EU doing it tough through drought– but prices flat?

The Snapshot

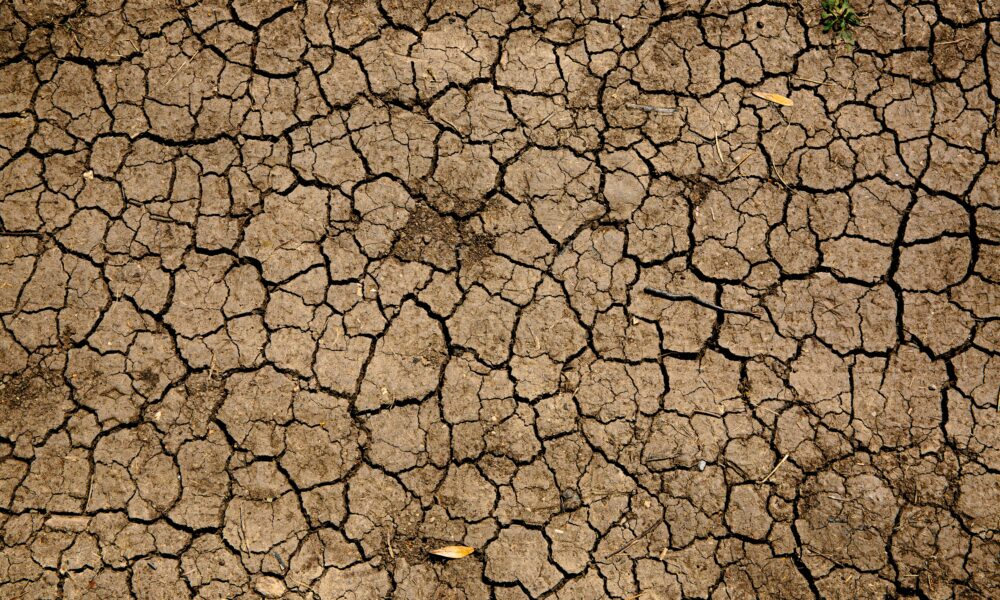

- Europe is struggling through a devasting drought.

- Rivers are drying, and crop conditions are worsening.

- Wheat prices in France have fallen as conditions deteriorate.

- Basis levels between French and US futures have increased.

- This shows basis working as normal; as conditions fall, local premiums rise.

- Globally wheat prices have shown little reaction to the conditions in Europe.

The Detail

It seems that we have changed our climate with that of central Europe and the UK. The news is filled with pictures of rivers running dry and the worst drought in 500 years.

The EU is a major producer of grains, and a devastating drought should significantly impact grain markets.

