Is corn something we should look at for barley pricing?

The Snapshot

- We all know about the different contracts for hedging Australian price risk for wheat and canola (CBOT, MATIF, ICE etc).

- The poor cousin Barley doesn’t tend to get discussed from a hedging point of view.

- Australia has access to a barley futures contract through the ASX.

- The volume is low. The low volume adds a liquidity risk.

- Australian F1 barley has a strong correlation with the ASX wheat contract, enough to generally make it a reasonable tool for hedging barley, with lower liquidity risk.

- Hedging east coast barley for either producers or consumers is relatively easy by using either ASX barley or ASX wheat contracts.

- Hedging barley in Western Australia can be conducted using ASX contracts but requires a little more finesse.

The Detail

If we use futures to manage our grain price, we have multiple options for our wheat (ASX, CBOT, MATIF etc.) and canola (MATIF/ICE). Our second most valuable cereal, barley, seems to be the poor cousin with limited options.

A subscriber sent through a request inquiring about risk management tools for barley, so I thought I would update you on this. If you have areas you’d like us to cover, you can contact us here.

So let’s dive into it. Where can we hedge barley? It’s is both a simple and more complicated question.

Use barley to hedge barley?

Well, it’s pretty obvious; we use barley futures. There is an ASX barley contract that is available and is an Australian based contract.

