Ho hum sorghum

The Snapshot

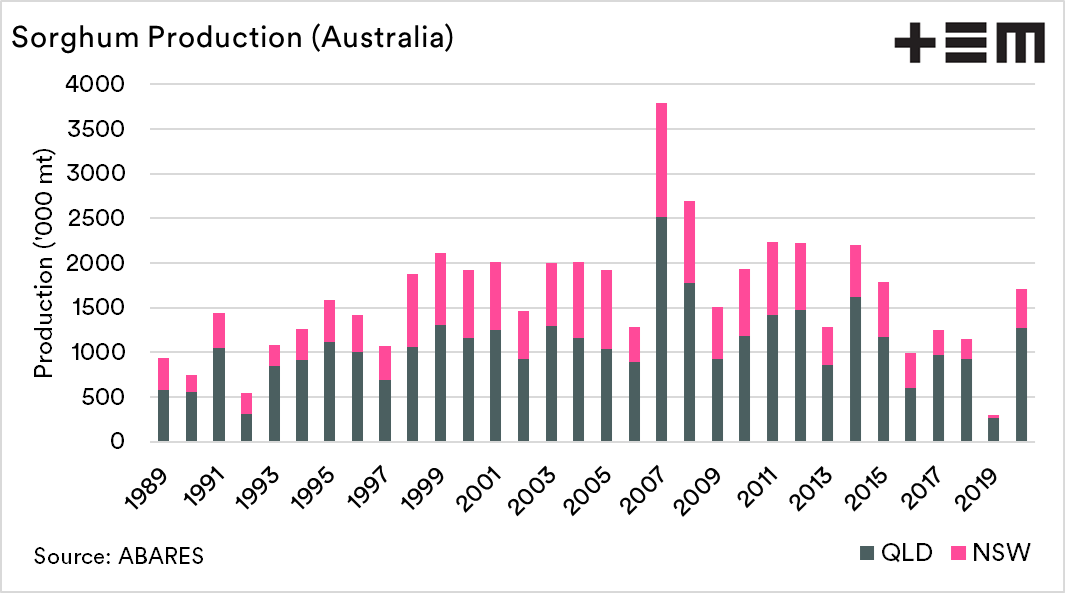

- The Australian sorghum crop is forecast at 1.7mmt, with 430kmt from NSW and 1.3mt from Queensland.

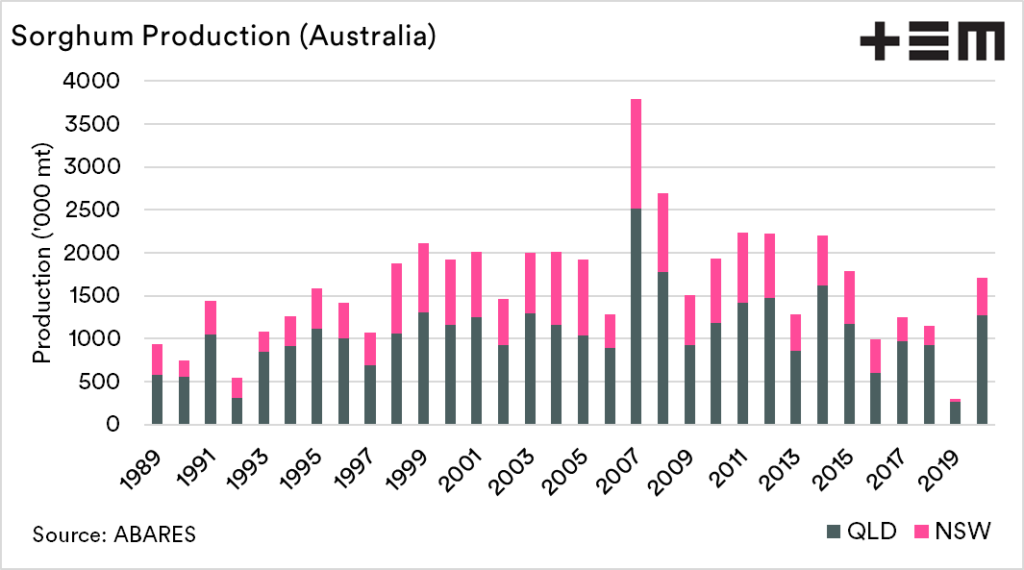

- Last years crop was a measly 296kmt, and the long term average is 1.5mmt.

- Prices in recent years were inflated due to drought conditions.

- Currently, prices remain above the long term average.

- There may be pressure on prices when sorghum starts to come off the header and is added to the already ample supplies of cereals on the east coast.

- China is likely to remain a strong buyer of sorghum this year.

- Will China buy from Australia, or will they preference sorghum (or corn) from US sources to meet phase 1 deal obligations?

