Global wheat pricing

Global wheat pricing

The final of our series on comparing pricing to the rest of the world is where we compare wheat. Wheat always has an interesting place in Australia. For a long time, Australian wheat seemed to always hold a strong premium versus the rest of the world.

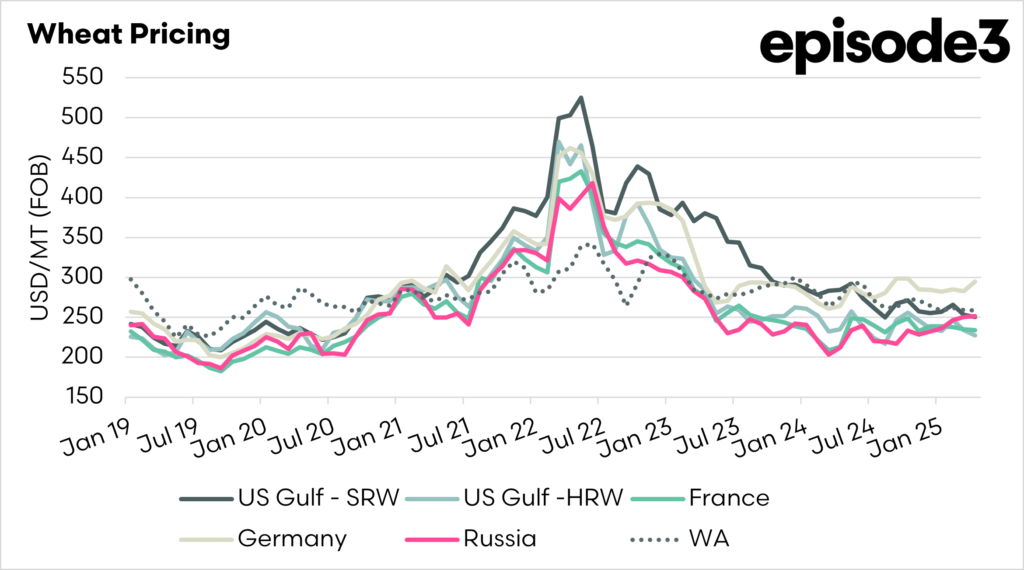

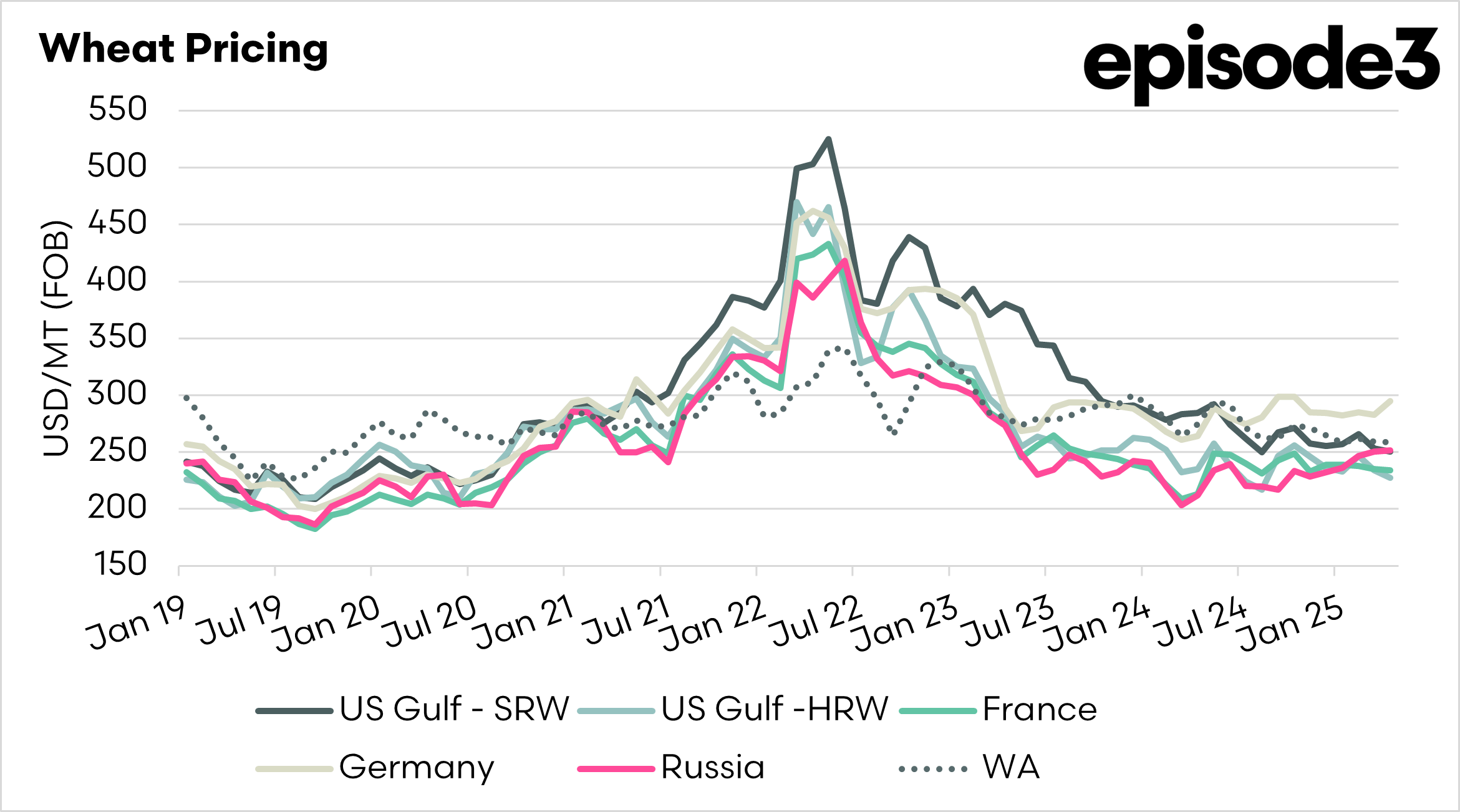

In this comparison, we use WA wheat, US Gulf (SRW & HRW), France, Germany and Russia. I have chosen WA due to its focus on exports.

