Grain Prices: Wheat and Canola Crash.

Pricing Update

As we move throughout the year, we will be focusing on the new crop more and more, and so on a weekly basis, we will be putting an update on what is happening in the local market, with a focus on being quick to read.

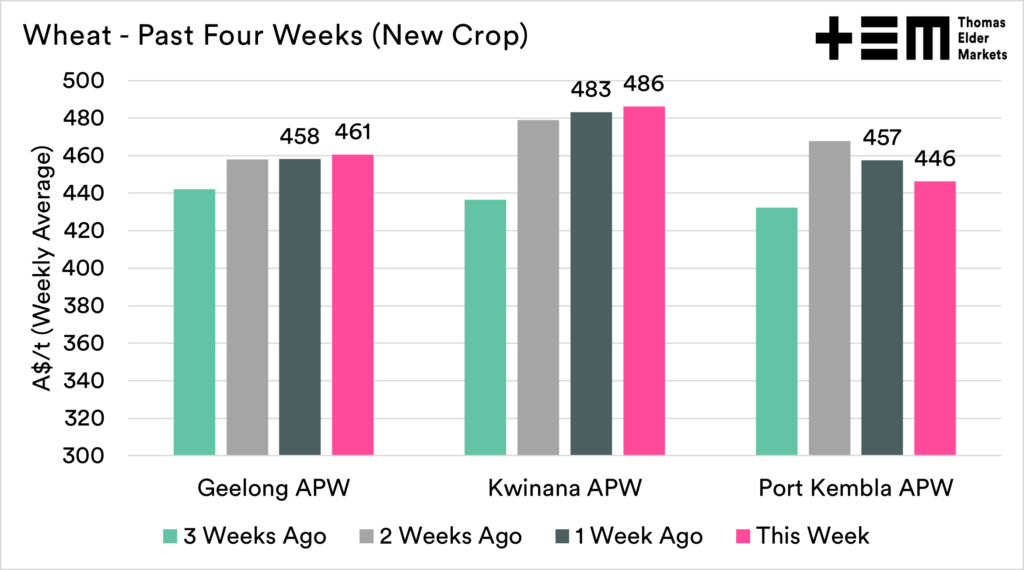

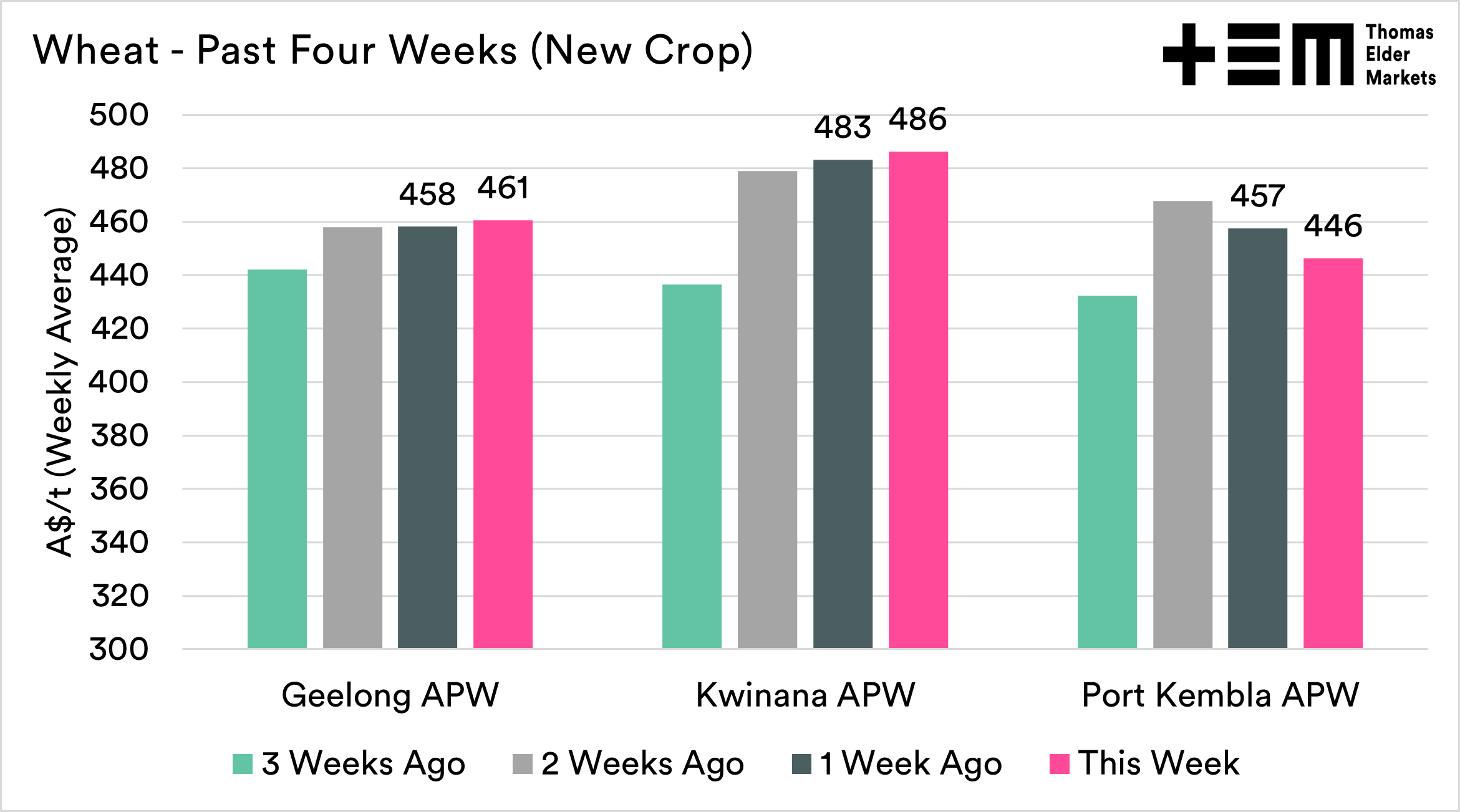

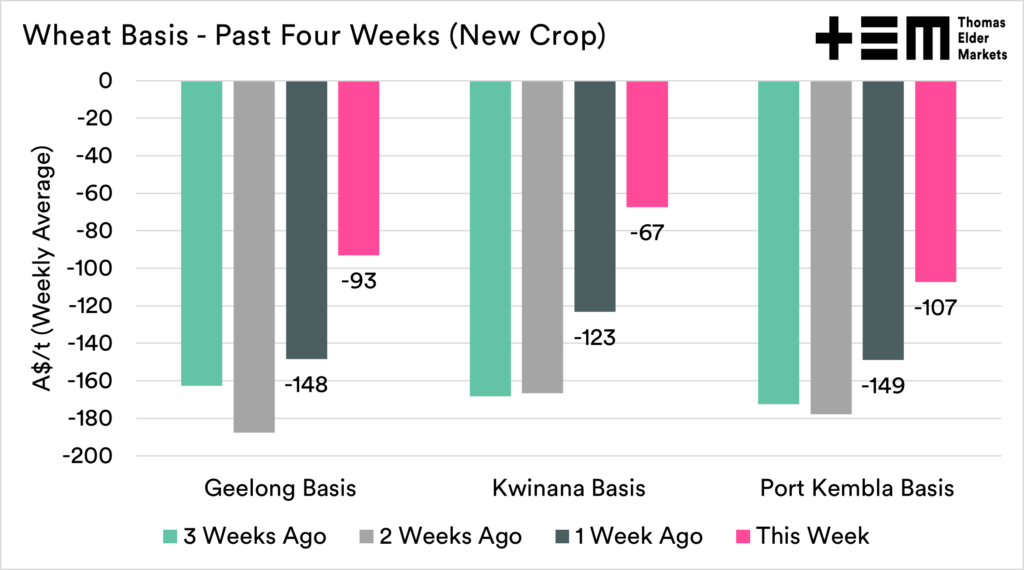

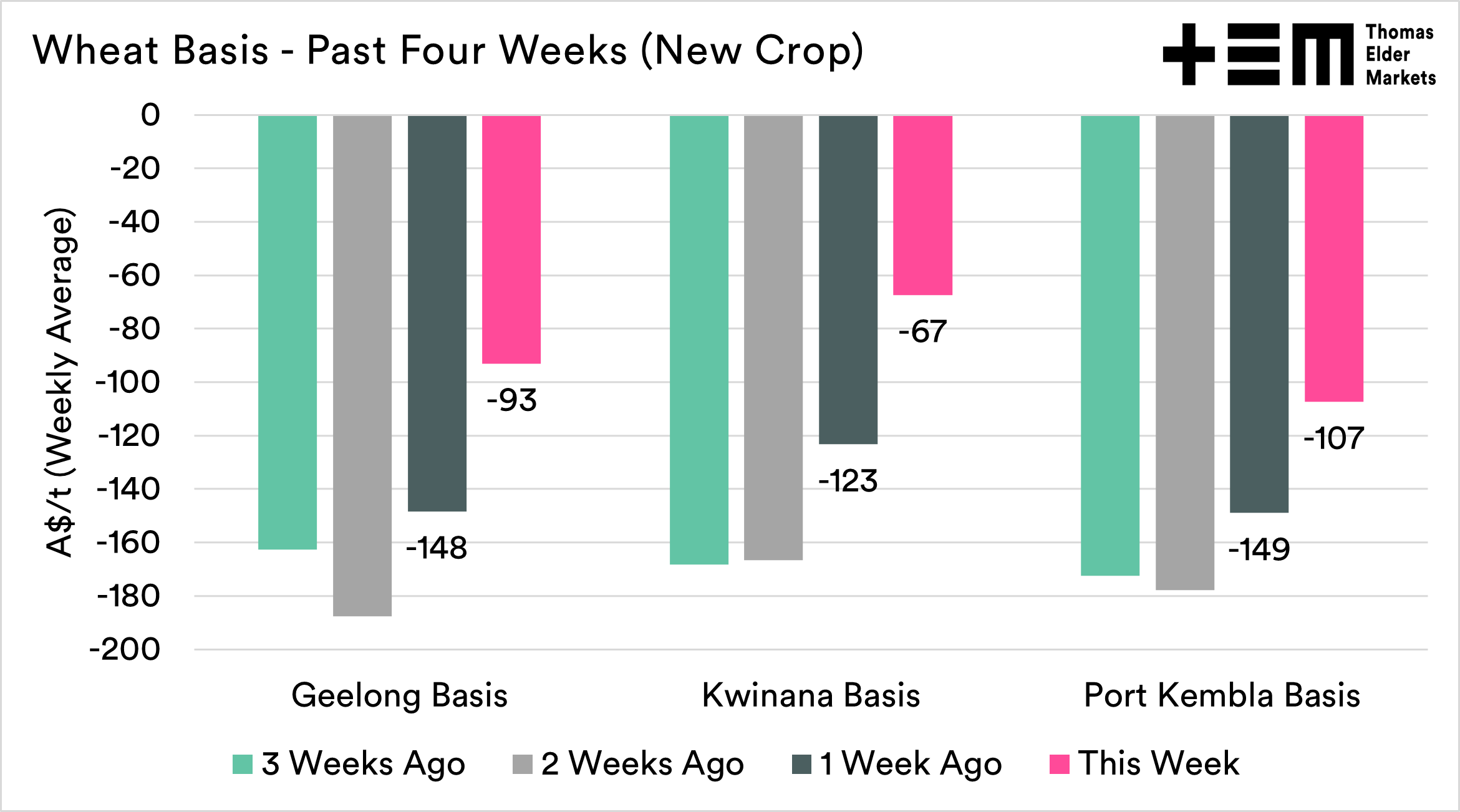

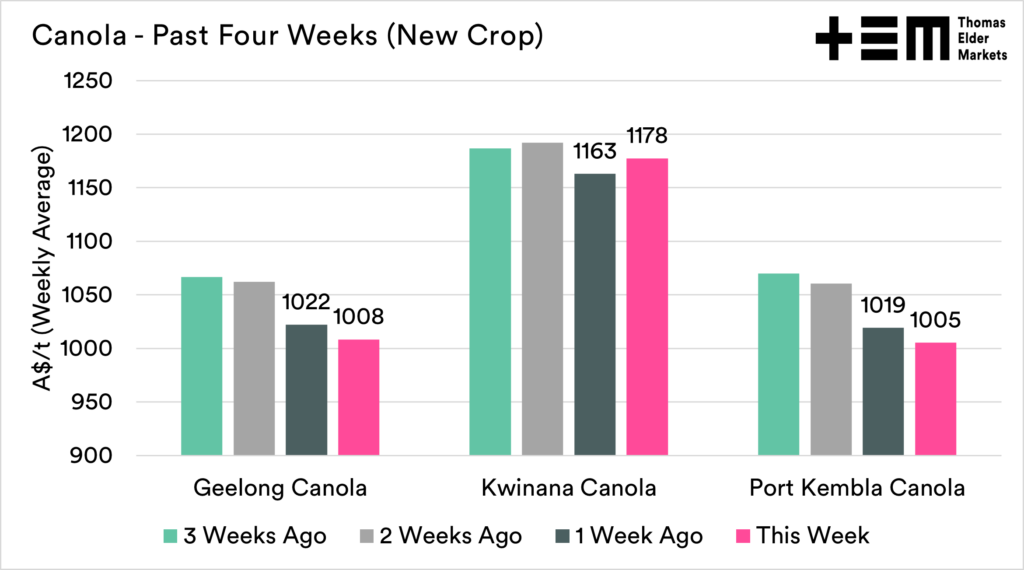

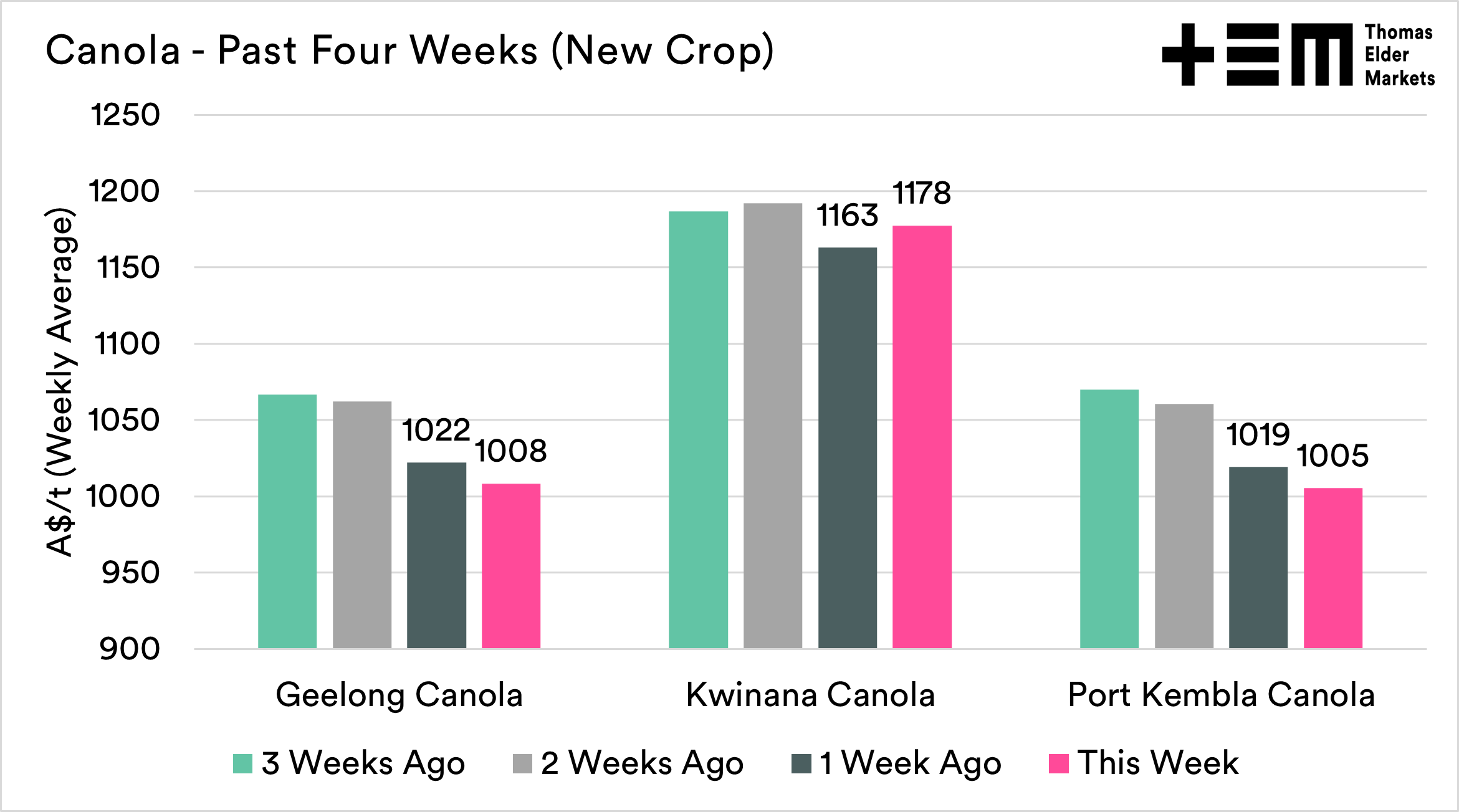

