Is there a drought premium in wheat?

The Snapshot

- The basis is the difference between two prices, either a premium or a discount.

- Basis can be an indicator of drought. If there is a drought, our prices will generally increase to a substantial premium compared to overseas values.

- At present, Australian ASX wheat futures (East Coast) are not at a significant premium.

- Generally, the basis will rise strongly in the second half of the year when drought hits.

- When we examine physical prices in the South, a premium is evident, but it is not a significant drought premium.

- The drought is affecting a vast area of South Australia and Victoria, but it is not covering as big an area as in 2018/2019.

- The drought premiums in 2018/19 were primarily caused by the domestic market needing to access grain.

- Currently, the trade still expects an average to above-average crop.

- Rises in domestic premiums tend to arrive in the second half of the year.

- If the lack of rainfall continues, there may be increased local premiums in affected areas,

- The premium is unlikely to be as large as experienced during the 2018/19 drought.

You only have to look at a social media feed or rural press to see that drought is impacting Victoria and South Australia. Additionally, parts of Western Australia and southern New South Wales are not faring too well either.

Drought is a natural cycle of the Australian climate. We have had a few good years in the 2020s; in fact, our record years. Now, the dreaded drought has returned to certain areas, and in reality, based on historical timeframes between dry and wet periods, it was overdue.

I wanted to use this piece to talk about drought and pricing, and I apologise for it being a lot longer than you would typically read on Episode 3; it requires a greater level of detail.

I am going to discuss basis, because it can and often is an indicator of drought. Basis, at its most basic, is the price difference (premium or discount). The basis can be calculated between many different pricing points, but we generally compare to CBOT wheat.

The largest driver of basis in Australia is supply. When supply is constrained in Australia, domestic consumers must pay more to ensure it remains in the country and doesn’t enter the export market, which causes the basis to shift to a huge positive.

If supply is high then the market will not have ‘FOMO’ and basis will drop to a negative.