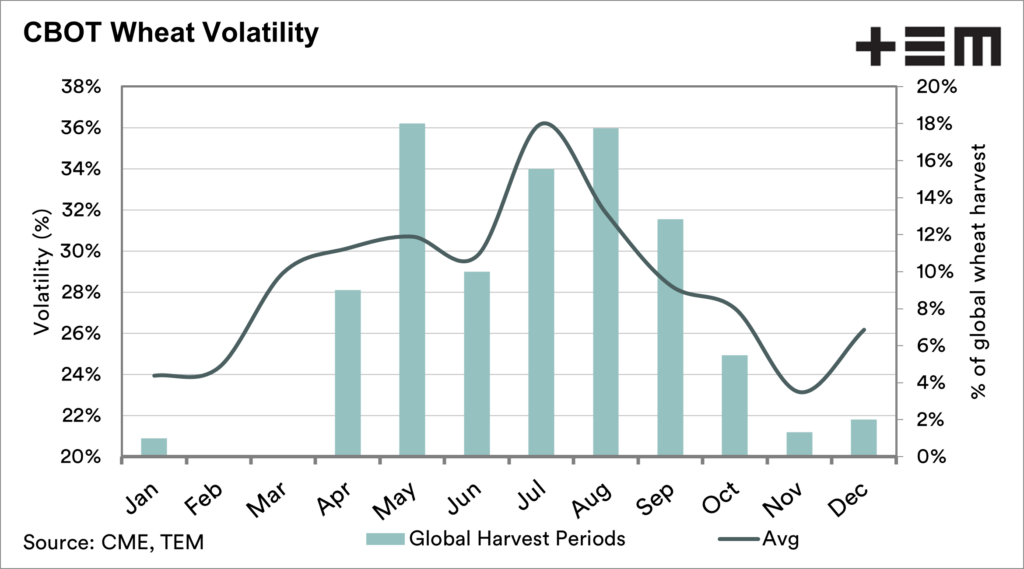

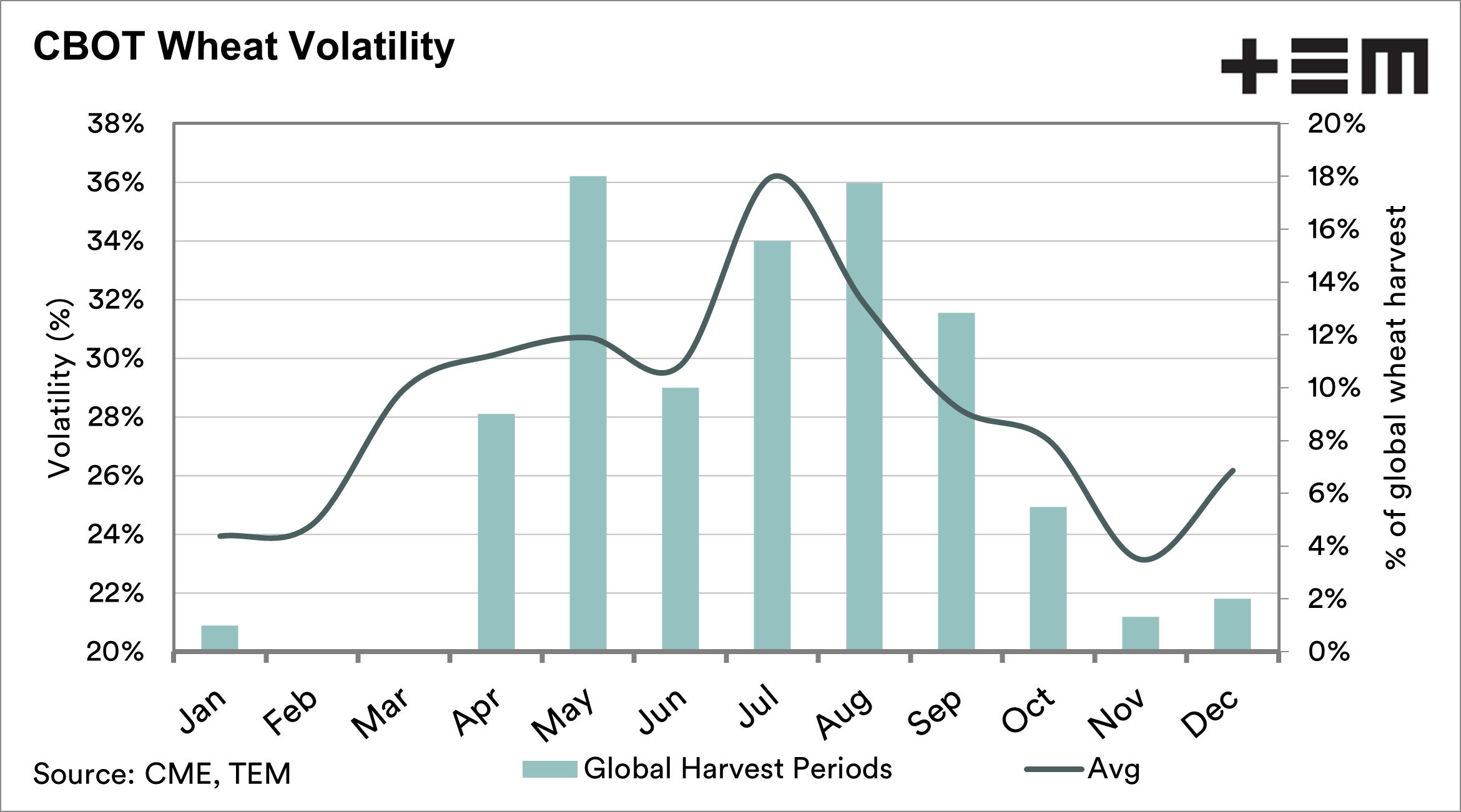

I often use this chart below. It shows the global harvest as a percentage of the average crop harvested each month, with the annualised wheat volatility overlaid.

We can see that the higher volatility tends to occur in the middle of the year, when a large proportion of the crop is either harvested, being harvested or ready to start. If there are issues in the northern hemisphere, we start to get fireworks.

So with a major drought, there should be fireworks in pricing? Right?

