Grainstop: The big short

The Snapshot

- Grainstop shares were driven into the atmosphere by retail investors purchasing shares. They then held onto these shares and stopped selling.

- This caused speculators who bet on a fall in price to attempt to buy shares to close their positions, causing a spectacular rise.

- In theory, this could happen in the grain market.

- It is however highly unlikely to happen to anywhere near the extent of Gamestop.

- Locally it is not unusual to find a buyer who is short of grain to load a vessel. This can result in short term spikes in price.

- This spike in prices could theoretically be supercharged by growers collectively holding off on selling.

I spent the last week on the Eyre Peninsula, conducting workshops to growers grain markets. These are free events open to all South Australian grain producers courtesy of GPSA, with another four to be held later on in the week (register here).

The most common question I received during the breaks was explaining what happened with Gamestop, and whether this was possible in the grain market.

One of the best explanations is actually by Gamestop (see here), which I recommend reading to get more details.

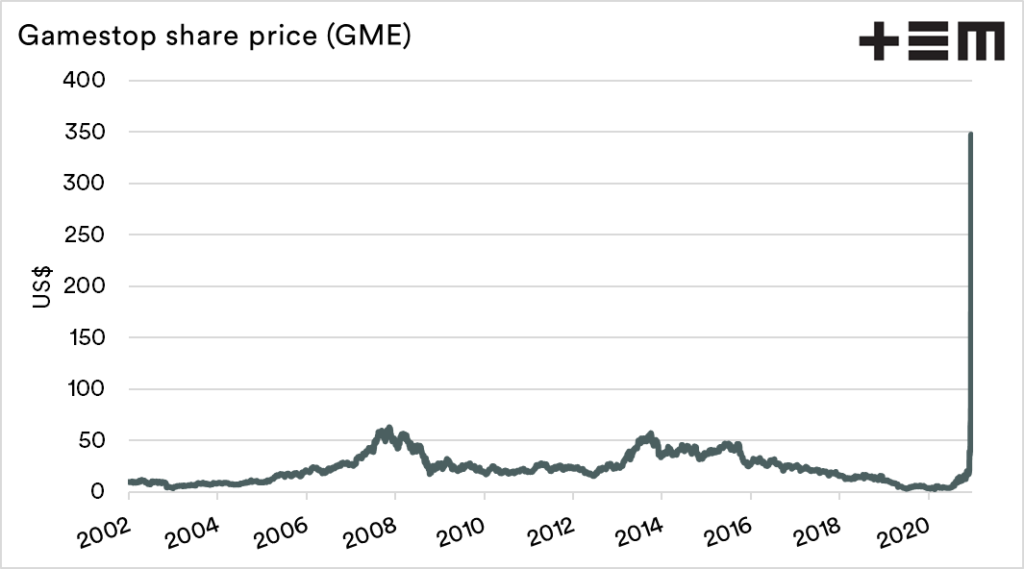

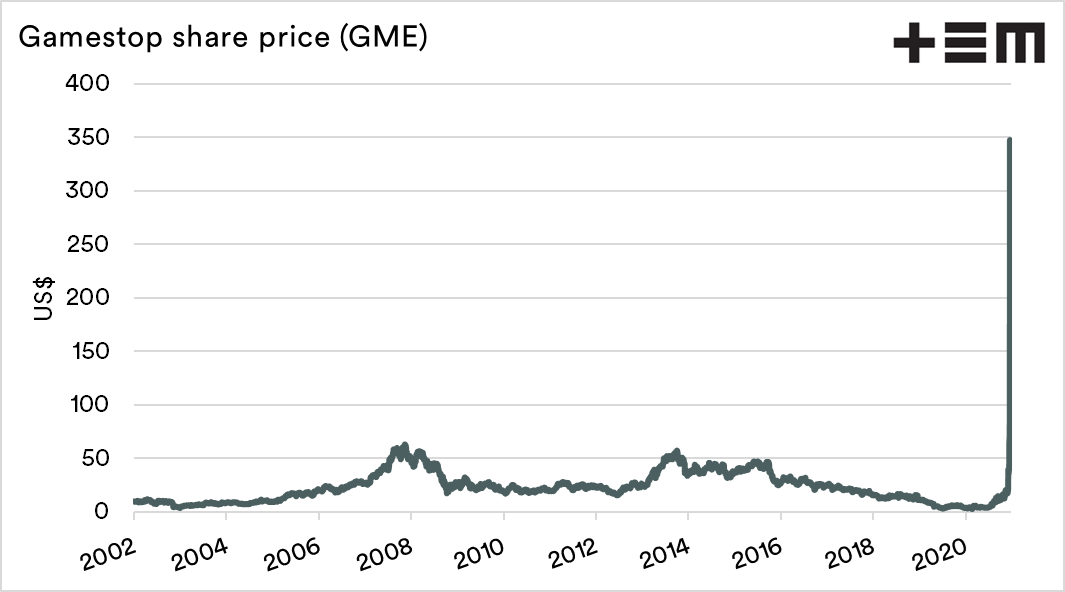

At it’s most basic, a short squeeze is where an asset increases in value rapidly. The increase in value forces those betting on the price dropping to buy back their positions to stem further losses. In the case of Gamespot, many retail buyers had purchased shares and were unwilling to sell – forcing the share price up and up.

So why am I sitting here discussing a poorly performing video game retail store? The big question is whether this would be possible in the grain market.

Is this possible in grain?

The answer is yes, at least in theory.

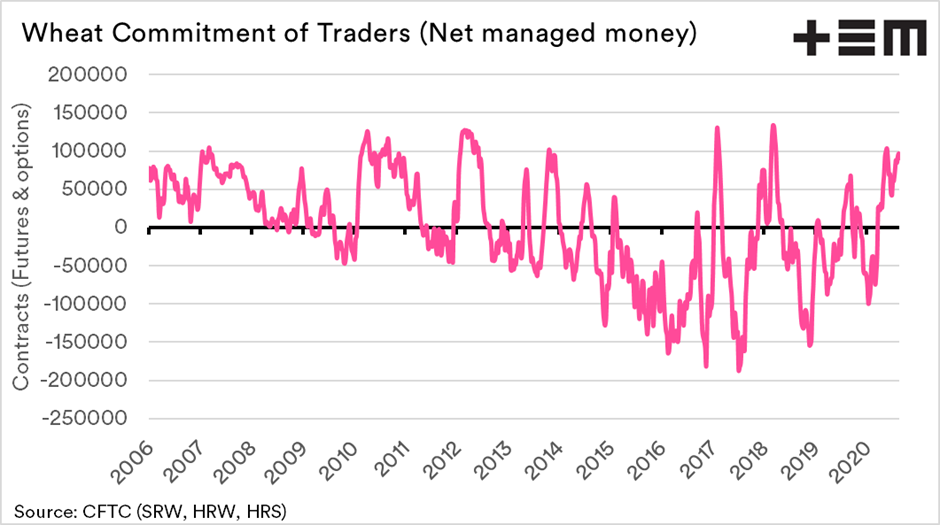

