I’ve bean thinking about you.

The Snapshot

- Canola and soybeans have a strong relationship with one another.

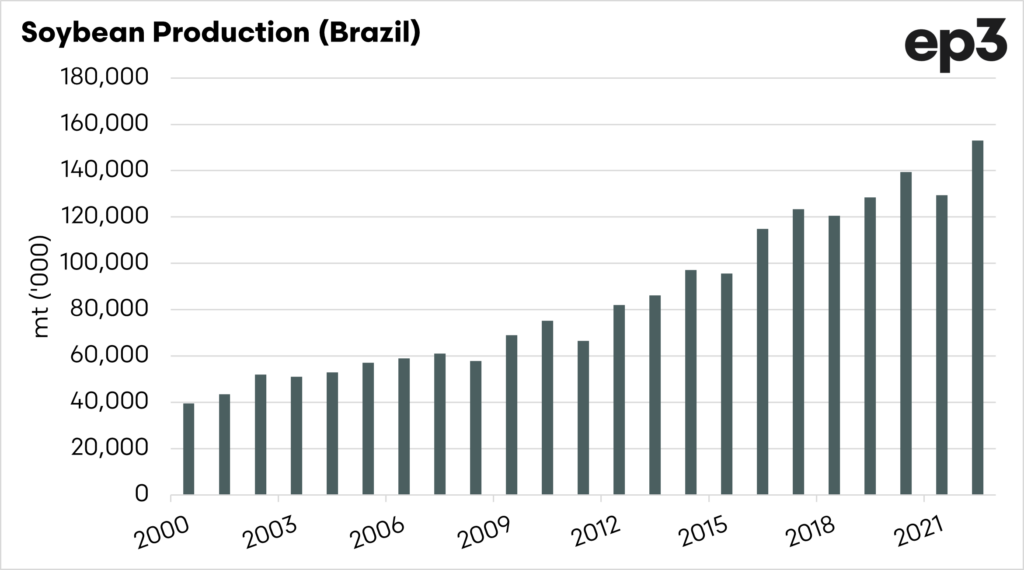

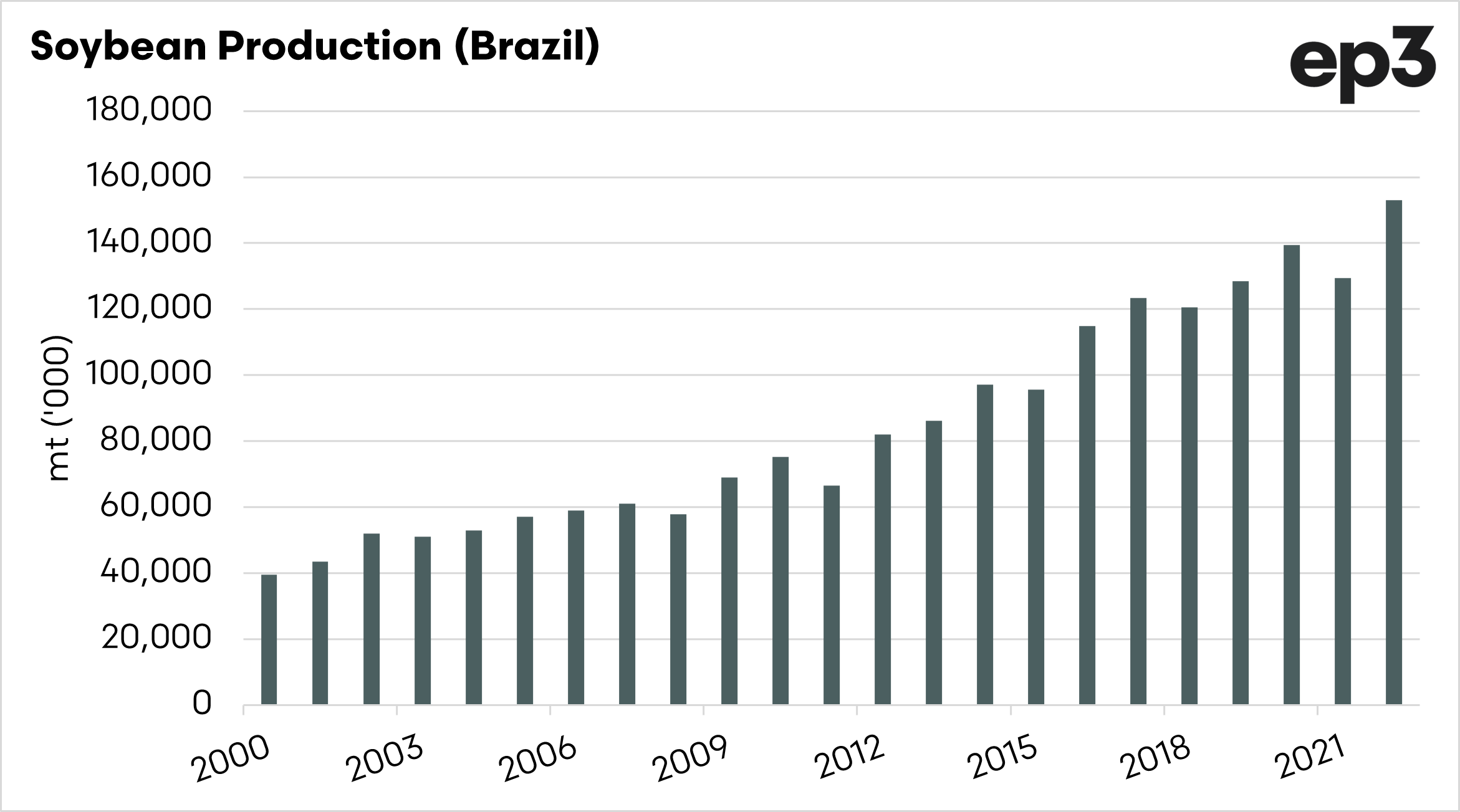

- Soybean production in Brazil is set to hit record levels.

- The soybean harvest is delayed due to wet weather.

- This large crop coming onto the market could impact pricing.

The Detail

Commodities operate in subsets, with most having some form of replaceability with another. For instance, in feeding animals, you could use corn, wheat or barley. As a feeder, you will utilise the cheapest option to provide the correct growth rates.

The same is true of canola. It operates in a subset of oilseeds, along with palm and soybeans. I received a request from a subscriber to have a look at the relationship between canola and soybeans.

