Grain Prices: Strong grain environment persists.

Pricing Update

As we move throughout the year, we will be focusing on the new crop more and more, and so on a weekly basis, we will be putting an update on what is happening in the local market, with a focus on being quick to read.

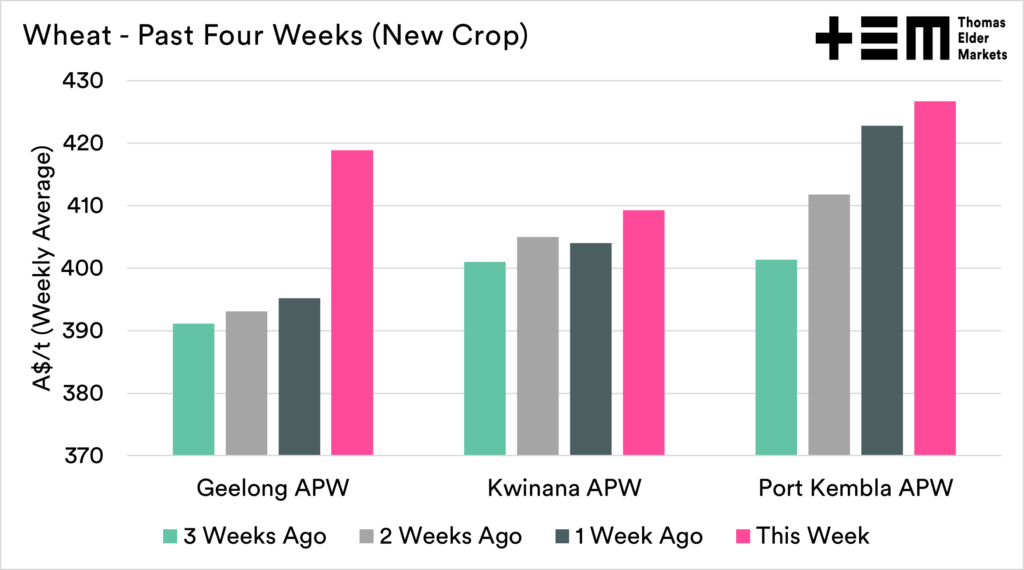

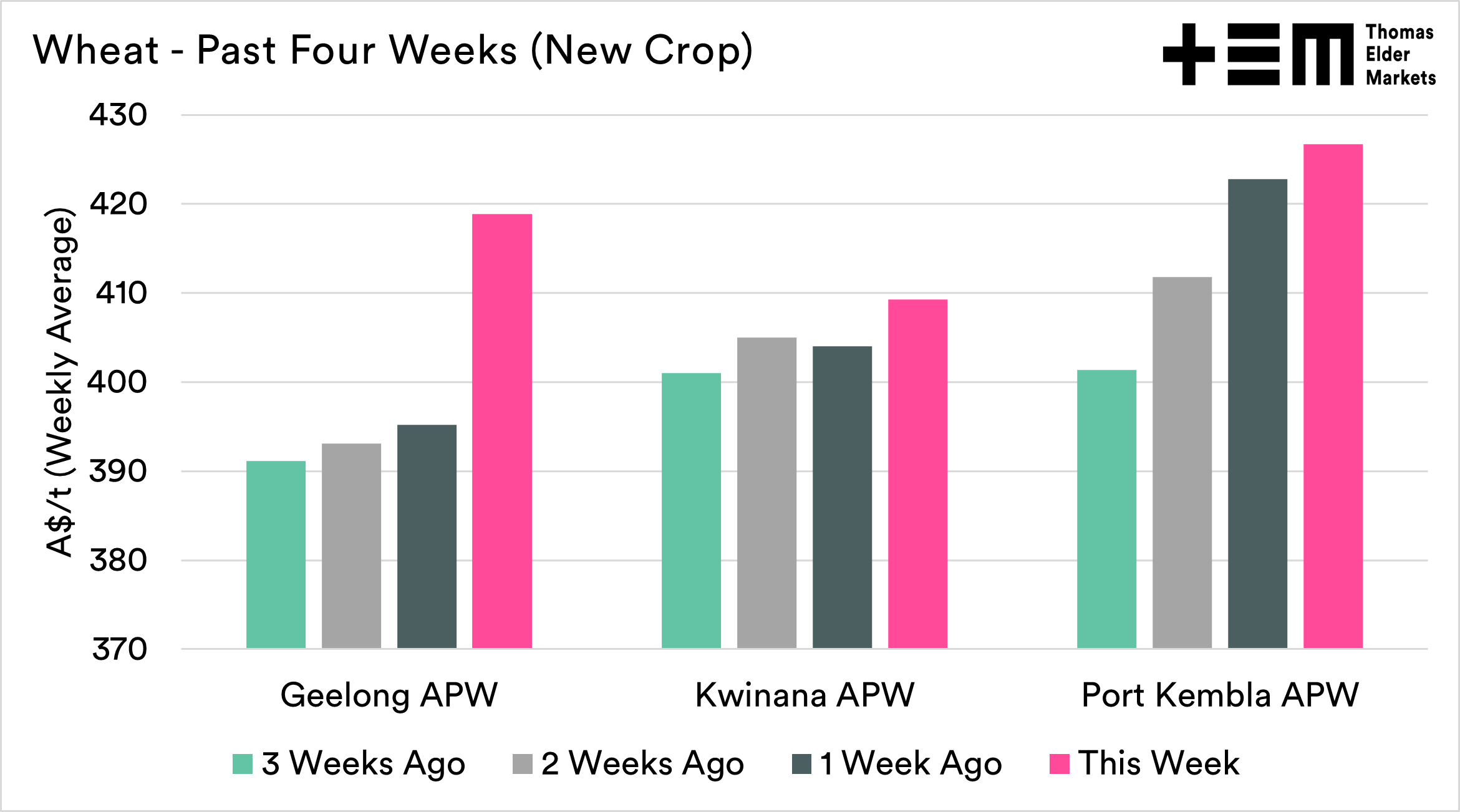

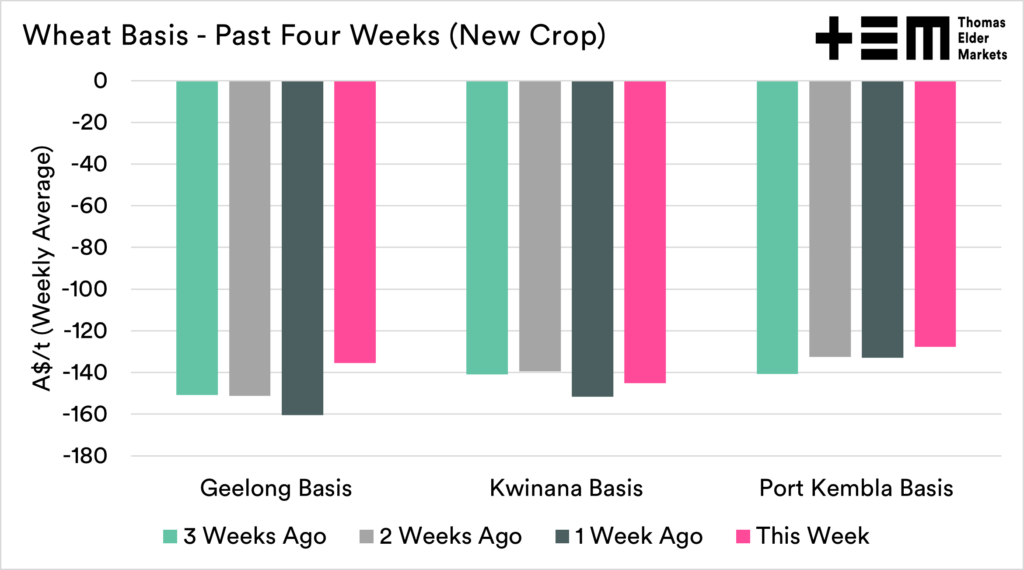

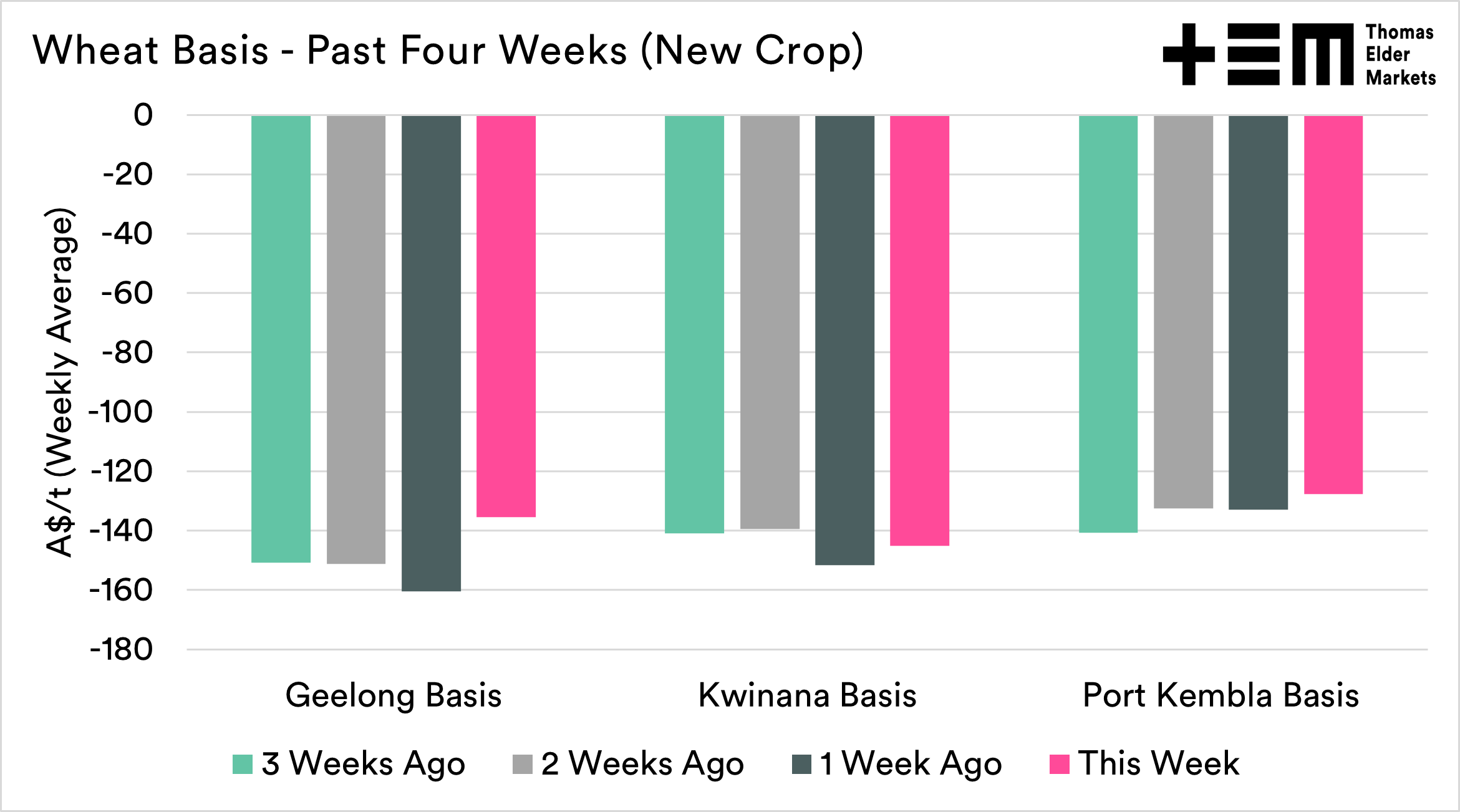

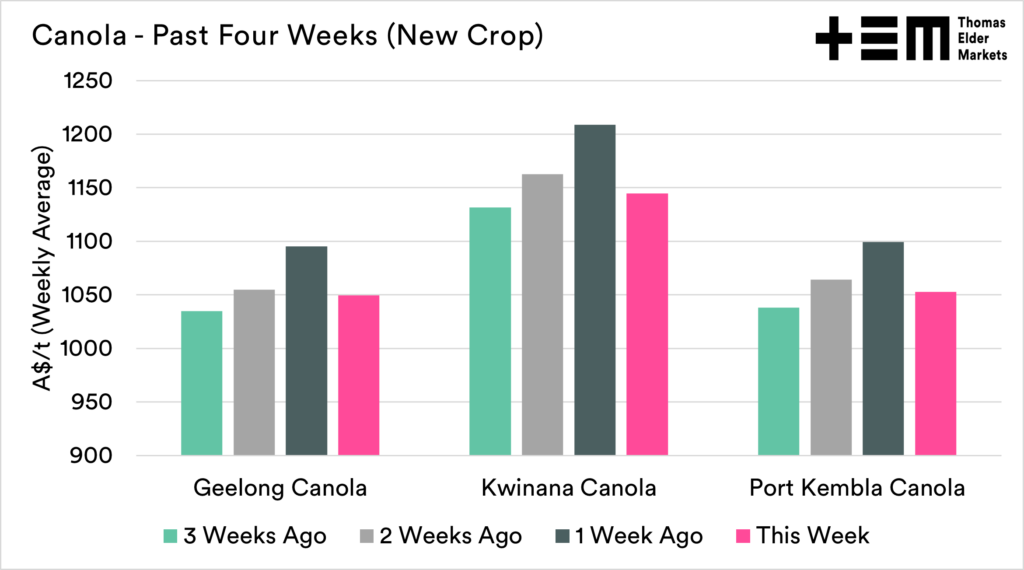

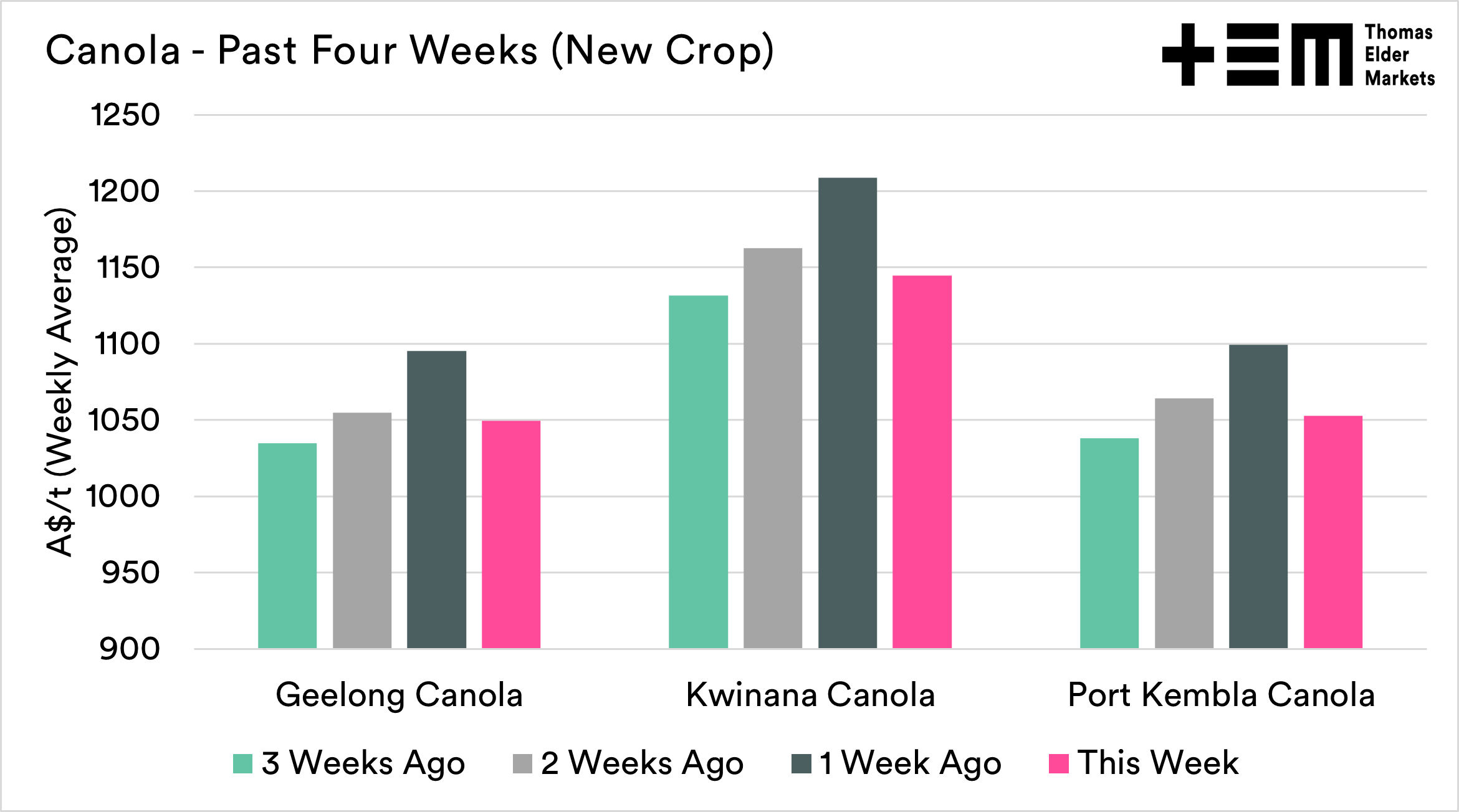

