Market Morsel: A rocket under wheat.

A rocket under wheat

As an analyst, I want some excitement in markets. I want to see something happen so we have something to talk about and interpret.

Recent months have seen wheat prices on a downward trend, despite still being in a precarious situation in relation to Ukraine, declining conditions and low stocks within the global exporters.

This week we have seen a reversal. CBOT wheat futures for December have increased from A$355 last week to A$416 today. Let’s delve into it a little more and what has been happening.

Getting Corny

The grain market is comprised of various grains which are largely substitutable with one another. The wheat market is really a corn market.

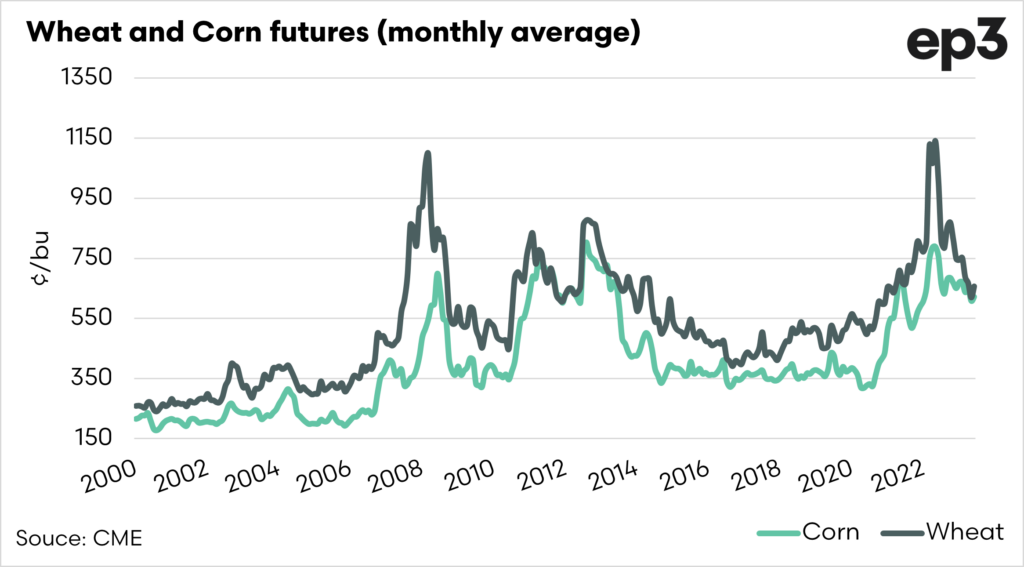

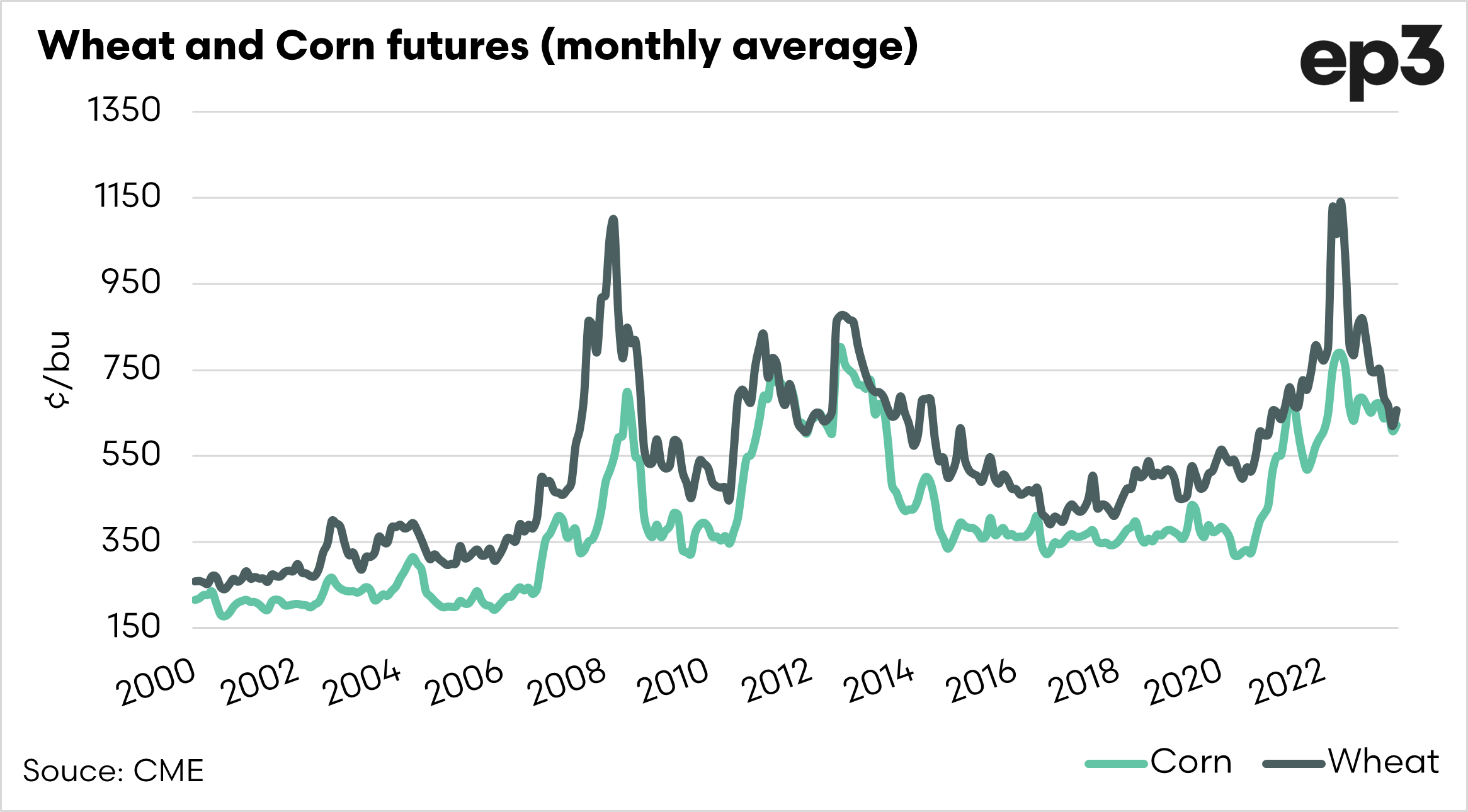

The first chart below shows the monthly average price of wheat and corn futures in the US. The world produces approx 1.2bn tonnes of corn versus just under 800m tonnes of wheat. Many of the usages are similar, with large volumes of each being used for feeding; what happens in corn will have an effect on wheat.

