Grain Prices: Support of wheat remains strong.

Pricing Update

As we move throughout the year, we will be focusing on the new crop more and more, and so on a weekly basis, we will be putting an update on what is happening in the local market, with a focus on being quick to read.

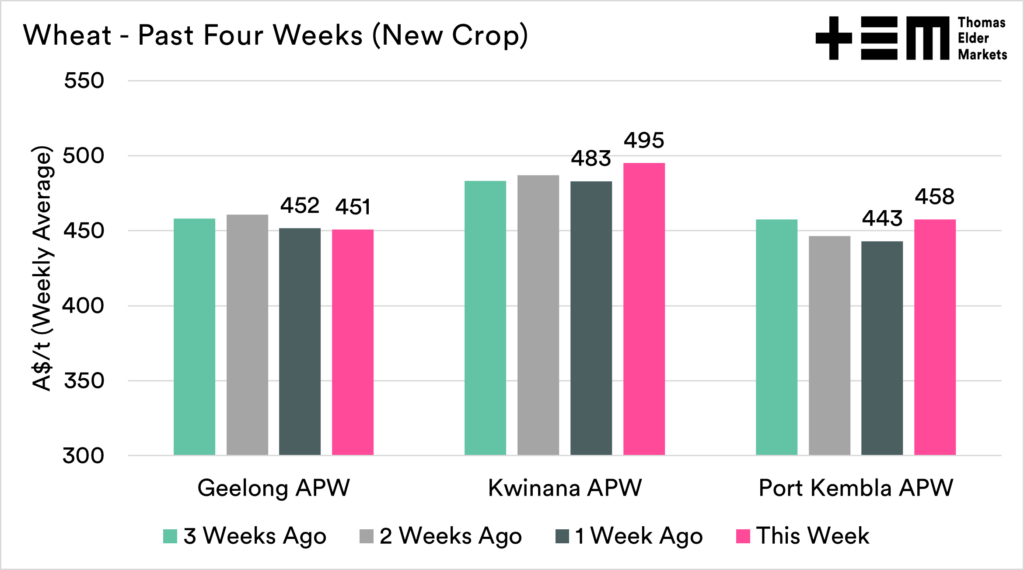

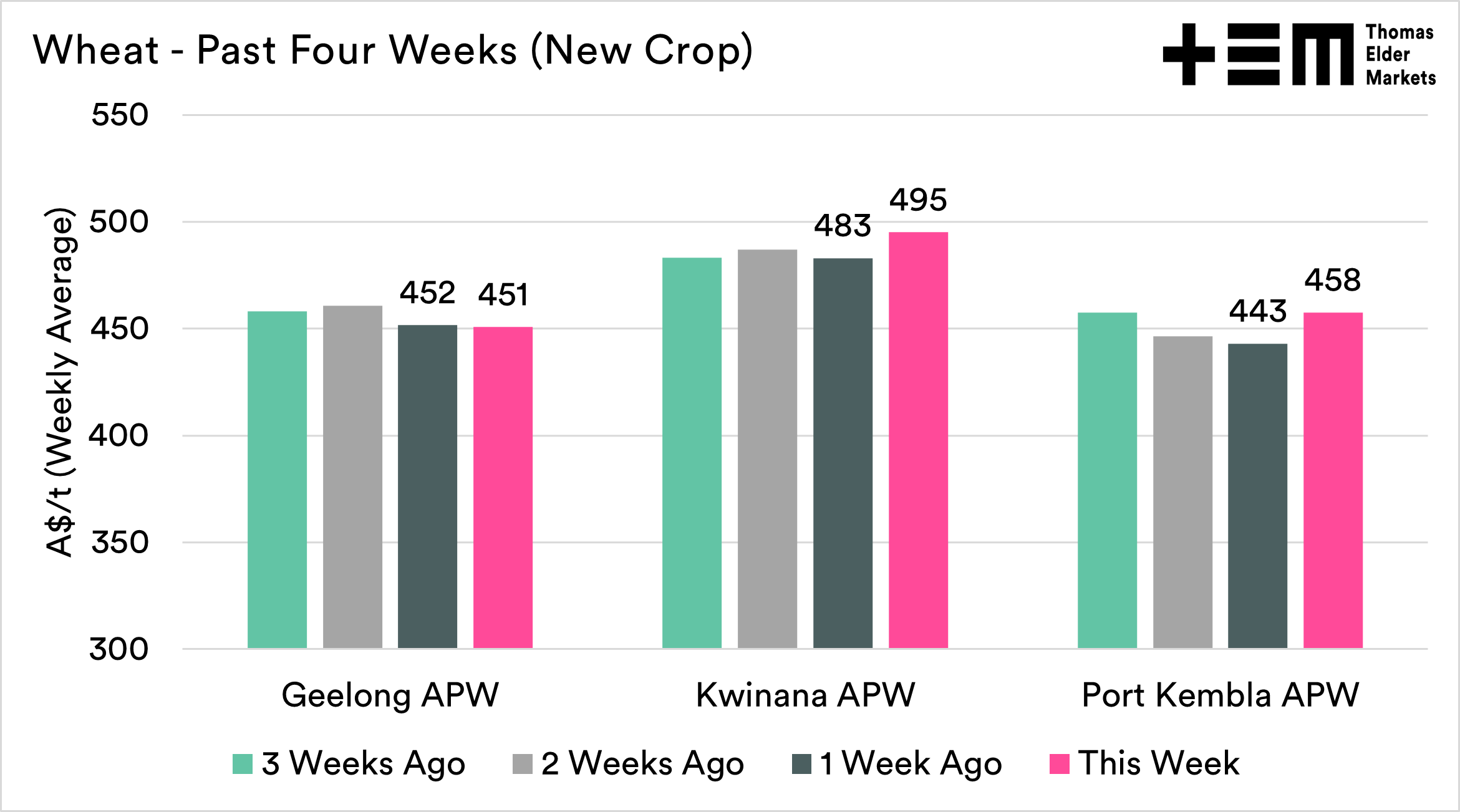

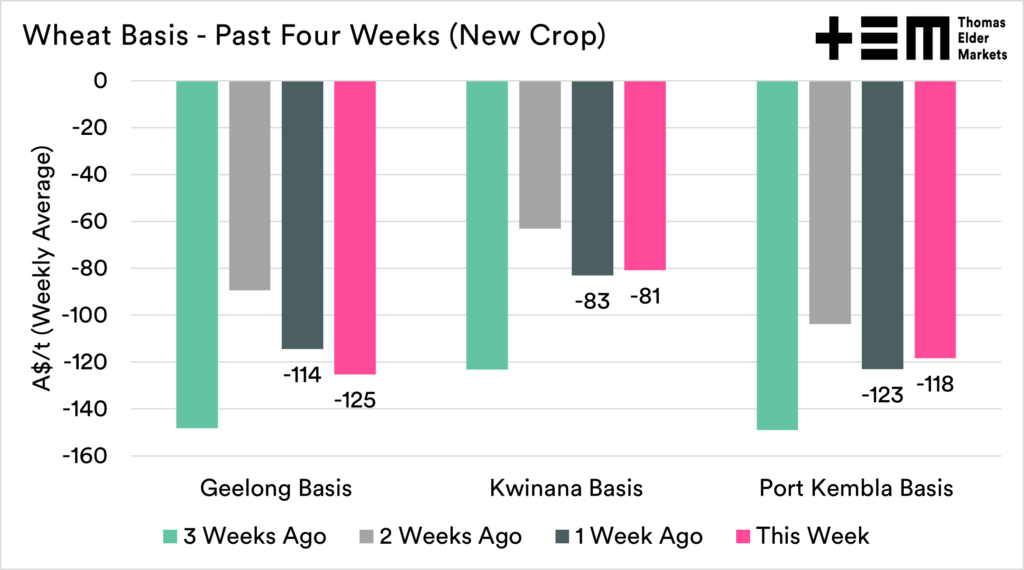

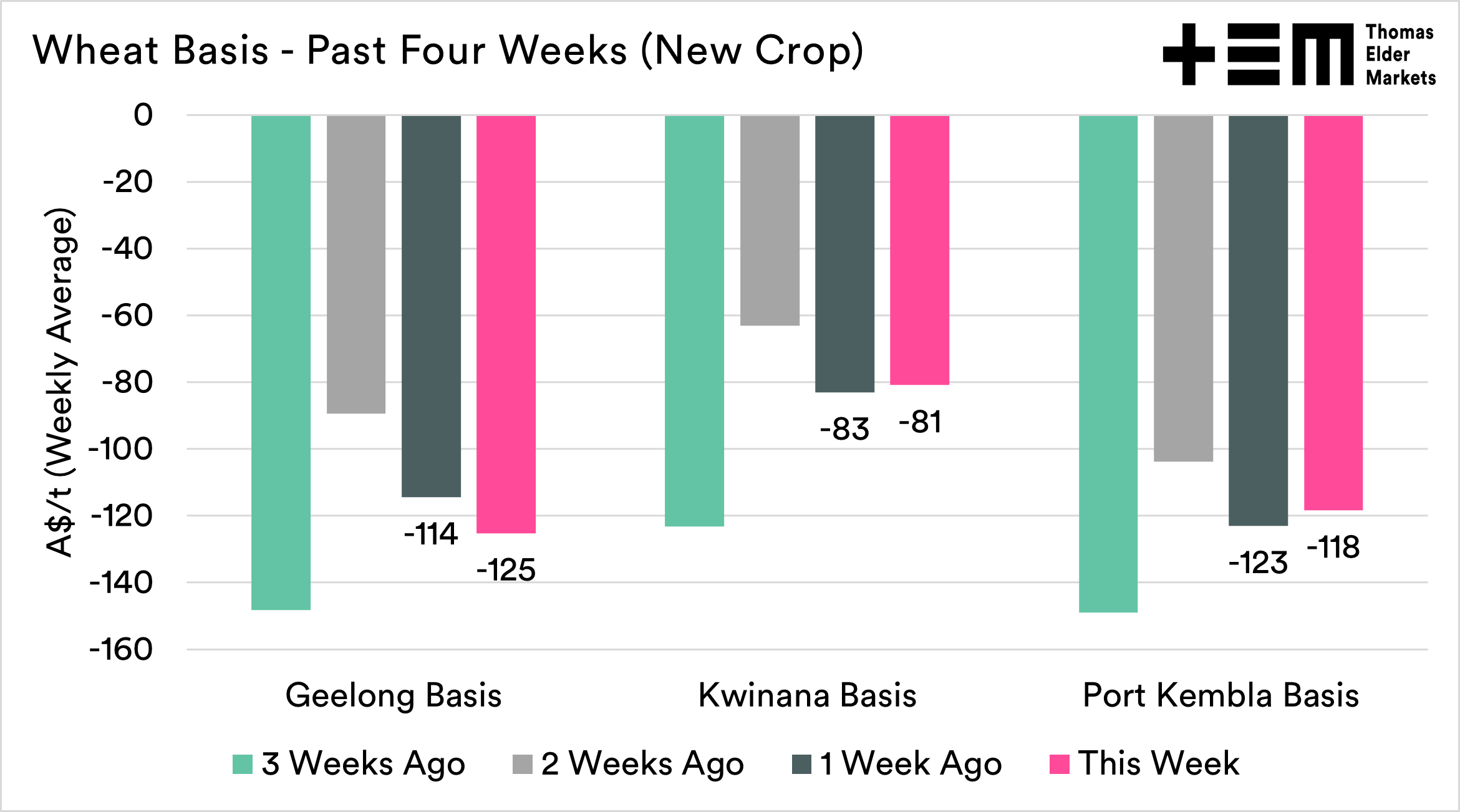

The charts in this report are all the weekly averages, so they won’t reflect a particular day but the average of the week as we look towards trends. In this update, we will focus on three zones, Kwinana, Geelong and Port Kembla, as they give a reasonable spread around the country. We may add more in the following updates.

If forward selling, remember that you are replacing price risk with production risk. Be mindful of this when allocating volumes.

Remember to sign up to make sure you don’t miss any of our updates, these are free to access. If you want to support this service, remember to share with your network.

