Fundamentally the world is tight for wheat

The Snapshot

- The WASDE report is released once per month and generally, the market reaction is light these days.

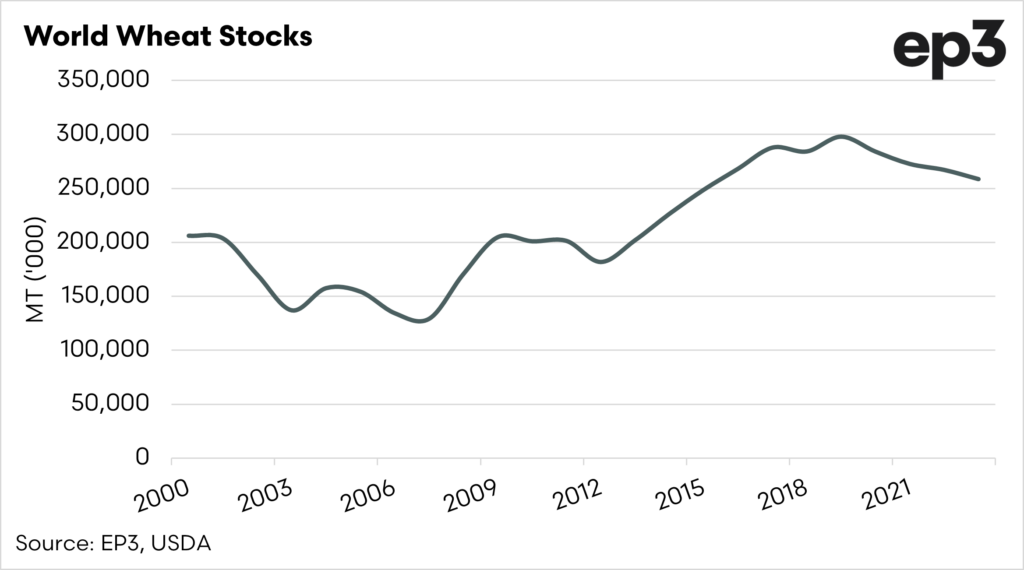

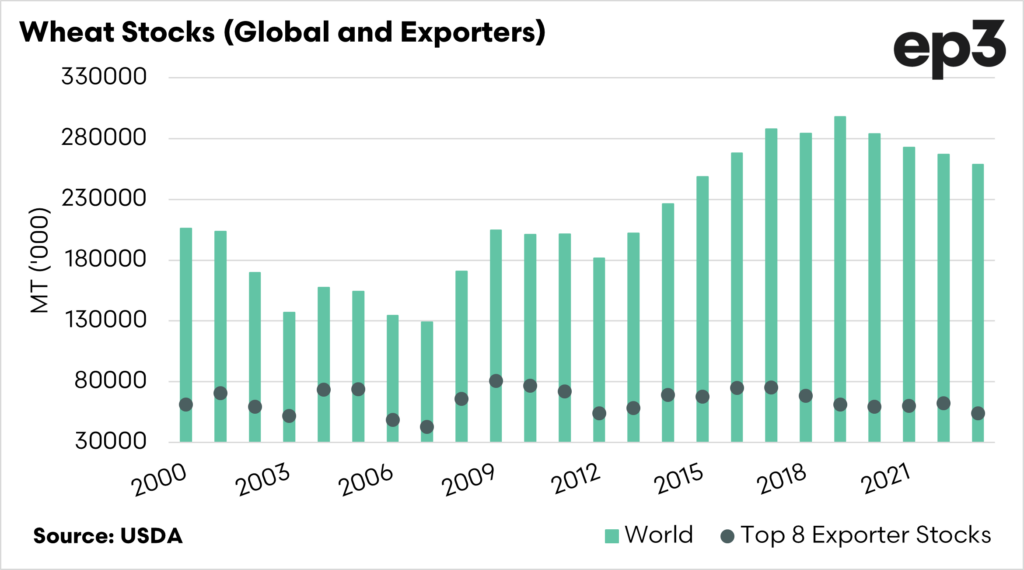

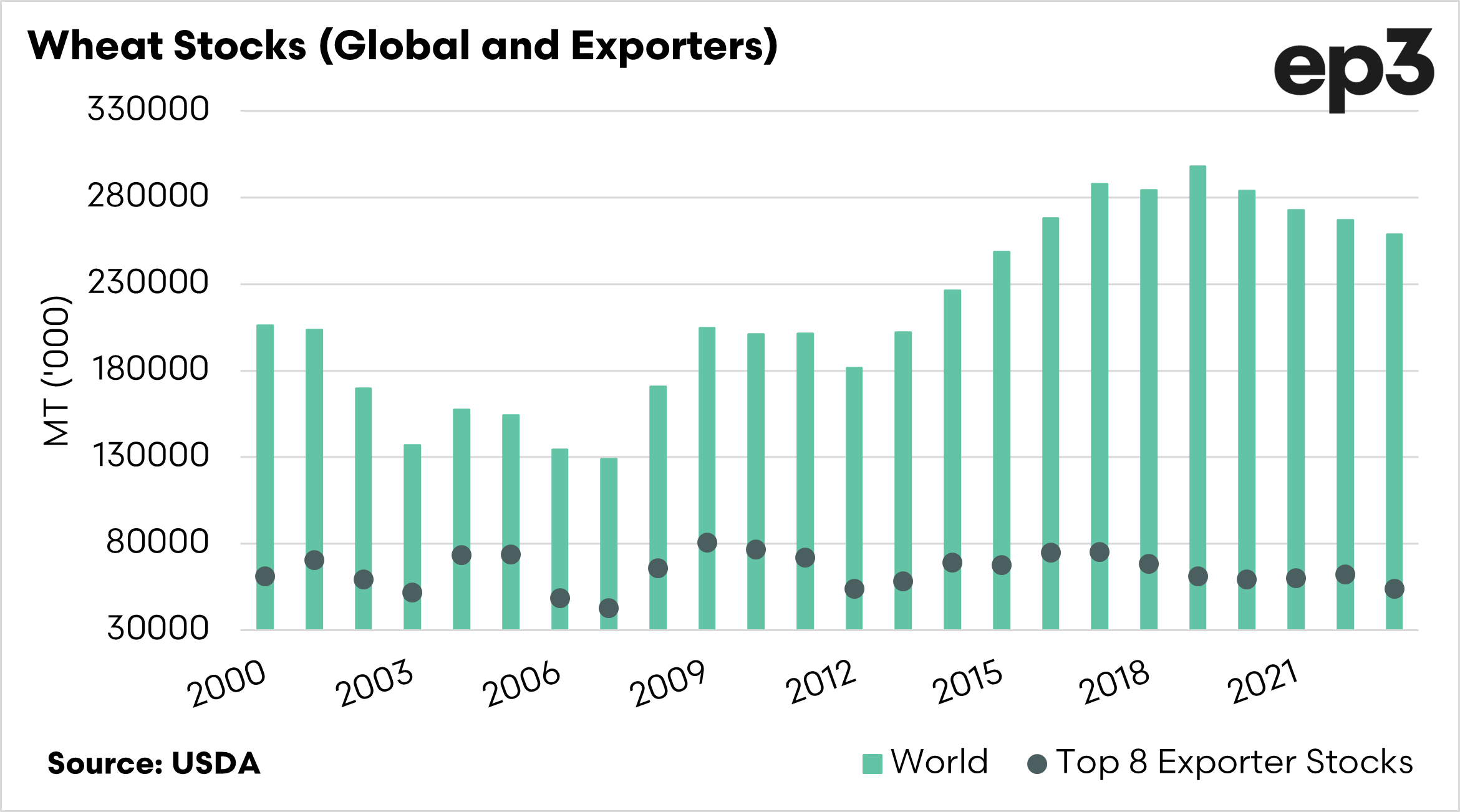

- Global stocks of wheat are still relatively high on a overall basis.