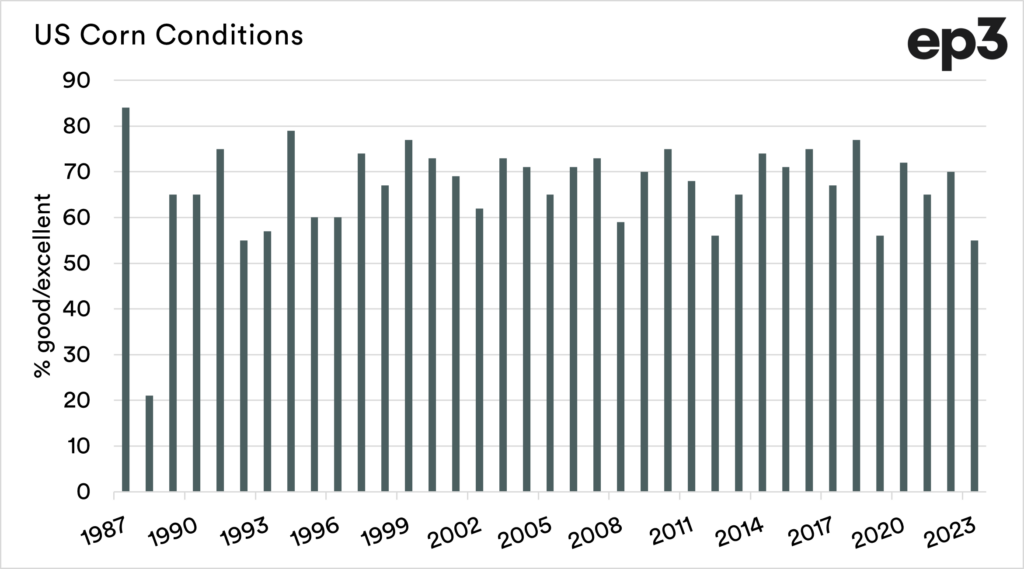

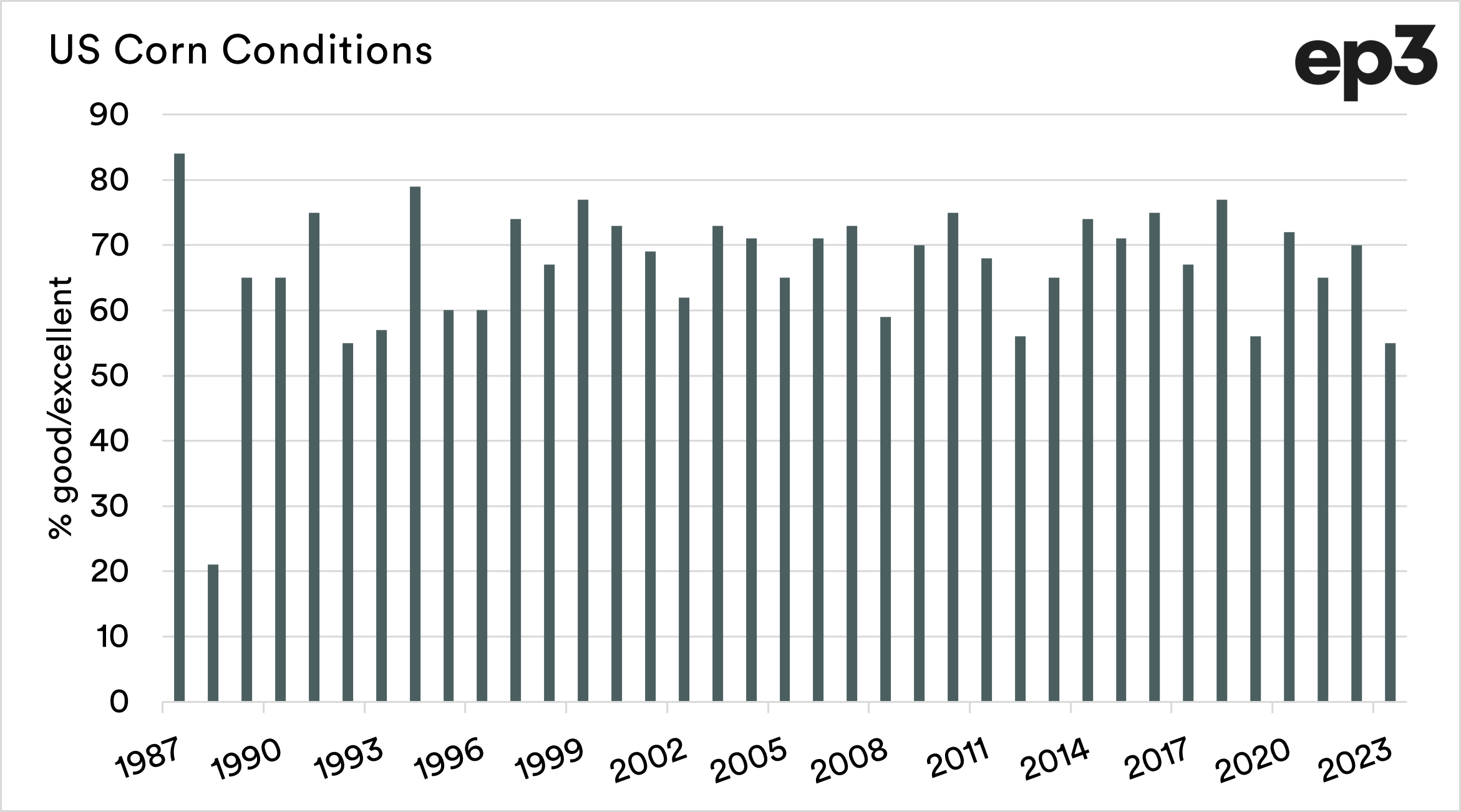

The US corn crop condition ratings are updated on a weekly basis, and the most recent data (last Saturday), showed a crop in a relatively poor state.

We are now in the El Nino alert, which caused the US to generally get wet, and Australia to get dry. So far it’s not really had much effect.

The US is very dry, which has impacted the crop condition. The current good/excellent rating is 55%.