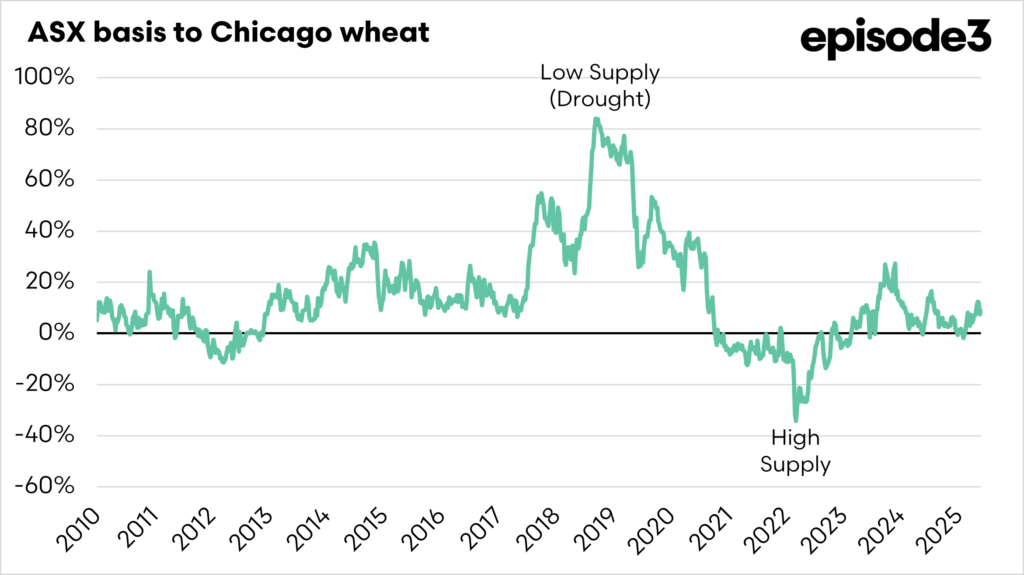

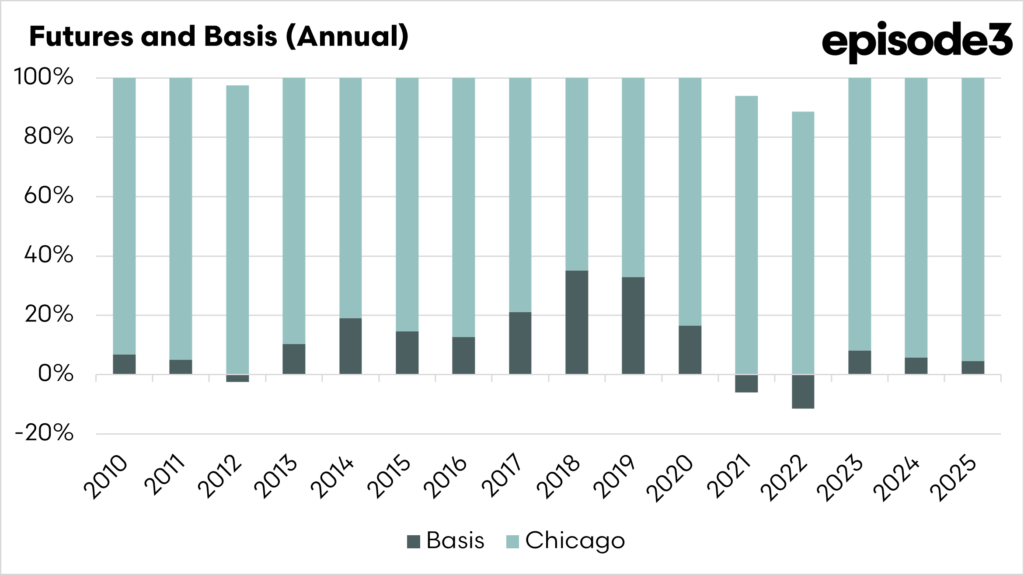

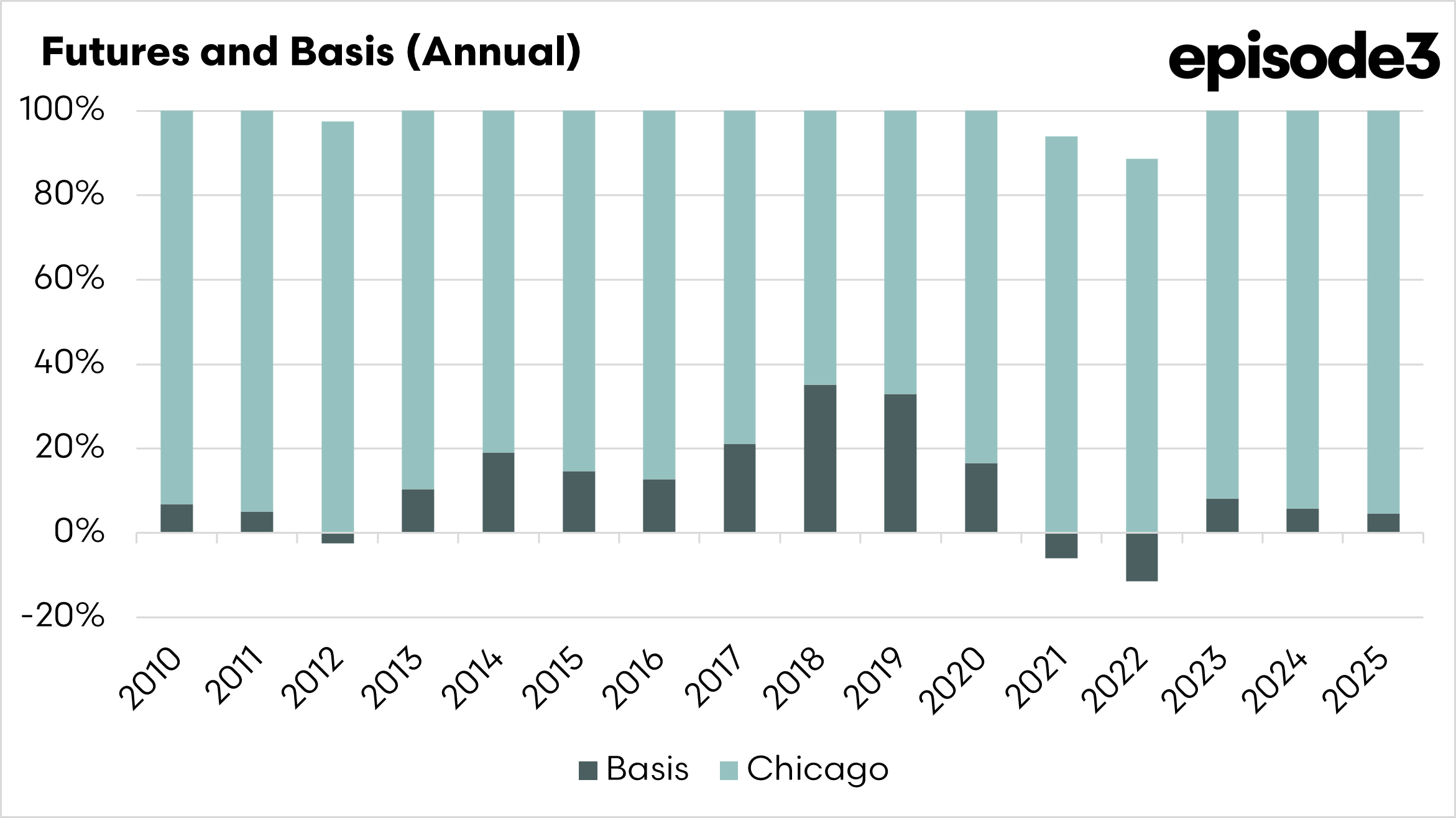

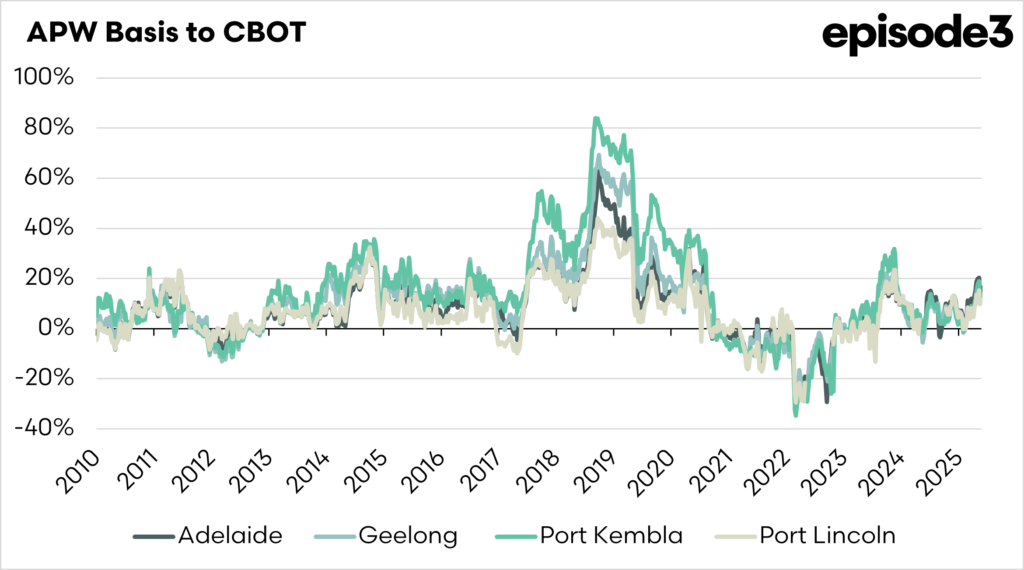

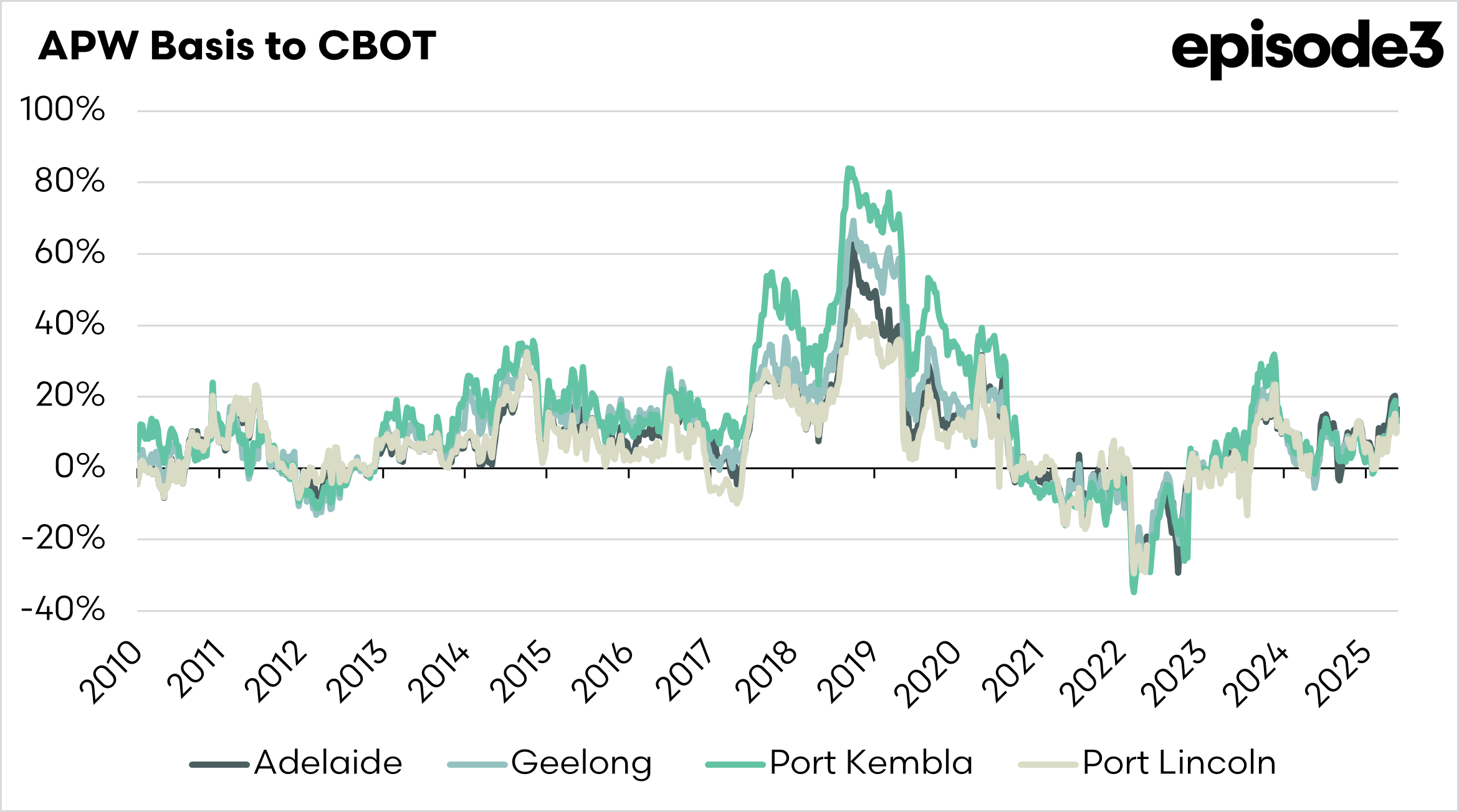

The chart above shows the basis (as a percentage) from 2010 to the present for ASX wheat (Eastern Australia) and Chicago wheat. The chart illustrates the relationship between dry periods and wet periods.

Currently, the basis is set at 9% for this week, and on average, it has been 15% since 2010. However, that does take into account the extremes of the 2018/19 drought. However, even during a relatively stable period from 2013 to 2018, the premium was then 19%. Currently, there is no drought premium for the ASX.

As ever, we will delve a little deeper into the data.

