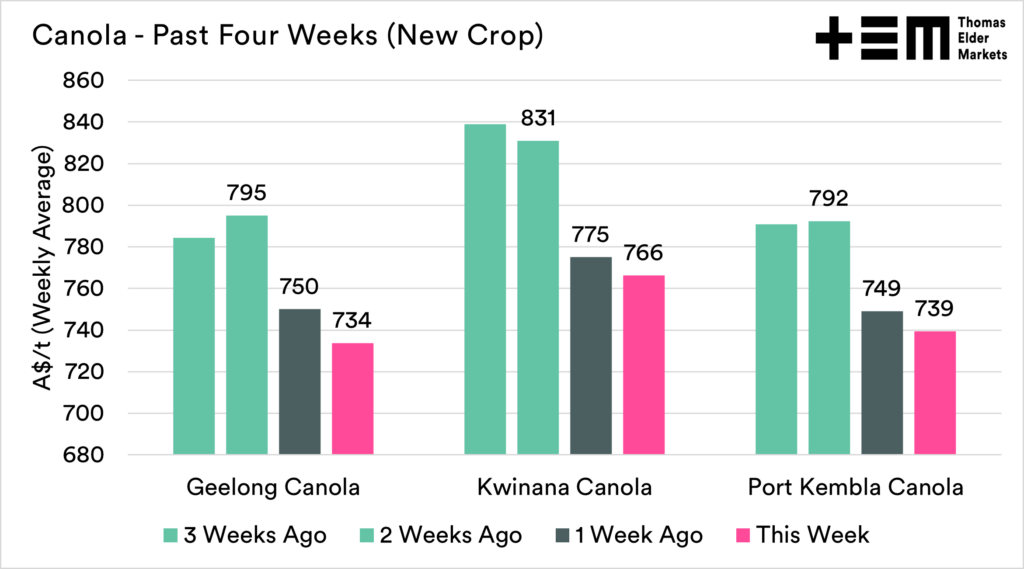

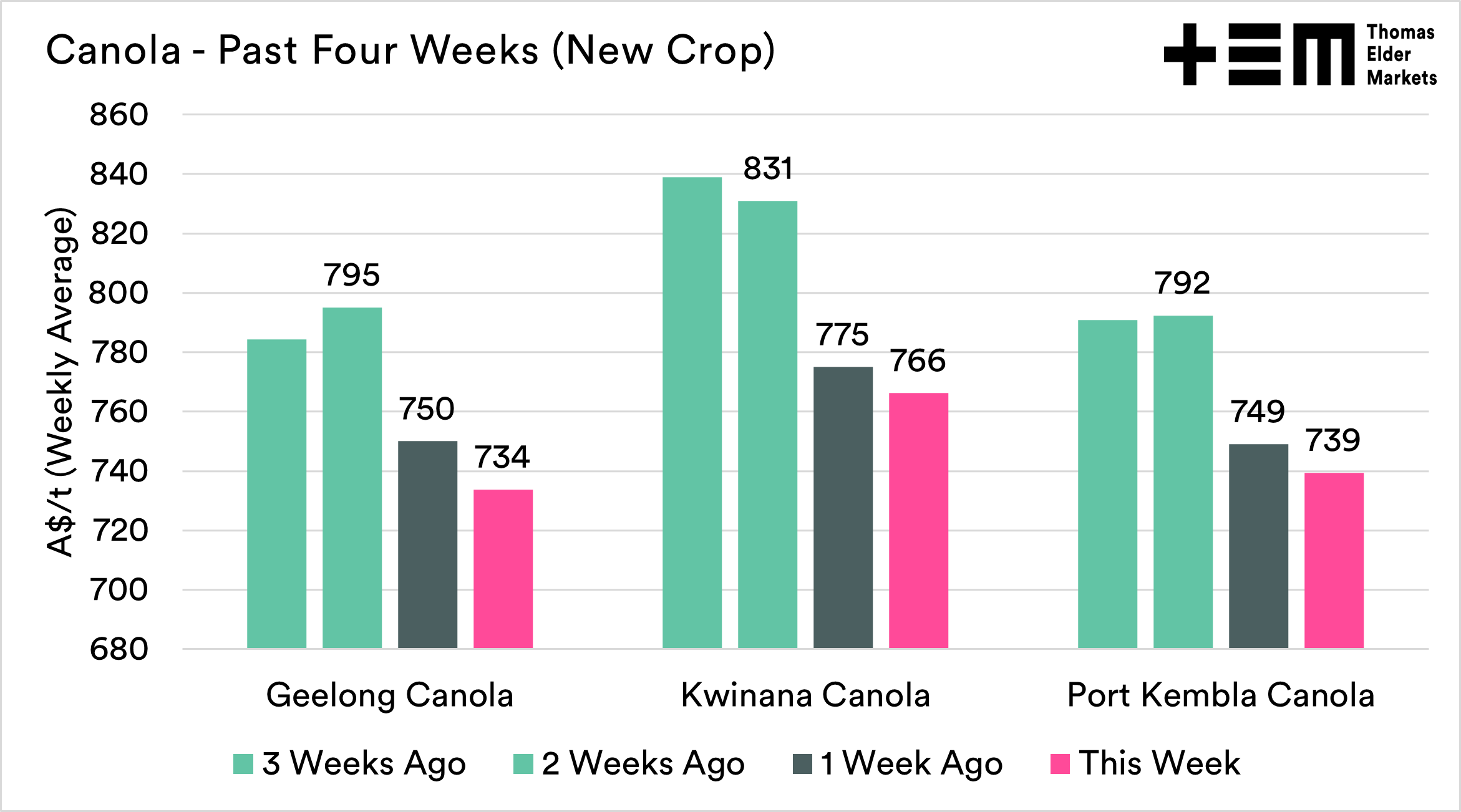

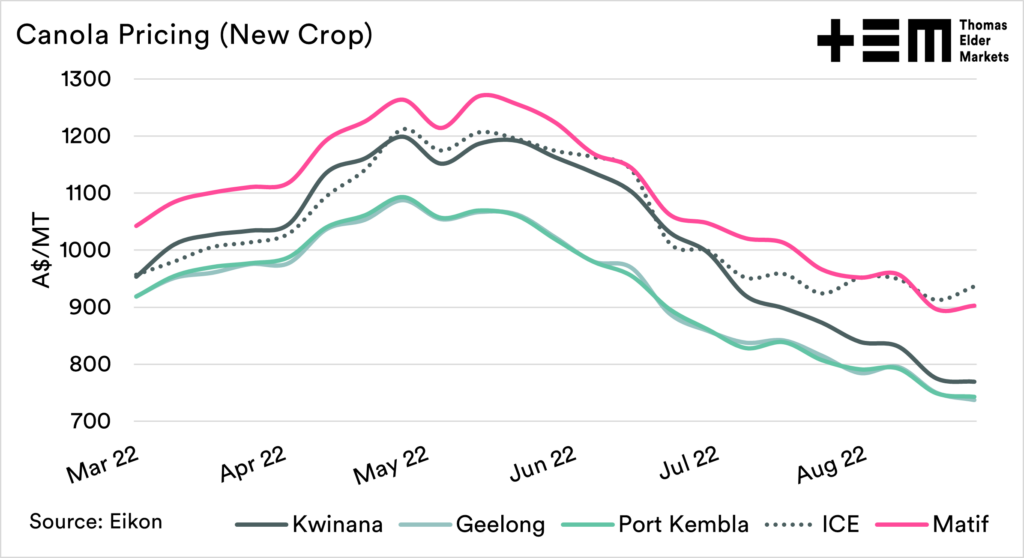