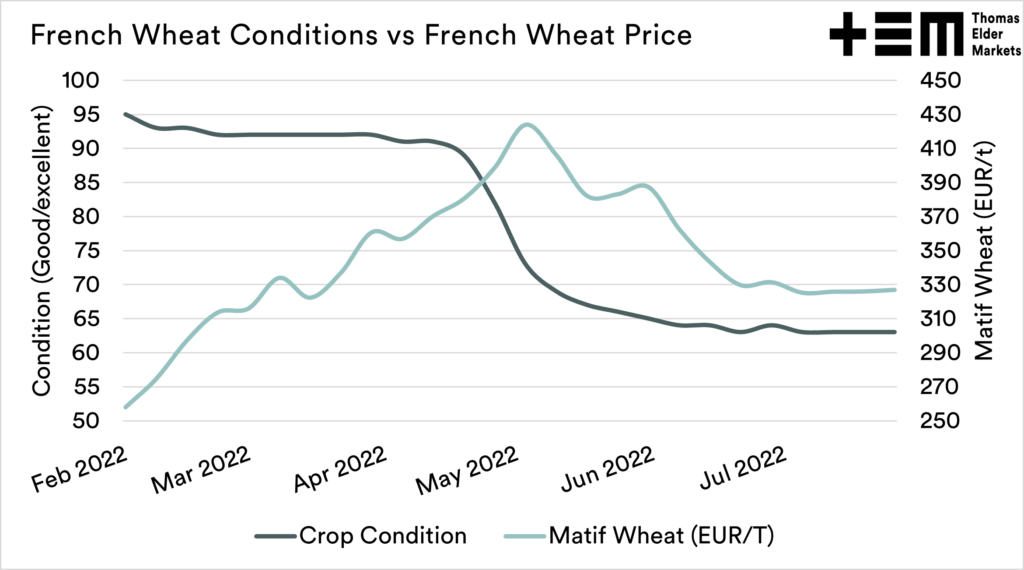

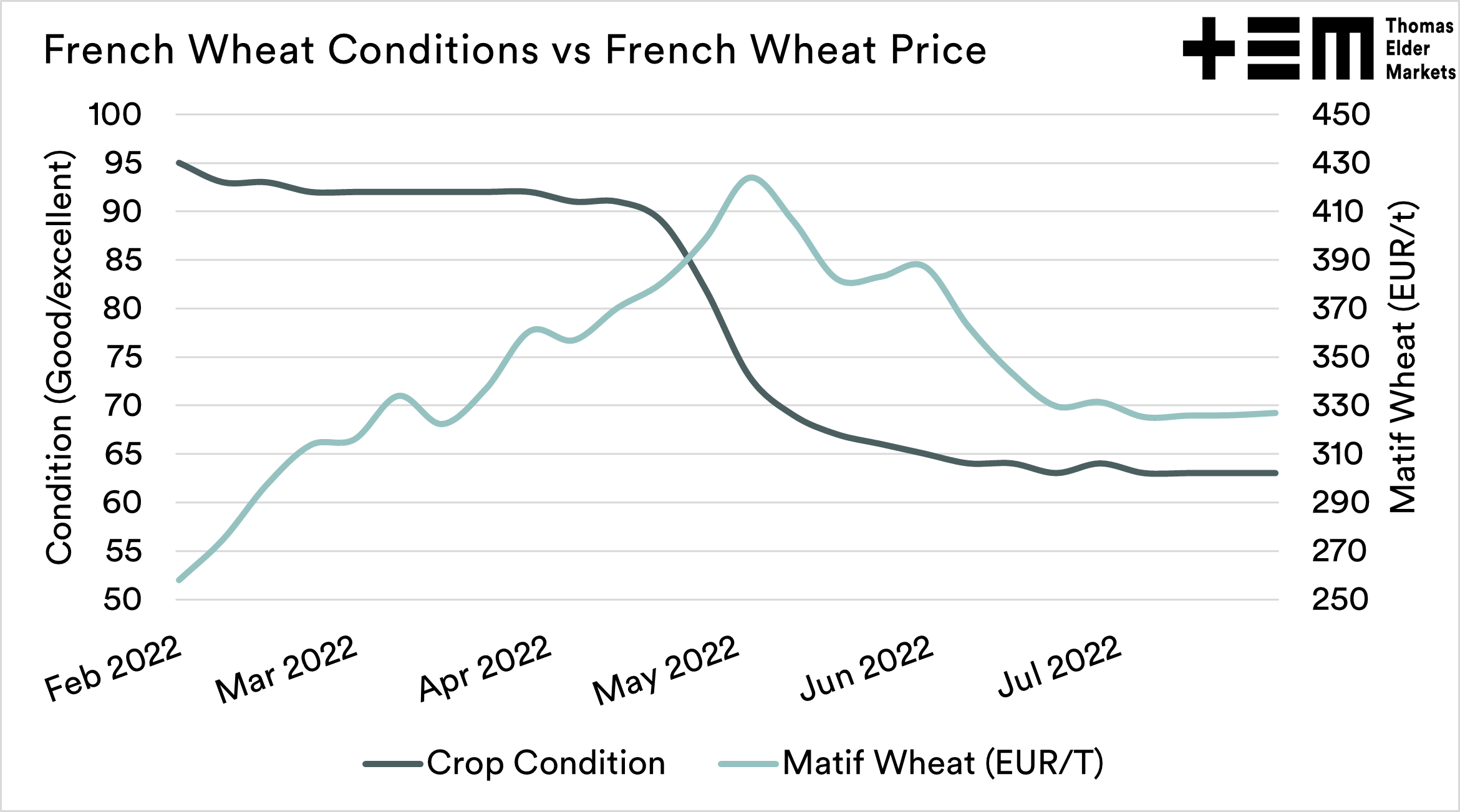

The reality is that the market in France has largely followed all the other markets further lower since the middle of May.

At its peak, Matif wheat was trading at A$648/mt. It has since fallen to A$473

The chart below shows the French wheat condition as a percentage that is good / very good or, in this case, bonnes/ très bonnes. Overlaid is the Matif wheat price; we can see that events overseas (opening up of Ukraine, large Russian crop) have weighed more on price than the deteriorating crop conditions.

Despite local conditions falling, prices have declined. However, that is not the full picture.

The reality is that the overall or flat price is not a true reflection of conditions. The flat price is not always a good indicator to use. We want to look a little deeper into the basis.

One of the largest drivers of basis is supply. When supply starts to come under pressure or has the likelihood of doing so, we start to see basis rise. This is something we should all be aware of. When Australia has a huge crop, we need to be cognisant that we will have lower relative pricing than other nations. The opposite applies during a drought.

