Many ports in a storm.

The Snapshot

- The export pathways in Port Lincoln have grown in recent years and are set to expand further.

- The additional pathways will lead to increase competition.

- Port Lincoln and Adelaide pricing have a very high correlation, almost perfect.

- In recent years there has been a premium for APW in Adelaide. This can partly be attributed to east coast domestic demand.

- Additional ports will increase competition but will thin out the volume over several export facilities. This will make recovering costs for storage and handling companies more difficult.

- The question is how many ports before overcapacity is an issue, is it 2, 3, 4 or 10?

The Detail

I was lucky to spend a week on the EP during February for GPSA, where I got the chance to present on grain markets and find out about the big issues impacting farmers in the region. The biggest one was the new export facilities.

My career in grain started off largely in logistics and storage, and it has always been a great interest of mine to look at the development of grain infrastructure in Australia and overseas. It was, therefore, interesting to see developments on the Eyre Peninsula.

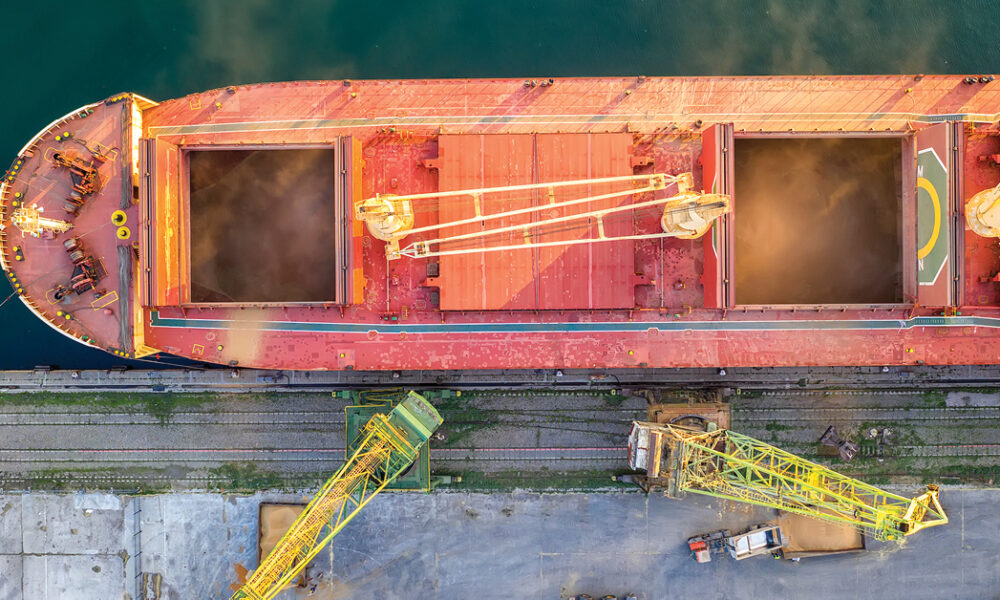

The T-Ports development was interesting as it is a transhipment facility, where grains go onto a vessel, which sails to deeper water to place on board a larger vessel. A first for Australian grain, but one which is used in other parts of the world.

There are also a number of other facilities in various degrees of development including the ‘Peninsula Ports’ at Port Spencer and the ‘Eyre Peninsula Co-operative bulk handling’ at Cape Hardy.

So, in a couple of years, the export capacity will increase by a considerable volume.

One of the reasons I heard for new ports was to support additional infrastructure is to increase competition, culminating in improved pricing for the ports already in situ.

One of the comments I heard regularly was that prices on the EP were at a significant discount to Adelaide, resulting from reduced competition and that the new ports would solve this.

Price comparison – Port Lincoln to Adelaide.