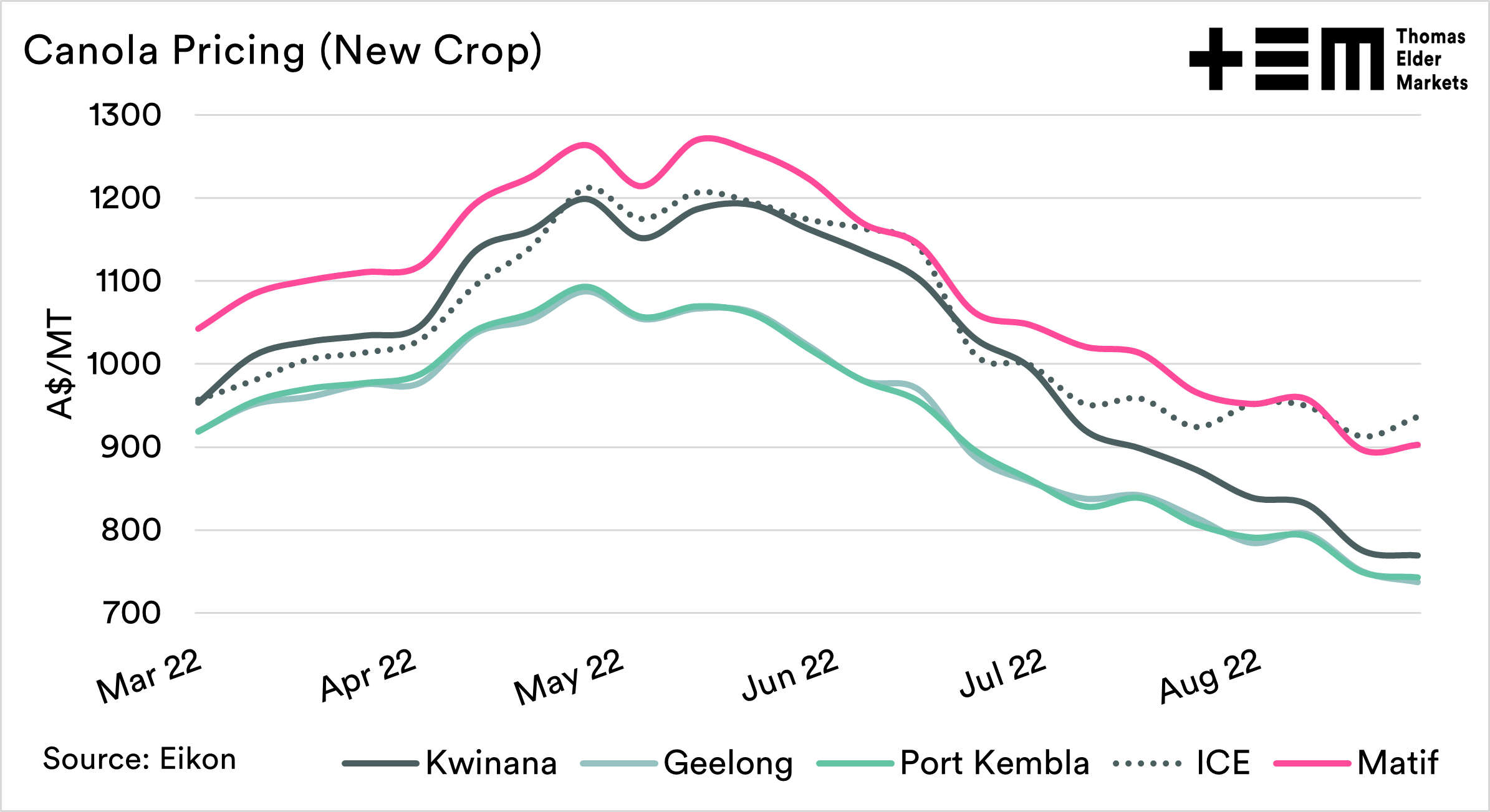

The canola market has come under a lot of pressure in recent weeks. The first chart shows the weekly average canola price for each of the past four weeks. It’s a step-down change in price around the country.

Let’s look at some of the drivers.

