Market Morsel: Good Canola Prices for next harvest?

Market Morsel

Farmers throughout Australia are pretty happy with the current outlook for pricing, especially canola. A stand-out performer in 2021, prices are high again for the coming harvest or are they?

One of the things you will often hear us talking about is the relative value. When we talk about this, we want to see how the prices you receive compared to another value, whether a futures market or an overseas competitor.

The purpose of this is to indicate whether the price is truly good or not. A price that you receive from a buyer may on paper look good, but in reality, it could be heavily discounted to the rest of the world.

So what about Canola? At the moment, the price on offer from buyers for the coming harvest is attractive. As an example, Kwinana is A$1020, Geelong A$958 and Port Kembla A$960. These are historically attractive levels and to most would be considered a good price – but are they?

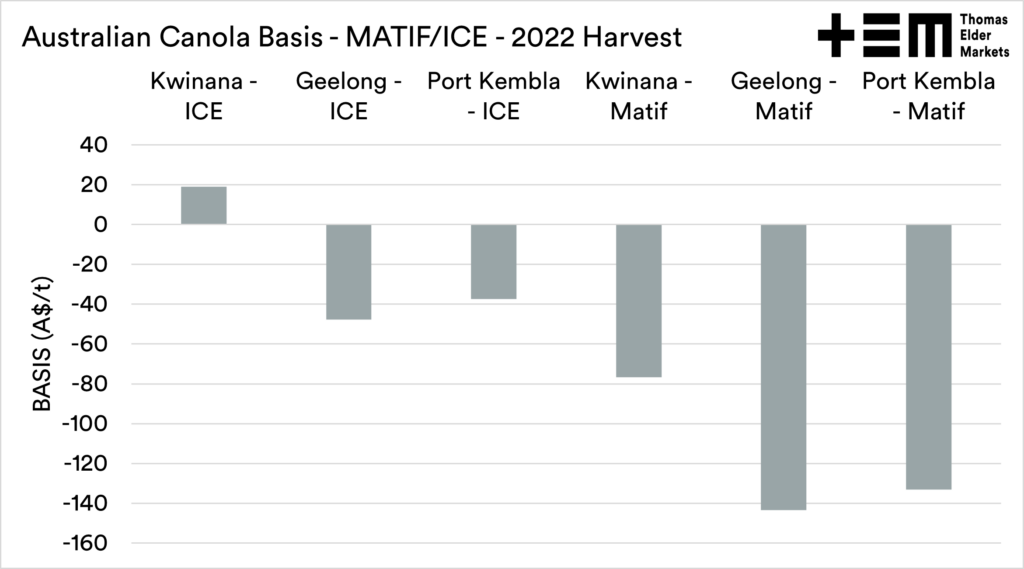

The chart below shows the basis (premium or discount) between Australian prices and the main canola futures exchanges. These are ICE (Canada) and Matif (France). These are for the comparable pricing points for the 2022 harvest. Australia would generally hold a premium over ICE and a discount to Matif.

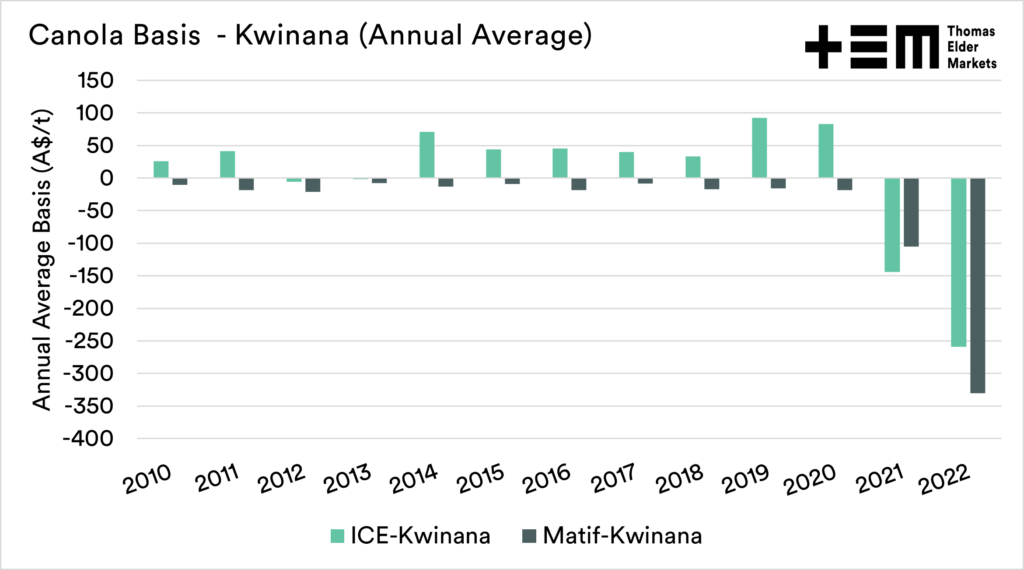

The basis levels in Australia for the past year have been at extreme discounts, as can be seen in the second chart. The basis level are much better than they are for old crop. The basis to ICE canola is still at a negative for Geelong/Port Kembla. Still, it is moving back into positive for Kwinana. The Matif discount is also a lot steeper than typical but improved on the past year.

So in summary, values on offer for new crop are at attractive levels from a flat price point of view, but also relative to overseas are better than they have been this harvest. The prices on offer are good; it is just the production risk that you need to worry about.