Grain Prices: A lot of good can happen in Grain.

Pricing Update

As we move throughout the year, we will be focusing on the new crop more and more, and so on a regular basis, we will be putting an update on what is happening in the local market, with a focus on being quick to read.

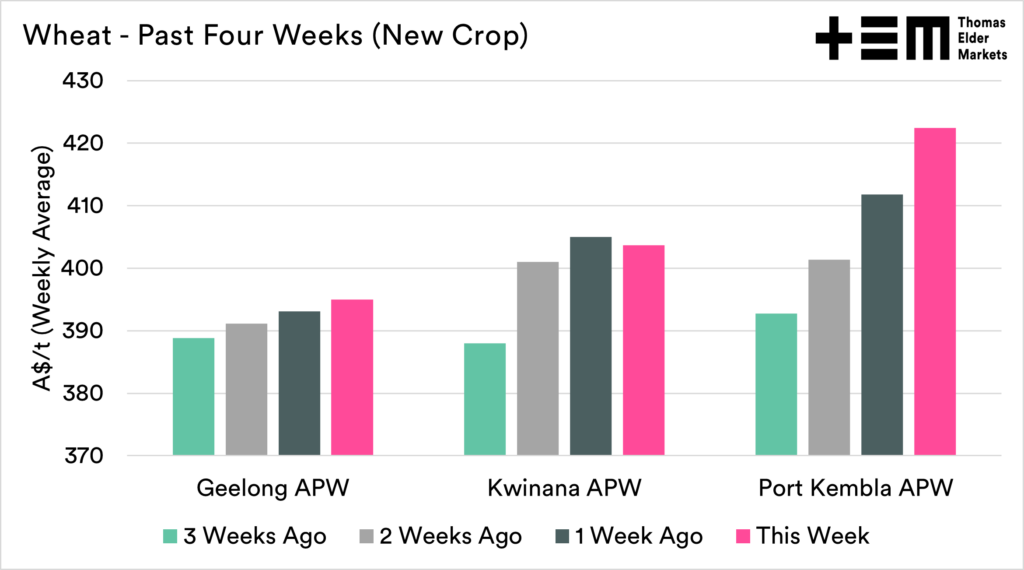

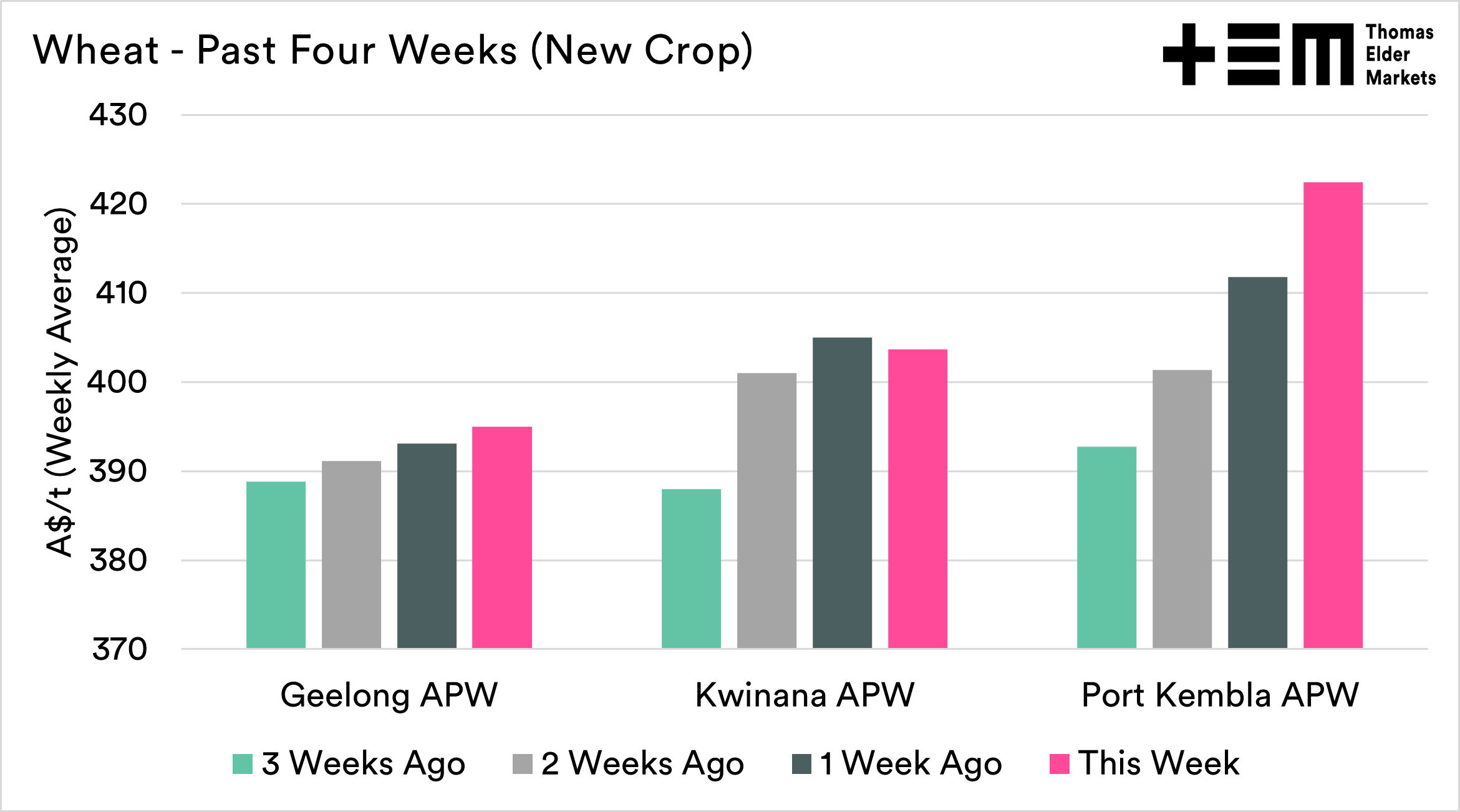

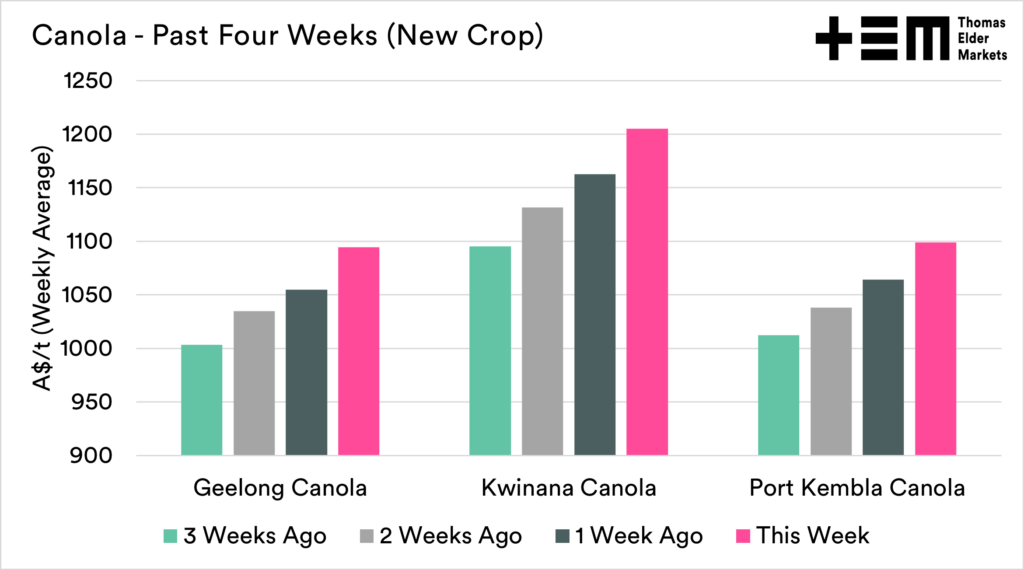

