La Nina – A look outside our bubble

The Snapshot

- La Nina tends to make the eastern states of Australia wetter, whilst large tracts of the US are historically drier.

- Wheat yields in the USA have been slightly higher on average during La Nina years, albeit the range is large (-13% to +12%).

- Corn is the worlds most productive crop, and the US produces slightly more than 30% of global production.

- The corn crop has been negatively impacted by La Nina (-3%) yields on average, whilst the range is extreme.

- Corn yields can be between -24% to 11.5% above the decade average in a La Nina year.

- There have been substantial spikes in corn (and wheat) pricing levels during or succeeding La Nina years.

- A perfect storm for Australian farmers would be a season where production is high locally, and prices overseas rise due to a poor US corn crop.

The Detail

The focus thus far on La Nina for EP3 has been on the impact locally, we spoke about the impact on east coast grain “La Nina to bring the rain?”, and in our market morsel on the WA impact “Don’t forget about WA”.

We don’t live in a bubble, and La Nina has an impact on the rest of the world – is it positive or negative for Australian prices?

La Nina tends to make the majority of Australia wet (see map), however unluckily for America they tend towards a corresponding dry period.

Wheat

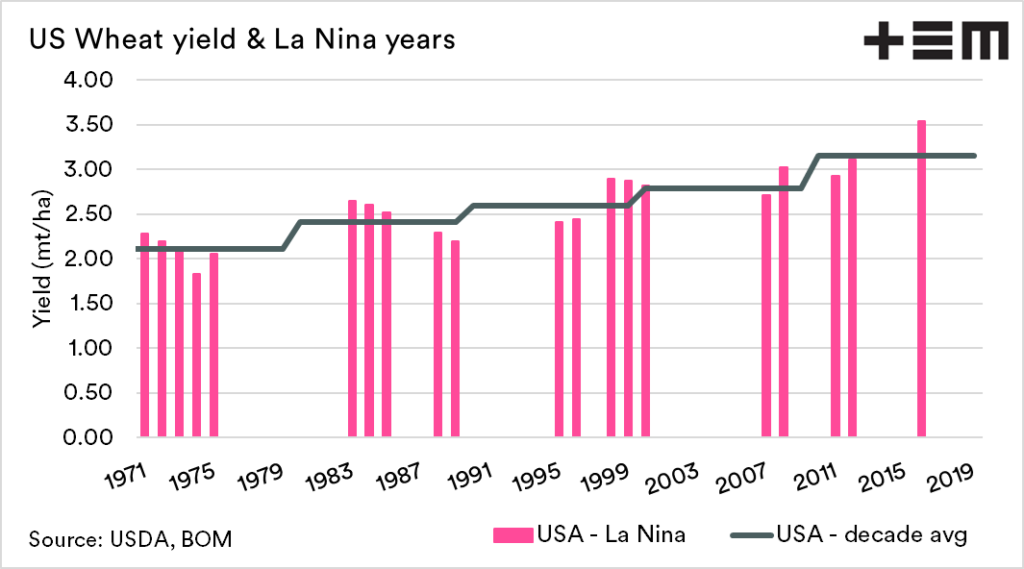

In the chart below, the decade average yield for wheat is shown in the grey line, along with the years when La Nina was active being the pink bars. The average yield has increased with the advancement in technology and agronomics.

The yield in La Nina years hasn’t been drastically impacted compared to the decade average. On average, the yield in a La Nina year has been down up (1.22%).

The range has been wide, with US yields ranging from -13% to +12%.

Corn

The story doesn’t stop with wheat. As we have discussed regularly, wheat does not trade in isolation. We also have to take into account corn.

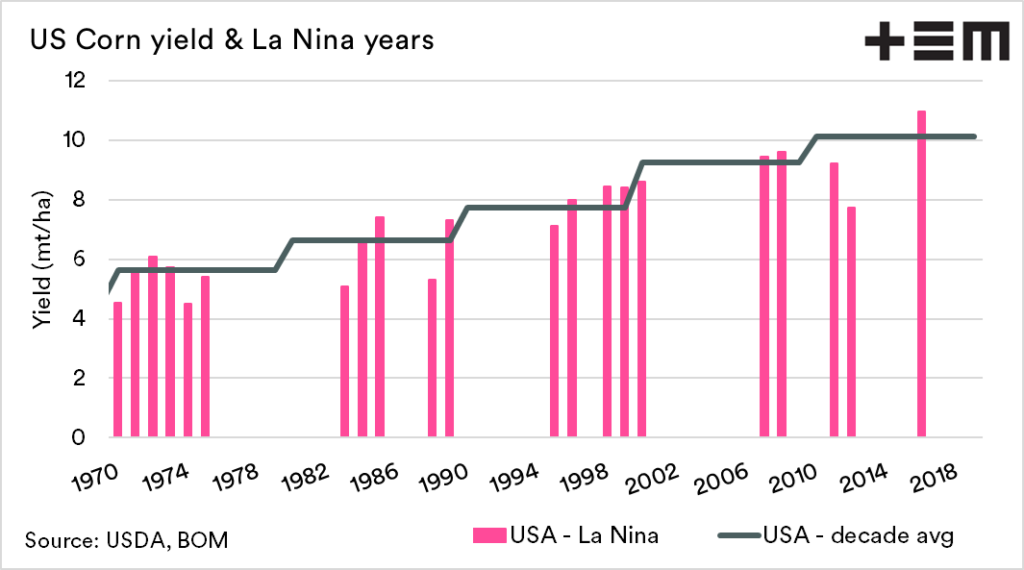

The use of biotechnology has seen corn yields in the US rise from an average of 4.5mt/ha in the 1960s to 10mt/ha during the past decade. The corn yields during La Nina years have been more impacted than wheat. Overall yields have declined by 3% in the US against the decade average.