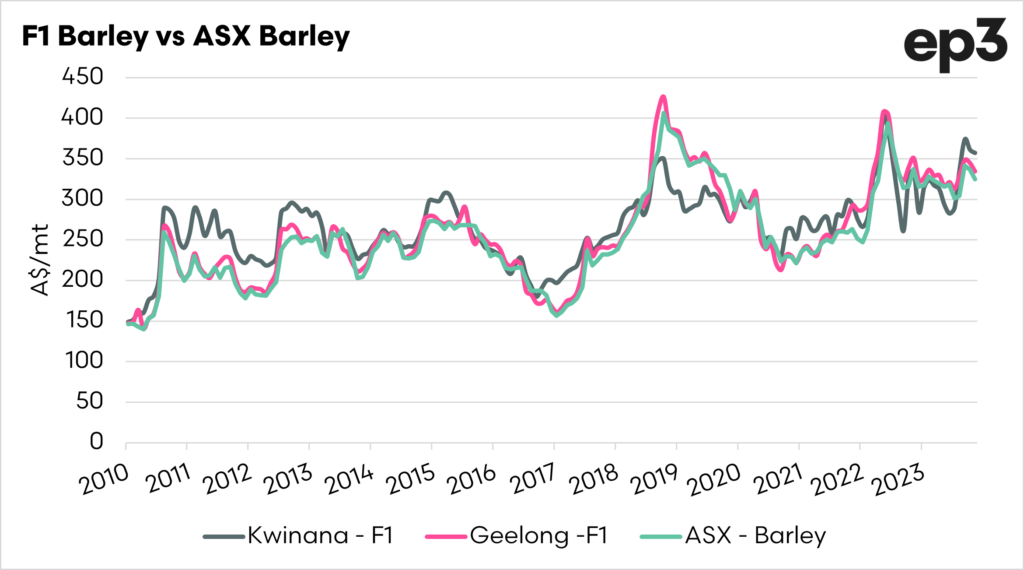

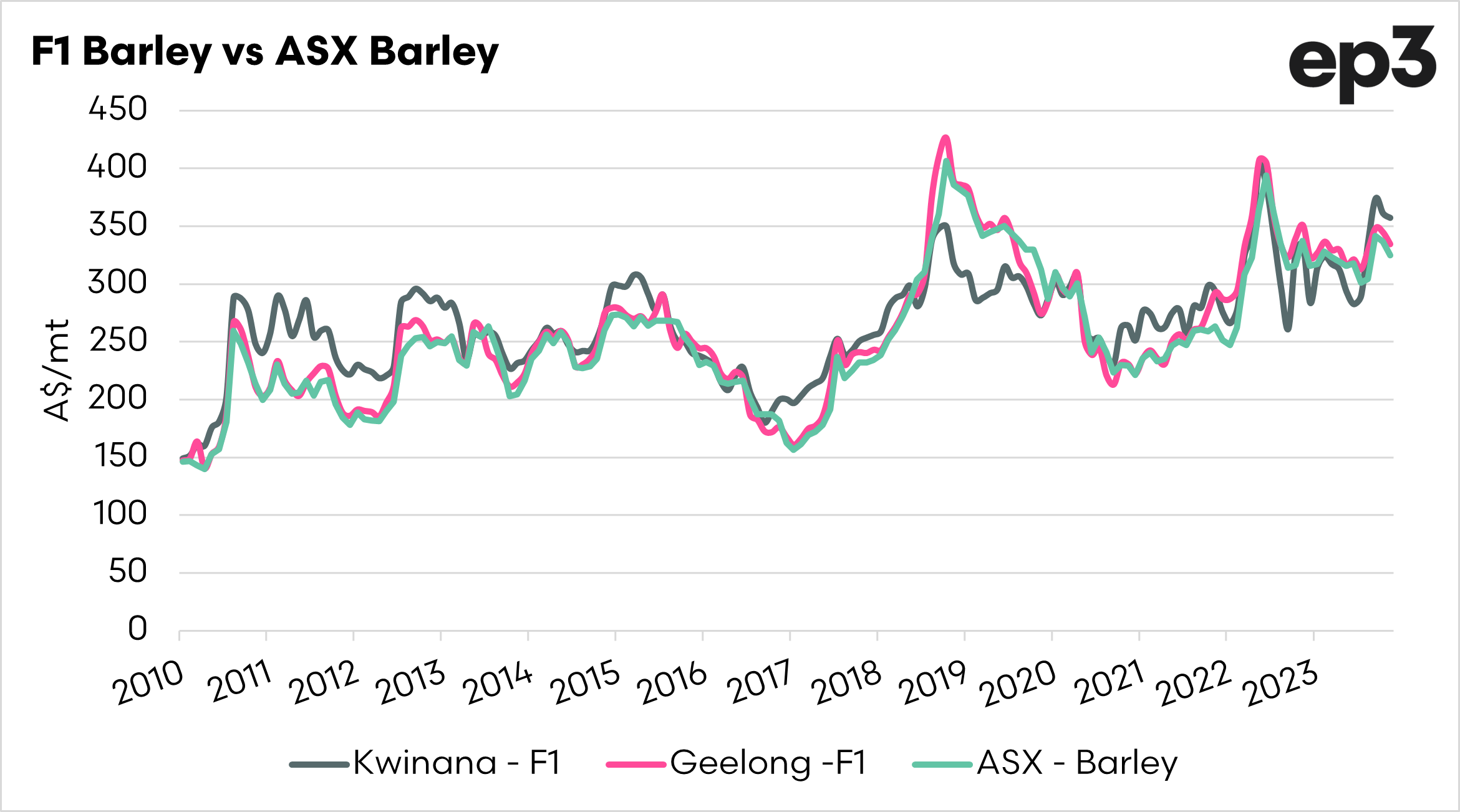

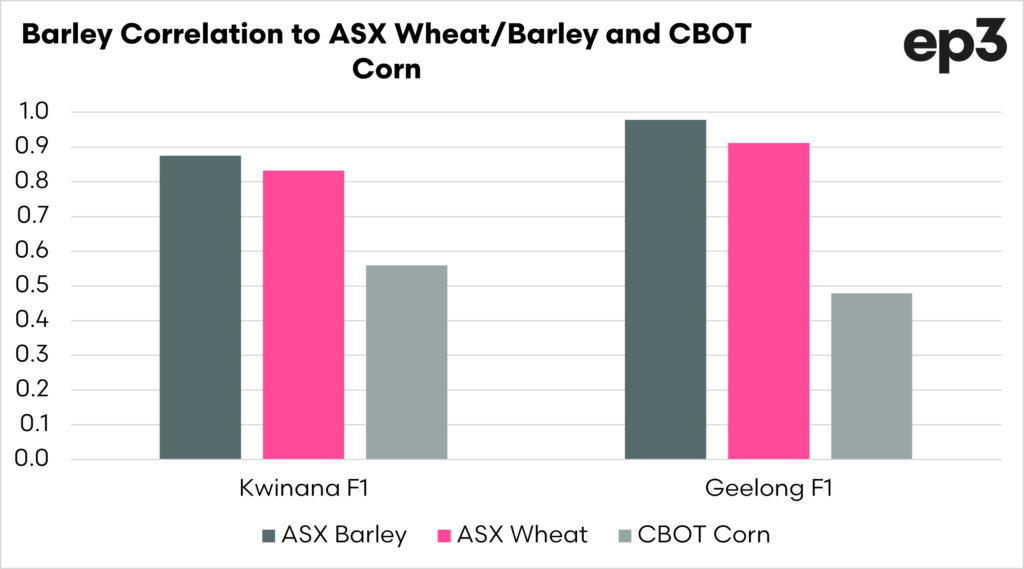

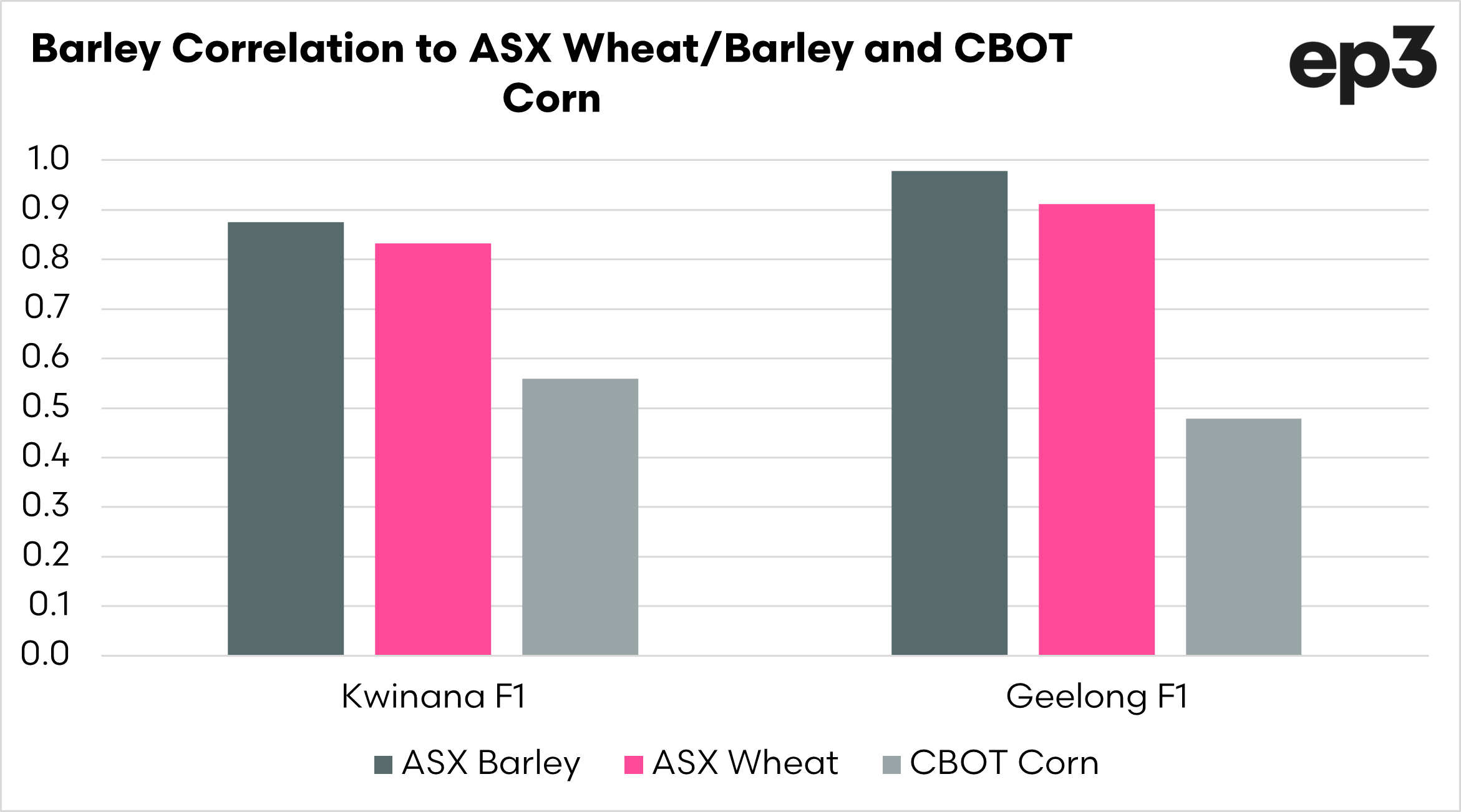

The chart below shows Kwinana and Geelong F1 spot barley against the spot ASX barley contract. The contract is east coast centric, with physical delivery available in Victoria/New South Wales. This is why the relationship between Geelong and ASX barley is so close compared to Kwinana.