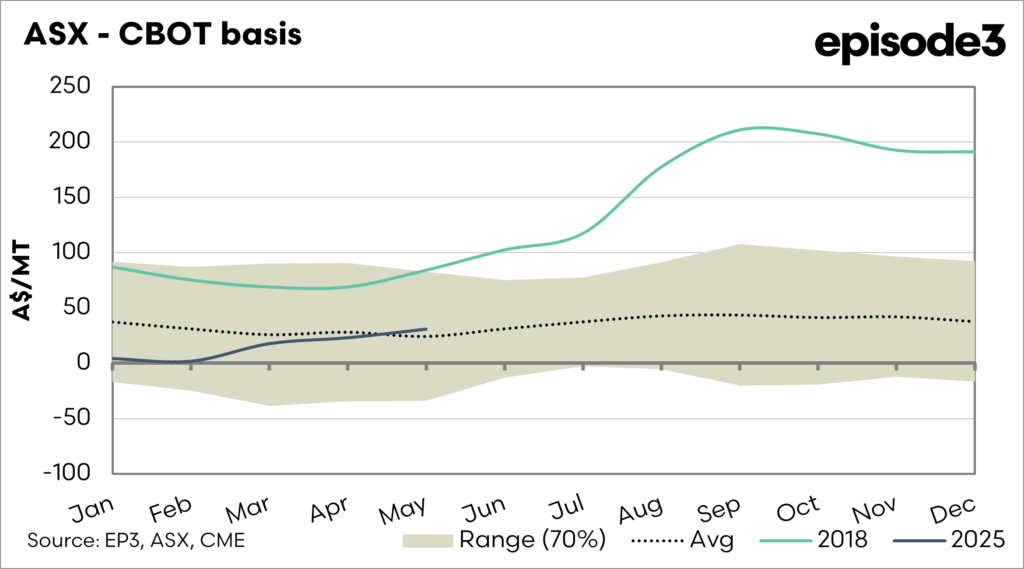

The chart above shows the seasonality of the ASX-CBOT basis. The shaded area represents the standard deviation (or expected range), along with the average, and I have chosen to overlay the data for 2018 and 2025.

I chose 2018 because that is the year when the last major drought really kicked in on the East Coast.

The basis level has been quite low, but let’s focus on 2018. Basis started to increase from July onwards. This happened because many buyers held onto a small amount of hope that things would turn around.

When things didn’t turn around after the seeding, the market went crazy as buyers, especially domestic consumers, had a fear of missing out and hit the market hard. This led to premiums turning massive.

Read this article on how psychology can and does drive markets (see here), the first article anyone should read concerning markets.

If our premium starts to rise dramatically, it historically occurs in the second half of the year.