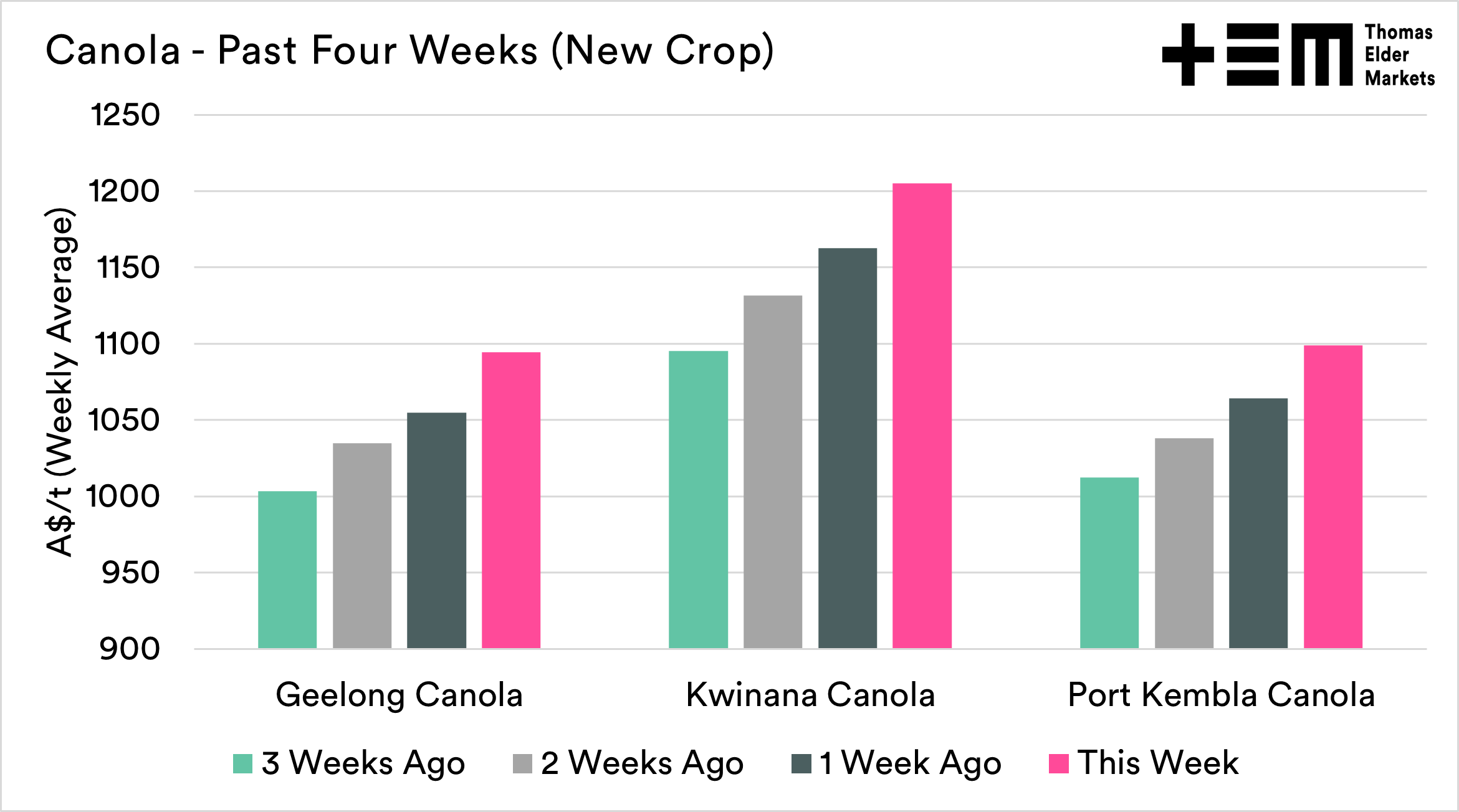

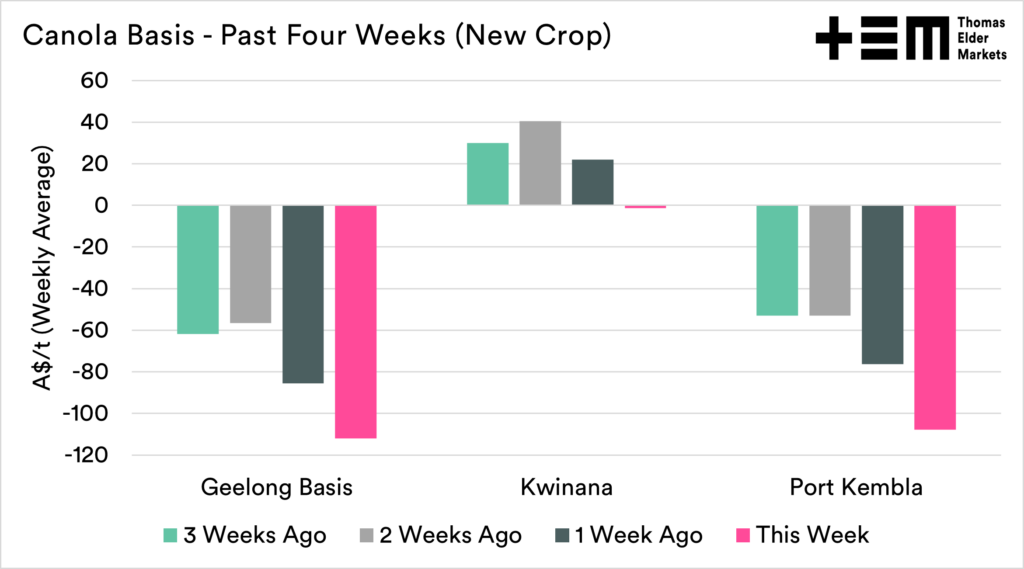

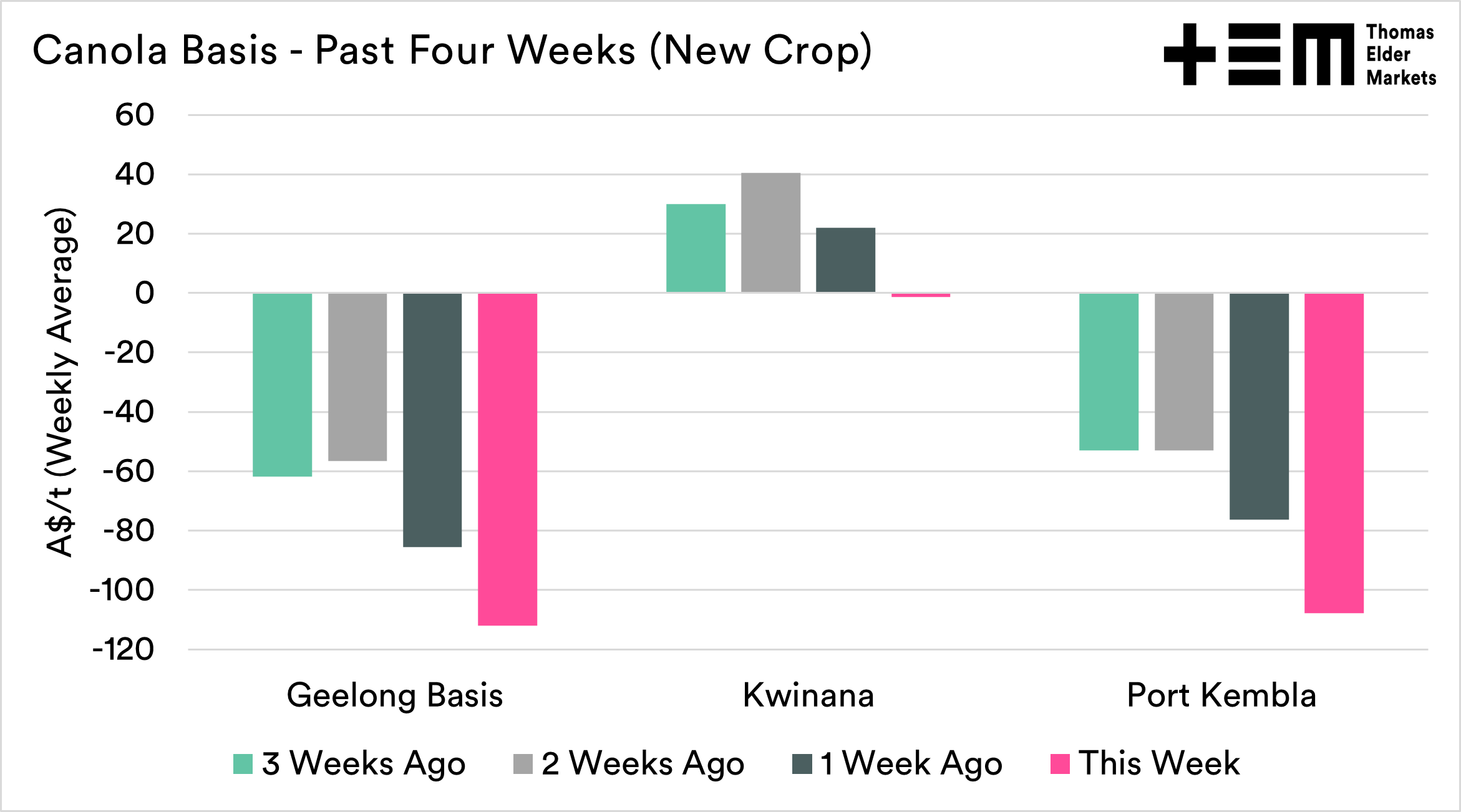

The charts in this report are all the weekly averages, so won’t reflect a particular day but the average of the week as we look towards trends. In this update, we will focus on three zones, Kwinana, Geelong and Port Kembla, as they give a reasonable spread around the country. We may add more in the following updates.