Wheat

Crop conditions in the US winter wheat have stabilised around the 30% good/excellent in recent weeks. This is the 6th worst condition for this week. The USDA are also now providing the overall spring wheat condition for the US. It is currently at 54% good/excellent. This is improved upon the same time last year but remains the 5th lowest rank since 1986.

The French crop continues to come under pressure, falling to 66% good/very good. The second worst since 2012.

Hot weather is expected across large parts of the US cropping belt over the next fortnight. In Europe, especially France, the weather is expected to also be hot. I’m not an agronomist, but the conditions aren’t great for crop development.

There is a continuation of the discussions of opening grain corridors to get Ukrainian grain onto the world trade. Turkey has said they would be willing to assist and doesn’t think de-mining is required.

Biden also got involved with statements that the US would build temporary silos over the border in Poland. There has been a volume moving overland from Ukraine into Europe since the invasion, albeit way below normal levels. The rail gauges are different, which requires changing the bogie, reducing the volume potential. Unloading and reloading at the border is seen as an option.

I see a number of challenges with this:

- It will take time to set up.

- It will be a white elephant if ports reopen.

- If it works, and large volumes start moving into Europe for re-export, it will cause logistical logjams.

- The export supply chain will be long and expensive.

What worries me is that this points to the conflict continuing and being protracted. The longer it goes on, the longer that prices will remain higher. Good for farmers, bad for consumers.

It’s been a mixed back of prices around the country for new crop. Prices remain very attractive historically speaking. Basis for new crop remains heavily discounted.