The Detail

In this article, I will delve into the production and price of the coming summer crop. I will also look into our export opportunity and the risk of China.

The majority of Australian sorghum is grown in northern New South Wales and southern Queensland. Last year was a shocker in terms of production, with only 296kmt grown, versus forecasts for this year of 1.7mmt. The average for 2010 to 2019 was 1.5mmt.

The rain forecast for the next eight days is expected to drop large downpours which will give some surety to the crop, and if continued will raise expectations.

So what about price?

Low supply, high prices and vice versa. Farmers know more than most the reality of supply and demand. Sorghum is no different. The massive winter crop, along with the coming sorghum harvest has had a negative impact on pricing.

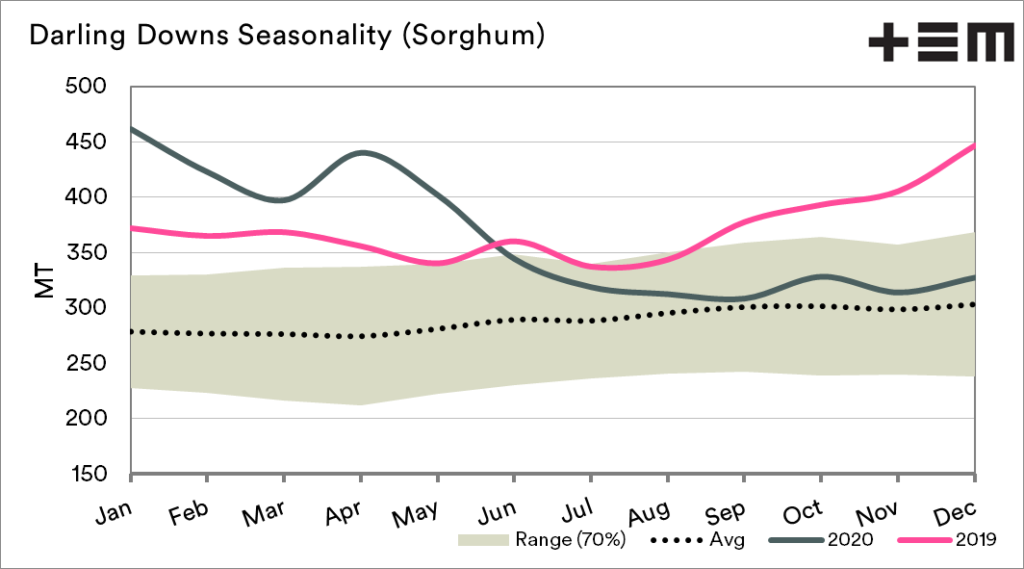

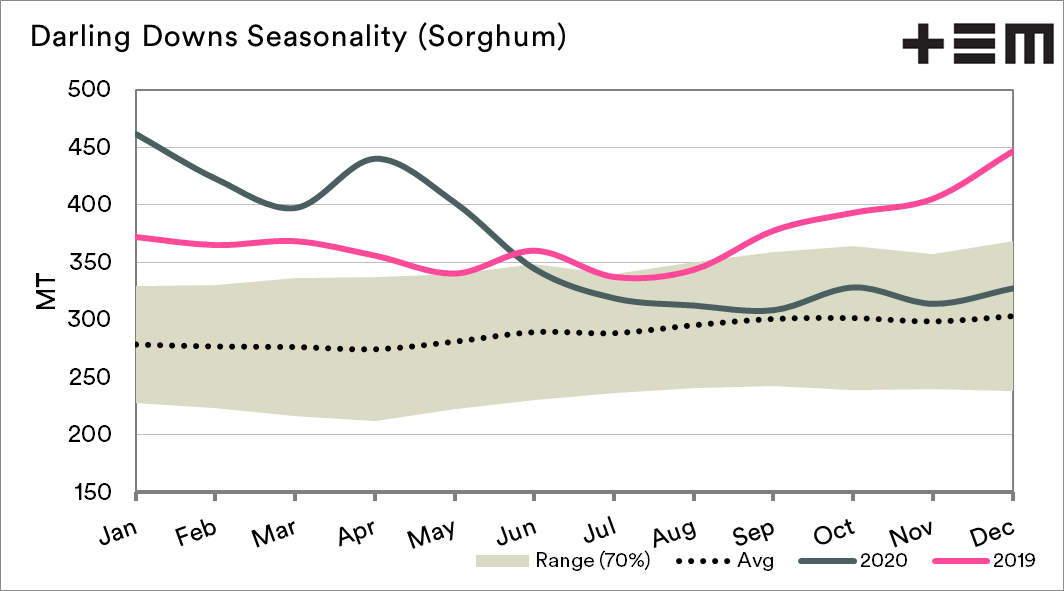

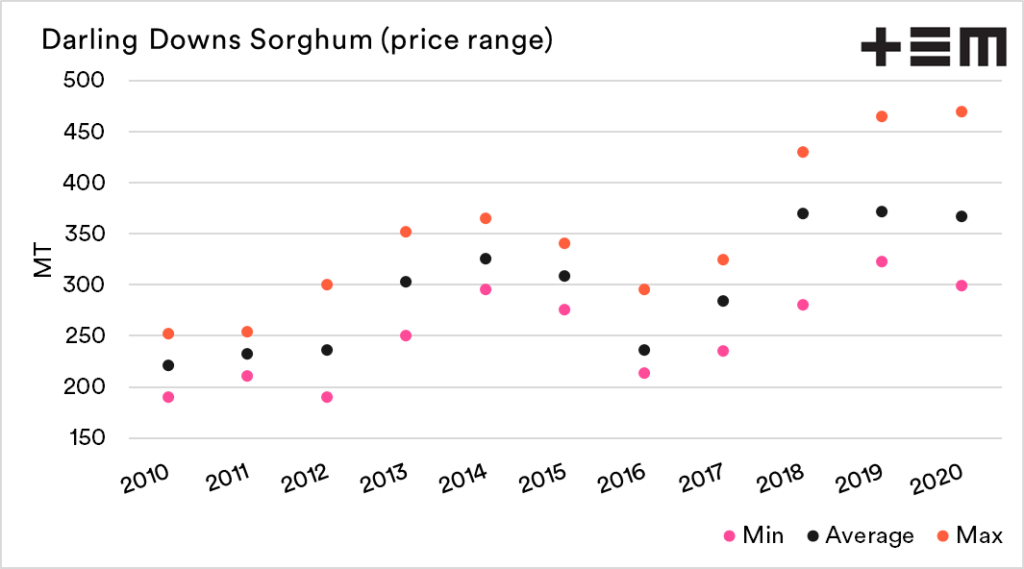