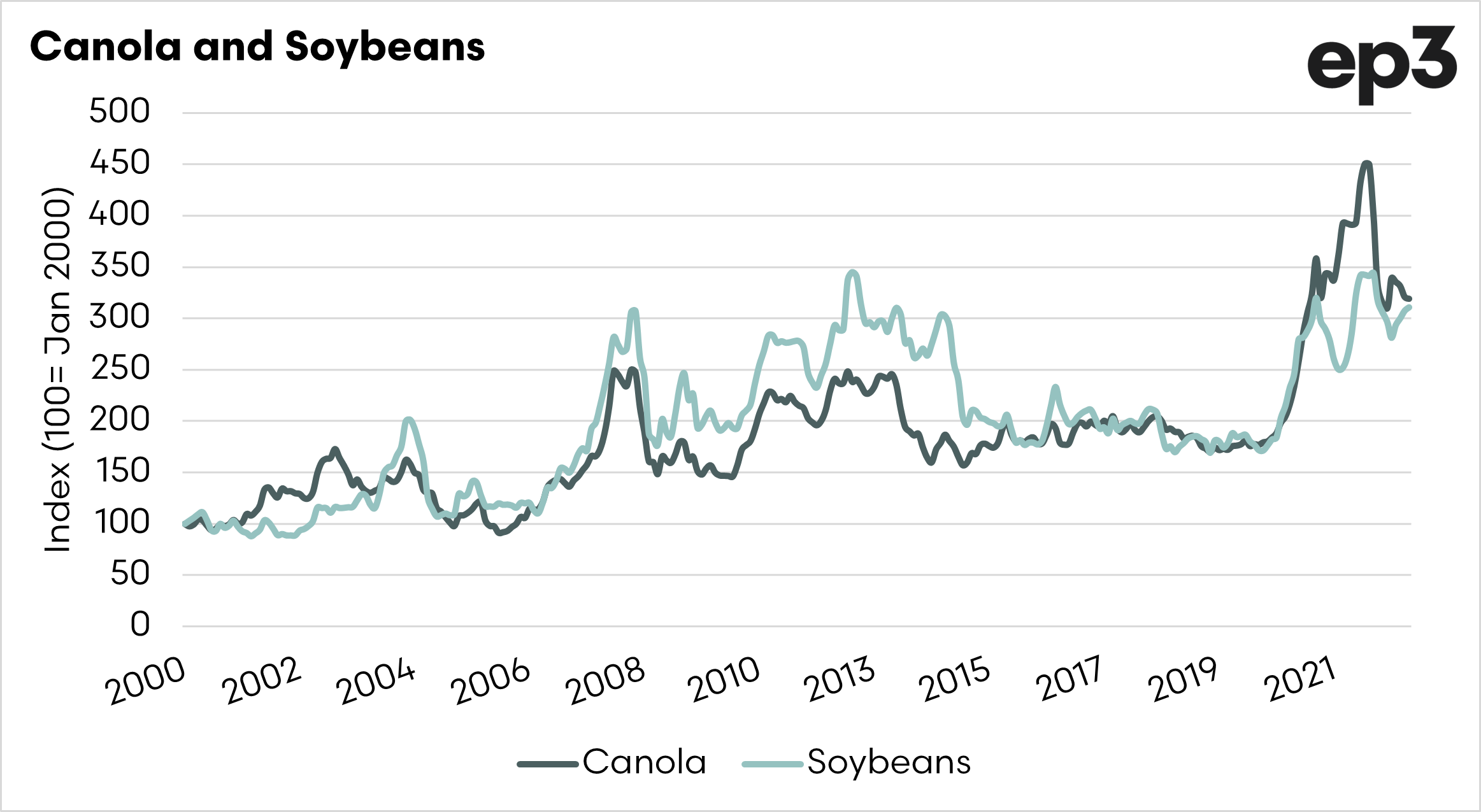

The chart below shows soybean and canola futures converted to an index (monthly), for the period 2000 to present.

The two commodities have a close relationship with one another. Again as above, this makes sense as they are both replaceable due to their similar usage.

The correlation between the two is 0.81, with 1 being a perfect correlation and 0 being no correlation. This is, therefore, a strong correlation.

What happens between commodities is important. Let’s delve into it.