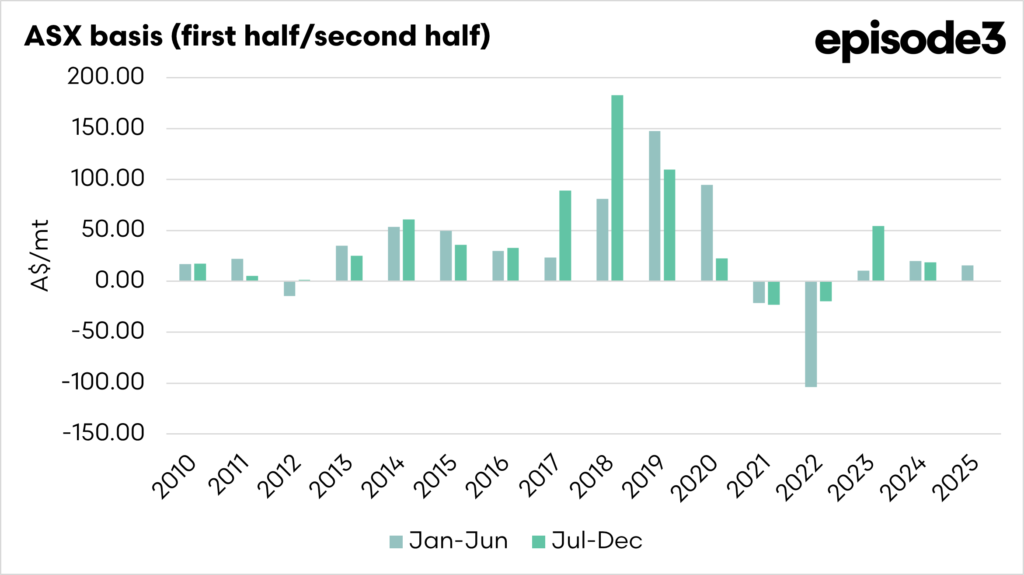

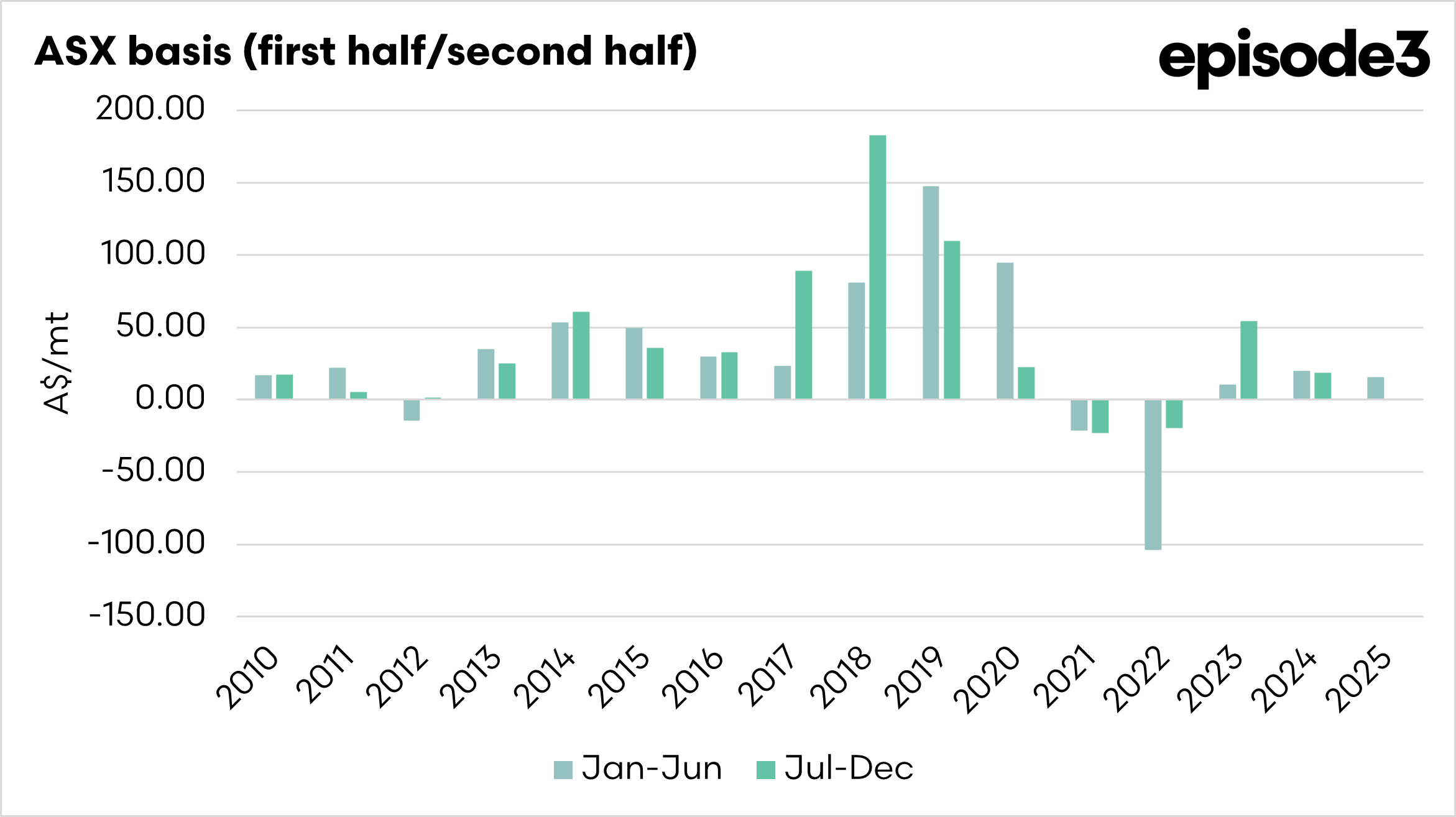

The chart above shows the basis levels on average for the first half and the second half of the year. If there is going to be a strong premium, then it is going to emerge in the second half of the year, generally. This is a logical reaction as it is when the crop is being grown. In January, harvest is far away, and things have time to turn around.

Just like in the first game of the State of Origin last night, the chance of Queensland diminished as the game continued.

Prices in Australia are generally comprised of futures, FX and basis. This chart shows, on average, how much of the price each year was made up of basis and futures. As drought increased, basis became a much higher part of the pricing picture.