During the past two years, pricing was well above the long term average due to the scarcity of feed supply. In recent months prices have trended down towards, but remaining above the long term average.

The pricing levels are low compared to recent years, but they are remaining stronger than the previous healthy production year of 2016. It is important to note that prices could come under some pressure in the coming months when the sorghum crop starts adding to the physical supply of feed.

It may be advisable to consider fixing some pricing at these levels, as they do still remain reasonably strong.

The good and the bad.

Sorghum has mostly been domestically focused in recent years. This year we are likely looking towards the export market. Regular readers will be aware that Chinese imports of grains are on the up (see here).

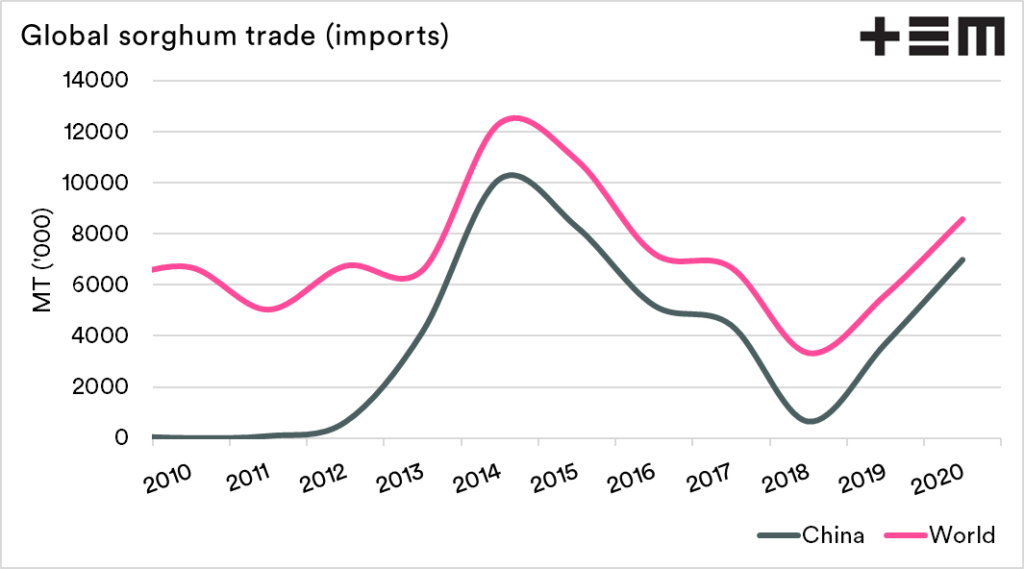

The chart below shows the global imports of sorghum along with Chinese import levels. For most of the past decade, China has been the worlds largest importer of sorghum. They will likely import substantial volumes of sorghum at levels eclipsing our 1.7mmt production.