Biofuel mandates

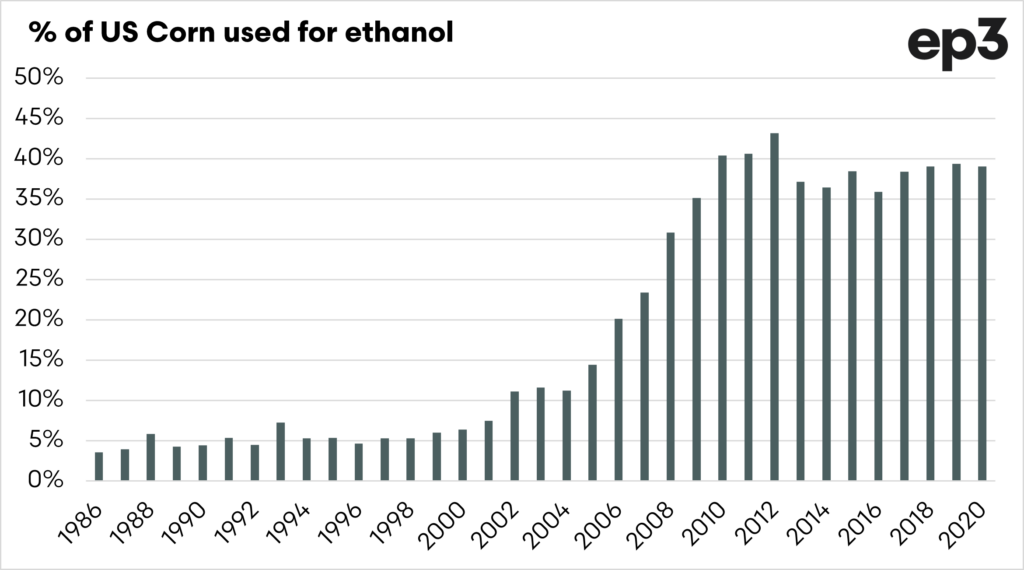

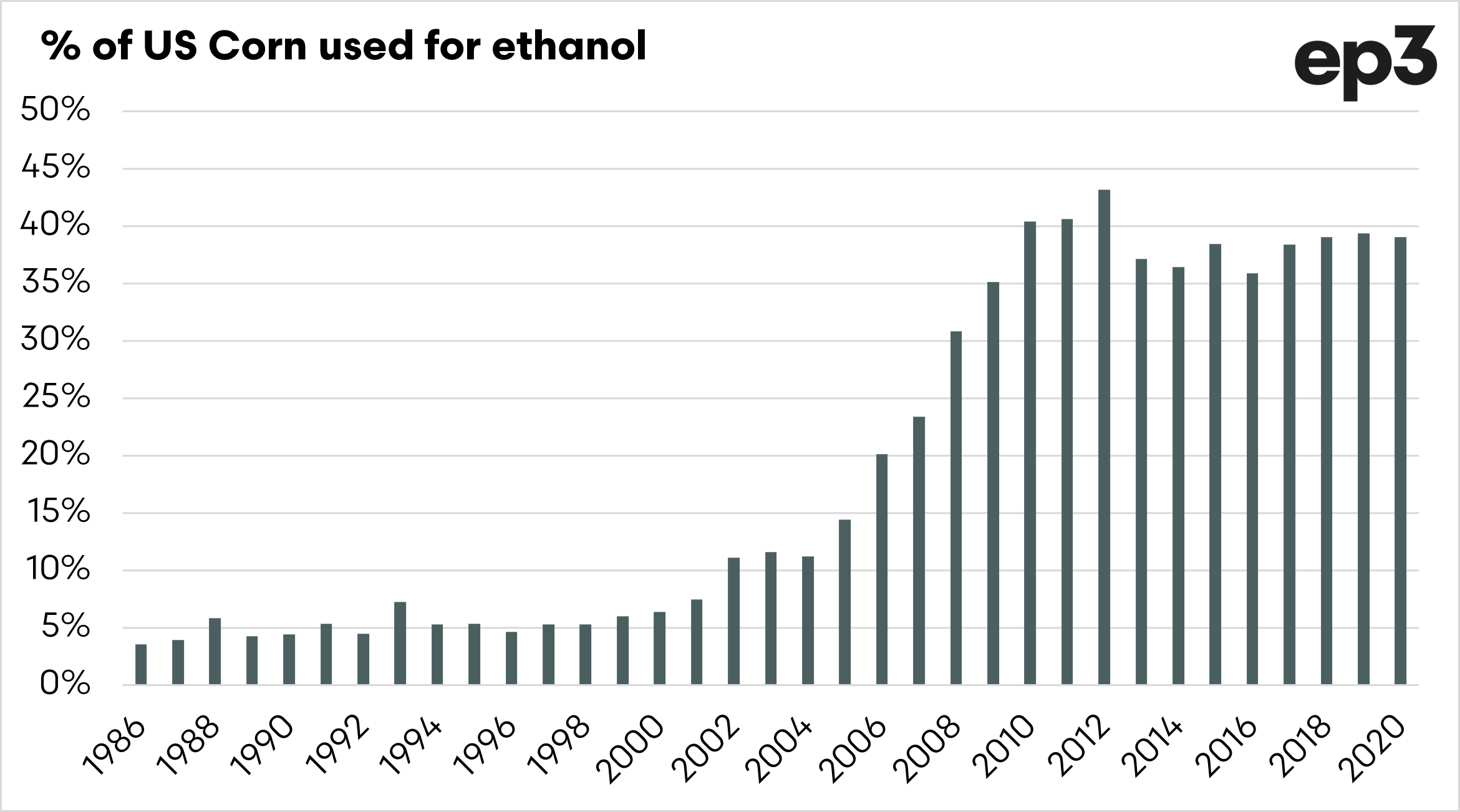

The corn market in the US has grown to become heavily reliant on the ethanol market. In the past two decades, ethanol has grown to be just under 40% of the market for corn. Biofuel mandates typically drive the demand for ethanol.

The new mandates are for higher inclusions of biofuels in the fuel mix, which increases demand in the short term. However, these increases are lower than biofuels groups were expecting.