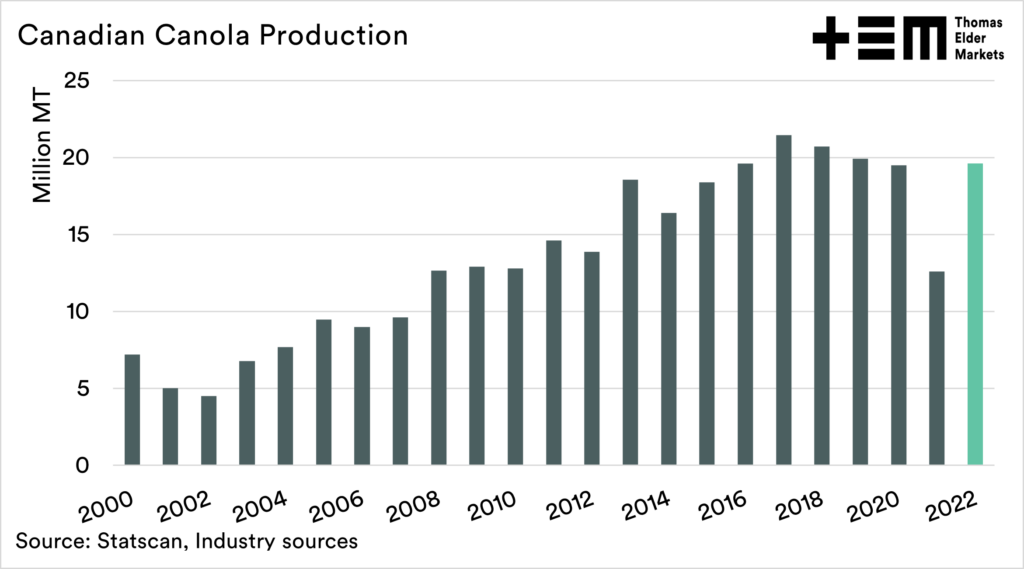

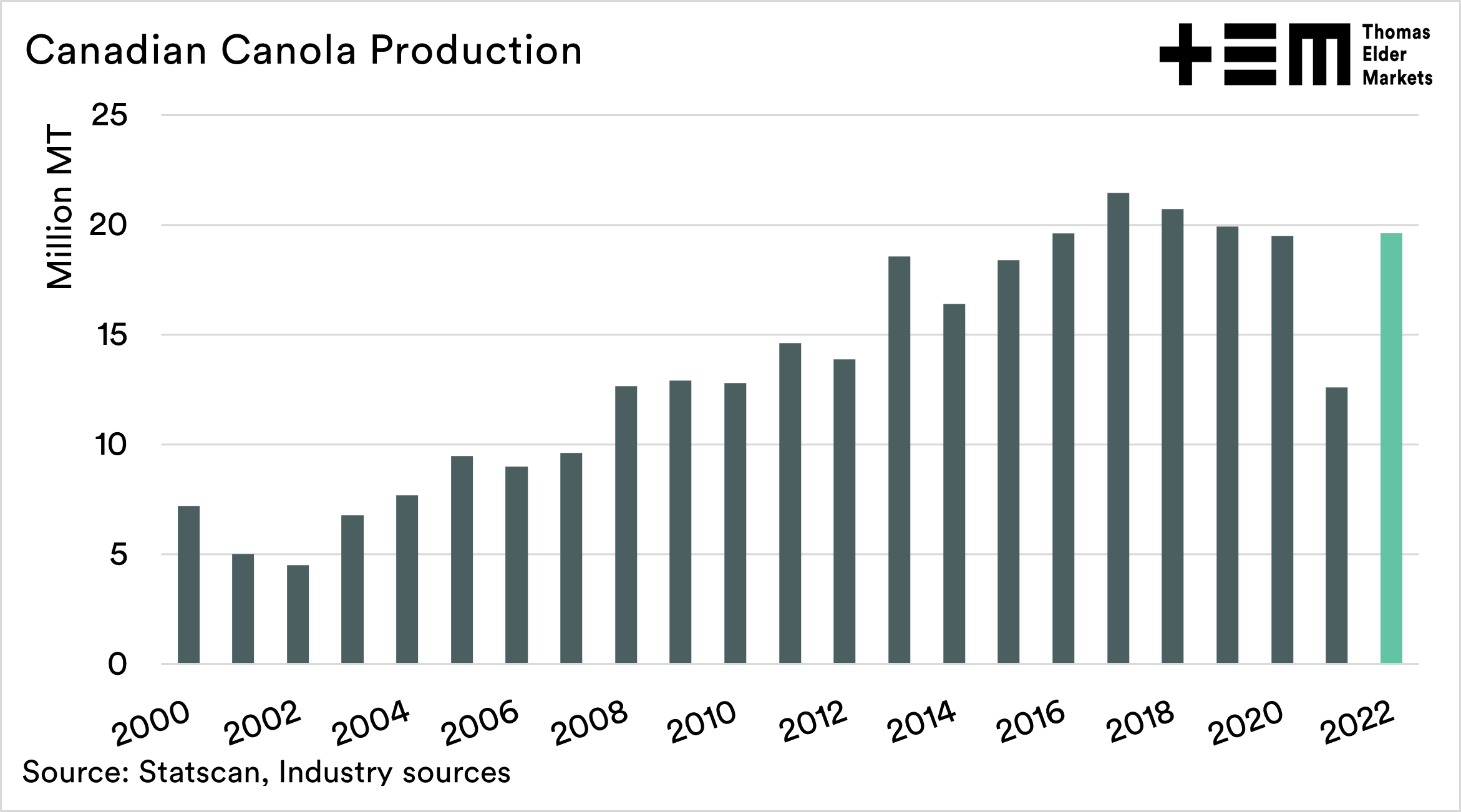

The Canadian crop has improved massively since last year when their drought robbed them of most of their potential. This year conditions, whilst not always ideal, have improved, and now production is expected to rebound.