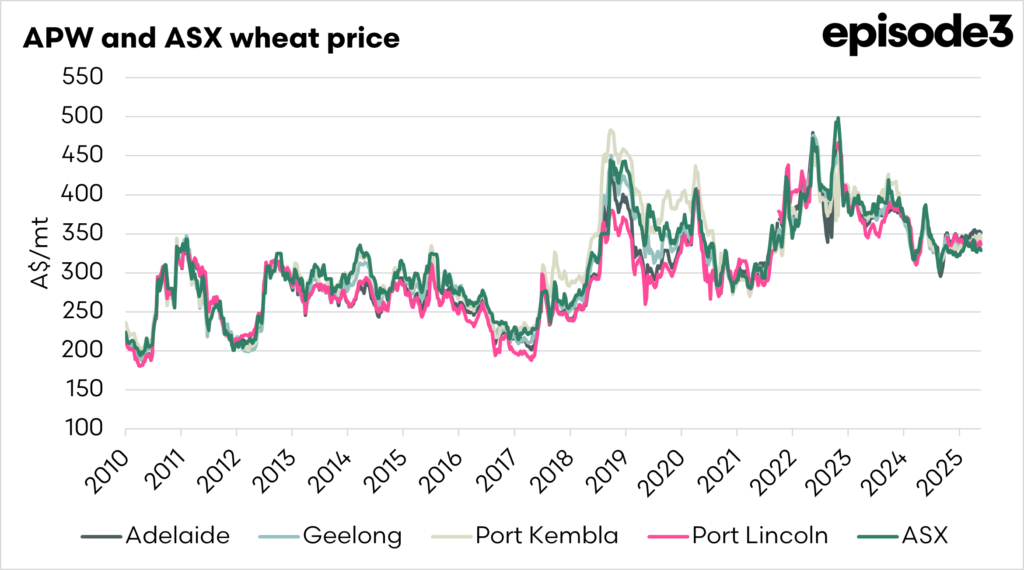

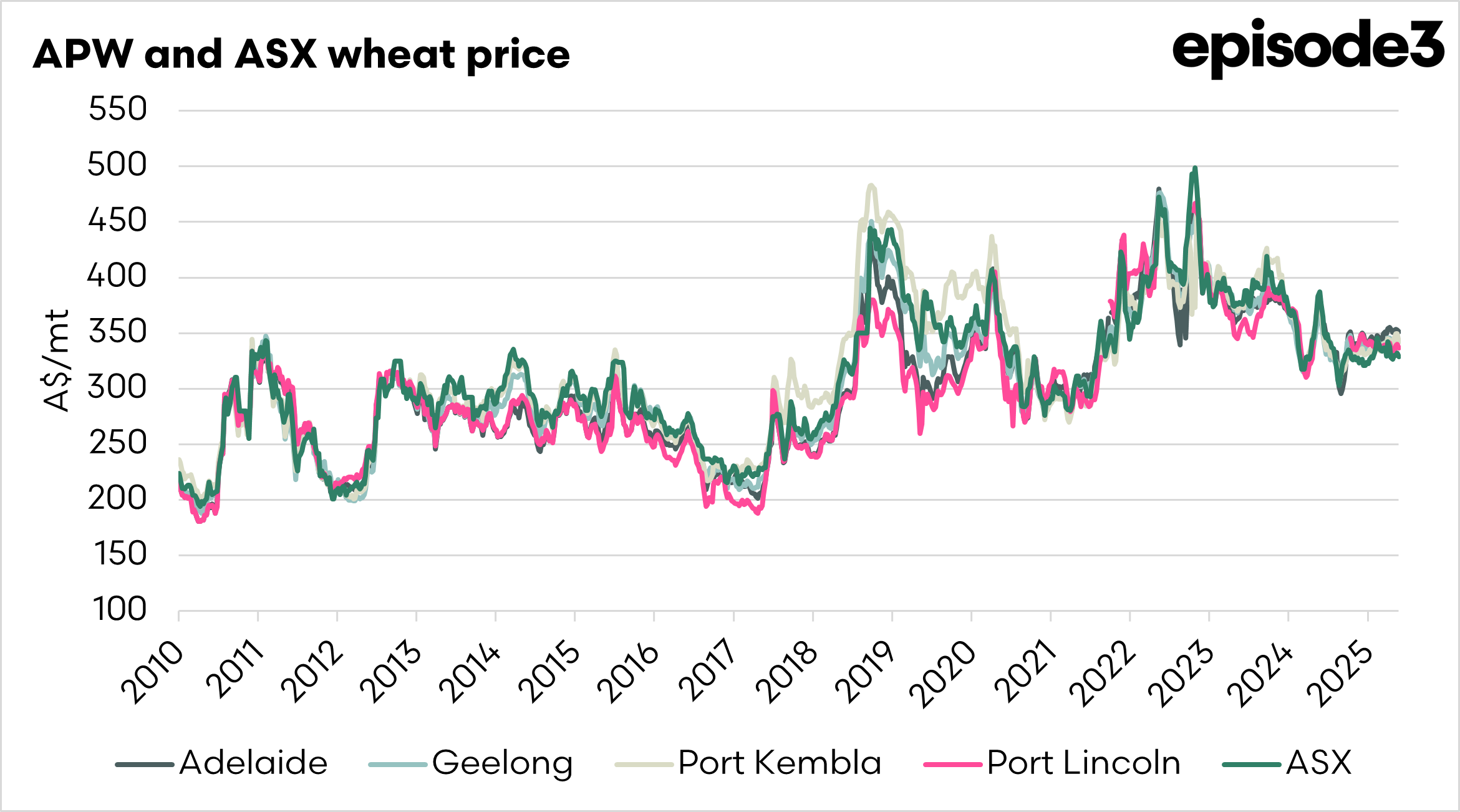

So far, this article has focused on the ASX contract, which is largely representative of the East, as shown in the chart below. The ASX and physical APW prices tend to follow one another very closely.

When looking at the ASX wheat price, it has shown that there really isn’t any drought premium priced into the Australian wheat market, but how does it look when we delve specifically into the drought-affected areas of the country, in South Australia and Victoria?

Let’s look into basis in those zones.

If we examine the chart above, it shows a pattern similar to that of ASX wheat, which isn’t particularly surprising, as futures generally follow the physical market.

What we see is a premium, but not a huge drought premium, like the one we have seen in those big drought years.

At present, the premiums over CBOT are as follows (current/average):

- Adelaide 16% vs 8%

- Geelong 13% vs 11%

- Port Lincoln 12% vs 8%

- Port Kembla 13% vs 15%

So at present, based on current basis, we are seeing a slightly above average premium, more so in South Australia, where the drought is at its worst.

The next question is, will we see premiums like we experienced in 2018/19? Currently, traders are confident of an average to above-average crop, due to the rainfall received in NSW.

A huge proportion of the country’s feed demand is in Northern NSW and Southern QLD. When they experience drought, it significantly drives up domestic premiums due to inelastic demand. At the moment, they don’t have concerns about local access to grains in the north, anywhere near the scale they had in 2018 and 2019. We can see that in the chart above, which shows if you look at the drought year that the premium rose the close you got to the feed demand in Northern NSW and Queensland. Currently, prices are not experiencing a significant spread between ports, unlike during the drought.

Let’s compare some maps.