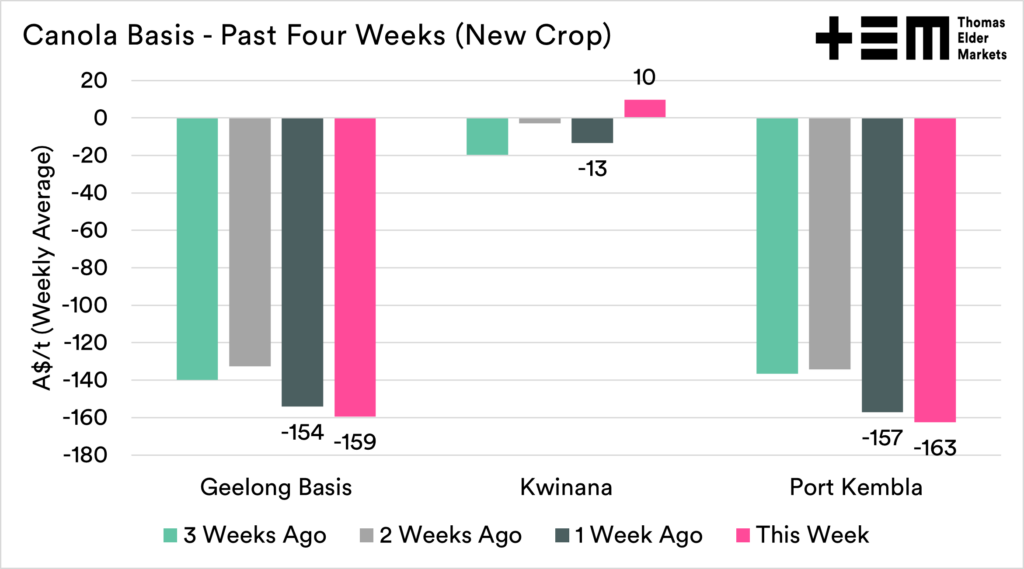

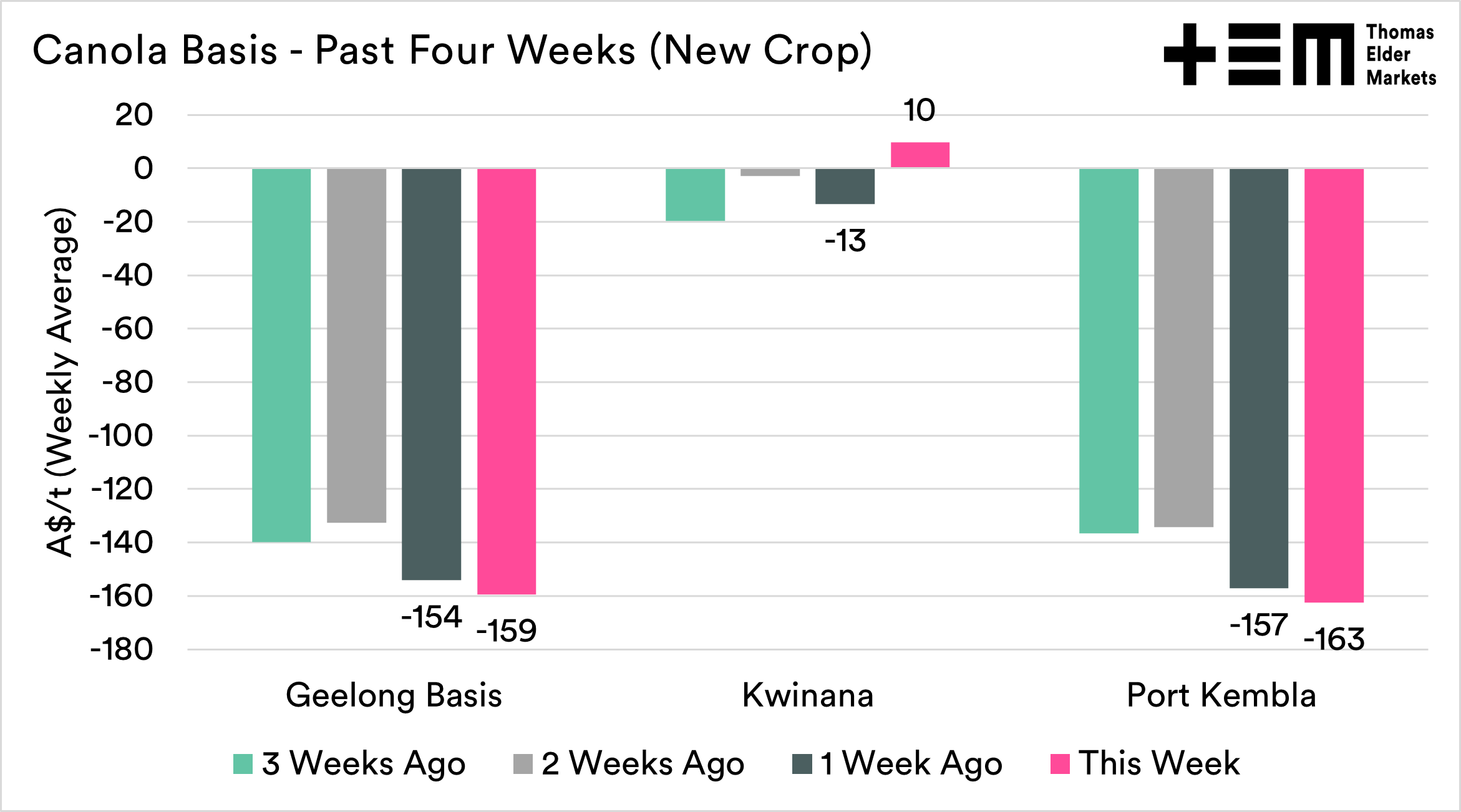

The charts in this report are all the weekly averages, so they won’t reflect a particular day but the average of the week as we look towards trends. In this update, we will focus on three zones, Kwinana, Geelong and Port Kembla, as they give a reasonable spread around the country. We may add more in the following updates.

If forward selling, remember that you are replacing price risk with production risk. Be mindful of this when allocating volumes.