Case closed. Well, not entirely. It’s never that simple.

We are lucky to have access to a local barley futures contract. There used to be other contracts in other major production areas, with a Canadian and a European barley futures contract.

There is a reason why these don’t exist anymore and its liquidity. These contracts never got enough volume in the end, and the result was that the exchange would no longer support them. This is the risk with the ASX barley contract; it does not attract a huge amount of volume. This can become a problem when trying to get in and out of your position.

Buyers and sellers should support the contract; as if it is discontinued, it likely won’t return (e.g. ASX canola)

There is more than one way to skin a cat.

As with everything, there are multiple solutions to problems. In the past, I have heard people discussing the use of corn due to its similar use as a feed grain. I don’t recommend this, as there are too many additional variables, and in reality, it can add as much risk as it removes.

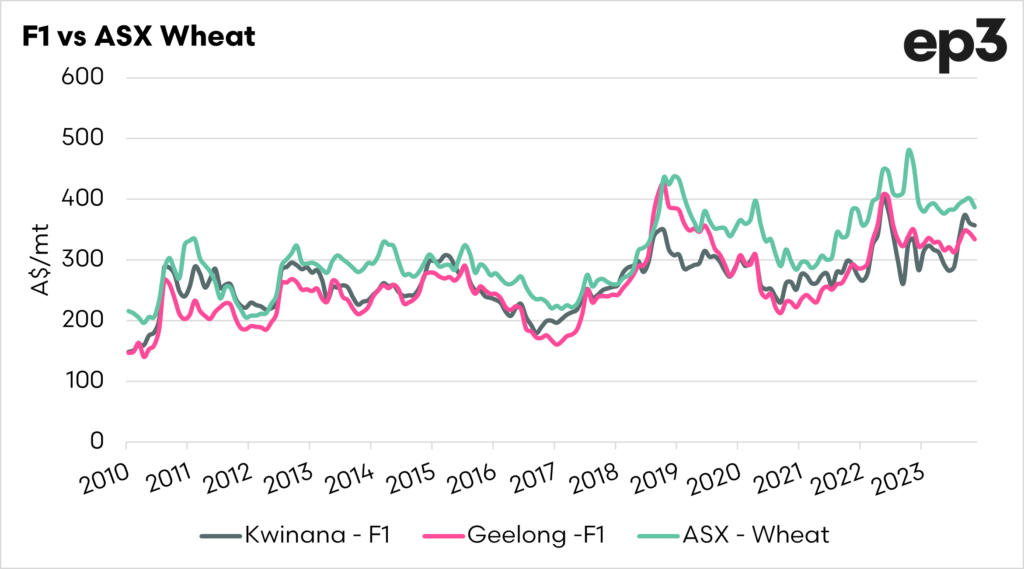

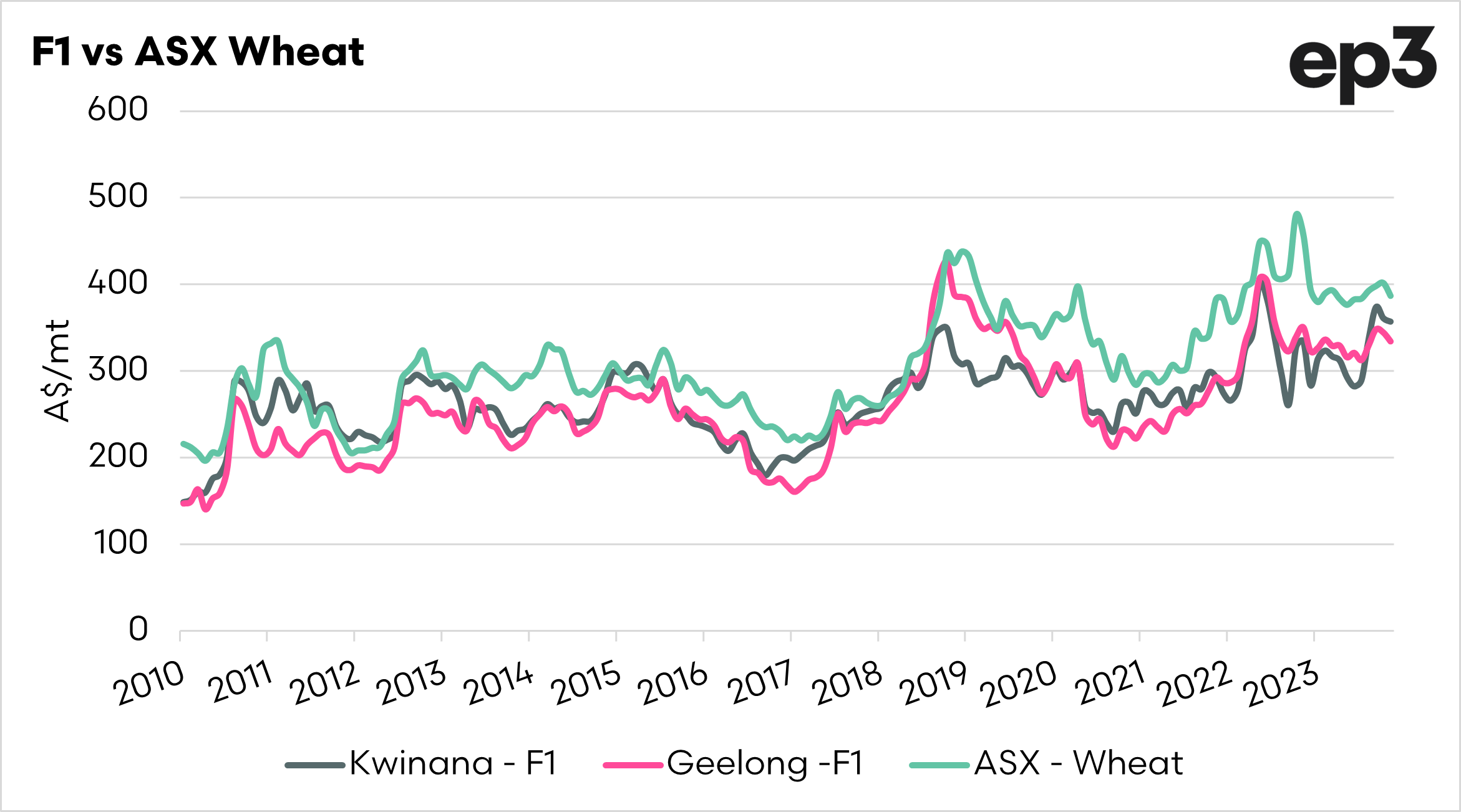

In Australia, our barley tends to correlate well with wheat. The chart below shows the relationship between Geelong F1, Kwinana F1 and ASX wheat.

