Market Morsel: Aussie wheat falls but remains high.

Market Morsel

This is the first year in recent times that hasn’t been a monster crop. We have gone back to a more normal level of production. It was clear that this was going to happen, and in reality, it should have occurred sooner than 2023.

We were lucky in two areas: our grain production and pricing worldwide reacted to various events that conspired to help give croppers exceptional returns.

One of the areas of major concern is Northern NSW and Southern QLD. They had it dry, and the winter crop returned at a knot rate.

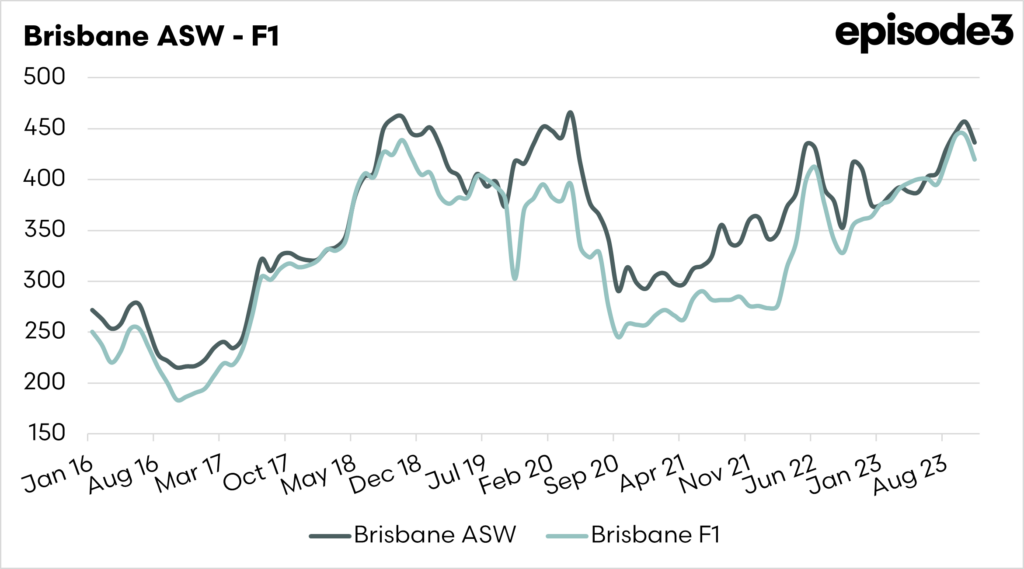

The chart below shows the price of wheat and barley in Brisbane. We can see that the pricing levels are off last month’s highs but are still very close to those achieved during the last drought when things were exceptionally poor.

We are nowhere near the drought levels of 2018 and 2019; this price is high in part because of the higher global pricing helping things rise.

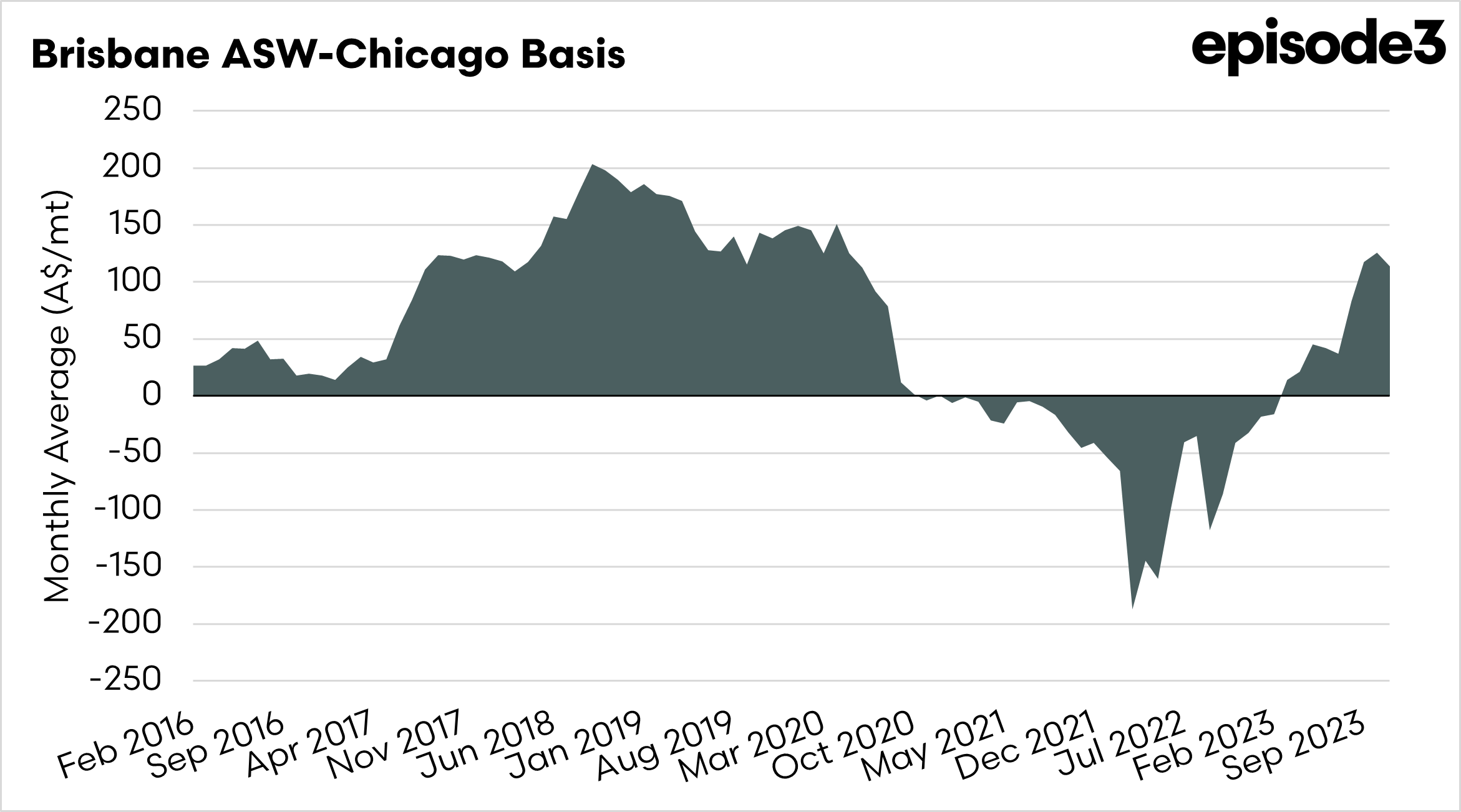

The second chart below shows the ASW to Chicago basis; we can see that the basis level is in drought levels. The question is whether this drought premium will continue to persist when conditions are nowhere near as bad as the previous drought.

The key thing is to sell when it is going to work for you; the market can and does fall.