Remember to sign up to make sure you don’t miss any of our updates, these are free to access. If you want to support this service, remember to share with your network.

Wheat

The wheat market took a shellacking this week, at least overseas. At the end of last week, Chicago wheat futures were at A$602/mt for December, at the time of writing they are at A$549/mt.

On Tuesday, after the American memorial day holiday, the price fell A$35 in one session. This is a huge fall and is the 7th largest daily decline (in A$ terms) since 2000.

What was driving it? The big driver is the ‘will he, won’t he’ in reference to the opening of the Ukrainian grain ports. There were comments that constructive talks had occurred with Russia.

Since this conflict started, the only major bearish factor in the wheat marketplace has been a potential opening of Ukraine. We will see if this occurs.

In weather news, beneficial rainfall is expected in Europe and parts of the United States. This will potentially reverse some of the downgrades in recent times, but at the minimum is likely to stop hold further downgrades at bay for a while.

At a local level, prices remained relatively unchanged. The downward movement in futures saw our basis levels massively improve.

Canola

Canola/rapeseed has also come under pressure in the past week. For the contracts corresponding closest with our harvest, Matif is down A$76/mt to A$1154 and ICE is down A$33 to A$1148.

In Canada, Saskatchewan, the largest canola producer, has seen improvements which are removing concerns about the canola crop (see here). Whilst conditions were dry, they improved through recent weeks, with rainfall hampering seeding in places.

Conditions for canola are expected to be good. The weather is expected to be cooler this summer, in contrast with last year’s heat waves.

At a local level, Kwinana experienced some light strength, but the eastern states came under pressure. The basis levels to ICE saw Victoria and NSW fall to a larger discount for new crop, with a move to a premium in WA.