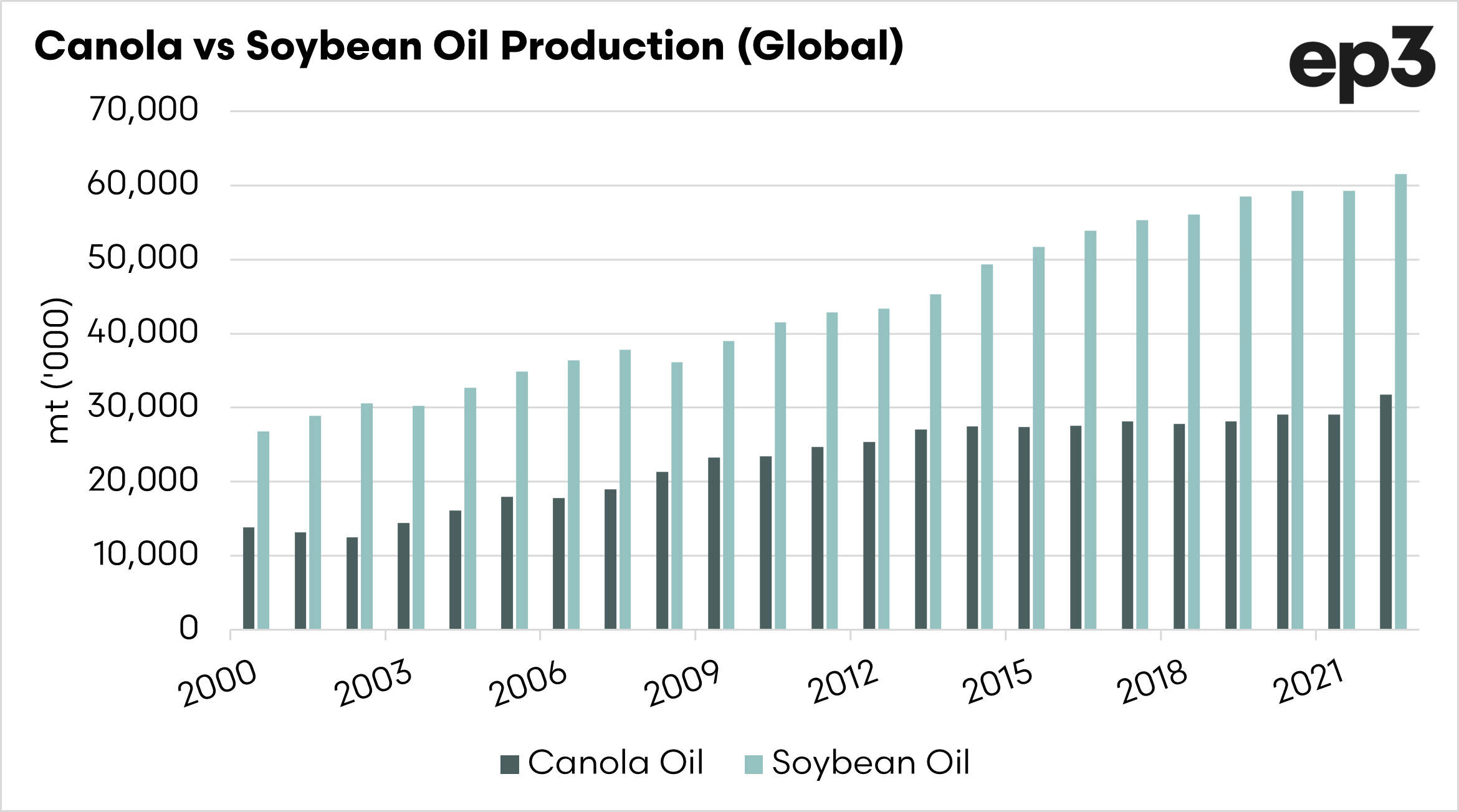

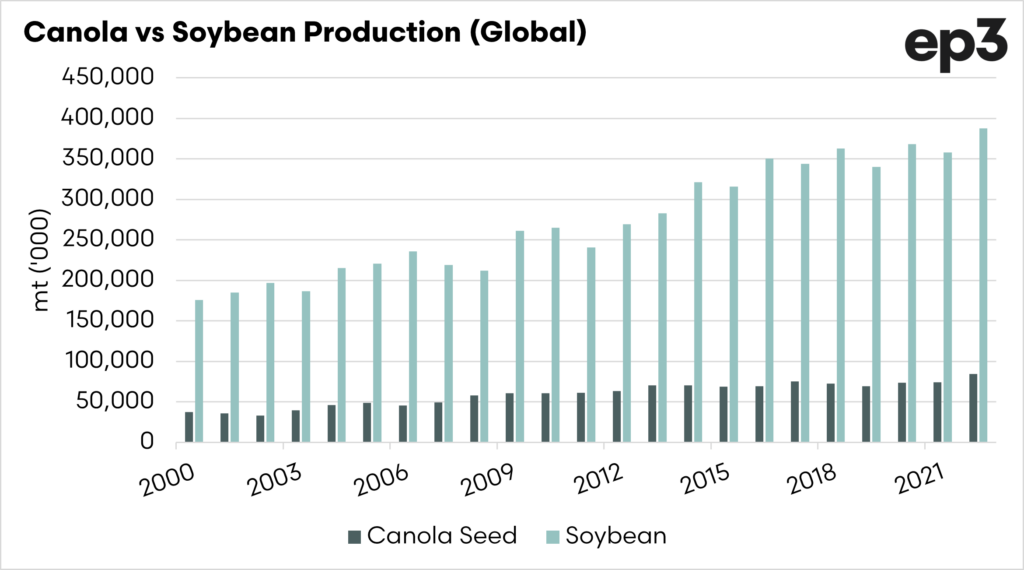

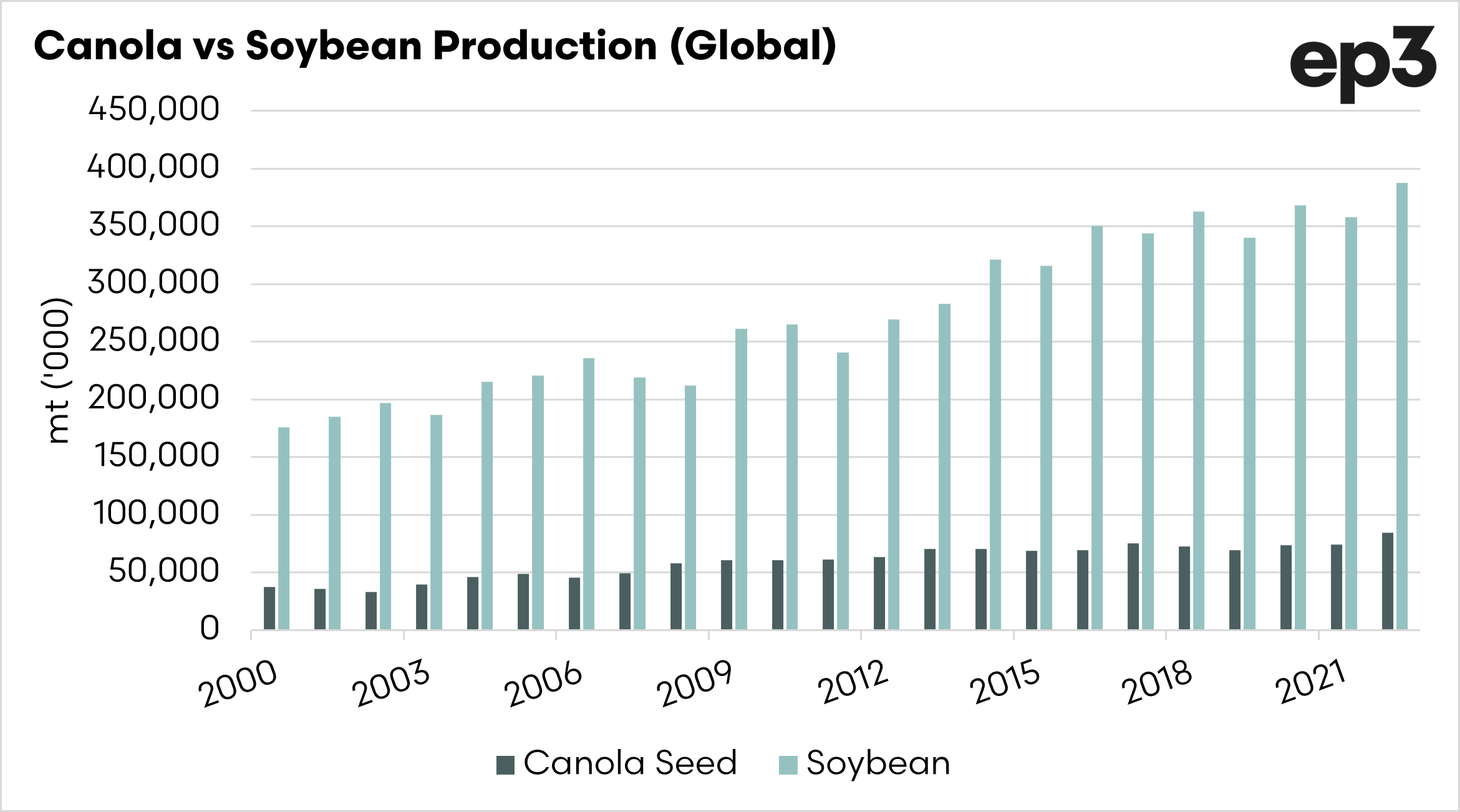

The chart above shows the global production of canola and soybean oil. Soybean oil is the big daddy compared to canola.

The volume of soybeans produced means that it has a huge impact if there is a significant move in either direction.

In recent years production has been increasing around the world, but so has consumption. What is happening this year?

The big soybean story is the Brazillian crop. This year Brazil is on track to produce a record crop of >153mmt. A significant increase from last year’s 129mmt, and still well above the prior record of 139mmt.

This is a huge crop, and whilst the harvest is delayed by wet weather (does that sound familiar?) there will soon be a large soybean crop on the market.

The scale of the crop could have an impact upon oilseed prices. A positive note of the delayed soybean harvest is that it can cause delays to the planting of the second corn crop, and that could help corn pricing (and, therefore wheat).

The next stage for canola is to see what the weather is like in Canada. That won’t be truly visible until April.