The chart below shows the production since 2000 and the industry expected forecast for this season. Statscan’s official number will be out on Monday.

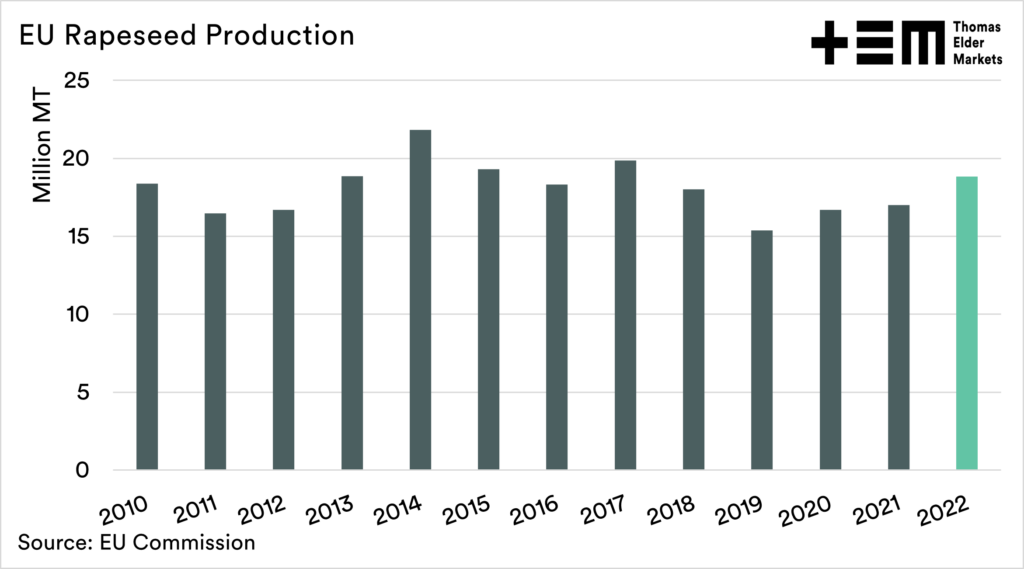

The EU has also released their latest production estimates. Despite the recent poor conditions, they expect production to achieve 18.8mmt. This would be the highest production since 2017 and comes from higher yield estimates.

In recent months this explains a large proportion of the fall in canola pricing, along with the wider macro environment (crude oil).

High prices are the cure for high prices. Farmers have switched to oilseeds where possible to capture the prices on offer. For example, Europe has had their highest oilseed acreage since at least 2010.

The reality is that the prices achieved last year were not the new normal, which we have been discussing for quite some time.

