How does GrainCorp’s drought protection stack up?

The Snapshot

- To protect against drought, GrainCorp took out weather insurance during the recent drought.

- If production drops below 15.3mmt, then GrainCorp will be paid A$15/mt up to a cap of A$80m.

- If production rises above 19.3mmt, then GrainCorp will pay A$15/mt to the insurer up to a cap of A$70m.

- It is expected that GrainCorp will be a yearly contract fee of under A$10m.

- Since 2010, the insurance policy would only have paid out to GrainCorp during 2018 & 2019.

- Conversely, GrainCorp would have paid the insurer for overproduction in 2010, 2011, 2012, 2016 & 2020.

- During that period, GrainCorp would have paid A$258m (ex annual fees), and the insurer would have paid A$136.5m

The Detail

In the middle of the recent drought, farmers weren’t only impacted; it was the entire supply chain. One example of a sector that struggles during drought is grain storage and handling companies. The largest on the east coast, GrainCorp, came up with an insurance solution to solve the cash flow problems of drought.

I came across an article on this policy over the weekend. It got me thinking about how it would have performed historically and whether it was a good or bad policy.

What was the policy?

GrainCorp entered into an insurance policy that covered the company for ten years. The policy intends to smooth out the rough years.

The agreement was on a payout structure based on the volume of grain produced during the winter crop in NSW, VIC and QLD. The data point used to determine the volume was the independent government forecaster ABARES.

The policy has a strike level of 15.3mmt. If winter crop production declined below this level, A$15/mt would be payable to GrainCorp, up to a maximum of A$80m.

In a bountiful year, where winter crop production exceeds 19.3mmt, GrainCorp pays the insurer A$15, up to a cap of A$70m. It is reported that the annual fee for this service is around A$10m.

The agreement limits both parties to pay out a maximum of A$270m over the ten-year policy.

So how would it have worked?

Past performance is not an indicator of future performance, however, those who do not learn from the past are set to repeat it. Therefore, it is worth taking a look at how this policy would have paid out if taken out at an earlier date.

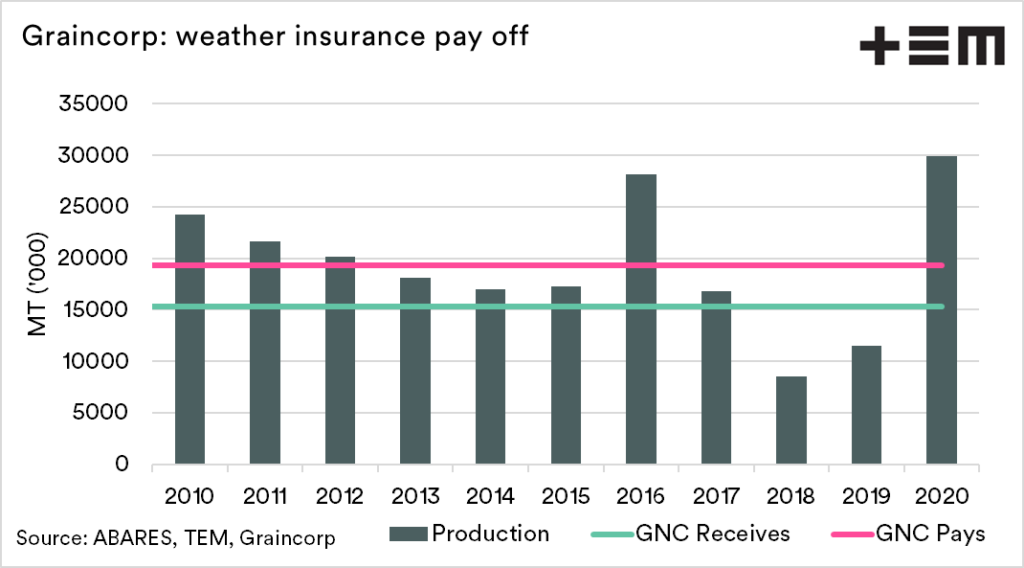

The chart below shows the past ten years of grain production for NSW, VIC and QLD, along with the strike level for payout and payment for GrainCorp.

If this policy had been taken out in 2010, GrainCorp would only have received a payment in 2018 & 2019. These were the only two years where production was below 15.3mmt. These years would have paid A$15/mt to GrainCorp up to a cap of A$80m.

Conversely, GrainCorp would have breached the upper production cap on five occasions (2010, 2011, 2012, 2016 & 2020) and would have paid A$15/mt to the insurer, up to a cap of A$70m.

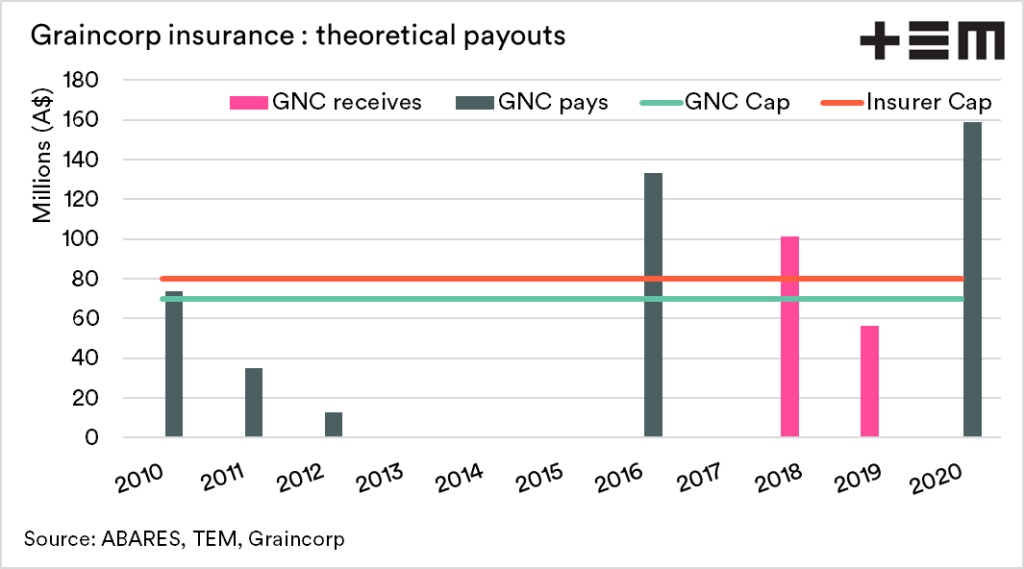

Based on the seasons from 2010 to the present, GrainCorp would have received A$136.5m; during the same period, it would have paid out A$258m. This does not include the approximate A$10m per annum contract cost.

Is it a good or bad deal?

In the years of significant deficit, such as during 2018 and 2019, the insurance would help shore up the finances as they would receive a cash injection. It is, however, at the expense of an annual fee for the insurance policy, plus payments when production is strong.

If the climate is getting drier and production starts to wane, then this insurance policy will be fantastic. If the period under insurance turns out to much like the past ten years, it will be in the insurer’s favour.

It will all depend on the climate and any increases in productivity in the coming years.

It is much like any insurance; you have to pay to get some surety. In this case, GrainCorp is protecting against the horrible years, but in the good years, they will be paying up.

It is important to note that during the years of surplus production, GrainCorp receivals will generally be higher, barring competing storage networks or increasing on-farm storage. The likelihood is that income will be substantially higher in the years that they have to pay the insurer.

If the insurance provides comfort to GrainCorp and its shareholders, then it has won. Still, insurance companies are there to profit and don’t provide protection without covering their backs.