Market Morsel: ABARES – Wheat

Market Morsel

During September the wheat forecast for Australia was well above average, at 28.9mmt. This was a strong performance, but there was still plenty of time between then and harvest for things to go belly up.

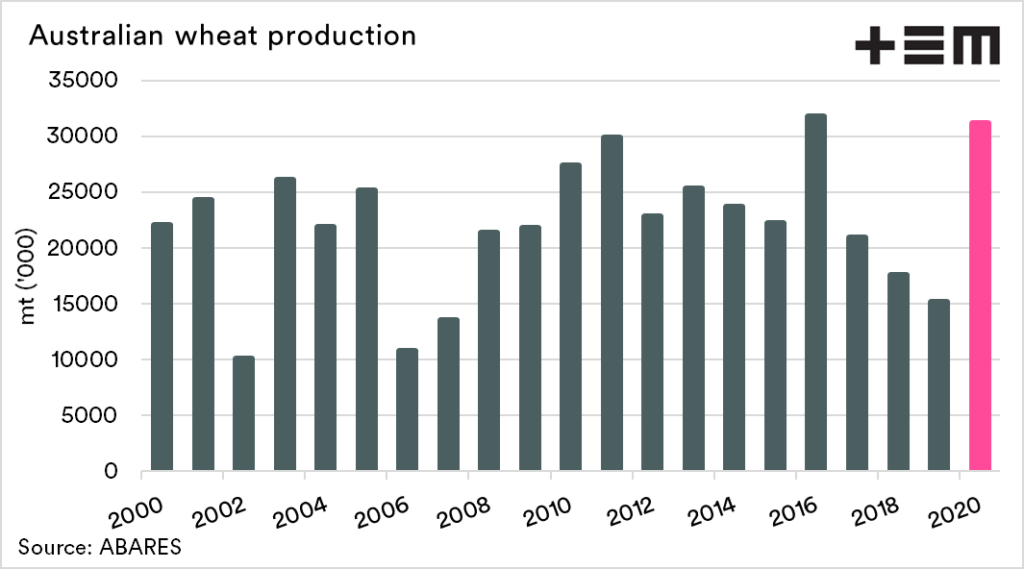

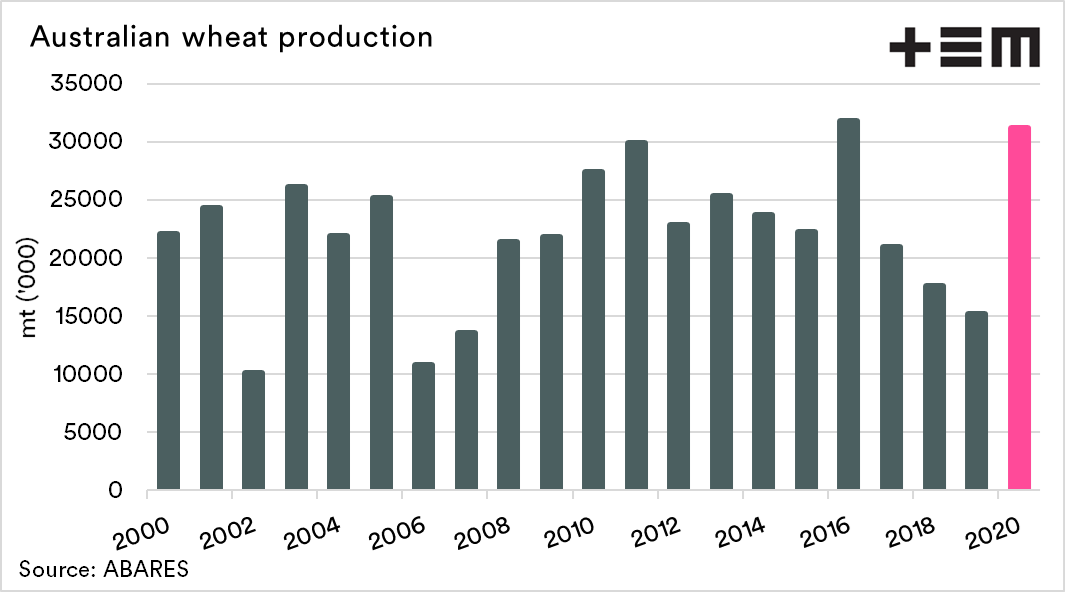

Despite some challenges in September/early October with heavy downpours, the national crop has gone onto to a forecast of a 2nd place finish at 31.1mmt.