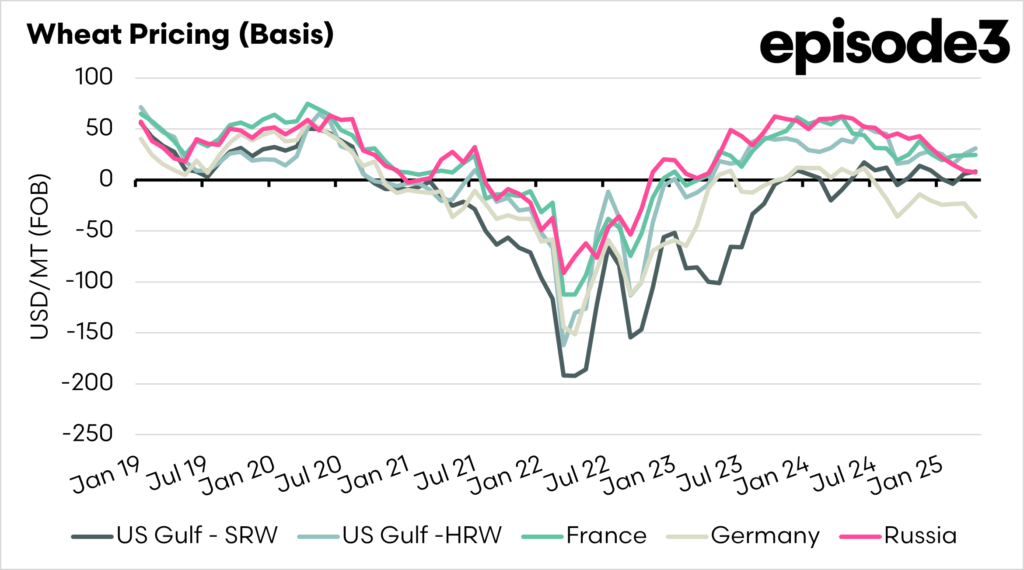

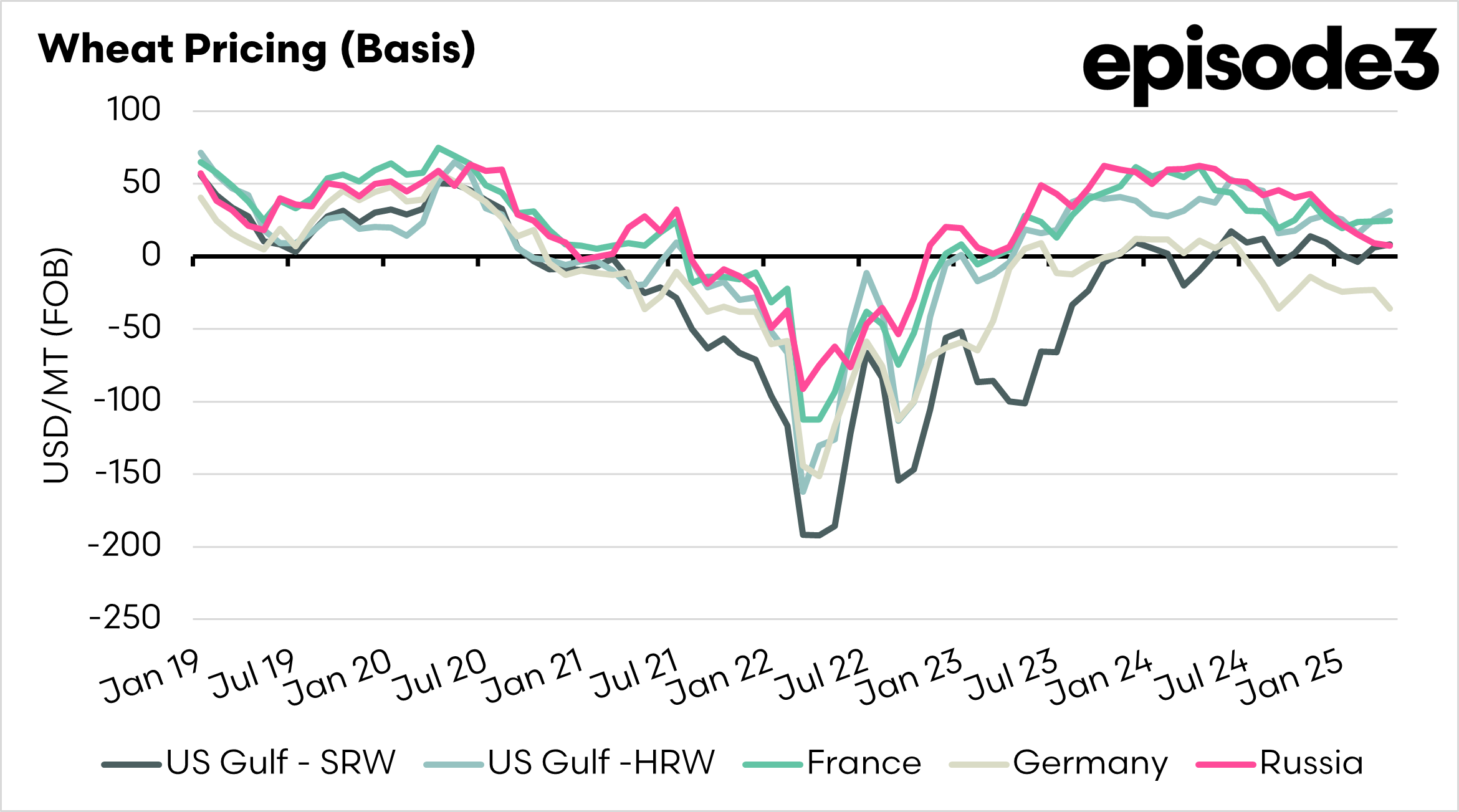

Australian values held a strong premium from 2019 through 2021, largely due to localised drought in Australia. When Australia recovered from drought, we had a series of very strong production years, which resulted in our values dropping to record discounts.

The pricing peak for Australian values came in mid-2022, when the Russian invasion of Ukraine caused peak uncertainty. That being said, our prices did not rise to the same levels that were experienced in other countries. Our pricing level has moved to a premium in the past two years, except against France.

These charts show a good example of how we cannot always rely on a positive basis. If we have a strong supply, then our price will move to a discount, sometimes a significant one.

I’d put wheat down as a winner at the moment in comparison to this selection of pricing points.