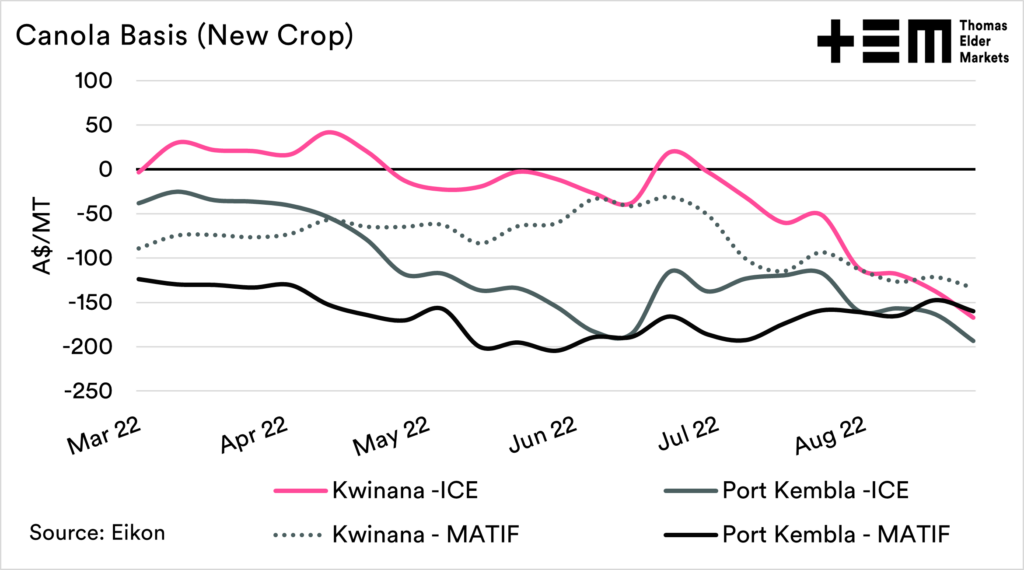

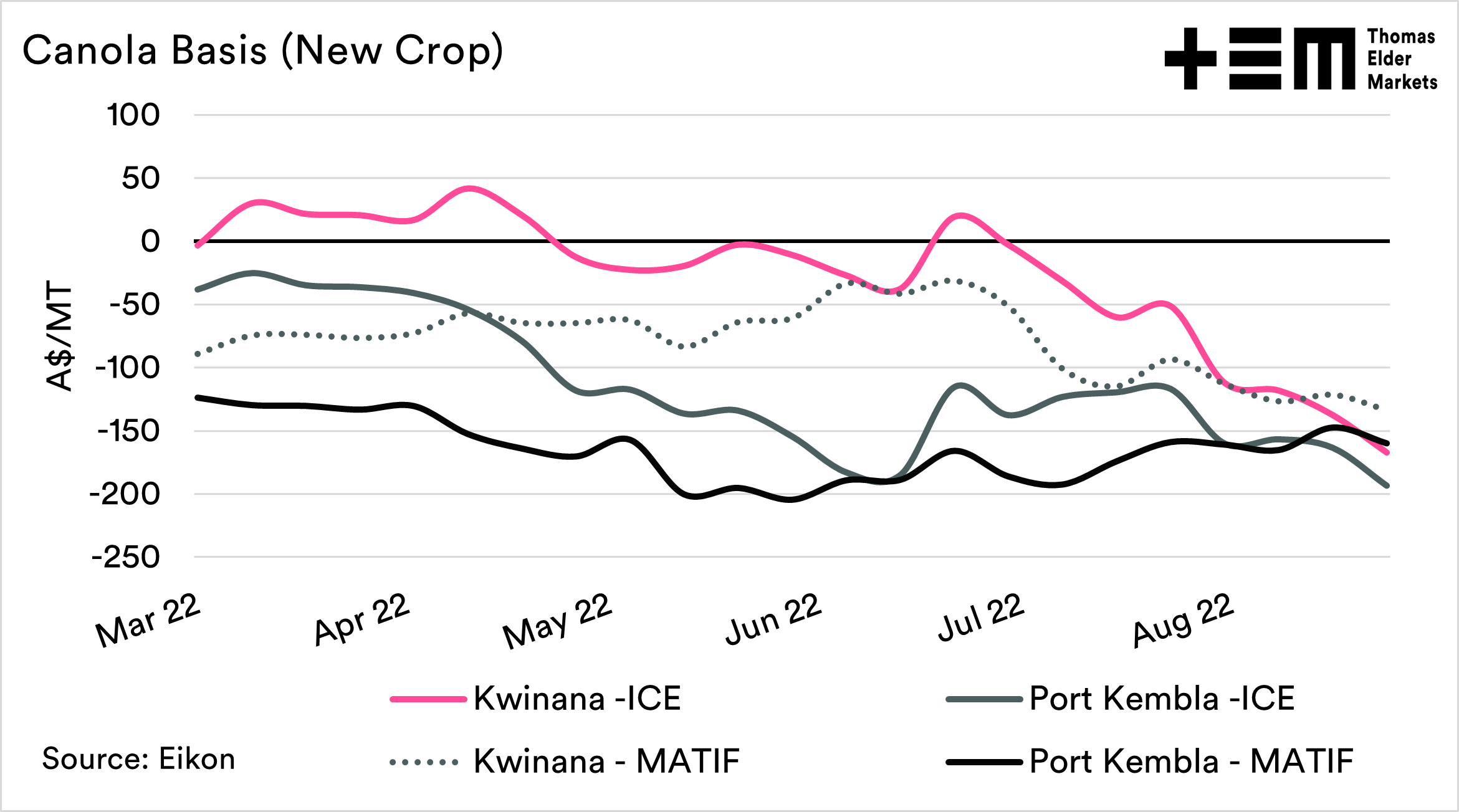

At the start of this article, the price change in Australia was displayed. When we delve further into the pricing, we can see that our pricing levels for new crop have been falling at a faster rate than overseas values.

This has meant that our basis to MATIF and ICE has fallen at a sharp pace. The biggest change has been the west, which is predominately export-orientated, whilst the east coast was already at hefty discounts. The west has just waited a while.

Australian canola prices have been discounted for much of the past season and this pattern is continuing into the new crop.