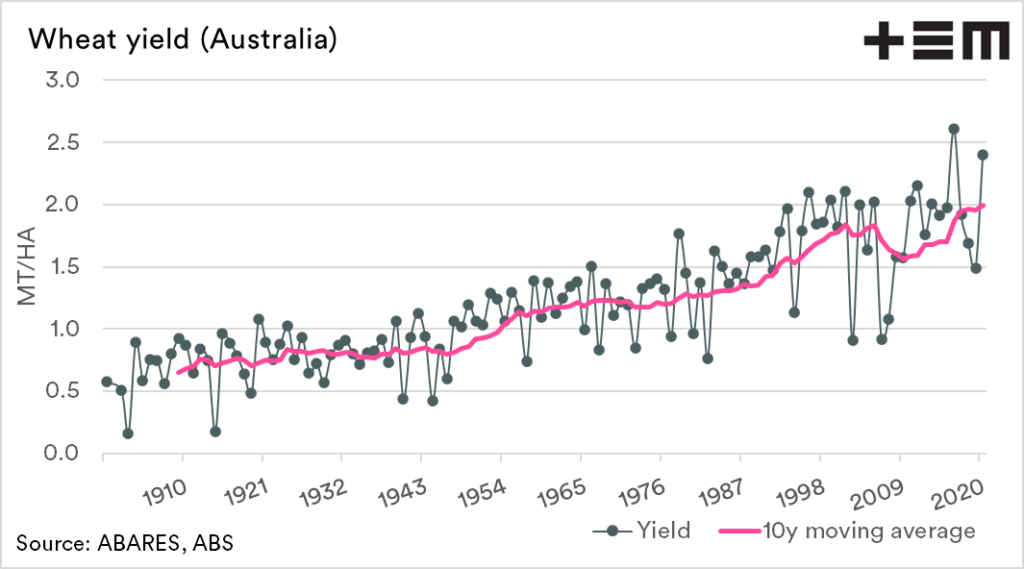

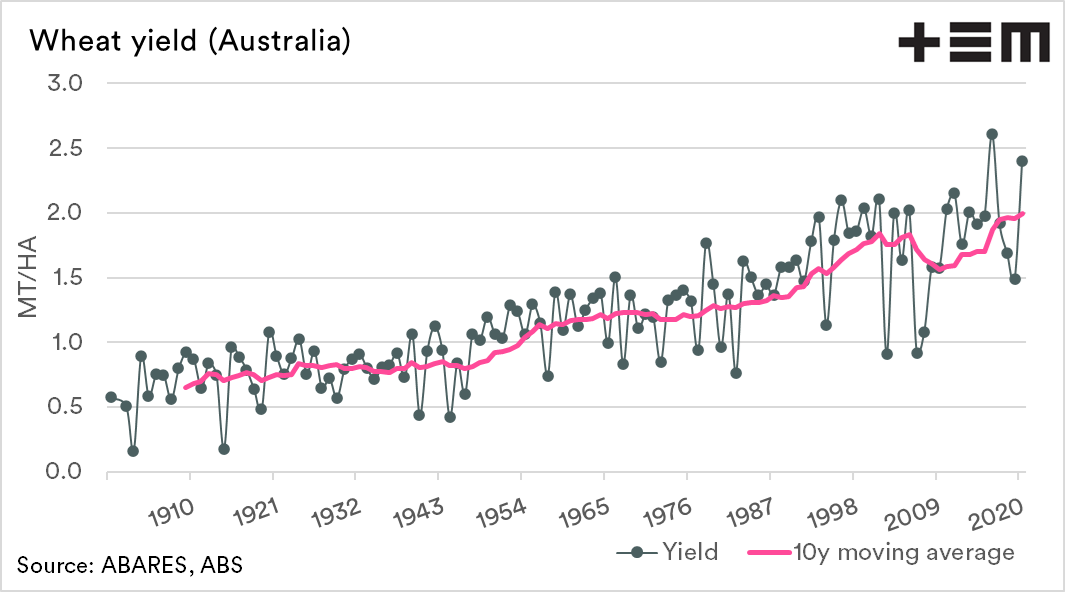

The average national yield during 2020 is 2.4mt/ha, the second-highest in history, and only fractionally below the recent record in 2016.