If forward selling, remember that you are replacing price risk with production risk. Be mindful of this when allocating volumes.

Remember to sign up to make sure you don’t miss any of our updates, these are free to access. If you want to support this service, remember to share with your network.

Wheat

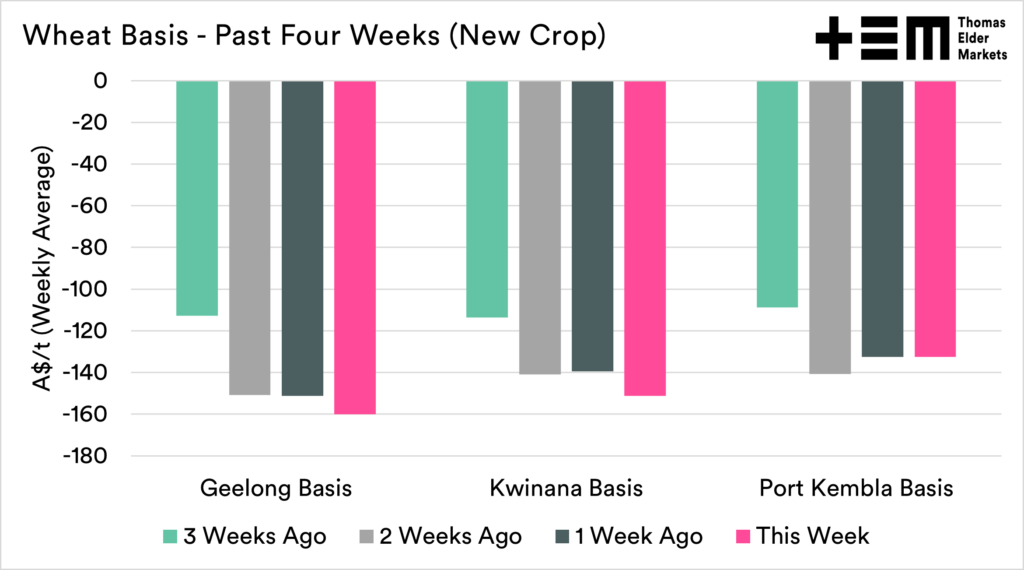

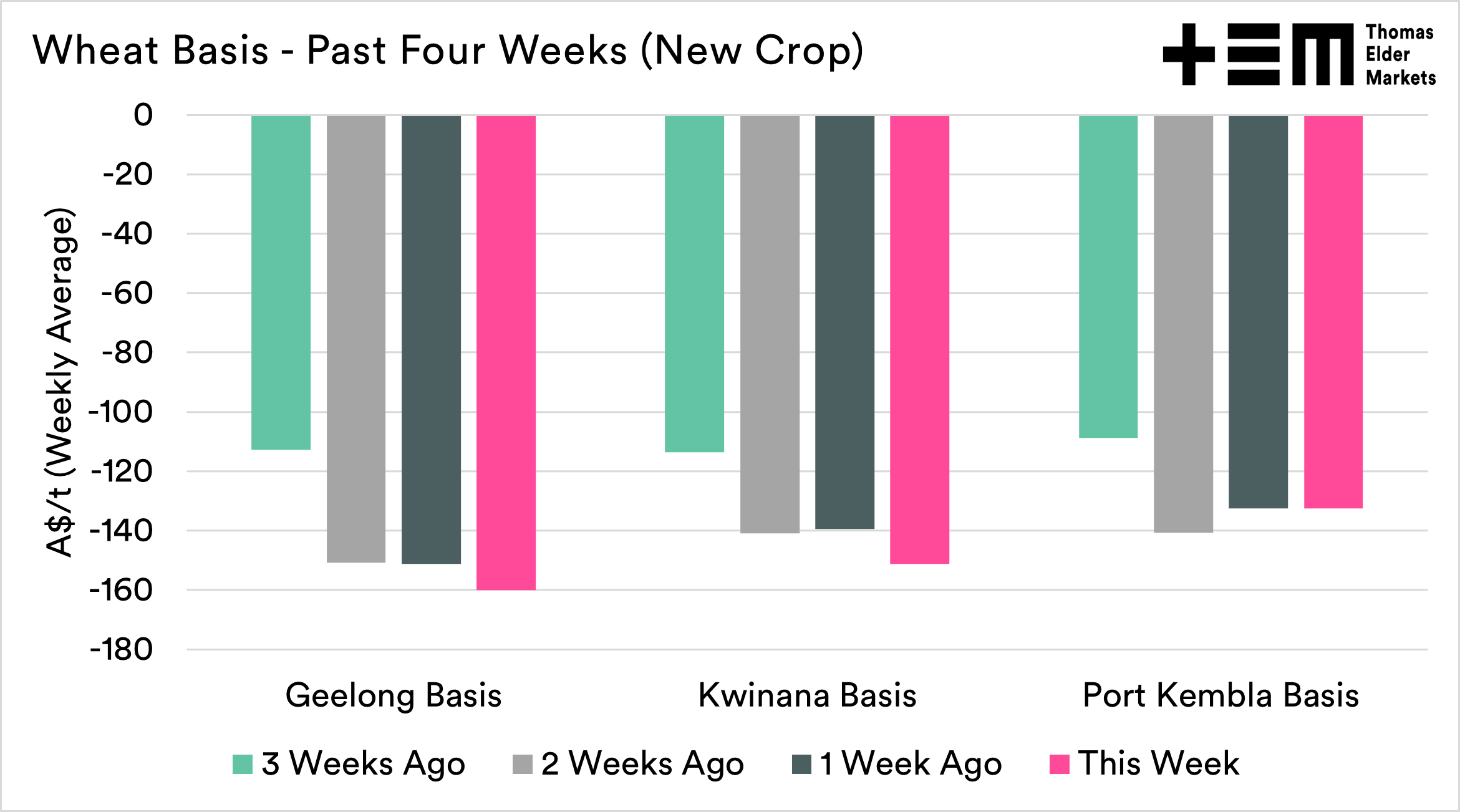

This week Chicago wheat futures for December hi A$560, a new high for the contract. Local prices in Australia were mixed, but with Port Kembla having the largest gain. Basis levels remain at heavy discounts, with only Port Kembla able to maintain the same average as last week.

The basis levels for new crop are at extreme discounts. Will we see basis levels improve, or will we see another year of massive discounts to the rest of the world?

The big fundamental news in wheat this week was the increase in acreage in Canada; wheat was up 7%, as farmers switched away from Canola. North America continues to be under poor conditions, with the winter wheat crop declining again. The winter wheat crop is now at 27% good/excellent, the worst for this time of year since 1989.

While the market has been really crazy in the last couple of months, with so many events, we are now moving into the traditional weather market. As the crop grows (or doesn’t), we will see pricing swings. It’s going to get even more interesting.

The current times in grain remind me of a quote from Lenin that applies quite well to the current market environment.

“There are decades where nothing happens; and there are weeks where decades happen”, Lenin

Canola

If wheat has been exciting in recent weeks, then I don’t have the right adjective for the canola market. This time last year I was bullish on canola, I feel more bullish at present.

At the end of last week, Indonesia banned the exports of cooking oils, including palm. They are taking it seriously, with the Indonesian navy seizing two tankers off the coast. Palm oil is a huge percentage of world vegetable oil, and a ban makes the market ultra tight. The question will be how long the ban is in place, determining the extent of the impact.

Palm is the biggest export product in Indonesia, and this intervention will reduce the foreign income. While they hope this ban reduces food inflation, it could have larger unintended consequences.

Canada reduced their expectations for canola acreage by 7% to 8.45m ha. Whilst this is a big fall year on year, the area is still larger than 2020. The high prices for canola should incentivise higher acreage, but not according to Statscan.

The conditions still remain dry in Canada, and they are forecast to have fewer acres to play with. While that is bad for them, they are responsible for >60% of world exports, and it throws demand to Australia.

This week saw futures prices rally on both ICE (Canada) and Matif (France), but the flow through to Australia, whilst strong, wasn’t as large as overseas.