Short Covering

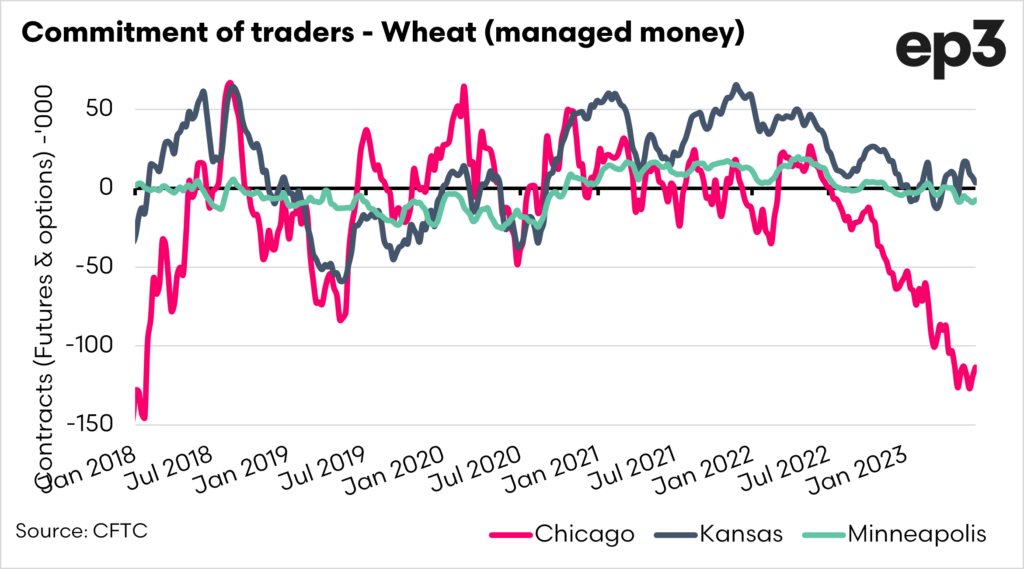

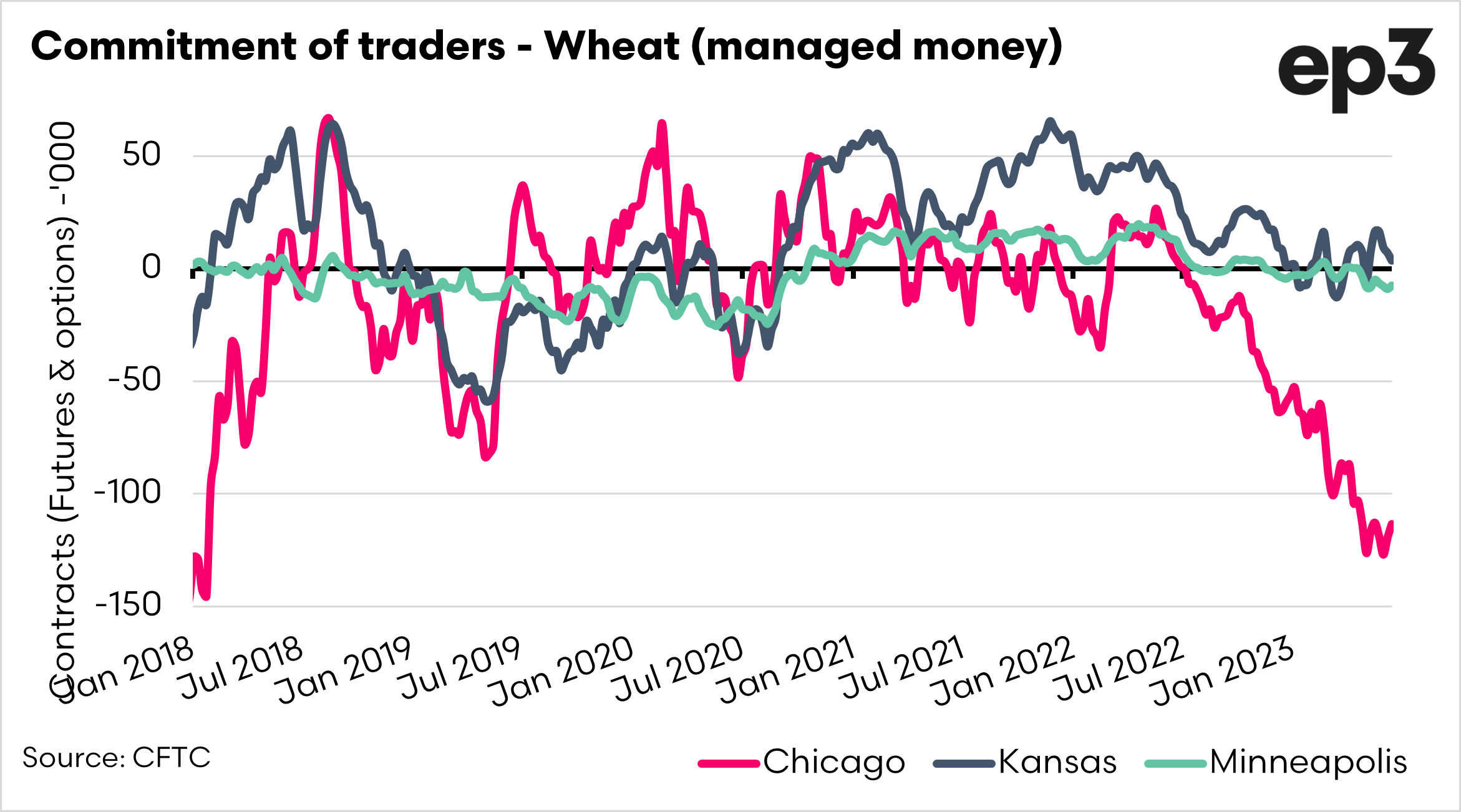

We have been reporting about how speculators within the marketplace have been ‘betting’ on a lower market. We believe that part of this rally in wheat has been a result of that.

The bullish sentiment coming into the market has meant that speculators have looked to close out their positions, therefore buying contracts.

This can cause big swings when large buying volumes come into the market. This short-covering rally can be short-lived but provides some opportunities.

So for farmers who say they don’t like speculators in the market, they ain’t so bad when they drive the market higher.