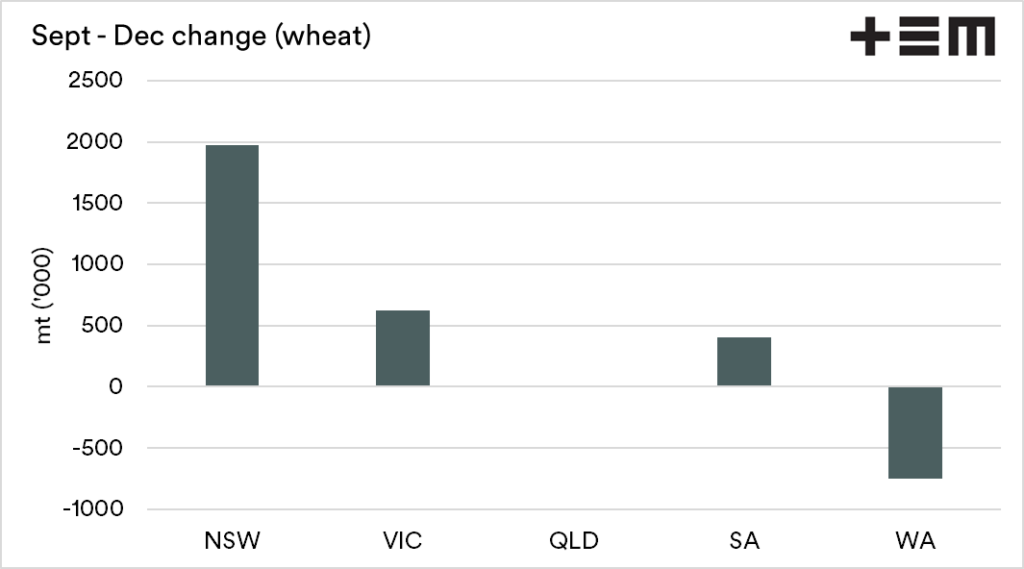

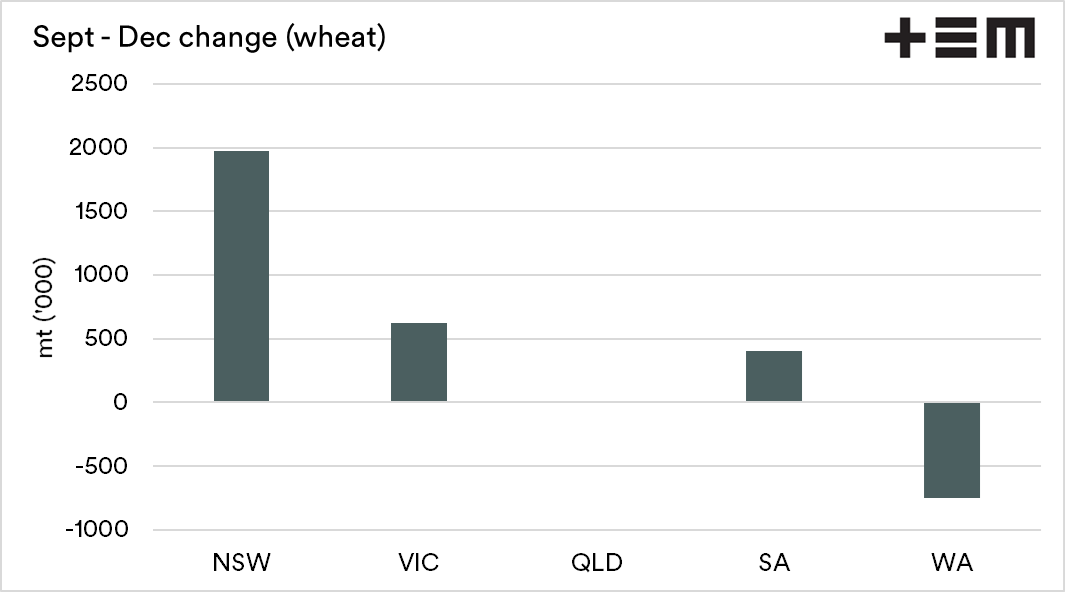

The big driver of the increase was NSW, which has a forecast 2mmt higher than September. This season NSW will contribute 39% of the national wheat crop the highest level since 1983. During 2018 NSW only contributed 11% of the national crop.

In general, NSW determines whether basis is going to be positive or negative in the eastern states. A big crop means that domestic demand will be met, and the ‘premium’ erodes from the market. At present, the market overseas has provided a reasonable futures level for pricing; however that may not always be present. We wrote about this briefly in September (here)

The rise was also strong in Victoria, and South Australia with 624kmt and 400kmt added to the ledger. This adds 3mmt to the eastern states in the past three months.

Western Australia was always the poor relation this year, and this has continued with a 750kmt drop in production to 8.15mmt. This is slightly higher than the GIWA figure of 7.9mmt. It was highlighted in the November report that they expected further upward revision.