The range has also been significant, from -24% to +11.5% against the decade average. This is important as corn is the worlds most highly produced crop, and the US grows just over 30% of global production. If corn production drops dramatically, then that will impact wheat pricing.

It must be noted though that weather and climates can be tough to predict, a La Nina event has the potential to be positive to both production and price.

Price

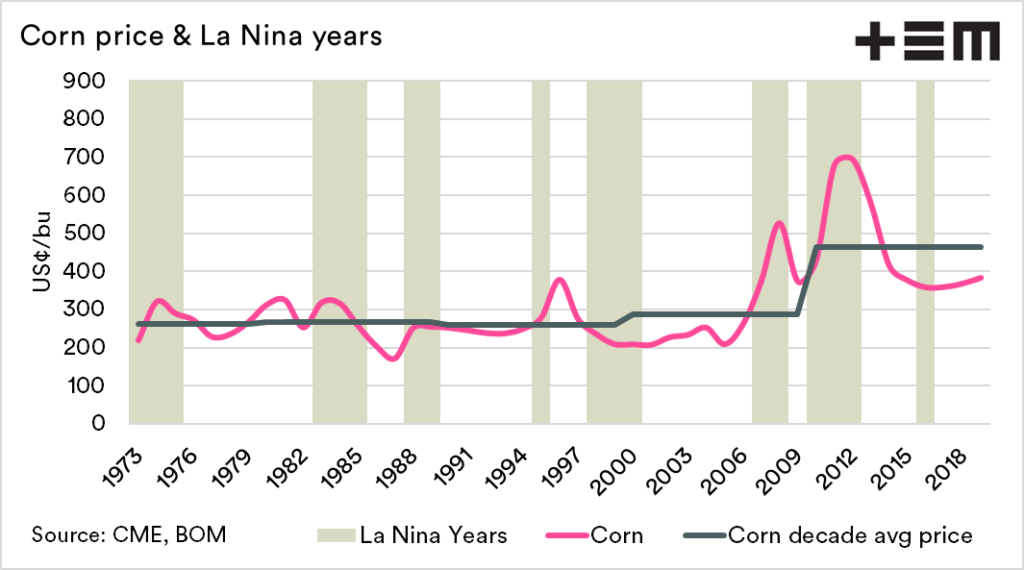

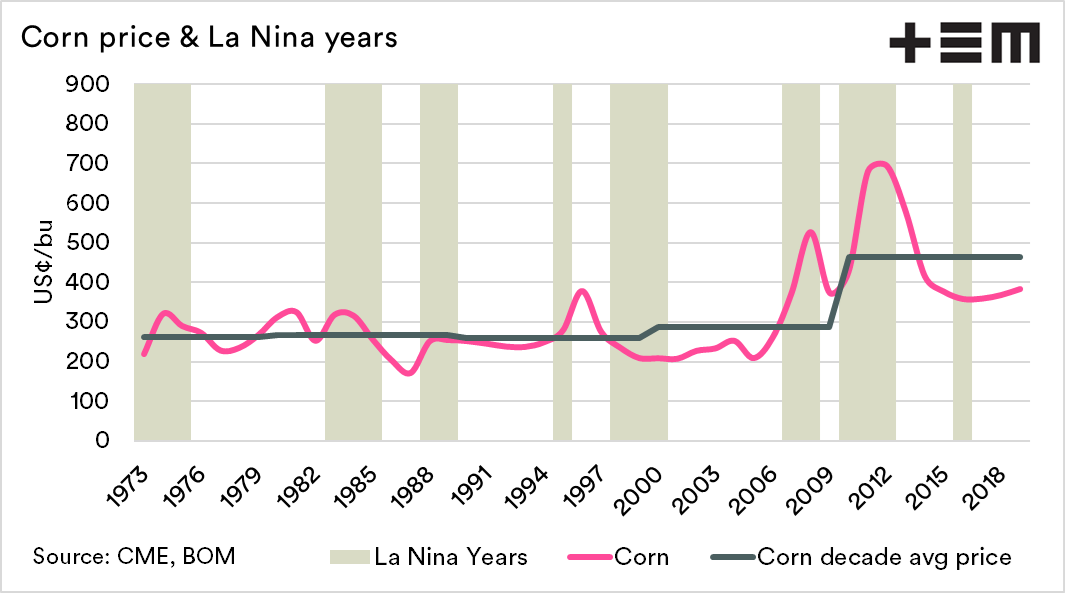

The impact of this can be seen in pricing. During several La Nina events the price of corn during, or the following season has been higher than the decade average price. If we focus on the 2012 season, the United States had a terrible drought during this particular La Nina event, this lead to futures of both wheat and corn rallying.

It is, therefore, possible that during a La Nina event that Australia (especially eastern) can produce an abundant crop whilst also benefitting from higher overseas values due to crop failures in the US. As discussed in previous articles, the futures price of wheat drives our local pricing more than basis, especially in times of surplus.