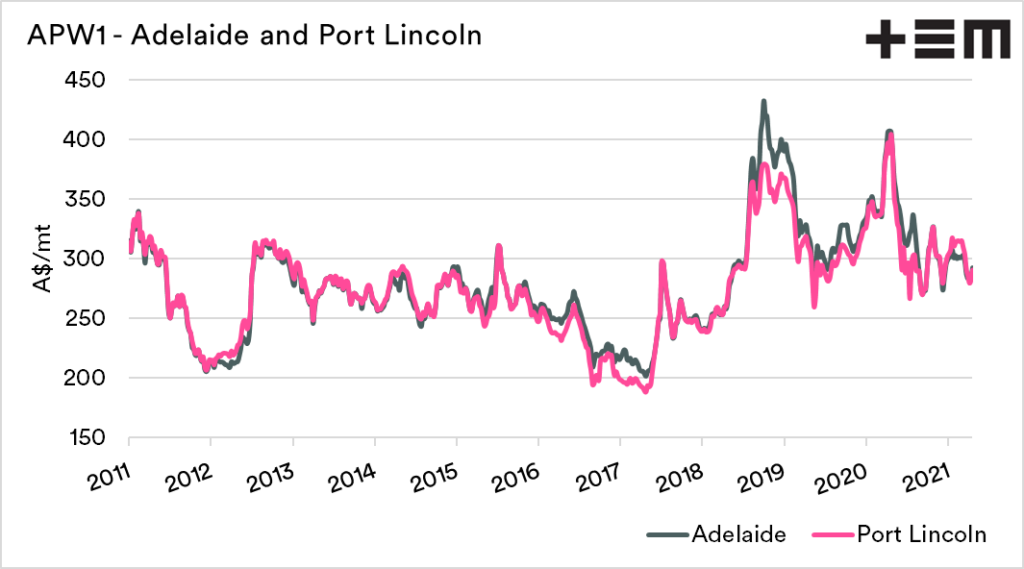

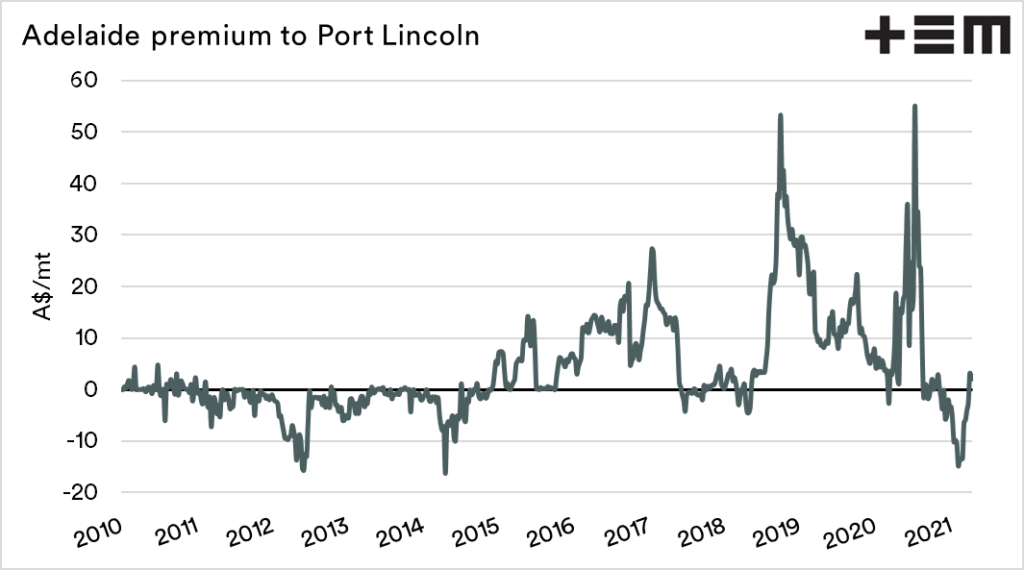

The chart below shows the spot APW1 price from 2010 to present for both Adelaide and Port Lincoln as a weekly average.

A cursory examination tells us that generally, pricing between Port Lincoln and Adelaide is pretty close.