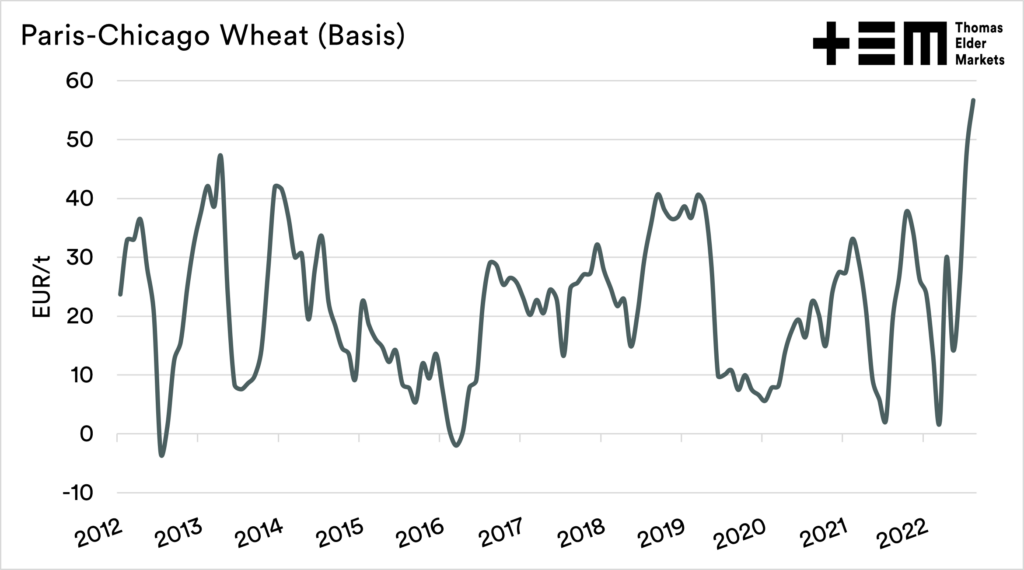

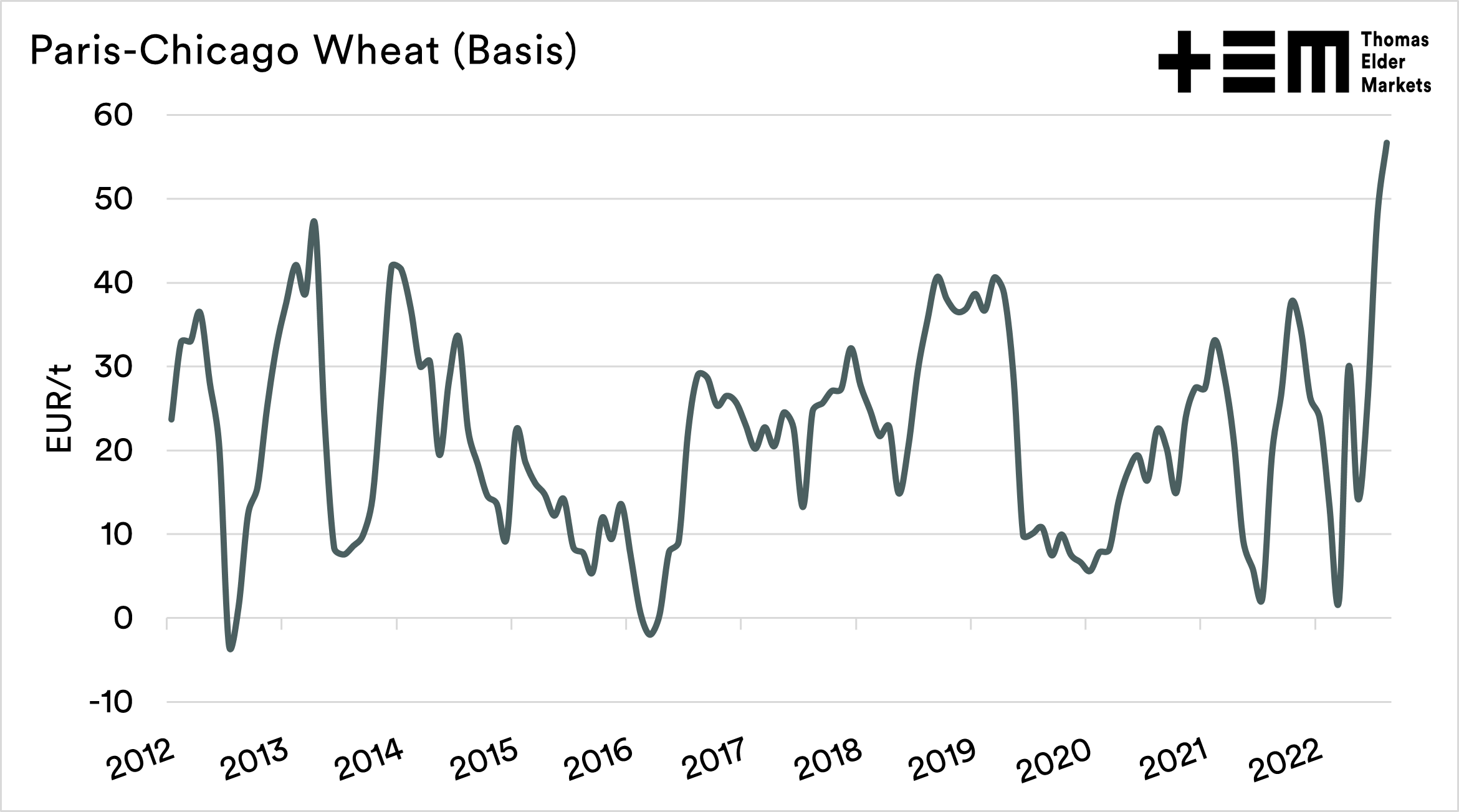

The chart below shows the monthly average basis between Matif and Chicago wheat. August has seen the strongest premium in the past ten years. A sign of local supply coming under pressure.

