Is China or Europe the trade threat in grains?

The Snapshot

- It is looking likely that our barley trade with China will be back on in the coming months.

- We were heavily reliant on China as a trade partner with 39% of our barley being destined for China.

- Our trade of Canola is heavily skewed to Europe at 73% of our trade.

- Europe is a risk, not for now, but for the end of the decade.

- Germany may reduce their use of crop-based biofuels, with proposals for 0% by 2030.

- The Farm to Fork policy due to be complete at the end of the decade could see exporters to Europe face challenges if they use farming practices not followed in Europe.

- The end of the decade could see a combination of reduced demand for Australian canola in Europe and harder trade access.

The Detail

There are expectations that the Chinese barley tariff will be removed soon. I expect that even if this does occur, it will not have a material impact on old crop prices but will start to see volume from new crop moving to China.

So this is good news, it looks like we might have a resolution. While many believe that the barley tariff had little effect on prices, I do not agree (read here). The price for barley received has been strong but would have been higher had China been available.

Having China back as a market is clearly good news, and I’ll put money down that they will be our largest customer in the coming years. Should we be looking at a threat from further afield?

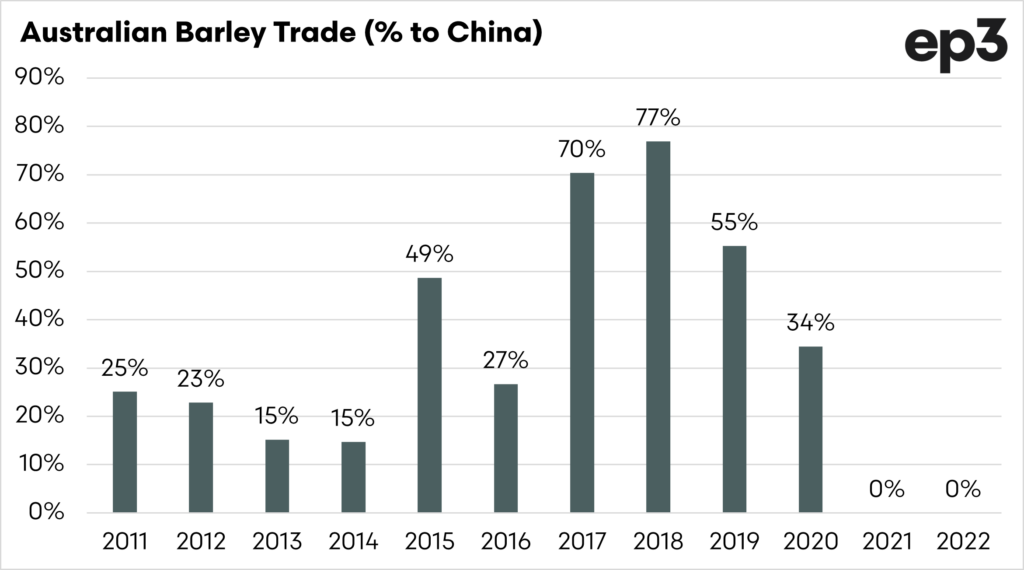

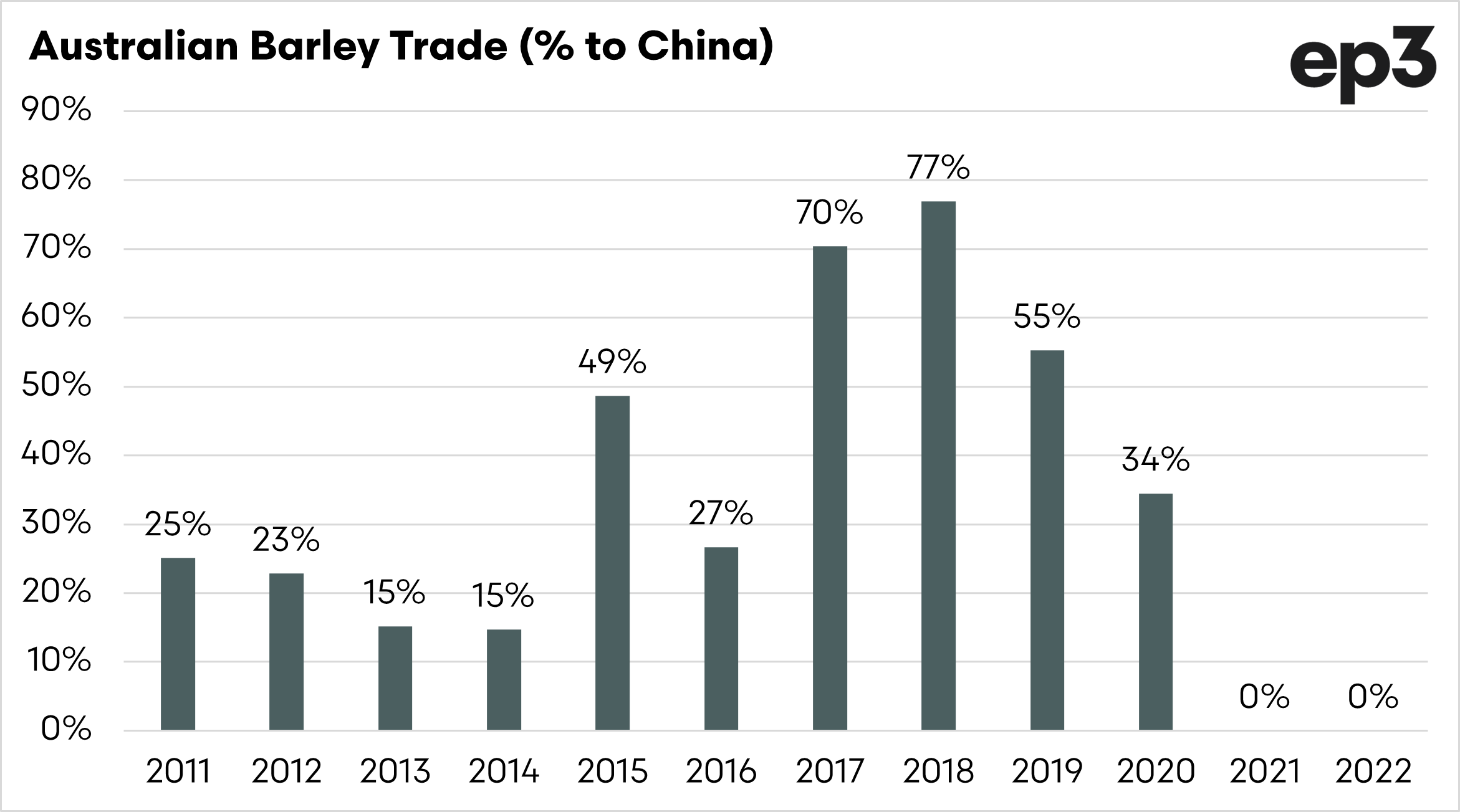

The chart above shows what percentage of our trade of barley was to China. From 2011 to 2020, when the tariff was introduced, an average of 39% of our barley was destined for China.

It was in 2017 and 2018 that our volume went through the roof. This was as a result of the large 2016 crop and the low prices on offer. It was this season that resulted in the tariff being introduced due to the accusations of dumping.

So we relied heavily on China for a large volume of our barley trade. However, it is only relatively recent, since the middle of the last decade.