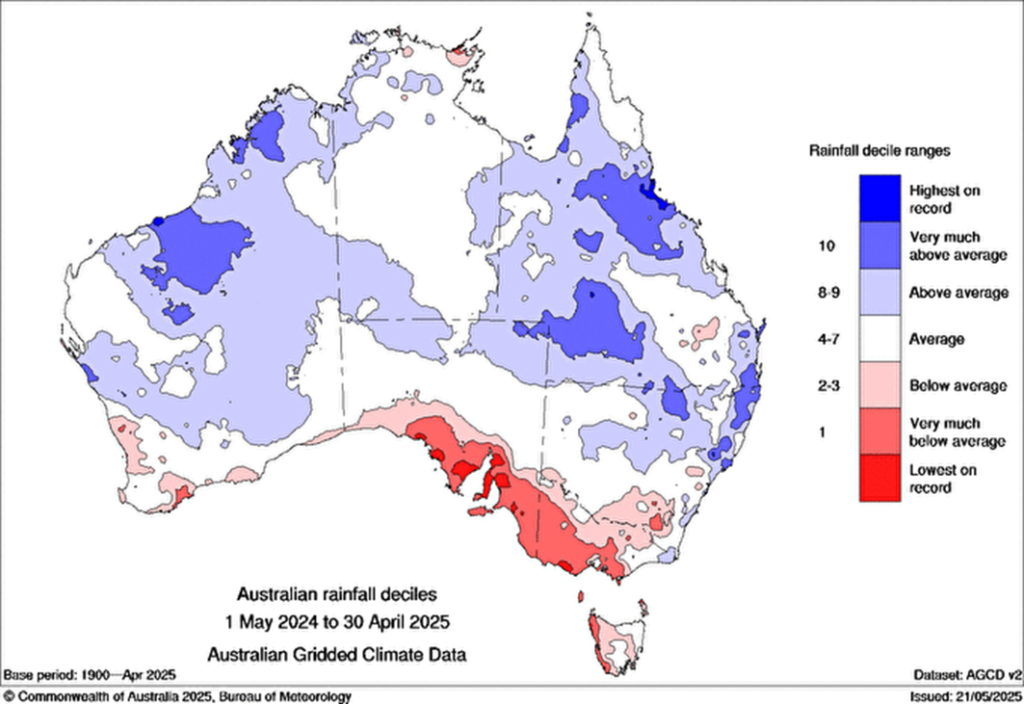

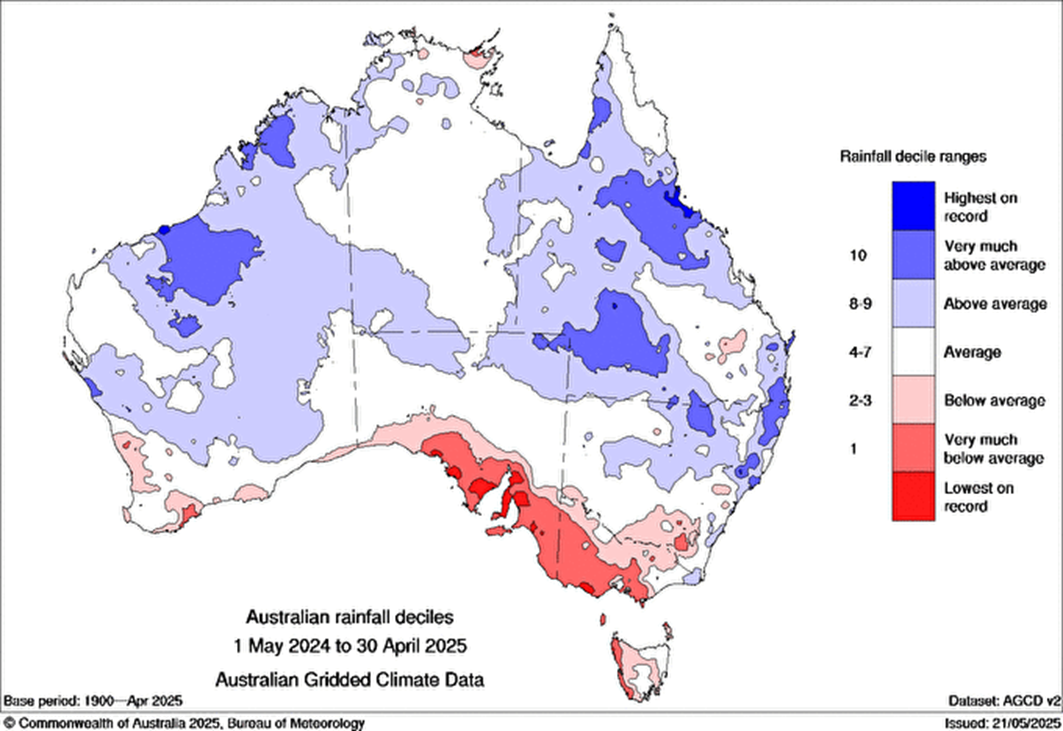

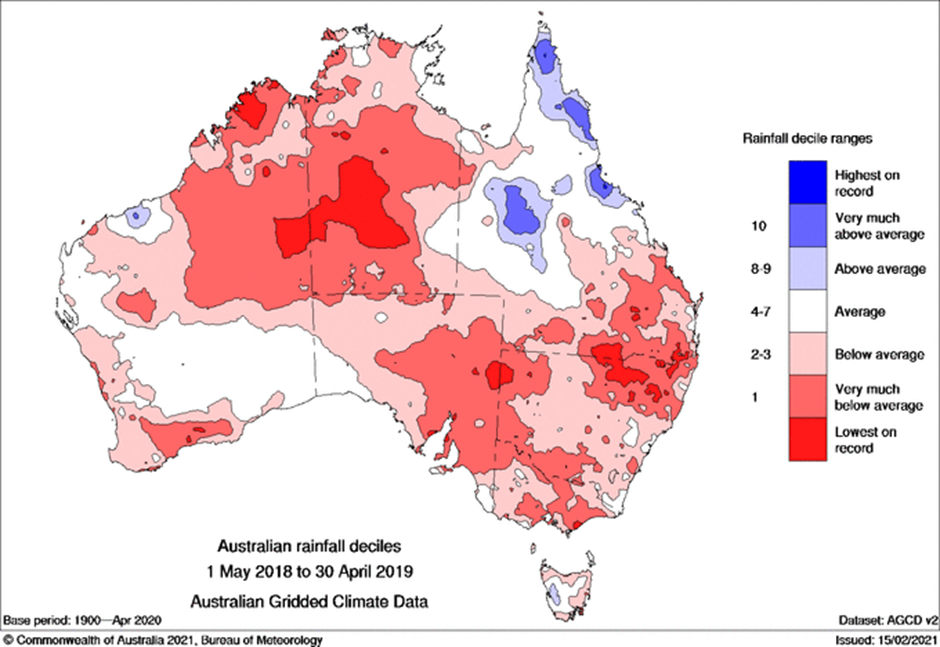

The above map shows the rainfall deciles to the end of April, new data will be available soon up to May. It shows how terrible the rainfall deficit has been in the south of the country,

However, the majority of NSW received average to above average rainfall. Let’s compare that to 2018 and 2019.