The wheat market can be played in the same way as the recent ‘Reddit surge’. The market operates in much the same way as the equity market. If speculators were heavily short wheat, then a price rise could be exacerbated by speculators looking to exit their positions.

It is important to note that this is theoretical. I am doubtful that this would be likely to happen, as the wheat market is not necessarily easy for retail investors with a $600 stimulus cheque to access. Another reason is that Gamestop shares were one of the most heavily shorted equities in the share market.

At the moment the speculators in the wheat market are heavily long, so don’t expect a short squeeze any time soon.

Whilst I think it is heavily unlikely (but not impossible) for this to occur in the wheat futures market, a localised variant can occur.

Example of local ‘short squeeze’

The ability to ‘squeeze’ a short is entirely possible in the Australian grain market, and here is an example.

Let’s say that it is November and a buyer has booked a vessel of 60kmt out of port X for the last week of the month. They currently have 20kmt in their possession.

The boat must be loaded as if not they may be hit with port fees, demurrage and costs for not using a shipping slot.

If growers hold off on selling, the buyer has to bid higher to gain access to the grain required. In reality, this does happen to an extent around Australia.

This rise could be exacerbated if growers held off selling en-masse similar to the Reddit retail investors.

What are the risks?

- Suppose you are collaborating with other farmers to cause a price spike. In that case, this can potentially be considered price-fixing, although check with a lawyer.

- Timing is everything. It would be essential to determine the straw which breaks the camels back. If the price rises too far, then the buyer should hold off.

In reality, this article is a bit of a thought exercise. We often see periods at a local level where buyers are short, which causes short term spikes in pricing levels. Whether this can be supercharged is an interesting proposition.