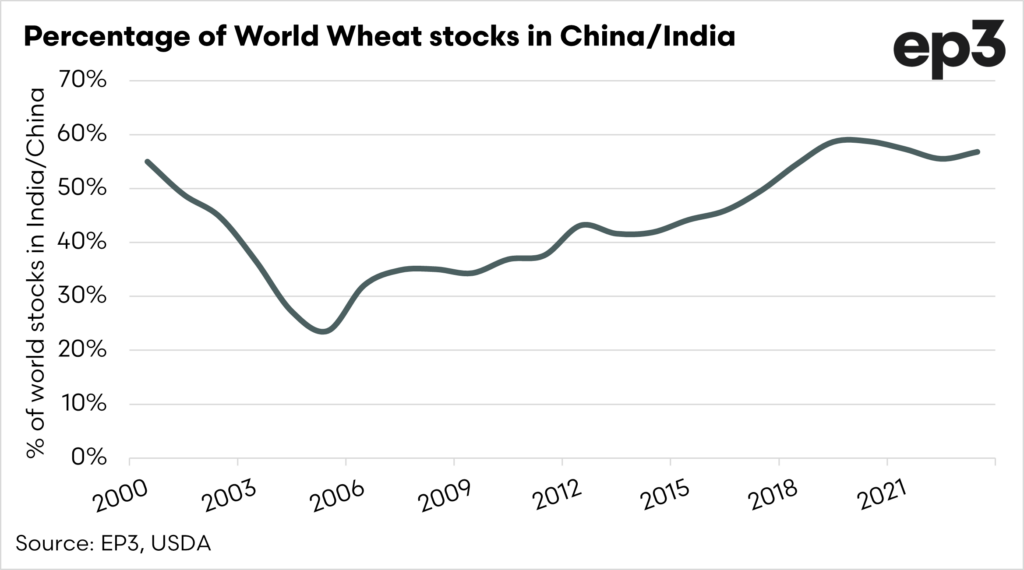

- The majority of stocks are held in India/China.

- The Australian wheat crop was reduced to 26mmt from 29mmt in August. This will be revised further down.

- The stocks of the major exporters are declining and the lowest level since 2007

- The global wheat stocks to use ratio is the lowest since 2013.

- The global wheat stocks to use ratio (minus China) is the lowest since 2007

- The wheat stocks to use ratio for the top exporters is tied with 2007 for the lowest since at least the turn of the century.

- Wheat is fundamentally getting tight. A tighter supply environment could force prices higher if further issues transpire.

The Detail

The WASDE report was out last night. It’s one of the ‘biggest’ reports of each month, but you’ll notice that I don’t often write about it. That’s because it is massively covered everywhere, and more often than not, it has very little market impact.

In the past, the WASDE report would cause wild swings in markets, but nowadays, the trade largely has a good handle on what is going to come out.

I prefer to write about it every couple of months, looking at some of the key indicators. So let’s delve into it and see if we can find anything interesting.

Where is the worlds wheat held?

Let’s start by looking at the big picture and then zooming in. Wheat stocks are one of the most important factors to keep an eye on. This is a good representation of what will be available at the end of the season once consumption has been taken out.

Wheat stocks globally have fallen since 2019 when they hit record levels, but they are still historically quite high.

Where are those stocks? China and India have for a long time hoarded large amounts of wheat, and currently, they have combined stockpiles accounting for 57% of the global pantry.

It is very unlikely that we will see any of that wheat on the export market anytime soon.

Look at who is important.

The stocks-to-use ratio is an important tool, as globally stocks could be high – but stocks dont take into account demand.

The stocks-to-use ratio is a metric that shows the amount of a commodity left in storage (stocks) relative to the amount consumed or used over a specific period. It is a crucial ratio for analysing commodity markets

- Low Ratio: A low stocks-to-use ratio indicates that there isn’t much of the commodity in storage compared to its usage, which can often lead to higher prices due to scarcity.

- High Ratio: A high stocks-to-use ratio suggests that there is an abundance of the commodity in storage relative to its usage, which can lead to lower prices due to oversupply.

