Market Morsel: A perfect night for wheat farmers

Market Morsel

As we approach the dawn of harvest, the overseas markets have provided a lovely gift. Overnight the futures market rallied almost perfectly.

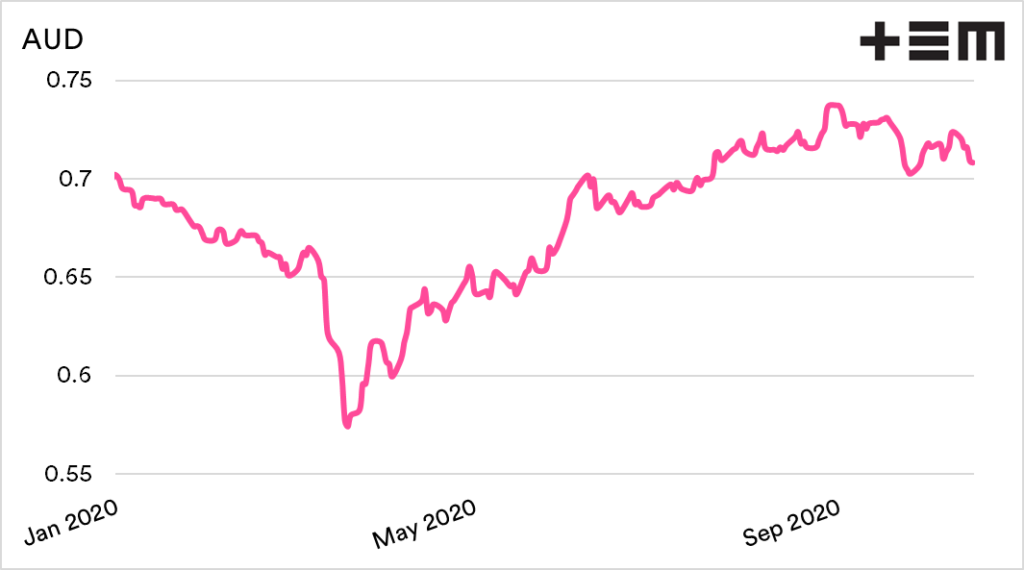

Firstly, the A$ lost ground. The RBA is expected to introduce rate cuts, this has seen the A$ drop to 0.709¢ against the US dollar. A lower dollar makes Australian grain more attractive and increases the swap value on overseas futures.

The biggest piece of news out overnight was that the Rosario grain exchange had lowered its expectations for the crop by 1mmt to 17mmt. I had spoken recently about the dry conditions in the article ‘Don’t dry for me Argentina’, and conditions have not improved.

The only real bearish news was that rain is expected for the black sea growing regions, however, it was not enough to hold back wheat pricing.

We saw overnight an increase overnight of 22¢/bu. When converted into A$/mt, this is an increase of A$15/mt. At present futures for this harvest are A$320.

This is a good baseline for starting a year with healthy production. Although the basis is lower than recent drought years, the increase in futures prices is likely to result in prices which will ensure healthy gross margins.