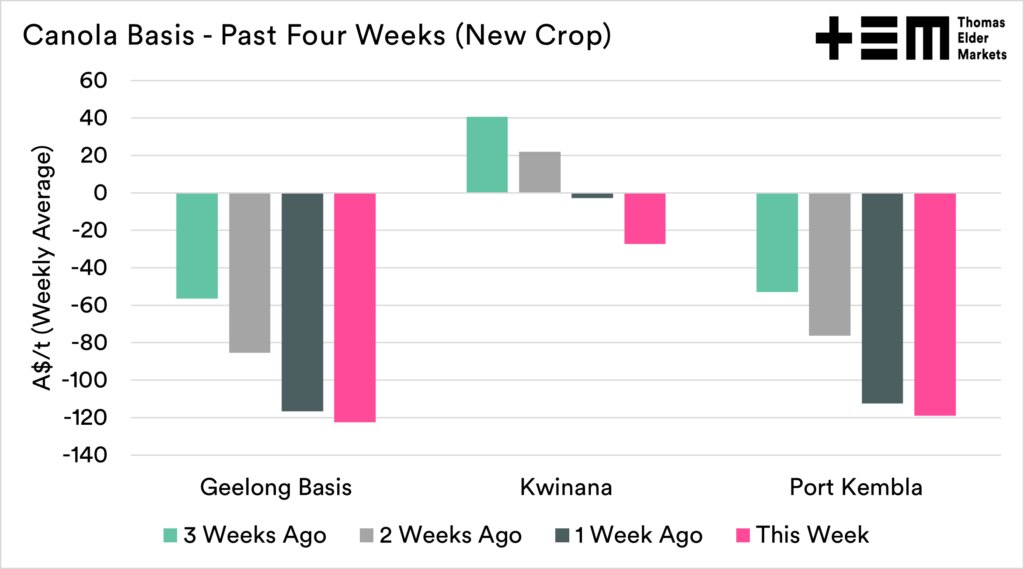

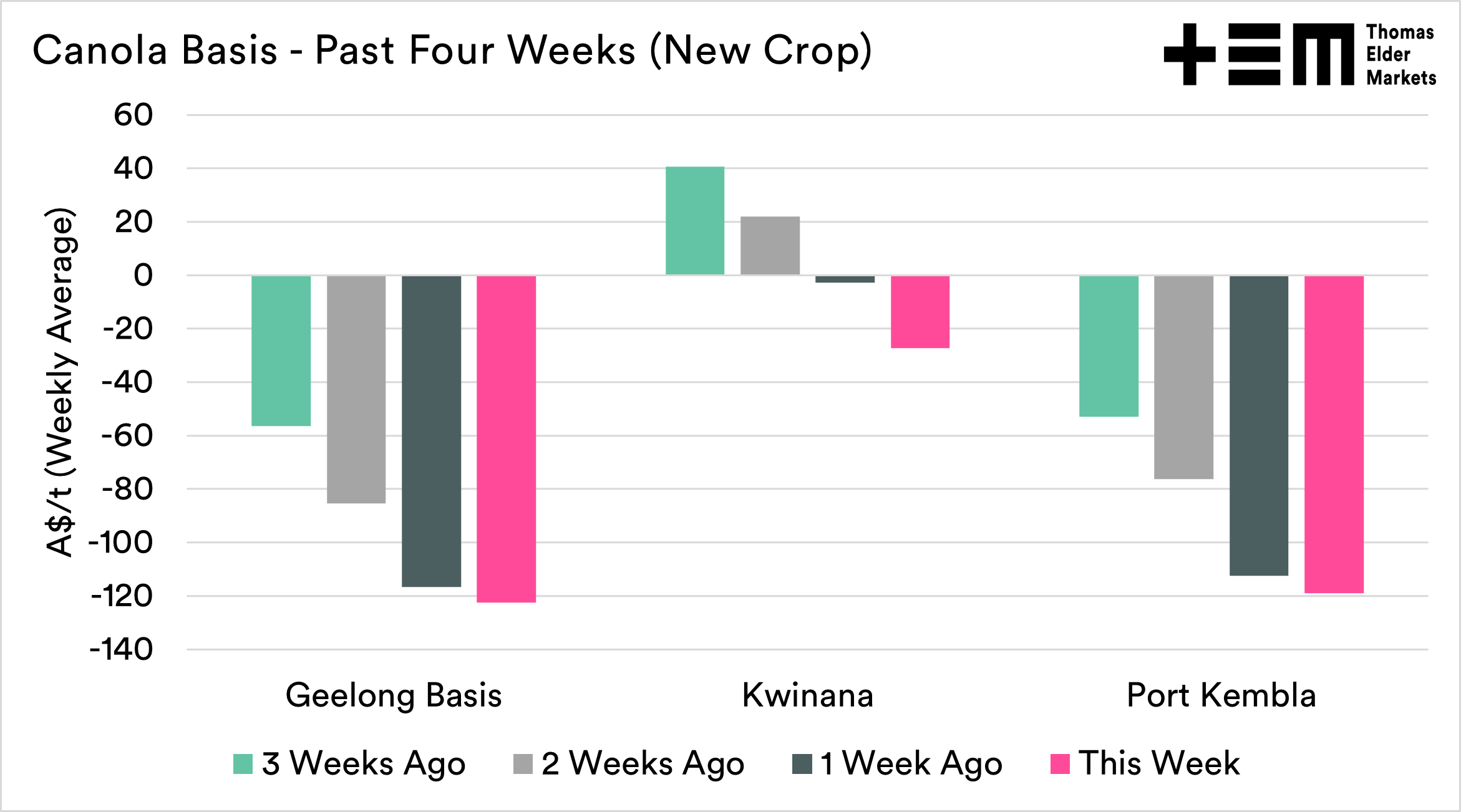

The charts in this report are all the weekly averages, so they won’t reflect a particular day but the average of the week as we look towards trends. In this update, we will focus on three zones, Kwinana, Geelong and Port Kembla, as they give a reasonable spread around the country. We may add more in the following updates.

If forward selling, remember that you are replacing price risk with production risk. Be mindful of this when allocating volumes.