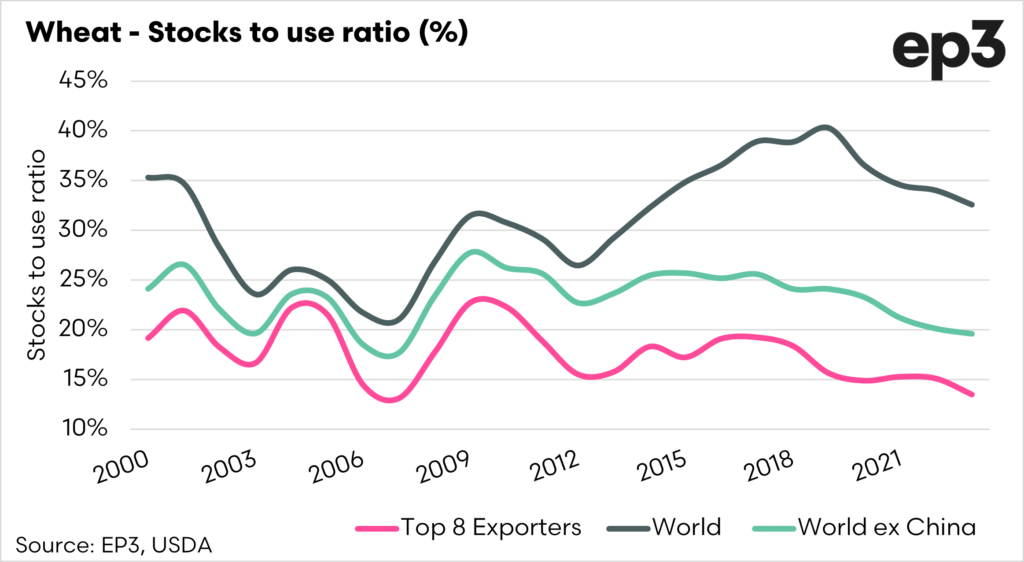

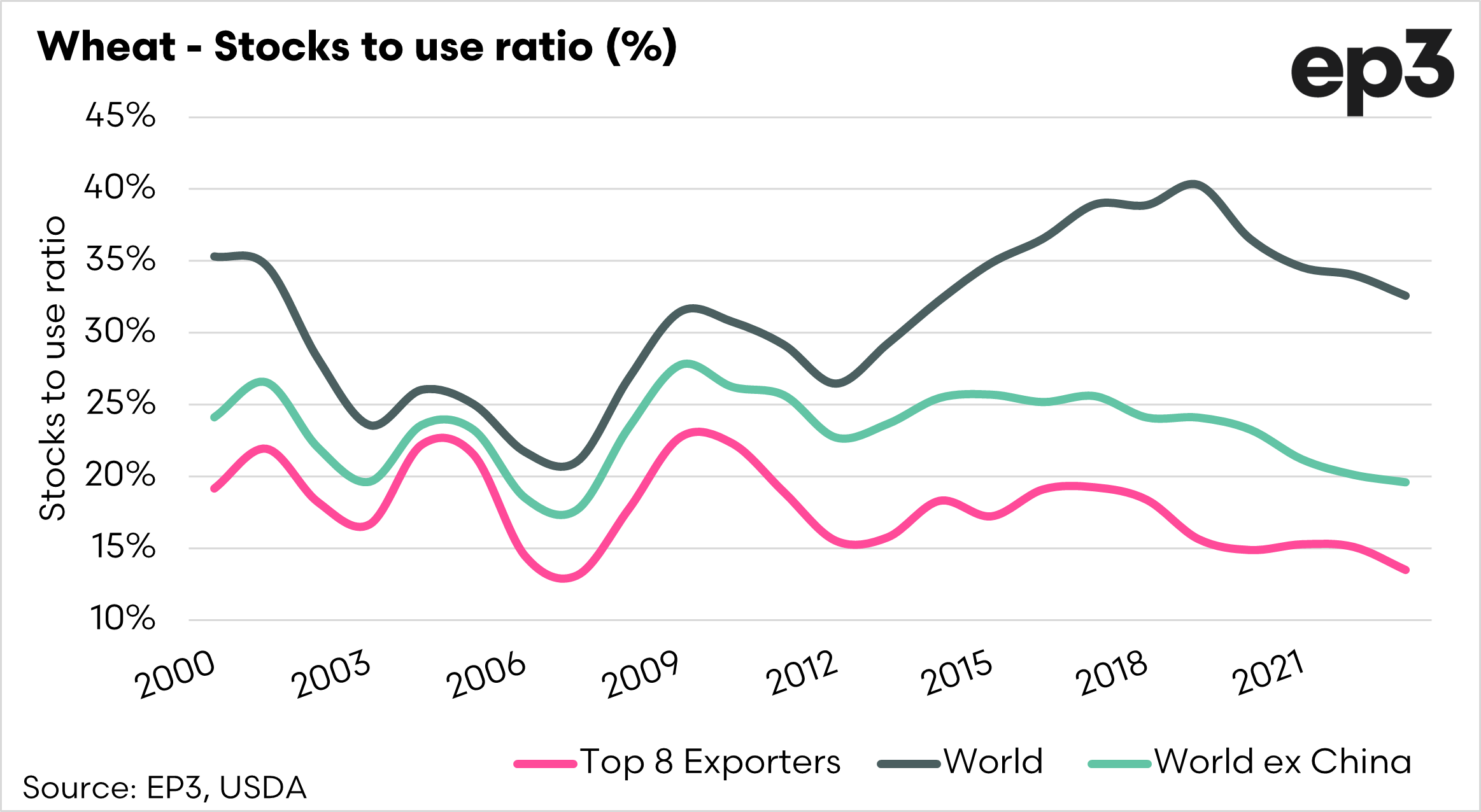

The chart below shows the stocks-to-use for the world (with and without China) and the top 8 exporters.

The stocks to use ratio for the global situation is lowest since 2013, but again we need to look at it without China. When China is excluded then it is the lowest since 2007.

As we delve in further, an area I think is key to look at is the top exporters. These are the countries which provide a surplus of wheat which can be shipped to countries of deficit. It is these countries which really determine the global market. The stocks-to-use ratio for the top 8 exporters is currently joint lowest since at least the turn of the century.

This reducing ratio really points towards a scenario of falling supplies, and therefore potential for higher pricing.