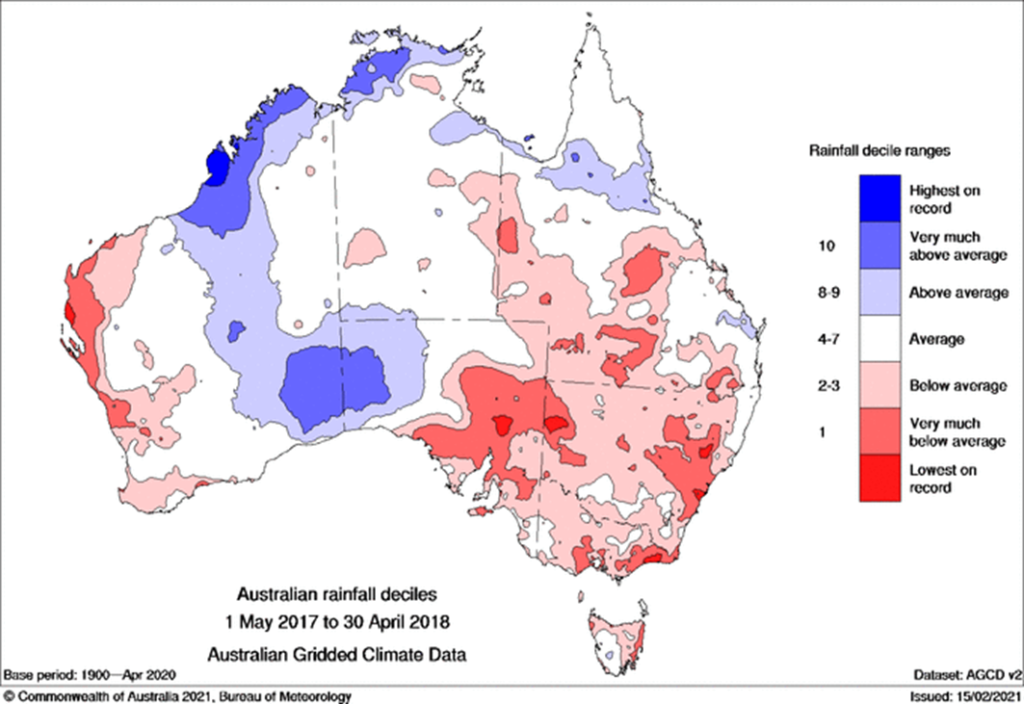

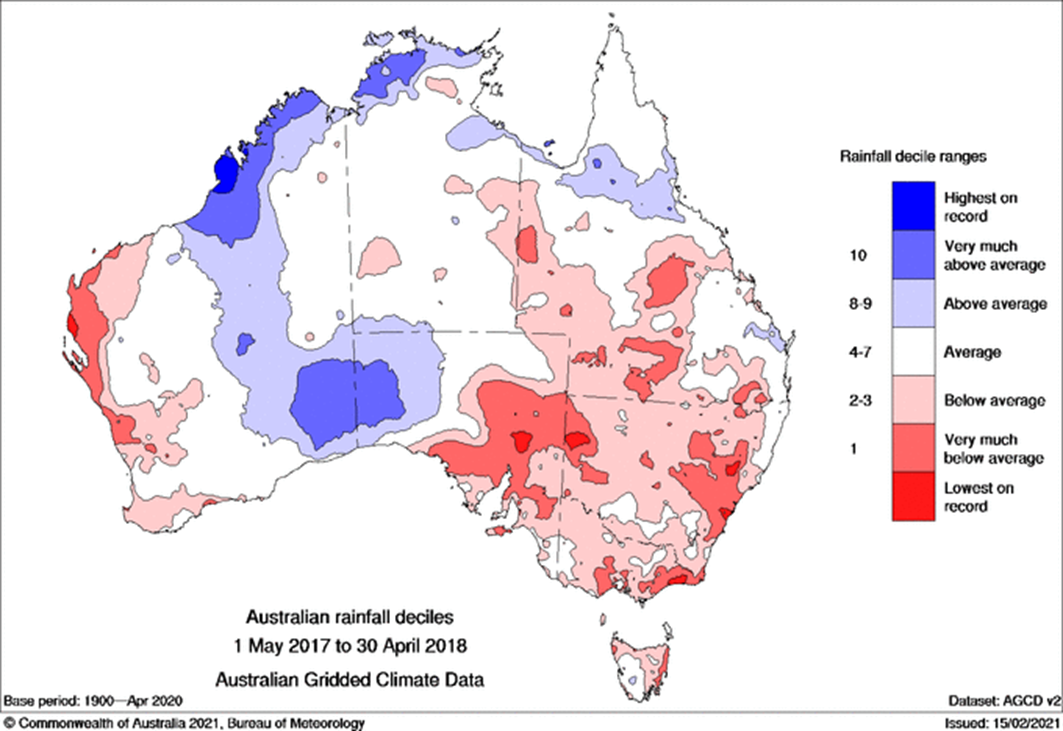

If we compare the same map for 2018 and 2018, the rainfall deficit was much more widely spread across the country, and by 2019, most of the country was in severe drought.

So the question is, will Australian farmers receive a drought premium, which will provide some assistance (although not cover all the yield losses) due to the effect of drought?

As mentioned throughout this article, the trade is not overly concerned about access to grains at present, as they expect a surplus to occur after the domestic market is satisfied.

The critical thing to remember is that a jump in premium, if it is to come, will likely only come from June/July onwards. Currently, the signals are not present for a premium anywhere near the extent of the 2018/2019 drought.

We can expect to see larger premiums emerging locally in Victoria and South Australia, but the widespread premiums are unlikely to be as extensive as those seen during the 2018/19 drought. That is, unless the poor weather spreads further.

This isn’t good news for farmers in the affected regions, and I genuinely wish I were giving you better news, but we prefer to be honest and frank.

Our thoughts are with you all. If you are struggling at the moment, don’t be afraid to reach out to those around you. This is a topic we recently spoke with the cricketer Brad Hogg about, which you can listen to here. There are also excellent resources available on the Grain Producers Australia website here.