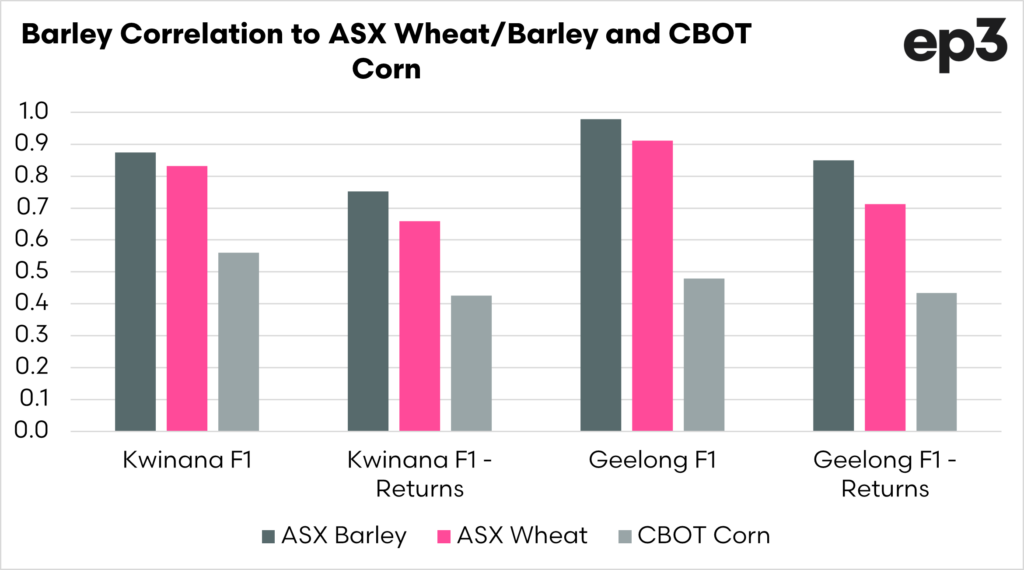

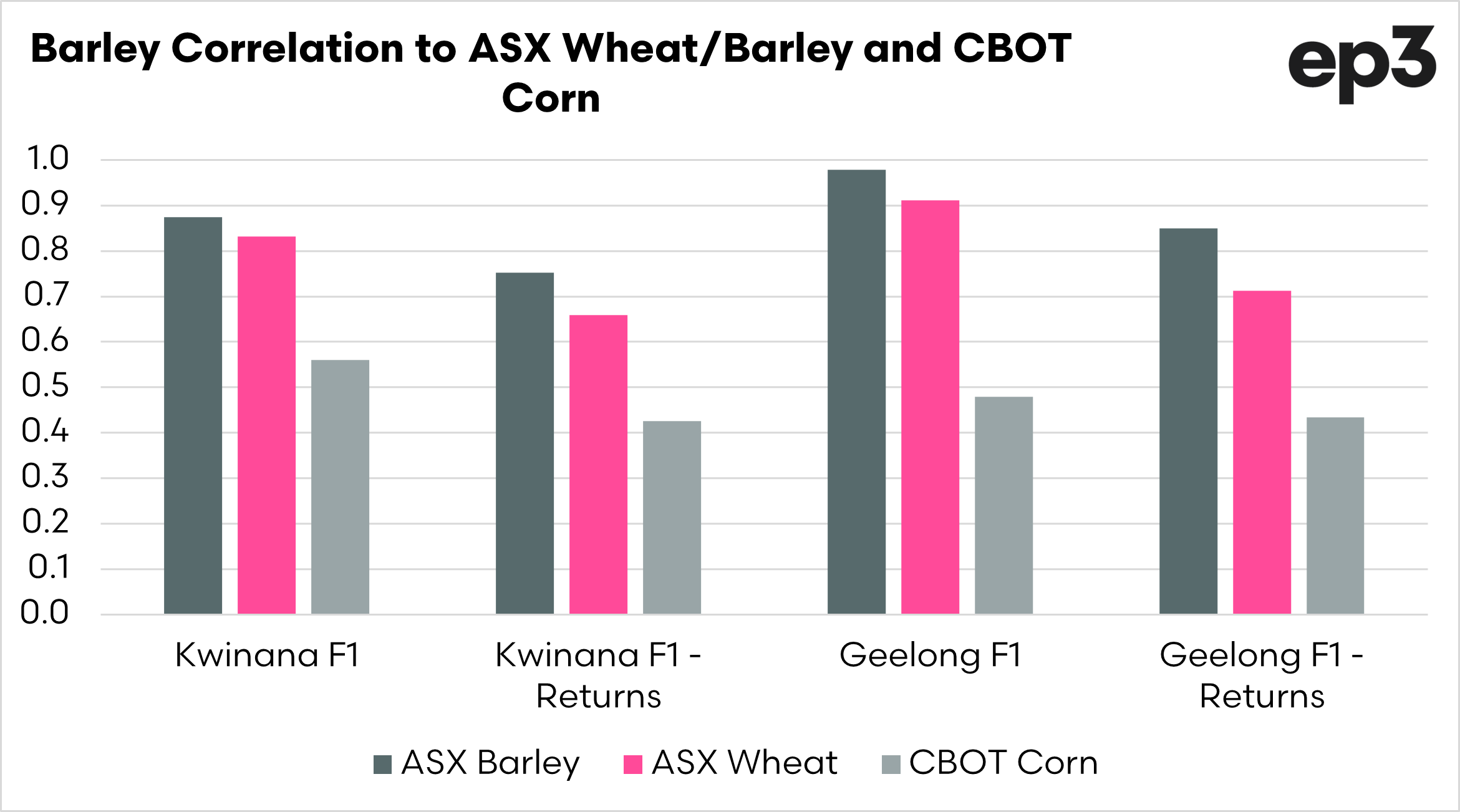

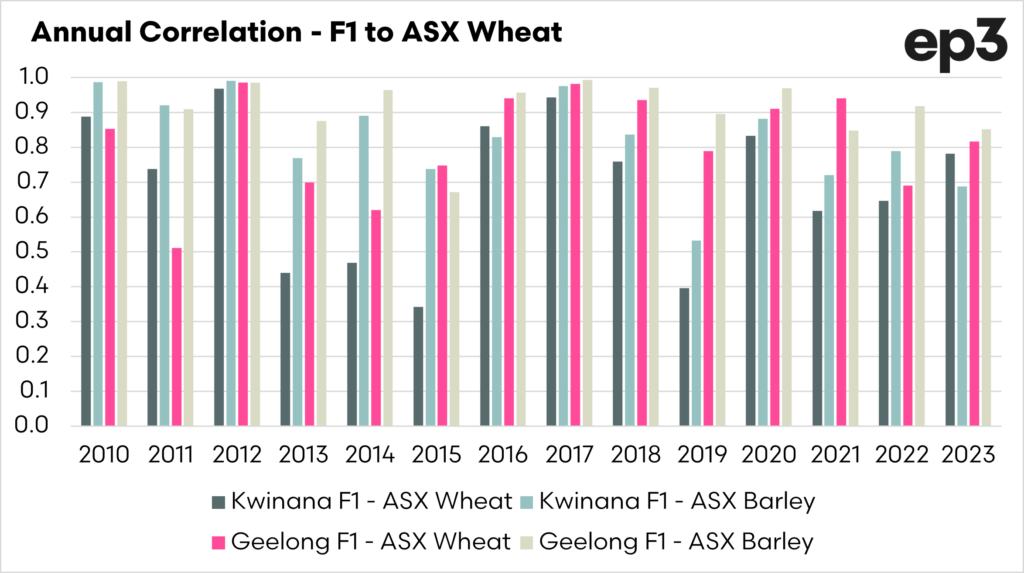

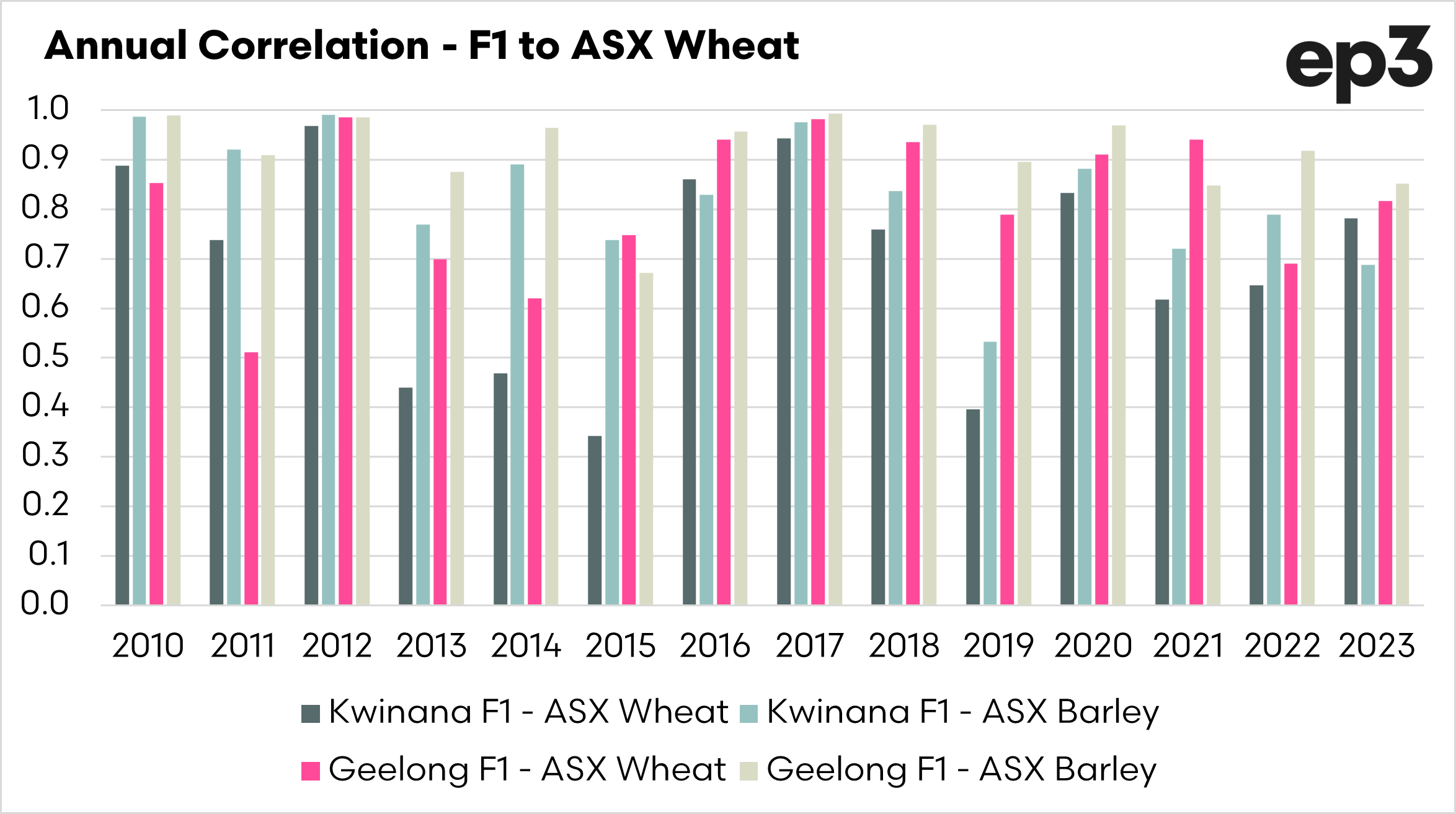

The chart below shows the correlations between F1 and ASX wheat/barley and corn. A perfect correlation is 1, and no correlation is 0.

ASX wheat and barley both hold close relationships with physical F1 pricing, especially east coast pricing points.

We choose a highly correlated futures contract to hedge a physical price because we want to ensure that they will be more likely to move in a similar trend.

We typically don’t want to manage our price risk with an instrument that may go in an entirely different direction, and therefore add more risk.

For those statisticians out there, I have also included the chart below, which shows the correlation of the returns. This is statistically a much more robust method for determining correlations; the correlations maintain very high levels for the ASX contracts and actually improve for corn.

While the corn correlation has improved when examining returns, it does not constitute a good enough improvement to consider using it over the ASX contracts.

So which should we choose?

The choice between using ASX barley or wheat to hedge your physical production (or purchase demand) is dependent upon location and risk appetite.

So some considerations:

- It is dangerous to use a long term correlation in isolation, as they do change over time. The chart below shows that at times the correlation can go out of whack (see chart below).

- If you are in the eastern states, either ASX wheat or barley will fit quite well. Since 2016, both have correlated strongly with physical pricing. The wheat contract would have lower liquidity risk.

- If you are in Western Australia, the correlation is a little sketchier on an annual basis.

- The ASX barley contract has a much more consistent correlation than the wheat contract with WA F1 pricing.

- This is due to the inherently different markets that the east and west coasts operate within (domestic vs export). A normal year should see ASX work well with the west, but years of east coast drought would see divergences.

There would be enough volume trading on the barley contract in a perfect world, but alas, it is not a perfect world.

On the east coast, the ASX wheat contract is a solid tool for hedging barley price risk. In Western Australia, it is not quite as clear and would be on year by year basis, dependent on conditions within Australia.

As an industry, we should be encouraging the use of price risk management tools by both producers and consumers of grain. If we don’t use them, we will lose them.

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.