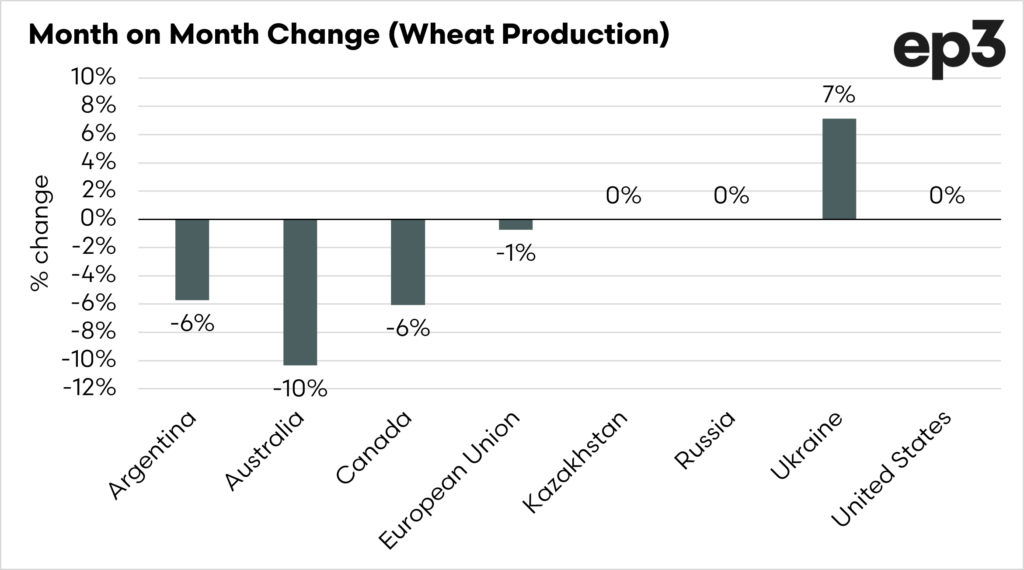

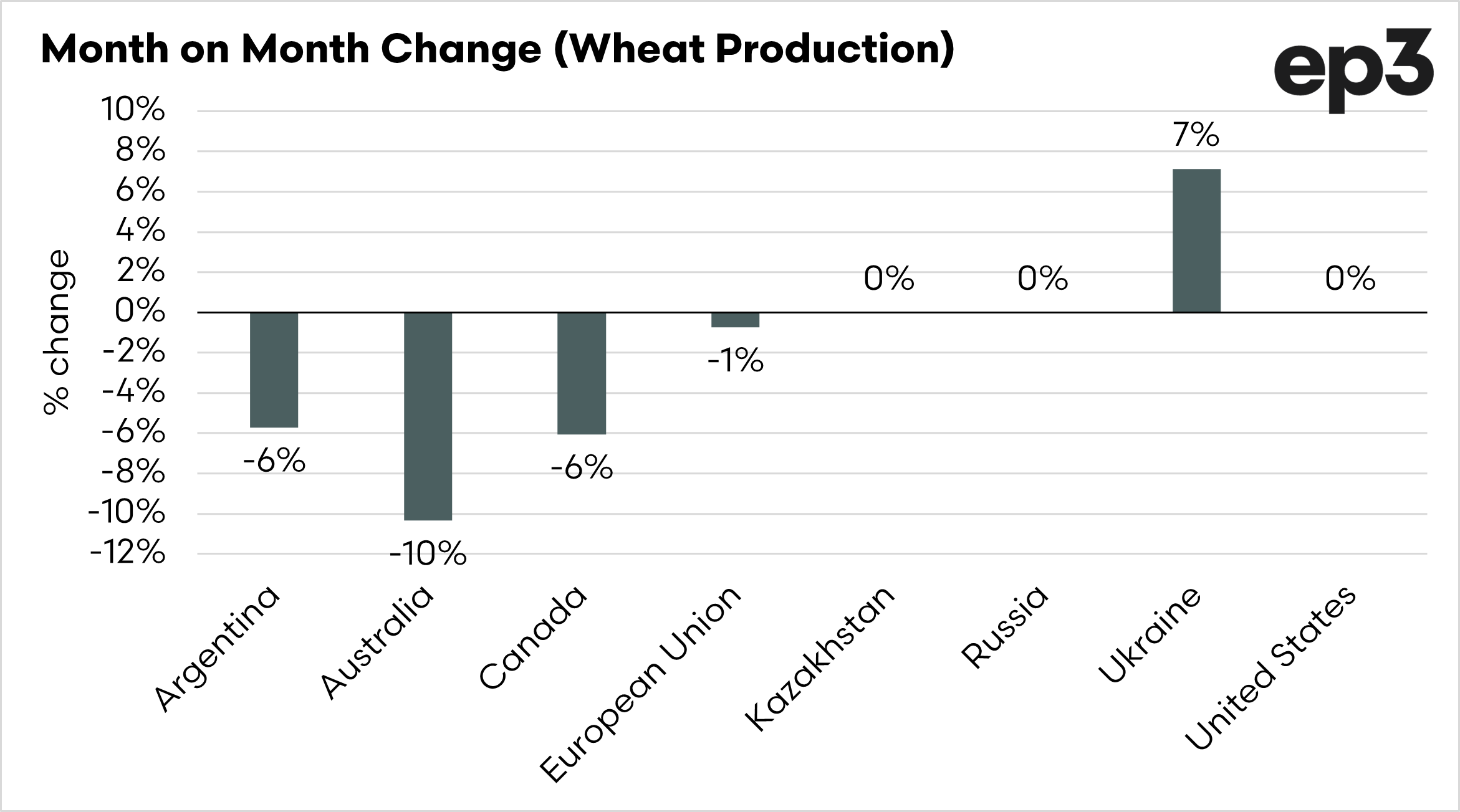

Ch-ch-ch-ch-Changes

In many parts of Australia, the crop is drying out. In recent years the moisture bank has been almost perfect, this year a dry September can really break the crop. The USDA have reduced the Australian crop from 29mmt in August to 26mmt. This is expected, and it is still too high. The final number will be revised further down, at present we are closer to a 23.5mmt crop.

If we look through month on month at the major exporters, there have also been significant reductions from Canada and Argentina.

So what does it all mean?

Well, I still view the global supply of wheat as fundamentally short despite an overall strong stock position. The wheat available from the top exporters is declining, and this doesn’t even take into account any potential further action in Ukraine/Russia. It won’t take much to light the fire under a rocket in the coming year.