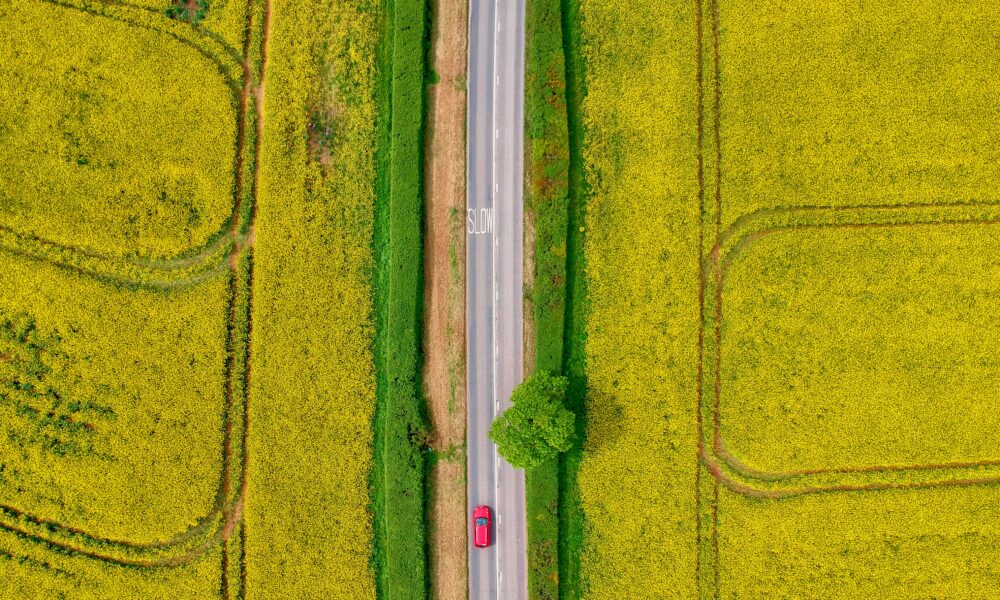

There is another market on which we have a much stronger reliance than barley, China, and that is canola to Europe.