Passing on the price

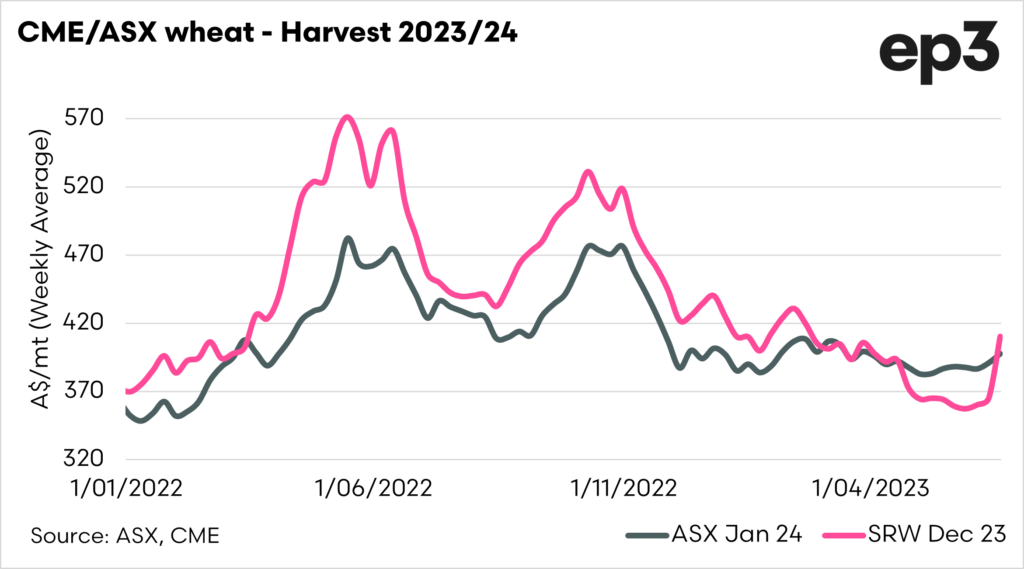

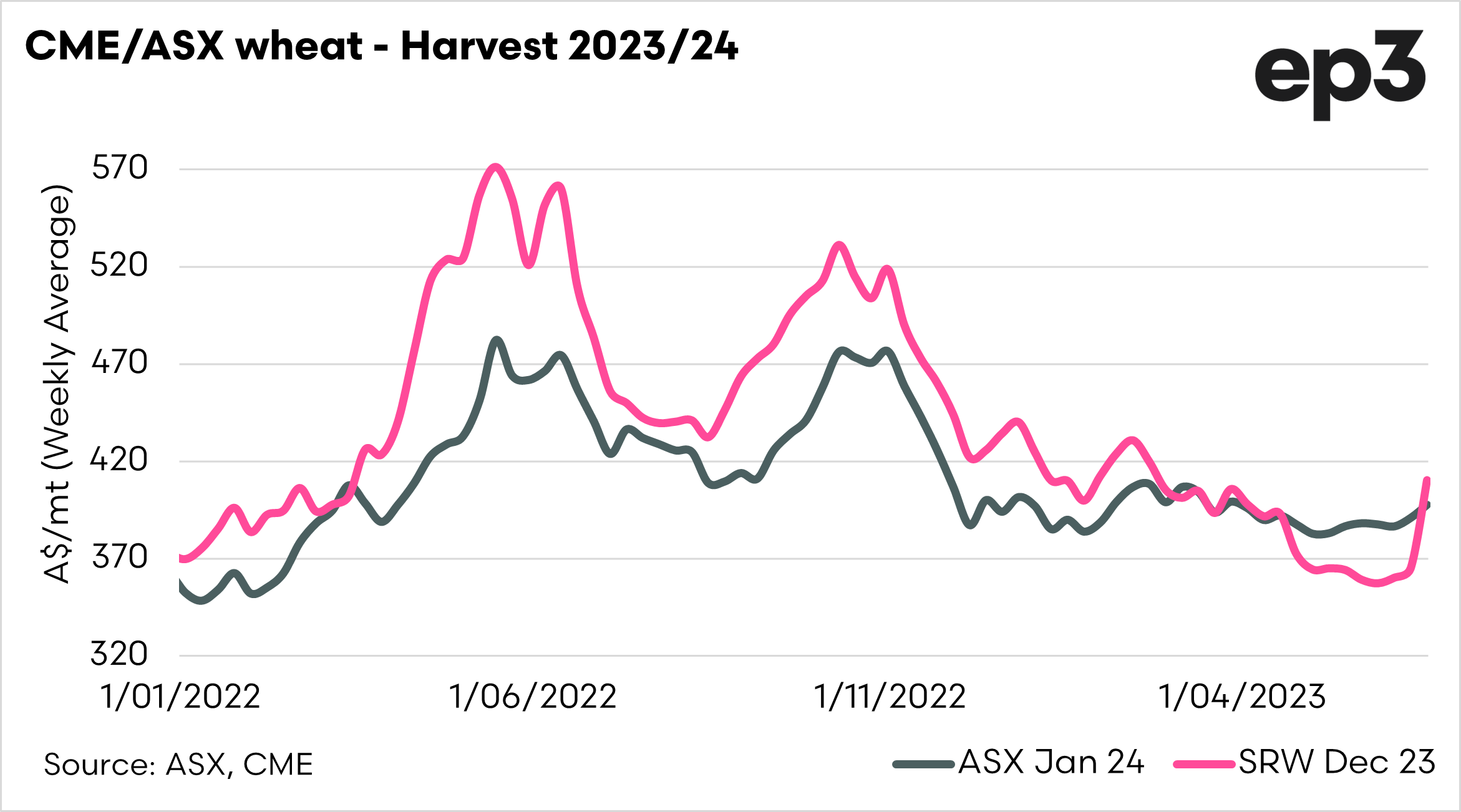

The price of wheat futures has rallied on CBOT, but will it flow through to local pricing? To an extent, yes. Although it won’t be at the same pace.

When there are very sharp rallies in the futures markets, these do not often get reflected in the physical market immediately. We don’t know if the market rally will be short-lived or not.

If the market stays stronger for an extended period of time, that is when we need to question the lack of any rise. At present it’s too early.

The past two years have seen large discounts in our grain pricing to overseas, but that was down to our huge surplus. Let’s keep an eye as we move towards a smaller crop.