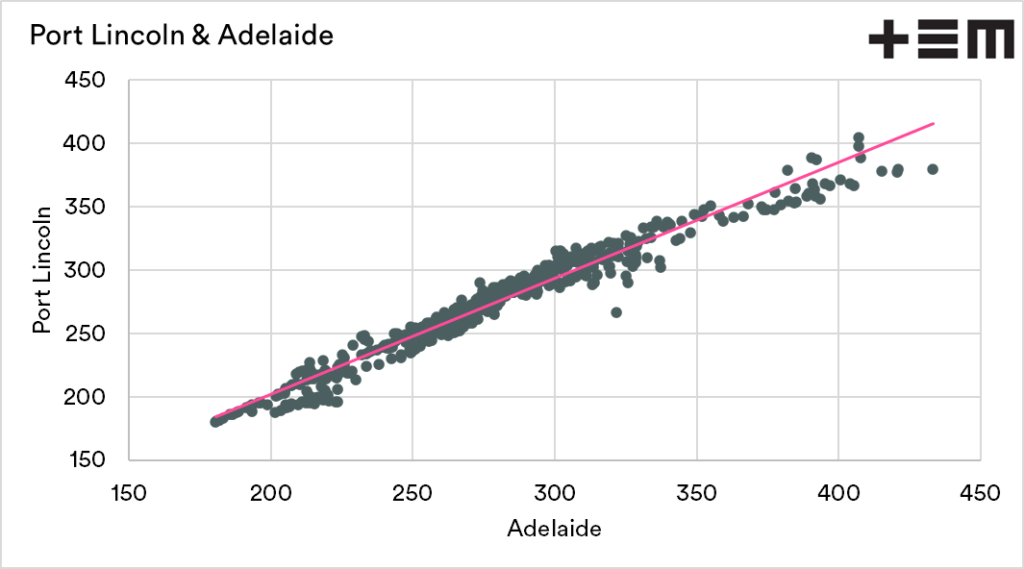

This can be seen in the second chart. The correlation between pricing is 0.97 for the price, and 0.91 for returns. A perfect correlation is 1, and no correlation is 0. This is nigh on a perfect relationship.

As both are in the same state, a close relationship makes perfect sense; both focused largely on export markets.

Let’s delve in further.

Whilst the charts above show the strength of the relationship between the two ports. It’s always worth delving further into the detail.

In the charts above, one point of view is that there have been long periods where pricing levels in Adelaide appear to be stronger than Port Lincoln. This seems especially so during recent years.

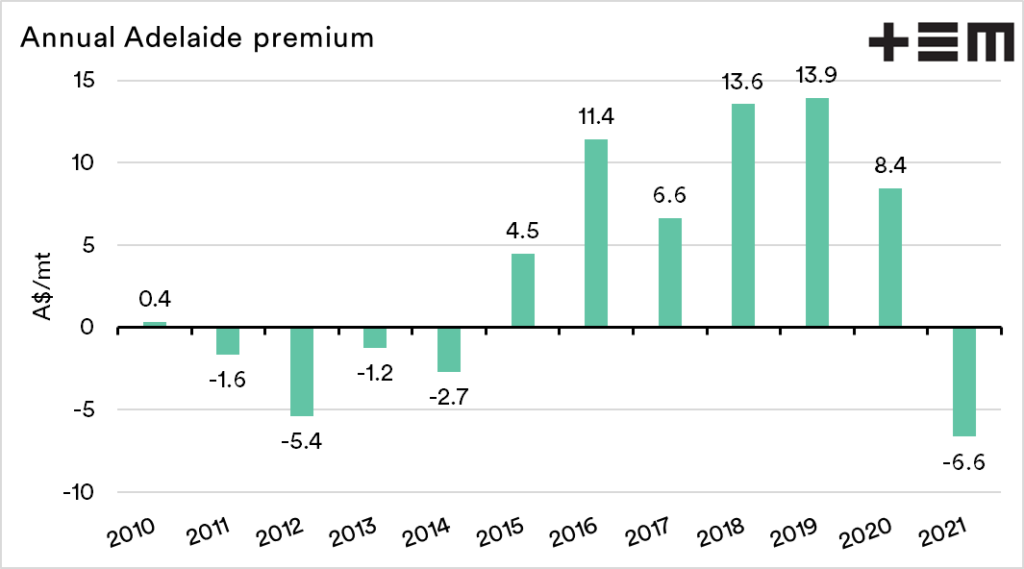

The chart below shows the Adelaide premium over Port Lincoln. The biggest rises occurred during the recent drought. This makes sense that Adelaide would switch to a stronger premium as the area is closer to domestic consumers.

On an annual (full year) basis, Adelaide has maintained a premium over Port Lincoln since 2015. The premium being from A$4.5 to A$13.9. This Adelaide has run at a discount for most of the year, but has risen to a premium in recent weeks.

So will more ports mean better competition?

Additional ports will add more competition for grain on the EP. There is the potential for exporters to be competing to gain the grain to fill vessels. However, in years of east coast drought, Port Lincoln is likely to receive a discount due to the tyranny of distance to domestic homes.

The main question is how many ports are enough? I hold some concerns that too many export facilities could lead to issues. Only a finite amount of grain is produced on the EP; it is now set to be spread more thinly across the ports.

The fixed costs on these facilities will be harder to recoup with smaller volumes, leading to reduced services or higher costs. On the flip side, with more competition, there is a limit to the costs charged, as alternate routes to market are available.

The concern about volumes is potentially one reason why some prospective ports are looking to gain long term agreements with farmers in the region.

Disclaimer: This article is not an exhaustive examination of the port infrastructure on the EP, and does not take into consideration all factors which influence the development of infrastructure. The author is neither pro or anti any ports.