Whilst our relationship has soured with China, there has been no mention of any action against the sorghum crop.

On the other hand, China still needs to meet it’s phase 1 obligations with the US, which may encourage more US sorghum or corn to fulfil their needs.

China as a customer

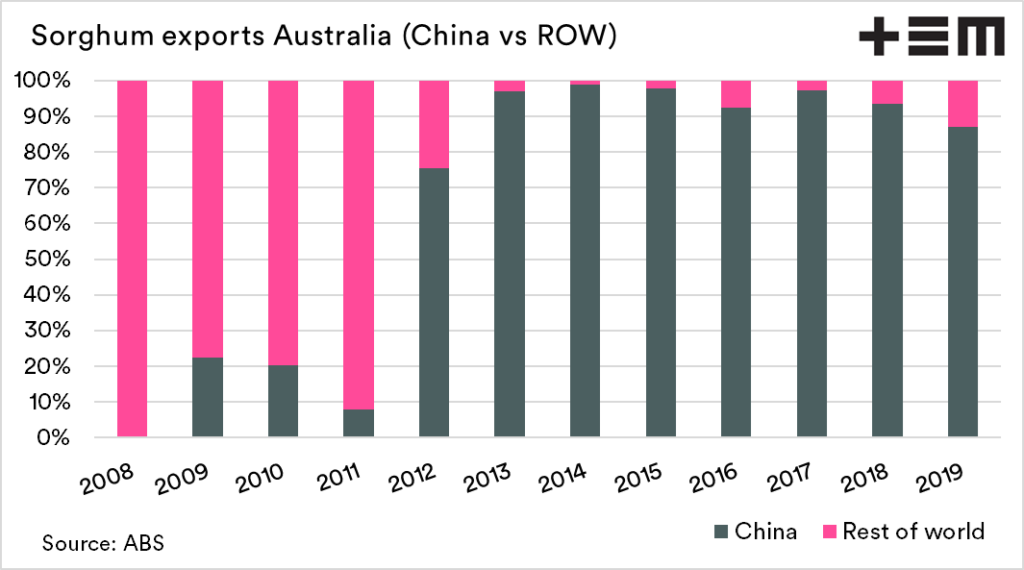

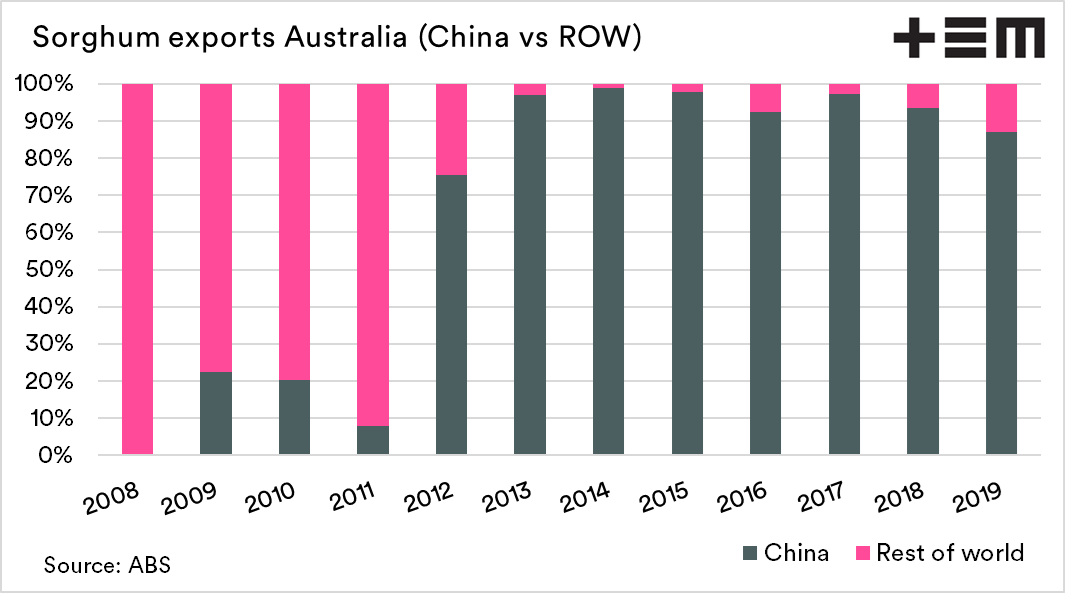

China has been a significant customer for Australian sorghum during the past decade, and since 2012 have taken the lion share of sorghum exports.

If China were to target another commodity on which we had for a long time being reliant upon them, then sorghum would be an obvious choice. As mentioned in the previous section, China could source from the US with ease, and it would assist in its trade deal with the US.