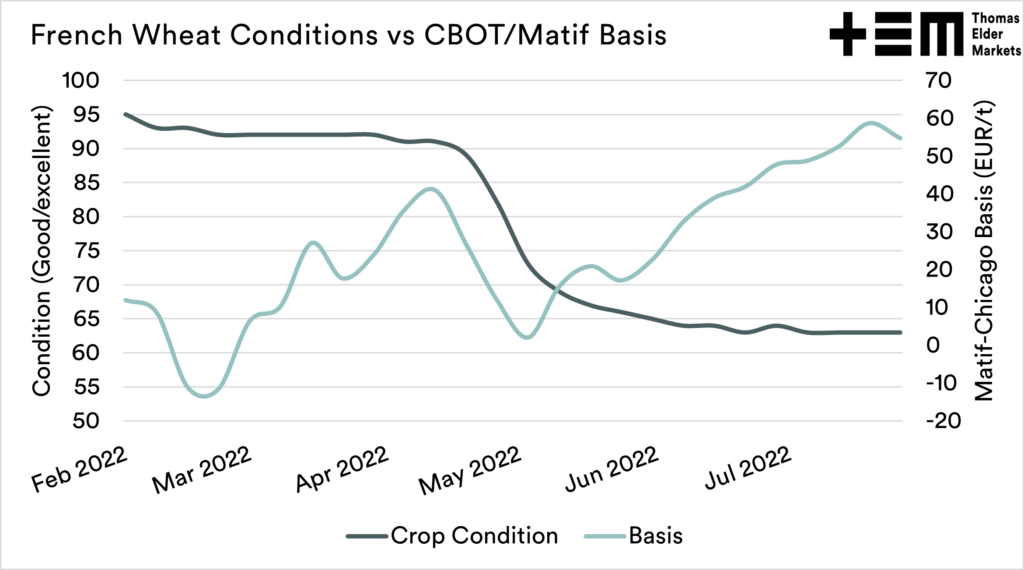

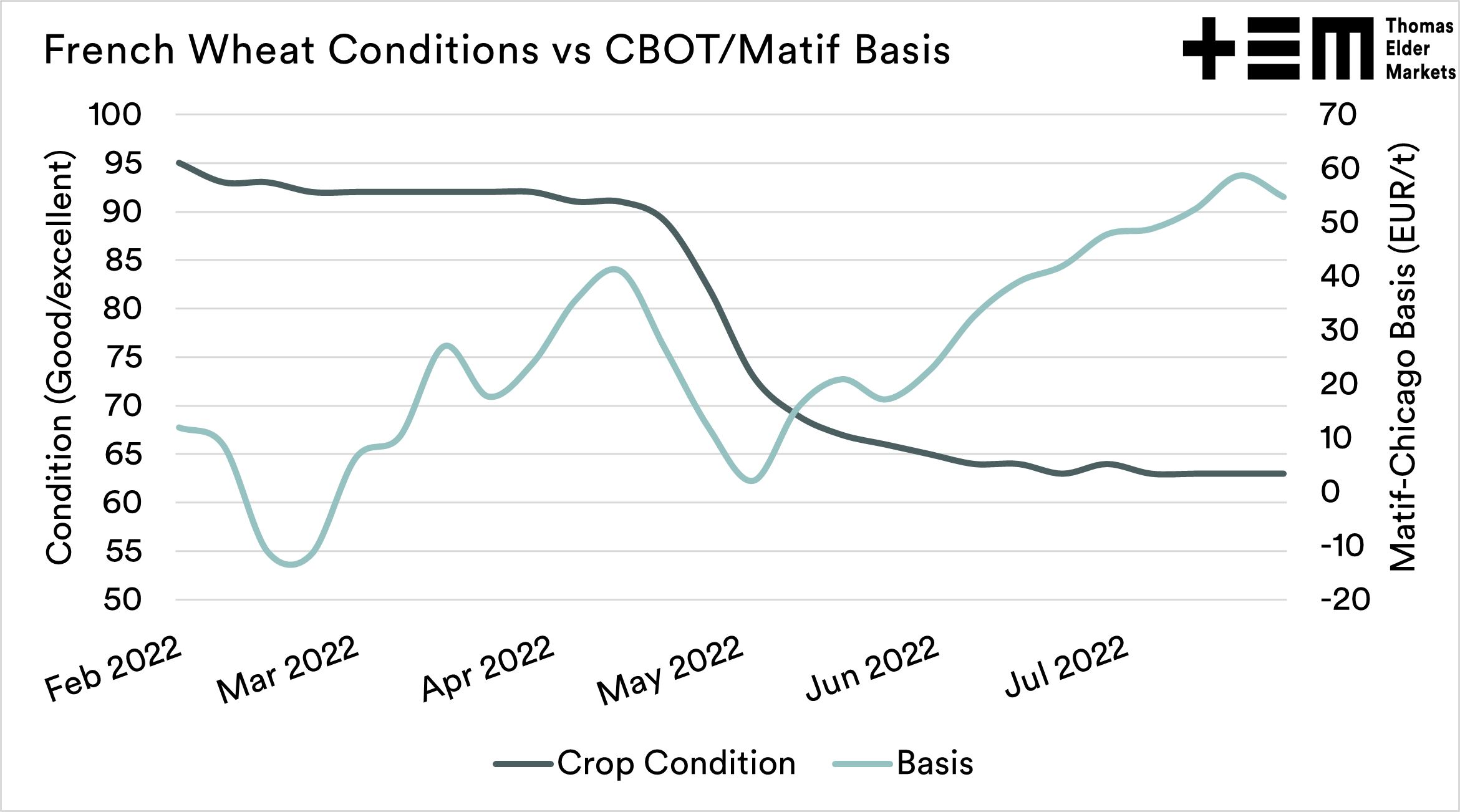

The chart comparing flat price versus crop conditions showed that prices were falling. In the chart below, which shows the basis against conditions, we can see that as conditions were declining, the basis was improving.

This is a great example of basis moving on the deterioration of supply. High basis, especially extreme highs, tend to be a poor scenario for farmers.

There is no point in having a huge premium if you have nothing to sell.

The EU drought isn’t having a huge impact on global wheat pricing. If we look at Matif and CBOT pricing in recent weeks, the pricing action has been relatively subdued and boring compared to recent months.