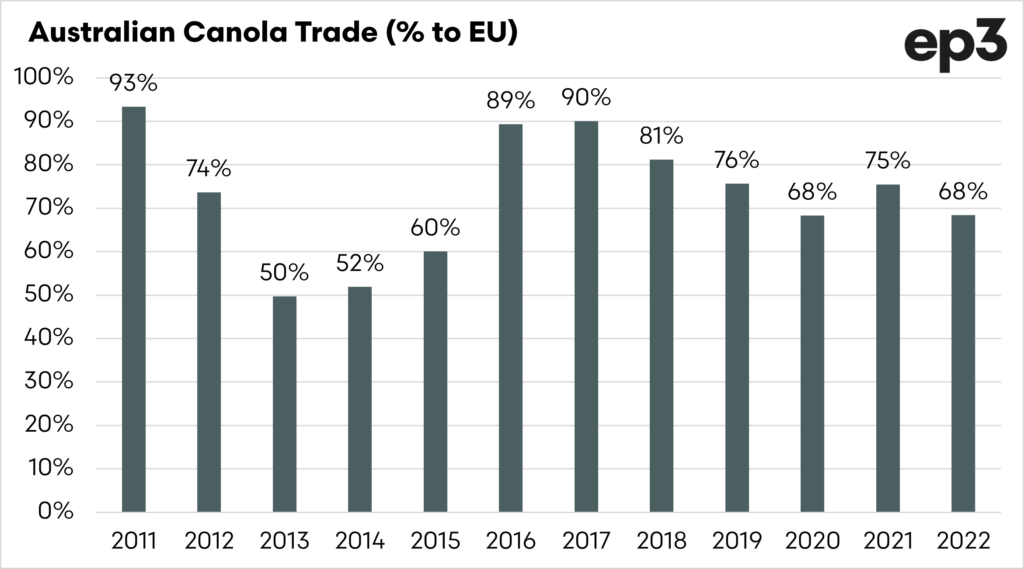

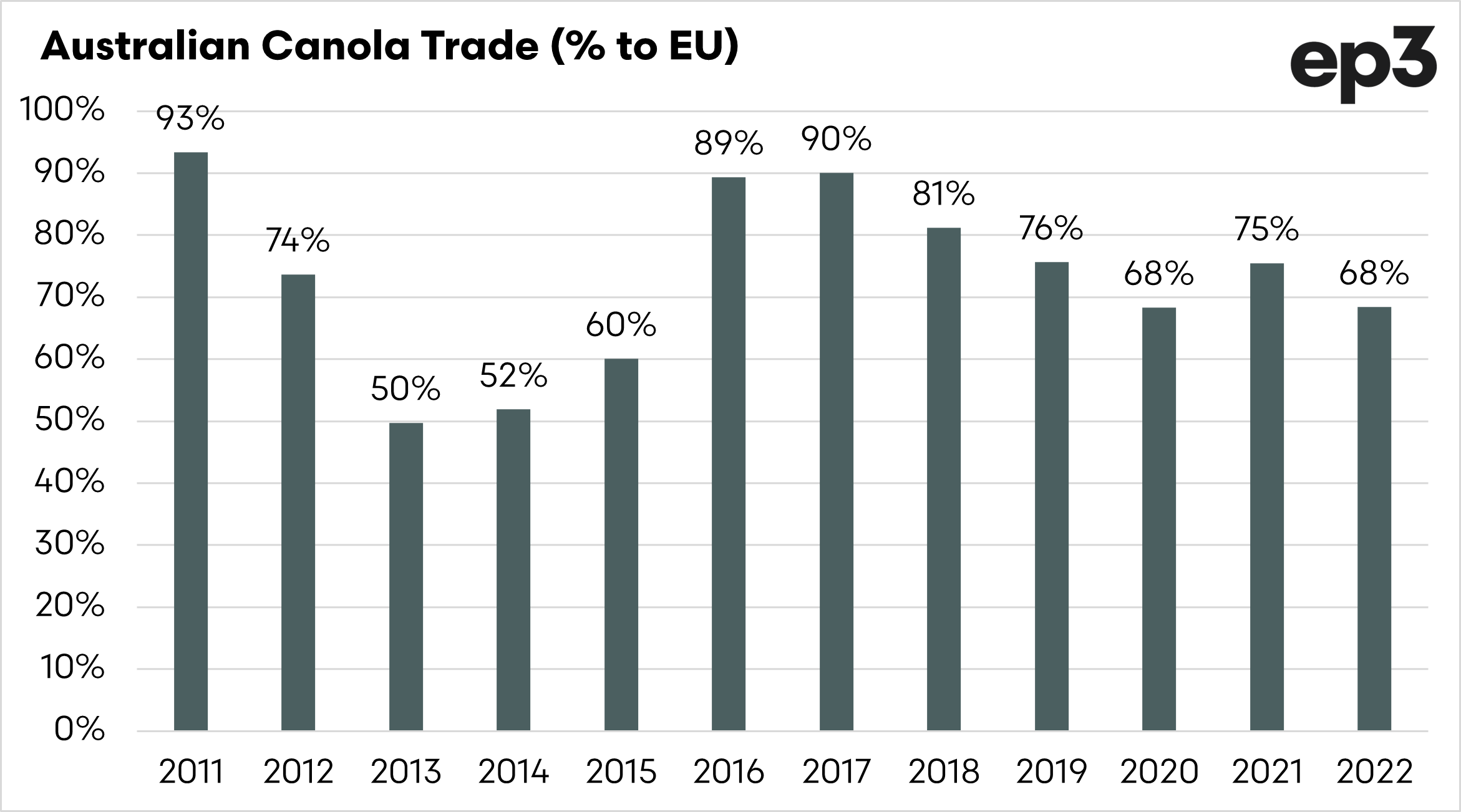

The chart above displays the percentage of our canola which is annually exported to Europe. The average volume in the period 2011 to 2020 is 73%, versus 39% of our barley into China.

This is clearly a significant reliance, and a concern, especially considering the increased importance of canola in our farming enterprises.

Why should we be concerned?

We should always be a little wary of market concentration, but why specifically do I have concerns about Europe and our reliance concerning canola?

I won’t go into a huge amount of detail, but here are some dot points for future discussion:

- Germany, the largest producer of biofuels in Europe, is potentially set to reduce its use of crop-based biofuels, which in Germanies’ case is mainly rape/canola. Reducing year by year until 2030, when none will be included.

- This is still not confirmed and may not make it to law.

- There is not demand for rape/canola oil in EU in such quantities for human consumption.

- The European Government is set to introduce the ‘farm to fork’, which includes provisions for green diplomacy. This is where countries supplying Europe may have to adhere to similar farming practices to those utilised in the EU.

- We have already seen a precursor of this with the recent change to MRLs for Haloxyfop (see here).

- I wouldn’t be surprised to see more chemicals (glyphosate) added to the list.

The regulation changes are set to come into force at the end of this decade, and whilst many in the industry are not focused that far ahead – it will come around quickly.

We heavily rely on Europe for our canola exports, and policy changes could have ramifications for our exports.

We have potentially solved one trade issue, but another is looming for the end of this decade.