Remember to sign up to make sure you don’t miss any of our updates, these are free to access. If you want to support this service, remember to share with your network.

Wheat

Another week, another rise. December wheat futures hit A$572 this morning, a contract high and a hefty A$25 higher than the previous close.

The big news this week, India, expected by many (not me) to be the saviour of wheat with large exports, has been hit by a heatwave, which has taken some spice out of their expectations. India will now need to balance its export intentions against the requirement to feed its population.

At a local level, we have started to see pretty strong gains, especially in Victoria, which had been lagging behind. The country is trading above A$400 across the country for new crop. An improvement in basis levels in Australia is occurring but still remains at large discounts for the new season.

The market overall remains very strong for growers.

Canola

It’s been an interesting week for canola. In the futures market, we have seen a lot of bouncing around, with the market losing ground at the start of the week and finding some relief overnight. At the moment, ICE (Canada) futures for our harvest are trading at A$1194, and Matif (France) are at A$1244.

As the current lockdown endures, there have been concerns that a slowdown in the Chinese economy will cause a drop in demand for beans. The Argentinian soybean harvest progresses well with good harvesting conditions and a slightly higher yield than previous expectations.

One of the big drivers for the oilseed market will be the macro market, especially crude oil. There is a strong relationship between veg oils and crude. This week we have seen the EU move to an effective ban on Russian crude oil. This has helped the crude oil market rise (US$109).

After weeks of consecutive rises at a local level, we saw a downward movement, albeit still remaining at very strong levels. The reality is that there is little liquidity, with few growers selling.

The downward movement in local pricing saw basis levels lose ground. Although most farmers are not necessarily concerned, their flat price remains strong overall.